Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowWhen doing this, gives me an error "You must set a transaction amount". But the bill and the credit total is zero.

Hello, @FabianaT.

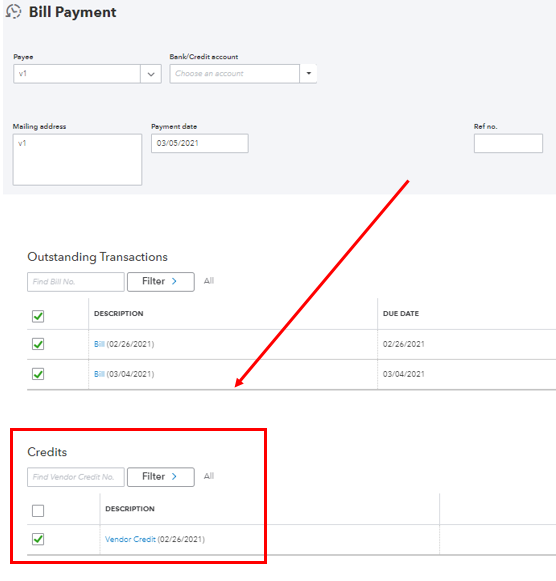

If you’re trying to apply vendor credits to a bill, you should put a transaction amount on the bill payment so there will be no error message.

You can refer to the screenshot above.

To apply a credit to a bill, you can follow the steps below.

Please also check this article for your future reference if you wanted to learn how to record a refund from a vendor in QuickBooks Online. Enter a refund.

Leave a comment below if you have any other questions. Keep safe.

Hello Quicken,

I am trying to apply a vendor credit however the system takes me to online bill pay - it is a manual entry - how do I apply the credit against the bill? Thanks!

This information will get you moving, @JRHAvion.

Entering the credit depends on how you record the purchases. If you’re using QuickBooks Online, you can follow my colleague steps provided above to do it.

You can apply that credit manually in the Credit Applied column in Online Bill Pay. All vendor credit created within QuickBooks and the incoming bills are eligible to be used toward bills on the Pay Bills Online page.

Once done, you can pull up the Transaction List by Vendor report to see the vendor's payment, bill, and the credits applied. Let me show you how:

I have an article here that can help you learn more about recording a credit from a vendor.

Otherwise, you’ll want to contact the Quicken Support team to assist you further with this matter. They’ll be able to guide you on how this transaction settled.

I’ve added this link that tackles expenses and vendors in QuickBooks. This will give you more details about your business and your cash flow through proper bookkeeping practices.

The Community team is always here to find a solution. Just leave us a message below, and I’m sure it will be taken care of.

product may have change, but I cannot find anything like the Plus mentioned below

I'd be happy to assist you.

Here's how you can pay your bills using your vendor credit:

I have attached a screenshot for your reference. nor can I find any screen shot to reference. When I pay the vendor bills, the CM does not show up in the list of invoice to be paid. I am using ProPlus2021

Hello there, PinotJim.

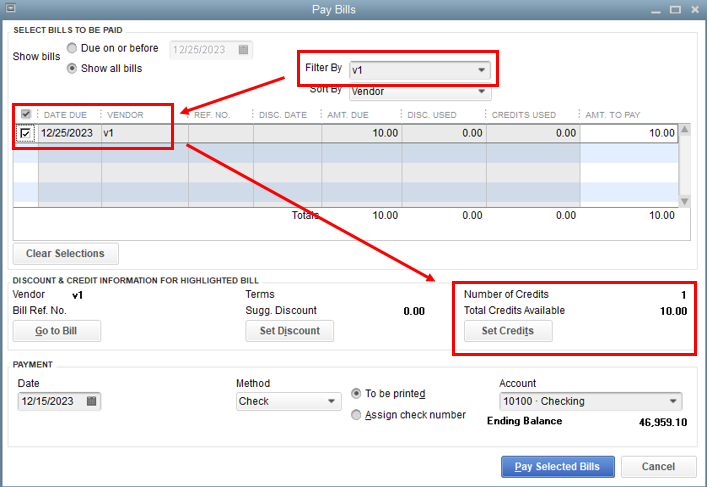

The steps you've shared above are applicable for QuickBooks Online. Since you're using QuickBooks Pro Plus 2021, below are the steps o follow. You can pay your vendor bills using the Pay Bills feature in QuickBooks.

For more details, you can check this article: Learn how to pay your bills in QuickBooks Desktop for Windows. Also, you can run the Transaction List by Vendor report to view the transaction and activities made to your vendor.

Feel free to check the articles below to learn more about customizing and memorizing report in QuickBooks:

Let me know if you have other questions or need further assistance. Take care and stay safe.

Hey,

I hve ongoing issues regarding the same. It's so hard to pay the bills when you have over 100 bills and also multiple supplier credits.

In "make payment" option, it only shows the outstanding transactions and not the credits.

So how to make the payment if i don't see any credits at all.

Nice to have you join this thread, @iprotruckrepairc.

I can share with you some information on how to apply those credits when paying your bills in QuickBooks Online (QBO). You’ll need to select your preferred vendor for the credit to show. Let me guide you how.

Then click Save and close.

However, if you’re using QuickBooks Desktop (QBDT), you can follow these steps instead.

In addition to this, in case you need to record a refund from your vendor, you can utilize these links that can walk you through the process:

I’ll be around if you have other questions about applying vendor credit in your QuickBooks account. Just tag me in your reply I swing back into action. Have a good one and keep safe.

eHi,

I'm trying to apply a vendor credit to a bill and schedule payment online. I created the vendor credit and bill, when i select the bill($1624.97) and enter the credit($16.59) it shows payment $1,608.38, which is correct. But when i click "Schedule Payment online" and go through steps it says its going to make a payment for the original invoice $1,624.97 without the credit.Why is it not showing $1608.38 as payment online

Let's find out why it is showing the original invoice amount when creating the scheduled payment, RadiantE.

Are you trying to create an automatic recurring payment to a vendor? If so, you can create a separate transaction for your scheduled payment so it would automatically apply the correct amount. To do this, you can follow the steps below:

Please read this article for more information and detailed steps: Create An Automatic Recurring Payment (check) to a Vendor.

You'll want to run a report for your vendors to find out how much is overdue.

Let me know if you need anything else about vendor transactions. As always, we're here to help you.

Hi,

No this isn't a reoccurring payment. Its a new Invoice that needs to be paid less the credit issued from the vendor. I'm paying online by scheduling an ACH within 2 days. The vendor account reflects the open Due Amount with the credit applied but when issuing payment it says it's paying full amount without the credit deducted.

Hello @RadiantE,

As of the moment, there isn't an integrated way to associate a credit when creating a scheduled online payment for your vendor bills.

With this, let's consider creating the credit first as partial payment for your bill before schedule an online payment. To do so:

Additionally, I've also included this reference for a compilation of articles you can use while working with us: Expenses and Vendors for QuickBooks Online.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

So how do I take the credit in desk top? I really wish desk top and On line was more alike so a user would know who to use both.

Hello there, pmpruneda.

I can help you create vendor refunds and soon apply them to your bills.

My colleagues shared the way on how to record credit in QuickBooks Online and Desktop. For QuickBooks Desktop, we have different situations to consider before recording a credit. You'll want to check out this article that will help you identify which scenario you're in and the steps on how to record a refund/credit: Record a vendor refund in QuickBooks Desktop.

In case you need to keep track of all the transactions you created for your vendors, you can run and customize reports. I'm also attaching this link that will help you in recording your payables: Accounts Payable workflows.

I'm just here if you have other questions about your vendor transactions. I'll be more happy to help!.

Good day, @FanOfHawks.

I’ve seen that you removed your post. I want to help you, but I need more details to discern your concern better. Can you share more info with me?

Our Support page contains resources, video tutorials, and tips to manage your company files. If you need more information, feel free to visit the site.

Don’t hesitate to tap the Reply button below for assistance. I’ll be here to help. Have a great day and always take care!

I found my answer in the comments above and was able to properly apply my credit to the invoice and pay it via bill pay. Thank you!

What if I am paying with a Credit Card account? The drop down for bank account only shows checking accounts?

Hey there, @H-S.

Thanks for taking the time to follow along with the thread. I hope you're enjoying the day so far.

To pay vendors using a credit card, you'll want to use the steps I've included below.

That should do it. For additional information about this process, please check out our Account Payables Workflow in QuickBooks Desktop.

Please let me know if you have any questions or concerns. I'm always around to lend a hand. Take care!

Where is the plus sign

what if the vendor credits are not showing/populating in th "add to check" area?

Nice to have you join this thread, @JLR-5150.

I want to make sure I address your concern accurately. Can you share with me what specific goal you're trying to accomplish and what you mean about the "add to check" area? Any additional information can help us narrow things down.

Furthermore, when using a vendor credit, please ensure that the bill is filtered to the vendor for whom the credit was created. This way, you can use the credit to pay the bill. I'll show you how.

In case you received a refund from your vendor, please see this article for your reference on how to record it in your QBDT: Record a vendor refund in QuickBooks Desktop.

I'm always available whenever you need help with your vendor credits and QBDT. Our door is always open for you. Stay safe and more power to your business!

Your explanation looks like a Quickbooks Online transaction. I am working with Quickbooks Desktop Enterprise. I have a payment on a vendor account of which part goes to an invoice on the account. How can I clear the invoice?

Karen

Hello there, @Karrob.

I'm here to help clear your invoices using the payment from a vendor in QuickBooks Desktop.

You can create a clearing account and use it as the payment account to mark bills and invoices as paid, at the same time. Let me show you how you can create and use your new account.

From here, you can create a journal entry to move the said amount of payments. Learn more about your clearing account with this article: Set up a Clearing Account in QuickBooks Desktop.

I've also got this article helpful in providing a different report you can use to determine the status of your accounts, financially: How does QuickBooks Generate Reports?.

Keep in touch if you need any more assistance with this, or if there's something else I can do for you aside from working with the payment accounts in QuickBooks. I've got your back. Have a good day!

There is no longer a make payment button there is only a make online payment button. Quickbooks online has become more of a permanent intuit add then an accounting software. Very disappointed in intuit.

HI:

Where is the + sign icon you're referring to that I need to click on it and choose check?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here