Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am at the beginning of my business; I am a single member LLC and will probably choose to be treated as a sole proprietorship. I do not have a business credit card as yet, so that I might use my personal credit card to pay my expenses at least for a while. I have a couple of questions:

1. What are the steps to record inventory purchases in QB that I paid with my personal credit card? and

2. How to record my business expenses (like internet, hosting, domain) in QB also paid them online using my personal credit card?

Thank you greatly.

Palomar

Solved! Go to Solution.

Yes, you're right, @Palomar.

You can also record those expenses by creating a bill and mark them as paid using the Pay Bills window.

In QuickBooks Desktop (QBDT), you can record your expenses by writing a check, entering a bill, or through credit card charge for purchases you track through expense accounts and for the following types of items: fixed asset, noninventory part, service, and other charge.

To record an expense for inventory items, you can record them by entering a bill, then use the Pay Bills window to view and pay the bills.

Here's how to enter bills:

Here’s how to pay a bill properly:

Check these articles for more information:

Please let me know if you still have follow-up questions about recording your transactions by leaving a comment below. I'm always here to assist. Take care and enjoy the rest of the week.

I can help you record these purchases paid with your credit card in QuickBooks, @Palomar.

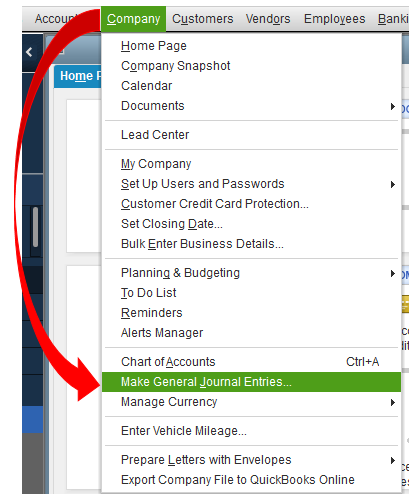

Frequently, business owners will pay for business expenses with personal funds. These expenses can be recorded in QuickBooks by creating journal entry.

The expenses should be entered to the relevant expense categories via Owner’s Draw/Equity. Let me outlined the steps for you:

You can also visit this article for further information on how to track expenses in QuickBooks. This provides ways to manage and organize your personal finances.

Don't hold back to drop a comment below if you have other questions besides recording expenses. It's my pleasure to be of great help. Take care!

I did some search on QB website and found that this should be recorded as entering a Vendor and a bill and pay that bill with a credit card....is that right?

Yes, you're right, @Palomar.

You can also record those expenses by creating a bill and mark them as paid using the Pay Bills window.

In QuickBooks Desktop (QBDT), you can record your expenses by writing a check, entering a bill, or through credit card charge for purchases you track through expense accounts and for the following types of items: fixed asset, noninventory part, service, and other charge.

To record an expense for inventory items, you can record them by entering a bill, then use the Pay Bills window to view and pay the bills.

Here's how to enter bills:

Here’s how to pay a bill properly:

Check these articles for more information:

Please let me know if you still have follow-up questions about recording your transactions by leaving a comment below. I'm always here to assist. Take care and enjoy the rest of the week.

How do I enter the invoice in from the vendor, and in turn pay myself back without it showing up as another purchase?

Nice to have you joined this thread, @TJ62.

I can share some insights and steps on how to record an invoice from your vendor without showing you purchase it.

You’ll want to use a clearing account to move the funds from one account to another. This account normally has a $0.00 balance and is also called a Barter or Wash account. Let me show you how to set it up in your QuickBooks Desktop (QBDT) software.

To use the clearing account, create a Journal Entry (JE) in entering those transactions. For more details about this process, you can check out this article: Set up a clearing account.

Also, I'd recommend working with your accountant for additional guidance. This way you’ll be guided accordingly on which account to use in creating a JE. If you’re not affiliated with one, you can visit our ProAdvisor page and look for one form there.

Once everything is all set, you might want to utilize this link for reference in reconciling your accounts.

Keep me posted if you have follow-up questions managing your accounts or with QuickBooks. I’ll be around to help you any time. Stay safe!

Unless I missed something, the answer of how to get the purchase applied against INVENTORY was not addressed. When I do what is suggested, at creates a debit to COGS, not inventory, and a credit to A/P.

When I go to Vendor and create a bill for the purchase of inventory items, it records this purchase against COGS.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here