Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowYou do not, there is no fix necessary, that is the regulation started several years ago by the IRS

Your company only reports cash and check payments to contractors. Gotta love it, I got all my contractors to accept paypal payments and now I have zero 1099's to prepare

I did some research on this subject and found that Quickbooks is not correct, they are confusing a credit card company who collects many transactions for a company, vs. a company who is paying their subcontractors via a credit card payment. Credit card companies must issue a 1099K if a company's credit card receipts total a certain amount, which is $20,000.00.

I am a bookkeeper and therefore need to include those credit card payments to a subcontractor on their 1099MISC.

Hope this helps you!

Hello, @sullivanps.

It’s my priority that you’re able to get all your subcontractors on the 1099. If you contractor paid with a credit/debit card, gift card, or PayPal you’ll want to edit those transactions and use a different method like check or expense.

If the accounts you used on your vendor transactions are not mapped for 1099, then the transactions will not show on the report. This includes the accounts you used on your items.

Here’s how to map them:

Here’s an article about contractors missing from the 1099s that will be helpful:

I’m just a few clicks away should you need anything else.

All entries are mapped correctly and coded correctly. The payments made by check show up under 1099 Vendor Summary, it is the payments to subcontractors paid by credit card that do not show up in the 1099 Vendor Summary. Quickbooks says this is correct, they are wrong! I am a bookkeeper and my construction company clients sometimes pay their subs with a credit card, not a check or by EFT. The check and EFT pays show up under the 1099 Vendor Summary, but the credit card payments do not. This is a program error by Quickbooks.

A credit card company has many clients/customers, and they must prepare and file a 1099K if their their client/customer has more than $20,000 in transactions, i.e., a restaurant, clothing store, grocery store. This is what Quickbooks is basing their claim on that credit card payments to subcontractors by a construction company do not get included on 1099MISC. This is not correct.

I appreciate you for getting back here in the Community, sullivanps.

When running the 1099 Vendor Summary report, it only includes payments made by cash and ACH. For credit card transactions, I suggest reporting them using the Form 1099-K.

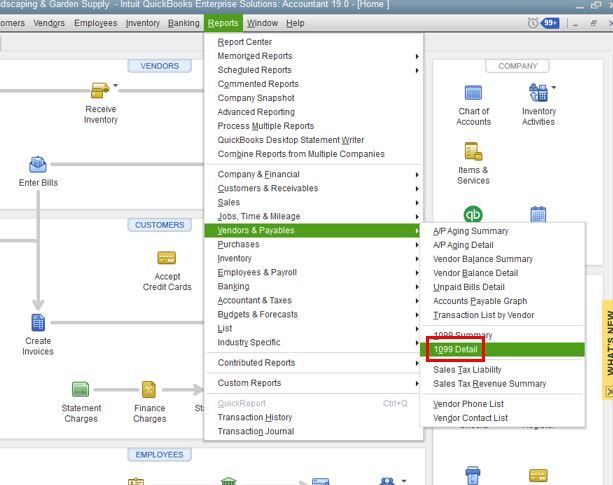

You can run the 1099 Detail report to show the list of payments. Here's how:

For additional guidance with Form 1099-K, you can refer to the IRS website: Understanding Your Form 1099-K.

Reach out to me whenever you have additional questions or concerns. Please know the Community has your back, and I'm here ready to help you. Have a good one.

Which specific filter(s) do I need to change? I also need the subcontractors I've paid by credit card to show up on my 1099 summary. I followed your directions and made changes to every filter (one at a time) having to do with payment, but's still only showing the ones paid by check.

Thanks for dropping by, @taraodesign.

Instead of running the 1099 Vendor Summary report that only includes payments made by cash and ACH, you can follow the steps recommended by my colleague by reporting the credit card payments using Form 1099-K.

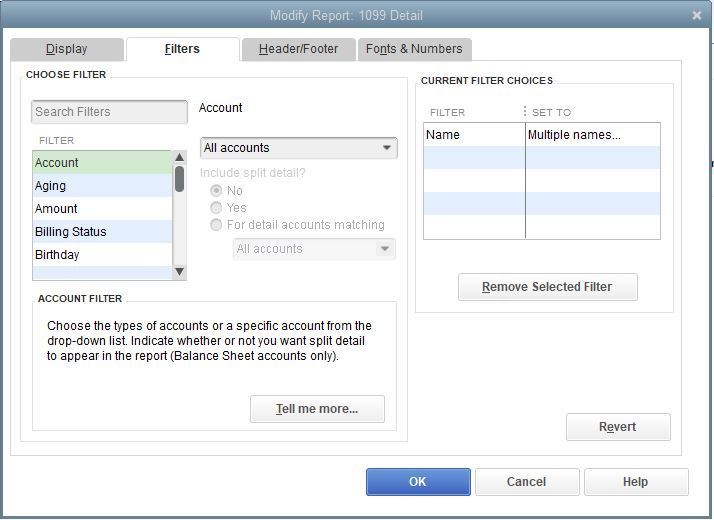

Run the 1099 Detail report to show the list of payments like the credit card. When you filter this report, include the Payment Method and filter it to specific credit card accounts. I've added a photo for visual reference.

Once set up, click OK to run the customized report. Then you can read the guide for 1099-K for additional info.

For other resources that you can check, see this links:

Let me know if you have other questions in mind about running 1099 reports. I'm always around to help. Take care and have a great day ahead!

This was one of the filters I tried before I contacted support, and it doesn't work either. I currently have all payment methods selected, and only my checks to my 1099 vendors appear in the 1099 Detail. If I filter multiple payment methods, even my checks disappear and the report is blank. I also tried ticking checks and visa individually under multiple payment methods, but the report goes blank then, too.

I appreciate you for performing the steps to get this sorted out, taraodesign.

You'll want to check the expense accounts you mapped to report 1099 transactions to make sure payments are associated with them. Once verified, yet the report is blank, I'd recommend running the Verify/Rebuild Utility Tool to resolve possible data damage of your company file. This can be the reason why you're 1099 report is blank.

Here's how:

Please get back to me if you have any other additional questions concerning the 1099 reports. I'm always here to help.

All of the payments are mapped to the same expense account (subcontracted services). I paid one contractor first with a check, then switched to credit card. Only my check payment to him is on the 1099 Detail. I ran the Expenses by Vendor Detail report to be sure, and all the payments that should be on the 1099 Detail are there for each contractor.

I ran Verify Data anyway, and no problems were detected.

Before I started this, the default was set to all payment methods and only the checks to my subcontractors showed. Only when I filter multiply payment methods is the report blank.

I will repeat whar was correctly stated here a year ago but then trumped by someone else who shoukd know better. The mapping of payment types that excludes your payments by credit card for contractors or others eligible for a 1099MISC or a 1099NEC is correct.

Do not attempt to override this as it can result in your contractors receiving multiple 1099 for same services, one from younand one from Visa or Paypal. If you do not believe Intuit I include multiple sources.

https://smallbiztrends.com/2015/01/1099-contractors-paypal-credit-card.html

Unbelievable! Long story short, the comments by Rustler and john-pero are correct. You only 1099 people paid with cash or checks.

I read the comments and assumed the bookkeeper that responded knew better than Rustler, especially since Quickbooks seemed to offer a suggestion to "fix" it after that. I sent the link to my CPA to confirm, and he somehow misunderstood my question, telling me that the ADMIN comment was correct.

Fast forward through a whole day wasted trying to do the impossible (what on Earth Quickbooks was trying to tell me to do, I still don't know!). I asked my CPA again to clarify, and he said that you only 1099 people paid with cash or checks.

Sorry for the long rant, I'm just so aggravated. If the "experts" don't know or give the wrong information, how are we regular people supposed to figure all this out!?!

I'm on quickbooks for mac and don't see and "expenses" button anywhere...

Thanks for joining us here in the Community, @psalex.

I'd like to ensure that you'll be able to see the expenses button on QuickBooks Desktop. However, I'd like to know if which expenses button are you referring to? Is it in the banking tab or for your vendors? Any further details will be a great help so I can give you the right amount of information.

Please get back to me with more details and we'll take it from there.

I'll be keeping an eye out to your response on this. Have a lovely day!

Vendor gets a 1099K from his credit card MERCHANT not the issuer of the payment!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here