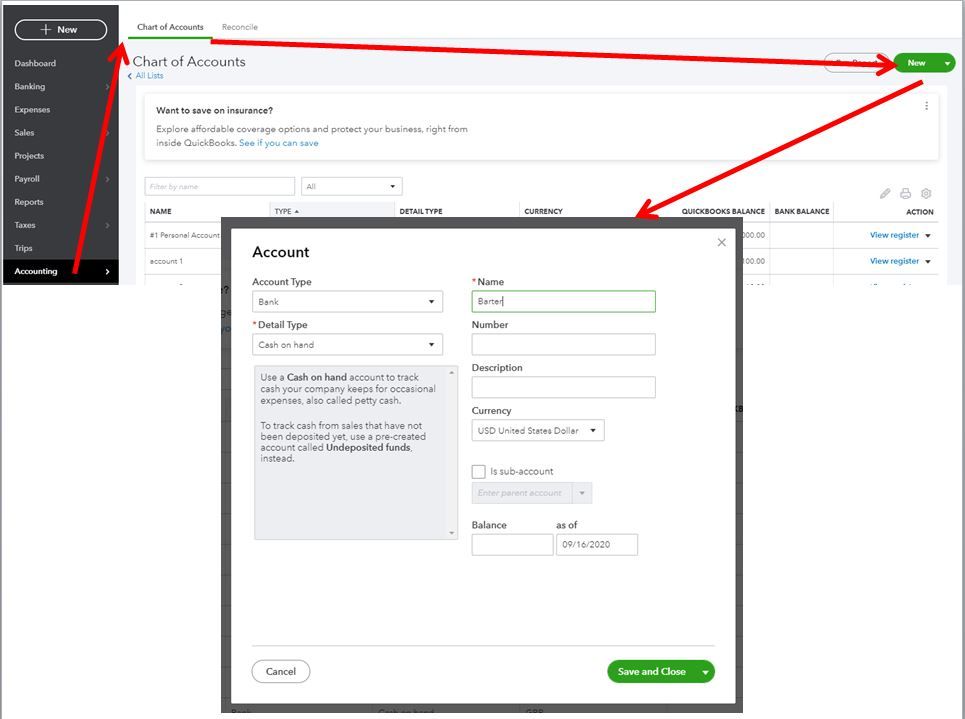

1. Go to Lists > Chart of Accounts, click on the Account button, select New and create a new bank account called Clearing Account.

2. If not entered already, enter the invoice (Customers > Create Invoices) and bill (Vendors > Enter Bills) you want to offset. QuickBooks won’t let you use the same exact name for both a customer and a vendor so you’ll need to change them slightly

3. Go to Vendors > Pay Bills, select the bill you want to pay and enter the amount you want offset by what your customer/vendor owes you. If it’s less than the entire amount of the bill, change the amount in the Amt to Pay box. Use the Clearing Account as the account. You may also want to use something like Offset for the Check No.

4. Go to Edit > Preferences > Sales & Customers > Company Preferences and uncheck the box next to Use Undeposited Funds as the default deposit to account

5. Go to Customers > Receive Payments, select the customer account for your customer/vendor, enter the amount you want offset by what you owe, deposit to the Clearing Account, and select the invoice you want to apply the payment to

6. The Clearing Account should always have a $0 balance so make sure that the amounts you entered in Pay Bills and Receive Payments exactly match.