Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, @MMP3.

I've got the steps you need to update your WA Workers Comp rates for the existing Class Code in QuickBooks Online.

Here are some pointers that you can check to learn more about how QuickBooks Online handles workers comp:

However, if you're still unable to update the rates, I'd suggest getting in touch with our QuickBooks Support. They have the tools requires to edit existing class codes and rates.

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks Online. Assistance is just a post away. Take care always.

The answer provided does not work . My classes are already setup. The option to change the L&I rates is NOT offered in the Payroll Settings section where the WA SUI and FPML are available for update.

WHERE IS IT??? Can not update the class rates on the individual employee tab either.

Hello there, suewagz.

You can update the WA State Worker's comp rates by following the steps below:

Once done, you can run the Workers' Compensation report. Here's how:

On the other hand, if you mean you've tried updating the rate with the step above, you can perform the troubleshooting below fix this unusual behavior:

Also, you may want to check this article for additional details: Learn about and get workers’ compensation insurance.

Comment below if you need further assistance. Take care and stay.

I have the same issues. I had to Email my rate notice to this address for the update : [email address removed]

Thank you for joining this thread, @Jonettelee.

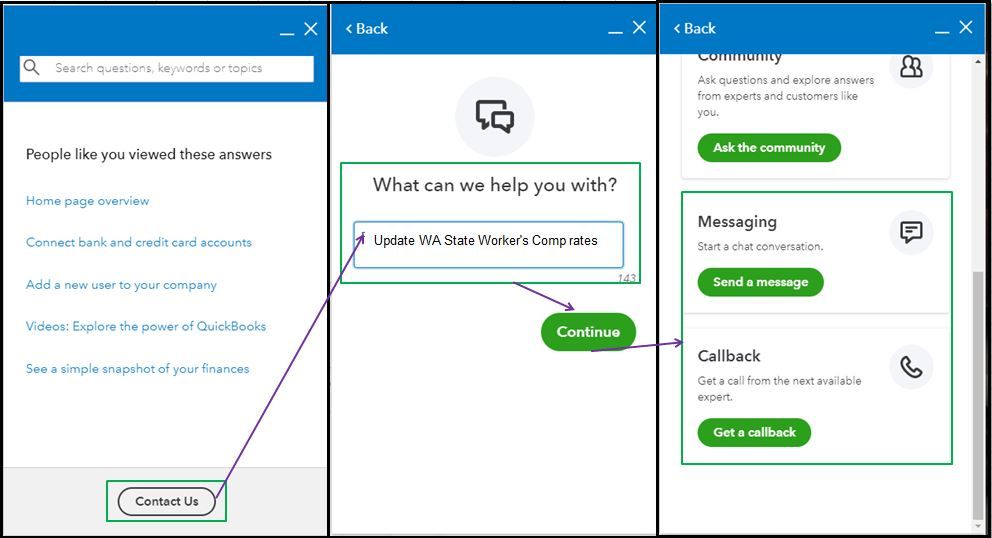

Have you tried the steps provided by my colleagues above? If so, and you still can't update your WA State Worker's comp rates, I recommend reaching out to our Payroll support team. They use specific tools to help you change the rates in a secure environment. Follow these steps to connect with them:

For more info about WA Comp setup and calculations, please visit this article: Washington Workers' Compensation.

Also, for your future reference, I've added this helpful article to guide you in viewing past filed forms and tax payments. See this article: See this article: Access payroll tax forms and tax payments.

Please know that you can always post here if you have further concerns about updating your WA Comp rates in QuickBooks. I'm always here to help you. Have a good one.

Yes I did reach out to the payroll team through the online chat feature and I had three people help me. only one gave me the Email address which has been blocked out but it can be found in the end of year check list. I also found out my company will be charged $50 for the update that is impossible to do through the Quickbooks Online software. That seems like something that should be included with the Payroll Premium Plan my company pays for already. It also can take up to 21 days to complete.

This is absolutely ridiculous. It will let you edit the employee's rate class, but it won't allow you to update the actual rate that applies to that rate class. Which means, the first time you input a rate, you are stuck with that rate for that rate class forever. The rates change annually for each rate class. FIX THIS ISSUE.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here