Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHi there cory2,

Here are a few possible reasons why vendors are not showing up in the 1099 MISC even if they meet the threshold.

Let's make sure to track your vendor payments to 1099 by following these steps:

You can also check this article for the other steps: E-file Through The 1099 E-File Service (QuickBooks Online).

Please let me know if you need more help with QuickBooks. Thanks.

I am also having this issue. Nothing is working! I have multiple vendors (all set up the same as the ones showing properly), that are not showing up in my reports even thugh they all made more than $1,000! Some made close to $4,000. But these are still not showing up on my 1099 report

Let's get all your contractors show on your 1099 report, @MaryKAccountant.

There are reasons why a contractor won't display on the report, and we'll utilize them to guide you in fixing this.

First, let's verify if the Track payments for 1099 box is ticked in their profile.

Second, if you paid your contractors with a credit card, debit card, gift card, or PayPal through your Payroll product account, you can edit those transactions and use a different method like check or expense.

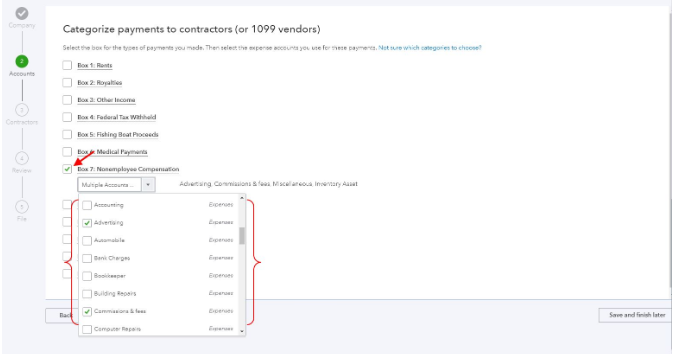

Third, if the accounts you used on your vendor transactions are not mapped for 1099, then the transactions will not show on the report. This includes the accounts you used on your items. Here's how to map them:

Then, you can run your 1099 report after checking and correcting your records.

I've also included this reference to run a couple of different reports to help file your 1099s: Create a 1099 report for vendors and vendor payments.

Please let me know how it goes. I want to make sure everything is taken care of. I'll be here to help you always. Have a nice day.

I am having the same problem. I have tried all three things you suggested and still they only comes up when I select "1099 contractors below threshold"

Hi there, eric-fitts.

I appreciate you for performing the steps provided above to fix the issue about setting up contractors for filing 1099. Since the issue persists, I suggest contacting our QuickBooks Support Team. They have the tools to pull up your account to see the cause of the issue. They can verify why vendors or contractors still only come up when select "1099 contractors below threshold".

Here's how to contact them:

Please refer to this article to see steps on how you can E-file your 1099s and how to check your filing status: Create and file 1099s using QuickBooks Online.

I'm just one click away if you need a hand with filling your 1099 form or any QuickBooks Online related. I'll be here to help.

Isn't it great how the question is never answered?

Hey, QB support, this is the question: How/Where in QB is the 1099 threshold set?

Nobody needs to know how to tag vendors or any other 1099 issue - just need to know where in the global settings one would go to set/change the 1099 threshhold.

I acknowledge your desire to manage the 1099 threshold amount in QuickBooks Online, FeeGarro.

Please know that there's no direct option to modify the threshold, as QuickBooks strictly follows IRS regulations regarding its fixed value and calculation. Allow me to discuss this matter below for further clarification.

If a contractor is paid a total of $600 in a single tax year, that's the time when you'll be required to prepare and file 1099s for them. When the specified threshold is not met, the company will not be obligated to prepare and file a 1099 for the contractor. Furthermore, the payment type could also affect the threshold formulation, as stated by my colleague above.

For more information about the 1099 threshold, tax preparation, filings, or pulling up its designated reports, kindly check these links:

On the other hand, a contractor's transaction needs to be categorized directly into an expense account. Otherwise, some of their data will not be included on your 1099 records, even if the report is customized to display contractors that met or exceeded the threshold value.

In the event that your contractor's data is not visible on the report, I recommend double-checking the payments and how and to what account they're categorized. If not recorded to an expense account, you can change the linked account's Account type to Expense from the Chart of accounts page:

It's essential to note that this process could impact your financial records, so it's advisable to seek guidance from an accounting professional to ensure the accuracy of your books.

I'm also attaching this article that can help handle a situation where you need to file both 1099-MISC and 1099-NEC forms: Modify your Chart of accounts for your 1099-MISC and 1099-NEC filing.

If you have more questions about the 1099 threshold and reporting, tick the Reply button. We're always here whenever needed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here