Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello

I had a customer use credit card on a square mobile POS and the payment went through and deposited into my account fine.

The issue im having is trying to link that payment to the appropriate invoice in quickbooks. I can easily add a manual payment and select Square account but then the payment is accounted for twice by quickbooks (manual entry and the quickbooks entry). How can i link the two? If I wait a day or two will there be a transaction i can match?

Thanks

Glad to have you here in the Community, @Ptonjalken.

We can delete the payments you've manually entered. This way, you can match the payment to the open invoice.

Here's how:

You can also check this article about managing your account register and utilize its related functions: Find, review, and edit transactions in account registers.

I've added this link in case you want to review your transactions after matching them: Find, Review, and Edit Transactions in your Account Register.

If there's anything else I can help you with, please let me know. I'll be around to help. Have a great day!

Thanks. That part isnt too hard but how do i go about linking the actual Square payment to the invoice in question once ive deleted the manual entry?

Its in my Chart of Accounts but nothing has come up as a reviewable transaction yet - do i just wait for that to appear and then match? (will it appear?)

Hey there, @Ptonjalken.

I'm happy to take a look at this with you today.

If the Square payment synced as an unapplied payment, it should just link it to the invoice through receive payment.

Alternatively, if it was synced as a deposit, you can post it to AR account and link it to the invoice.

If it's already synced as a sales receipt you can delete the related invoice instead and keep the sales receipt since that's already a sales transaction and we don't want to double post the income account.

Has this happened with Square transactions in the past, or is this the first one you've received?

I'd love to hear how this goes! Please reach back out if you have remaining questions on this or anything else.

Thanks for the reply.

From your options it looks like maybe this was posted as a deposit. The only spot I can find it is under Chart of Accounts > Checking

When I go to edit the posting I can't figure out how to move it to Accounts Receivable (if you could help me with that).

This is the first time ive used Square to process a payment

Thanks

Alex

You're welcome. It's our pleasure to help, @Ptonjalken.

I can show you how to move it to the Accounts Receivable.

You can go to the Register to edit the posting account. Let me show you how:

Here's more information about adding accounts to Chart of Accounts: Add an account to your chart of accounts in QuickBooks Online.

You can also refer to the following article on how to categorize and record payment using Square: Record invoice payments in QuickBooks Online.

I'm always here if you have additional questions in recording your invoice payments. I'm always here to help. Have a great rest of the day!

Wont that change my entire checking account on QB to Accounts Receivable?

Im just looking for the one payment to be moved over. Maybe I am confusing something.

I have an AR account and a checking already. Im just looking to move the one Square payment that is in my checking account currently to the proper invoice (through AR?)

Hello there, @Ptonjalken.

It won't make changes to your entire checking account. We just have to move the payment from checking to Accounts Receivable. To do so, you can follow the steps given by my colleague @MaryJoyD.

Also, I encourage checking our Help articles page to learn some tips and tricks in managing your QBO account. From there, you can read great articles that can guide you through the steps by steps process.

Leave a comment below if you have other questions. We're always here to help. Take care!

The example she provided is changing my entire checking account to an Accounts receivable. I dont see how this fixes the issue.

If you could please explain as im quite confused. The step by step provided does not fix my issue and does not show how to move the individual deposit to accounts receivable - it just shows how to change a checking account into an accounts receivable

Let me provide clarifications regarding this payment concern, @Ptonjalken.

You'll need to change the account of the deposit from checking to A/R. This way, you'll be able to receive the payment and link it to the open invoice.

To change the account of the deposit, just look for the transaction on the register. Then change the Payee Account to A/R and Save it afterward. Please see the sample snip attached for your reference:

After that, you can now receive the payment and link it to the open invoice.

Here's how:

To give you the complete process of receiving payments in QBO, please see this link: Learn how to receive and record the accounting for invoice payments.

However, if you're unable to change the account, I'd like to ask for a screenshot of your setup. This can help me to picture out this matter and provide an accurate resolution.

Please get back to me on how things turn out. I'll make sure you're all set. Keep safe!

Hi when I tried this it told me I cant change an account to AR or AR to something else

Is there any solution?

Let add some information about changing the account of your deposit transaction, Ptonjalken.

QuickBooks Online allows you to create multiple A/R accounts, however, it's not designed to work with them. We can't change the default A/R account assigned by QuickBooks. You'll want to track two types of income with the use of sub-accounts, or Location or Class Tracking. Please check this article for more information: Can I Change the Default A/R or A/P Account in QuickBooks Online?

For any complex questions with regards to recording, I recommend reaching out to your accountant for other ways on how to enter it in QuickBooks Online.

For your reference, I've got these help articles in case you have any other questions.

Post a comment below if you have questions entering transactions. I'll always be here to help you.

I have a similar question regarding QuickBooks Desktop Enterprise. We invoice our customers through QuickBooks. So our invoices are generated prior to a credit card payment being received. We recently switched from QuickBooks POS to Square and the payments are being deposited just fine. However, how do you post a Square credit card payment to an existing invoice in Desktop Enterprise? I've tried contacting Square and they asked me to contact QuickBooks Support. When I contact QuickBooks Support, they can only link me to information about QuickBooks Online and suggest I contact Square. Can anyone here help me?

Nice to have you in the Community space, @AngelicaR.

I appreciate you for sharing the details with us. To post your Square credit card payment depends on how you set it up in your QuickBooks Desktop (QBDT) software.

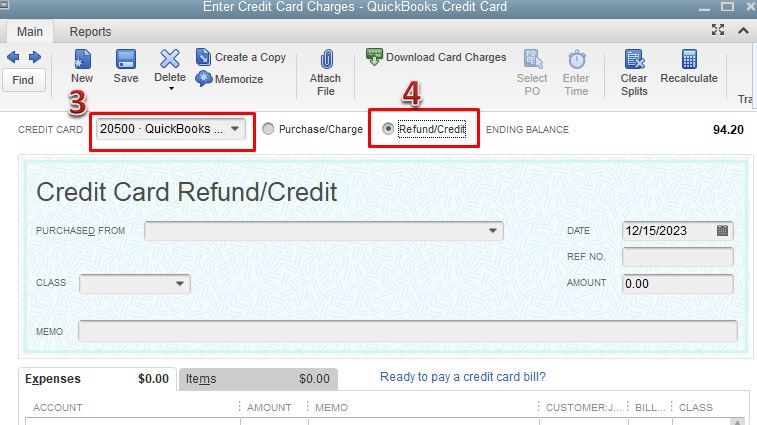

If you have a Square bank account set up in your QuickBooks, you can create a credit card credit and use your Square account to post the payment. Let me show you how.

I’d also recommend working with your accountant for further guidance in recording this. This way, we can guarantee your books is well accounted for after recording this. If you’re not affiliated with one, you can visit our ProAdvisor page and look for one from there.

However, if you don’t have a Square bank account, you can use Journal Entry to post the payment. You can work with your accountant in choosing the proper account.

I’m also adding this resource that can guide you effectively in reconciling your accounts in the future: Reconcile an account in QuickBooks Desktop.

You can always tag me in your reply if you have other concerns or questions about recording payments in QuickBooks. I’ll be around to help you. Keep safe.

Hello,

I came across these messages and was hoping I can get some help in a similar problem I have. I have a QB online account and just recently decided to start taking card payments through Square. I'm trying to figure out how to link Square to my QB invoices. I want my clients to have the option to pay through their QB invoice using Square, is that option? If so, can someone provide steps of doing so? I already linked Square to QB's so that part has been taken care of. I hope my questions makes sense.

Glad to have you here in the Community, zucd.

Let me share some facts about how syncing Square app with QuickBooks Online works.

Once you sync your Square app with QuickBooks Online (QBO), it automatically imports your sales transactions as an invoice and payment into QBO. Therefore, you won't need to creating anything in QBO. Just make sure your account mappings are correct for the fees and deposits to be posted correctly.

Your invoice will be paid in full and you will have another transaction for the Square fee. Then, the net amount will be deposited into your bank account. All these transactions will be exported to QBO.

Please check out the article about syncing with Square. This provides an explanation about the setup, the mapping of transactions. and the things you need to do in QBO.

You can always check out our resources in the QuickBooks Articles hub to get some steps on your daily business tasks. You can also take some insights and pointers from other users who shared the same experience.

Let me know if you need more help with syncing Square with QuickBooks or anything else. I can guide you some more. Take care!

Thank you for replying to my message, this information really helped clear some questions. However, I'm still confused as to how the client actually makes a square payment through the QBO invoice I send them. Is that an option I can give my client through the QBO invoice I create for them or do I need to send them a separate invoice to through Square, which then automatically imports my sales transactions as an invoice and payment into QBO like you mentioned?

I'm here to walk you through the process of recording your sales transaction, @info1372.

When you sync your Square app with QuickBooks Online, transactions are automatically downloaded as invoices or payments. If you want to record an invoice, then we'll have to do the following:

• Create an invoice.

• Make a receive payment once your customer paid the invoice.

• Deposit the payment and include the processing fees.

• Match the deposit to the Square transaction downloaded on the Banking page.

Here's how to create an invoice:

1. Go to the + New menu.

2. Select Invoice.

3. Choose the name of the customer in the drop-down list.

4. Enter the other necessary details.

5. Once done, click on Save and close.

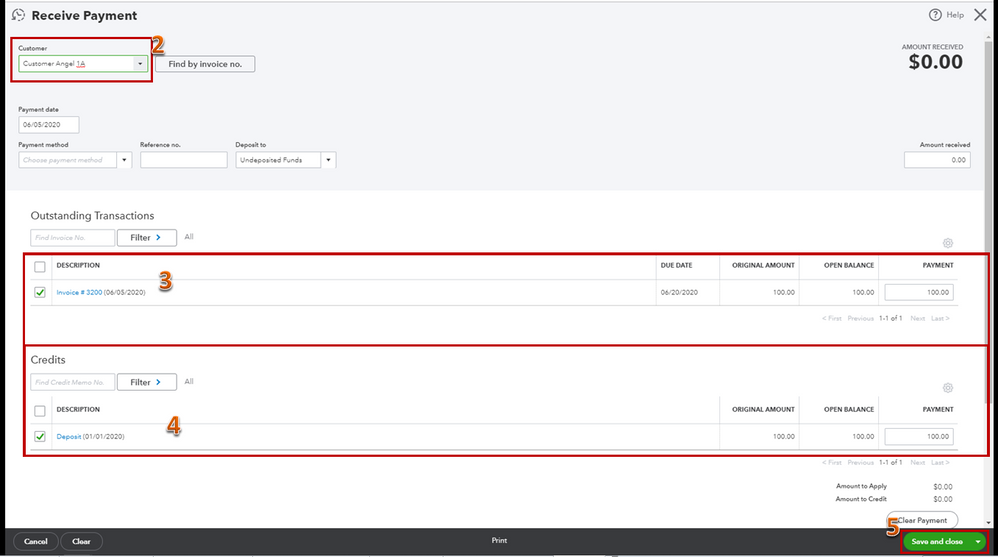

After that, let's create a receive payment for the invoice. Make sure to deposit the amount to the Undeposited Funds account. I'll guide you on how.

1. From the + New icon, select Receive Payment.

2. Choose the customer's name from the Customer drop-down menu.

3. Select the Payment Date and Payment method.

4. Under Deposit to, choose Undeposited Funds.

5. From the Outstanding Transactions section, put a checkmark on the invoice you want to pay.

6. Click Save and close.

Then, let's record a bank deposit to include the processing fees by following these steps:

1. From the + New icon, select Bank Deposit.

2. Choose the bank account where you want to deposit the money.

3. On the Select the payments included in this deposit section, put a checkmark on the payment you want to deposit.

4. Under Add funds to this deposit, select the customer's name from the Received From column.

5. Select an expense account from the Account column and then enter the fee as a negative amount.

6. Click Save and close.

Once done, we can now match the deposit to the payment posted on the Banking page.

Here are the steps:

1. Go to the Banking menu and then select Banking.

2. Click the For Review tab.

3. Find the square payment, then click the Match link.

For more information about managing Square transactions in QuickBooks Online, I suggest checking these articles:

• Sync with Square - Default Accounts and Names

Additionally, I've added an article that'll help you reconcile your accounts so they match your bank and credit card statements: Reconciliation Guide.

For more questions in recording transactions in QuickBooks Online, feel free to click the Reply button. This way, we'll be able to answer them for you.

We have this issue. The Square App integration imports the payment and auto-creates an invoice from Square (no clients configured in Square - essentially we only use Square as a payment terminal).

The issue we have is that we have, with the nature of the business, is that we create the invoice well in advance for a specific client. Then they opt to pay via Square. We simply want the Square payments to come into to Quickbooks Only via the App integration as unmatched. We do not want Quickbooks to auto-create the square invoices linked to those payments.

How can we do this?

Dear @Maybelle_S , is this thread still active? The last message from @Jenna Nickerson is exactly what a few people in this conversation were asking, but that question has not been addressed....

When I create an invoice I see "Payment Options Connect to PayPal" but not Connect to Square, so I assume it's not possible. Would it be possible to add this feature on QuickBooks?

I'm delighted to have you here sharing your concern about Square payment options on your invoices, Li_R. Let me share insights to help you achieve this matter.

Creating invoices with several payment options is convenient for your customers when paying the invoice received. Please know that QuickBooks is always dependent on the information imported from your banking data to your company file. Thus, to help you enable and connect your Square account to the online program, make sure to link your bank account so QB then downloads your transactions and matches them to your Square entries.

Then, you can set up the Connect to Square app feature on your account. To do this:

After setting up, the Connect to Square app downloads your Square transactions to QuickBooks.

For more detailed information, you can refer to this article: Connect your Square account to QuickBooks Online.

Once everything's ready, you can start reviewing and categorizing your transactions in your account to make sure all data matches your bank and credit card entries.

Moreover, I'm including this guide to help you reconcile your accounts, so they match your bank and credit card statements: Reconcile an account in QuickBooks Online.

Just keep me posted in the comments below if there's anything else you need further assistance with when managing Square integrations or payment options. I'll always be available in this thread to keep you going. Keep safe and have a good one!

You can use a 3rd party paid connector to reconcile Square payments into QBO.

Did anyone ever figure out how to apply a square payment to an invoice?

Did you ever get a resolution to this?

Thanks for joining the thread, @scottsfirstaid.

The option to directly match transactions from Square to invoices in QuickBooks is unavailable. Due to the fee that Square is taking out for the payment, the amount downloaded from Square won't be the same on the invoice you've created.

I suggest simply adding the transactions from Square by clicking the Add button. Doing this will create sales receipts inside QuickBooks. With regard to the invoices you have made, I recommend deleting them to avoid duplicating your sales records.

Here's how to add transactions:

In addition, you can send feedback to our developers about this option. They can review your suggestions and most likely incorporate them in future updates.

I'll also add this article to guide you in reconciling your accounts so they always match your bank and credit card statements: Reconcile an account.

Return to this thread if you have further concerns about applying square payments to invoices in QuickBooks. I'll be here to help you in any way I can. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here