Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a customer who has an existing credit balance with me. We've agreed that future work will be paid at half my normal rate via direct funds, with the other half applied against that balance until it is satisfied. I'd like these 'credit' line items to display on the individual invoices if possible.

How would I best set all this up in QuickBooks so that I may properly account for both new work and the credit balance, so that half of the billed subtotal shows on the invoice as having been applied to the balance? (Ideally, I'd be able to send him a monthly statement showing the current state of the credit—but if that's not possible I can live without it.)

The Community has got your back, @InteXX.

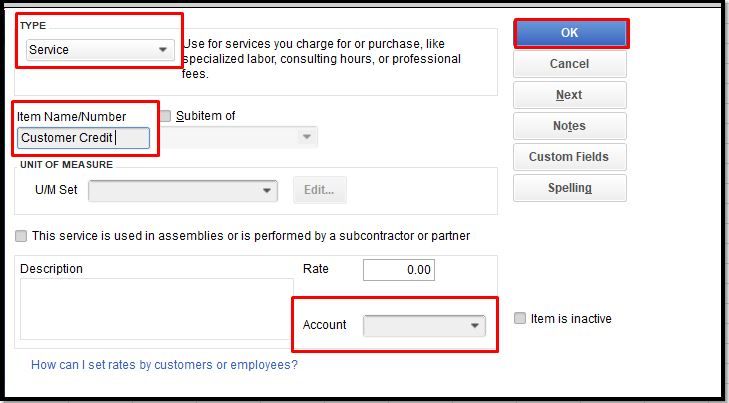

I can share options so the credit will show on your customer's invoice. First, you can create a Service Item to record the customer's Credit Line. You'll need to change the Income Account where you record the credit line of the customer. Here's how:

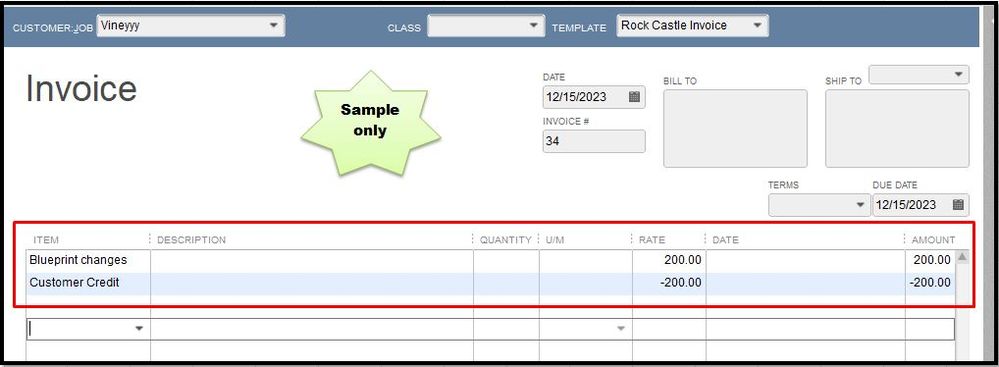

Once done, add this service item on the customer's invoice with a negative value to reduce the payable of the customer while the income stays at it is. Let me show you how:

For your reference, please visit this article: Give your customer a credit or refund in QuickBooks Desktop for Windows.

You can also create a Customer Statement that you can send to them to see the summary of their transactions. For the detailed guide, please check this link: Create a billing statement.

Let me know if you need further assistance in handling customer's credits in QuickBooks. I'm always around to help. Have a good one.

This looks good, thank you.

I'm not comfortable marking it as the answer just yet, though, because I have yet to try it out. I've just discovered that I entered his series of payment transactions in different ways. They're all marked as cleared for the bank account reconciliations, so I've got a project/mess on my hands.

I'm going to have to go back and redo a lot of stuff before I can get to this.

I promise I won't forget you, though.

I've been thinking about this.

I probably shouldn't enter the retainer payments directly on the customer's current invoice—as you describe—because they were made quite some time ago (years ago, in fact).

Also, I deposited the cash that he sent at the time into my bank account. So I'll need to record them as deposits so I can reconcile them against my bank statement(s).

Given these complications, how might I best address the situation? I still will need to produce an ongoing statement of invoices/charges/credits against the retainer.

FYI I've used up about half of the retainer, in terms of time spent on the current project. I mention this to highlight the need to spread these transactions across multiple invoices.

Please advise.

Thanks for posting here, @InteXX,

Joining the thread to share some insights about applying credits and payments to an old invoice. If you're not comfortable editing the sales transaction, you can instead use the deposit option for the credit and payment.

There are several options for you to handle this. First, you can use journal entries to do some adjustments with A/R balances. But we always recommend seeking help from an accountant to supervise the process.

Second option is using a deposit entry and mapping the payment to the Accounts Receivables. That way you can apply the payment or credits to the invoice without editing it.

If you want to consider this option, see the steps below:

Let me know if there's anything else I can do to help you. Just mention me on your reply so I get notified immediately. Have a nice day!

(Note: I don't have old invoices for his prior payments toward the retainage—they came as checks/cash and I deposited them in the bank immediately. They originate in QuickBooks as standalone deposit transactions.)

Your second suggestion seems the best way to go. But how would I link the deposit transaction to the specific new invoice, given that I'm assigning the entire A/R account in the Make Deposit dialog?

Thanks,

Jeff Bowman

Fairbanks, Alaska

Thanks for getting back to us, @InteXX.

Let me chime in and share some insights, so you can link your deposit transaction.

Once you assign the transaction to the A/R account, you'll have to receive the payment. This way, you can link the deposit to the new invoice. Let me show you how.

You can also refer to this article for more details: Receive and process payments in QuickBooks Desktop.

Once done, you can now open your new invoice and link your deposit transaction. Just follow the steps shared by my colleague above for the process.

For additional tips about creating invoices in QBDT, you can open this link: Create an invoice in QuickBooks Desktop.

On the other hand, here's how you can learn more about the different ways you can track customer transactions in QuickBooks Desktop.

If you have any other questions, please feel free to leave a comment below. I'll get back here as soon as I can to help you again. Thanks for coming, wishing you a good one!

But here you're talking about receiving the payment after making the deposit. That seems backward.

Can you clarify?

Thanks,

Jeff Bowman

Fairbanks, Alaska

Let me point out some things on how you can link the deposit transaction to an invoice if you have already assigned the entire A/R account in the Make Deposit dialog, InteXX.

You can treat it as retainers. You'll have to make sure that you've set up an account so you'll be able to accept upfront deposits or retainers. To create one, you can follow the steps below.

Once done, create an item to use so you can record upfront deposits or retainers. Please go to Step 2 of this article for the detailed steps: Manage Upfront Deposits or Retainers.

Next, you can create a journal entry to apply the credit to the A/R account. You'll also want to run specific reports in QuickBooks Desktop to know where your company stands. Here's an article that you go over: Understand Reports.

Fill me in and keep in touch if you have any questions about invoicing to existing credit. We're here to help you if you have any other concerns.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here