Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

the account the income posts to is determined by the item you use on the invoice or sales receipt

so you will have to make an item for the customer that links to the income account you want it to post to - not a real efficient way to do things in QBO

most all of us post income to one account, and use class or location to track where it came from and be able to report on it (plus and higher only)

Thank you Rustler for your response. If I may ask another question related to this. How do I set up a new item and link it to an account

For rent can I set up a separate AR GL Account?

It’s commonly advised to maintain only one Accounts Receivable in order to keep your records organized, sphilip.

Creating another AR account aside from the one generated by QuickBooks is possible. Though, the system won’t be able to recognize this AR. Your receivable transactions will still route to the default account.

You’ll need to transfer these transactions manually from the default account to the one you’ve created. If you’d like to group your receivables, you might consider the location tracking method. Please refer to this article for additional information: How to group Accounts Receivable.

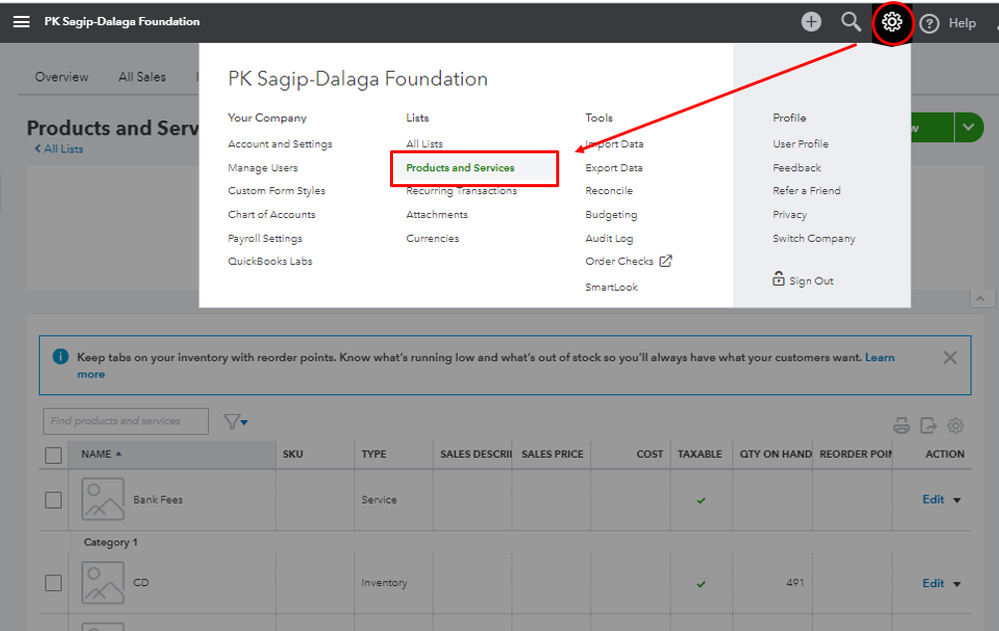

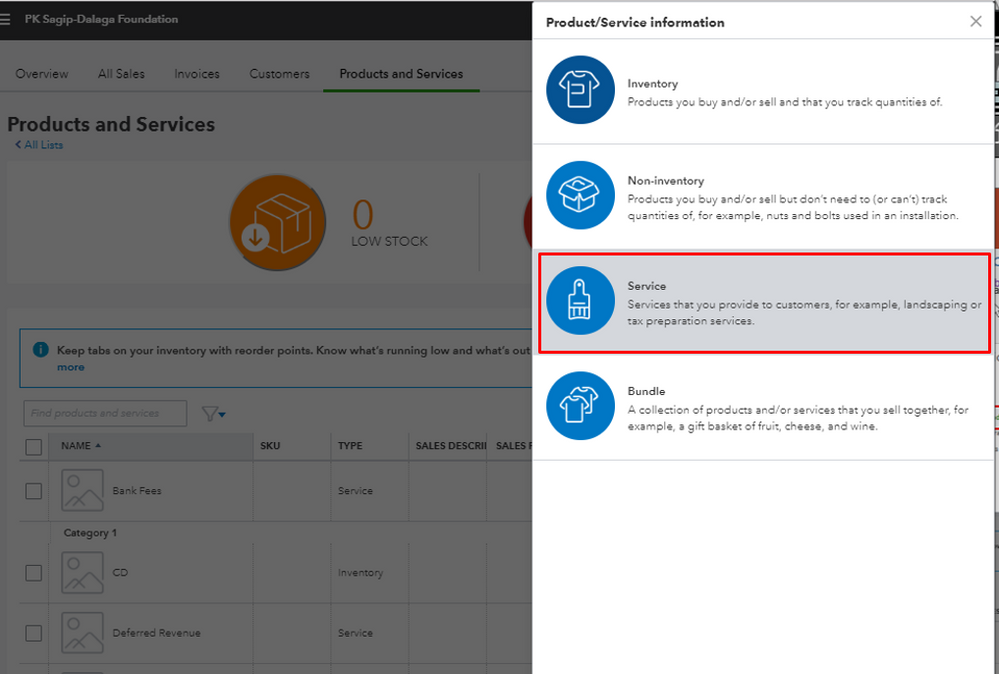

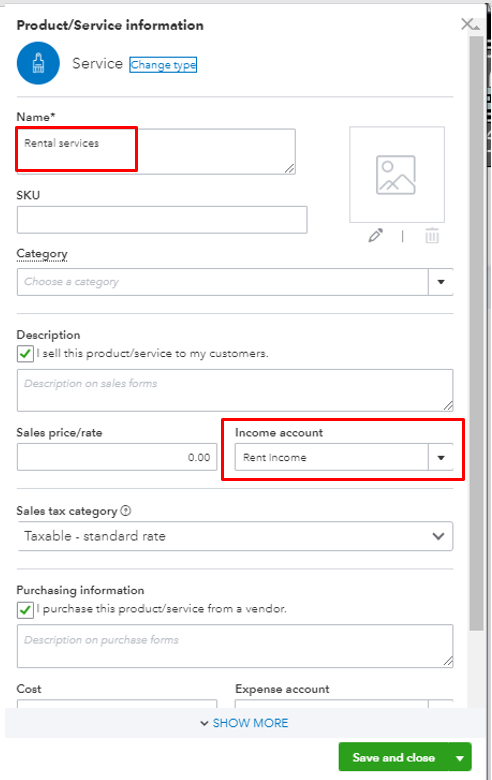

Also, I can walk you through the steps of setting up an item linked to an income account. Here’s how:

You can also learn more about creating items in QBO through this article: Adding Products and Services.

The Community space is created to cater all your concerns about QuickBooks, so please don't hesitate to visit us again.

xThank you for your response. Maybe I am not explaining this correctly. We are basically subletting a portion of our office to a tenant who pays us rent. Their portion of the rent will partially offset our rent as well. What would be the best way to capture this transaction in quick books?

Do I need to set them up as a customer and link them to certain GL accounts?

Hey there, sphilip.

You can deposit the rent payment directly to your account. And yes, you need to set them up as a customer.

Our class tracking feature lets you track your income and expenses for the rent. You can create a service item and add the class type for easy tracking.

Here's how:

After that, you can create a check to pay your rent.

To know more about our class tracking feature, check out this article: Set up class tracking.

The following articles are good references for QuickBooks Online products and services:

Feel free to drop a reply below if you have any other concerns. Have a good one.

Thank you MikiD. I think this might work. I will let you know once I have a chance to try it out.

Thank you for your response. I am actually collecting rent and not paying it. But all the solutions provided by the QB community suggests to create a rental income account and map it to that. I will try this and let everyone know if there are any other issues. Thanks for all your help with this.

Thank you all for your timely responses. I am still stuck with a couple issues here. For one, when I tried to go back and edit the customer I created it wouldn't let me make any GL changes.

To summarize what I am trying to do is this:

We have a customer that we sublet our office space to and they pay us rent which we want to use to offset our own rent.

Is there a way to map this customer to two different GL accounts. We want the rent to go to Balance Sheet Account and the other charge to go to a P&L account.

Please let me know if any of this is not clear. Thanks

Thanks for getting back and for the detailed information, sphilip.

The suggestions in this thread to create an income account, a rent item, and use it to your customer transactions are correct. Now, you might also want to set up an expense account for your rent expenses.

You can use this to create an Expense, Check, or Bill to track the rent expenses. Check this link to know more about it: What is the Difference Between Bills, Checks, and Expenses?.

Make sure you use the customer name in the Payee field if you select Expense or Check.

If you select Bill, you might need to create a vendor profile (for the customer). This is to associate your rent expense to the customer.

Though that's how it works in QuickBooks Online, I'd still recommend settling this with your accountant. They can give you other options on how to record the rent expenses.

Once you've recorded the rent expense correctly, it should also reflect on your financial reports (Balance Sheet and Profit and Loss).

Thanks for your response. So we have the customer set up but is there a way to map it to multiple GL accounts based on type of charge. For example rent needs to go to the Balance Sheet account and another charge from the same customer needs to hit the P&L account.

We can only map transactions, sphilip.

From what I'm getting, the rental amount you collect is not an income because your customer is just sharing the rental payment with you. That's why you want to show it in the Balance Sheet. Then, you are liable to give that to your landlord together with your rental share. With this, you can create a liability account to track the payment you collect. When you receive the payment from your customer, the amount adds to the liability account. Then, when you pay your landlord, the liability account should be reduced by that amount.

Here's the recording part for receive payment (rental share):

When you pay your landlord, create a check. Be sure to choose the liability account as another line item in addition to your payment, which is on another line item. That will do it.

Please let me know if you have other questions in mind.

Thanks Jess T. I am not asking as to how to create a journal entry in QB but rather how do I set this customer's payment each month who will be sharing the rent with me. Can I set up this customer and then map them to the accounts that I need? For example map them to Balance Sheet and P&L account at the same time?

or if this is confusing. How would I set this customer up who shares office space with me and pays me rent each month (recurring) a portion of the rent should go to the Balance Sheet and a portion to P&L. Thanks

Hi there, sphilip.

The Balance Sheet report shows what you own (assets), owe (liabilities), and invested (equity). Profit and Loss on the other hand will report all your income and expense, and net income accounts. The affected bank account you chose when creating the customer payment will flow in both reports.

If you create an invoice when recording the rent it will affect the Accounts Receivable (A/R) account. When the customer pays it it will reflect on the resister both bank and A/R account.

If there's anything else that you need, please let me know.

Thanks Catherine_B. We don't want this to hit our trade AR since this is not receivables as related to the business we are in. We created a Non-AR account to capture this rent payment.

We're unable to map your customers to balance sheet, sphilip.

We can only map transactions, and not customers or any other profiles. This is also why JessT suggested to use Journal Entry above since we unable to use sales entries for they will reflect to your sales reports.

It would be best if you can reach out to your accountant. Then, let us know if there are special setups, so we can guide you with them.

Please know that we're here if you still have questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here