Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI set up an Inventory Assembly item following Quickbooks instructions. The Total Bill of Materials Cost did not transfer to the Average Cost field. I then went to the "Build Assemblies" option under "Activities." I had 1,000 assemblies to build, and it transferred 1/2 of the Total Bill of Materials Cost in the average cost field. How can I get Total Bill of Materials Cost to equal the Average Cost field?

Solved! Go to Solution.

Let me share some insights on how the average cost works, @sfreese70.

The average cost is the total amount of cost of all of the inventory you have divided by the number of items. The total bill of materials (BOM) cost would differ from the average cost if you purchased the BOM at different rates.

QuickBooks also uses the weighted average cost to determine the value of the item and the amount debited to COGS when you sell it. This article discusses this a little further: Understand Inventory Assets And COGS Tracking

Here's an example:

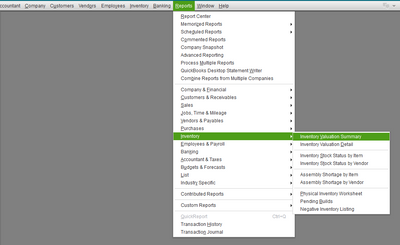

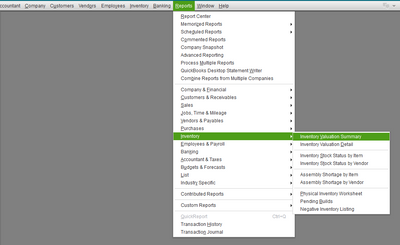

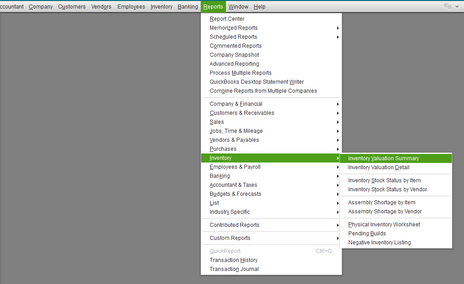

This is how QuickBooks determines the average cost. You can run the Inventory Valuation Summary report. This shows you how QuickBooks got the item's average cost.

Don't hesitate to visit us and post questions anytime you need help with inventory tracking. The QuickBooks Team is always here to answer them for you.

Let me share some insights on how the average cost works, @sfreese70.

The average cost is the total amount of cost of all of the inventory you have divided by the number of items. The total bill of materials (BOM) cost would differ from the average cost if you purchased the BOM at different rates.

QuickBooks also uses the weighted average cost to determine the value of the item and the amount debited to COGS when you sell it. This article discusses this a little further: Understand Inventory Assets And COGS Tracking

Here's an example:

This is how QuickBooks determines the average cost. You can run the Inventory Valuation Summary report. This shows you how QuickBooks got the item's average cost.

Don't hesitate to visit us and post questions anytime you need help with inventory tracking. The QuickBooks Team is always here to answer them for you.

This is so helpful! Thanks so much!

I have been on the phone 3 times with Technical support ( close to 6 hours!) and am trying to escalate this but to no avail. No call back when said they would. When we built an assembly, the cost of material was 27.88. Quckbooks calculated the average cost of the assembly at 287.88 No one can say how to correct this as it is overstating the inventory significantly. Data services has said its not their problem-- that an accountant must fix. The only thing an accountant can do is create an entry writing off the $15,221.60 against the COGS , but that is really not right. We should be able to correct the average cost. I understand the concept of average cost, but this is a bug of some sort.

This has been tagged by QBs as solved, but it has not. This isn't a case of understanding how the average cost is calculated. This is the case of an incorrect entry or calculation done by QBS that seems to be unable to fix.

We are having a very similar issue -- did you ever get this resolved? Quickbooks Tech support hasn't been helpful either.

Thanks for joining the thread, @amooreCRS.

QuickBooks calculates the average cost by adding the cost of all of the items in inventory divided by the number of products or services.

The system is programmed to calculate using this method.

If your expected average cost calculation is incorrect, you can run the Inventory Valuation Summary report. This way, you can verify many times the items were purchased and change their average value. Here's how:

After getting the data, you can now manually calculate the average cost and compare it to QuickBooks. You can also ask your accountants for further guidance when it comes to calculation. This way, we can ensure that they are accurate.

If QuickBooks shows an incorrect amount, let's run some basic troubleshooting steps to address the issue. There might be a minor data damage in your company file that's causing this behavior.

To start, update QuickBooks Desktop to the latest release. This way, you can refresh the program and have the latest features and fixes.

Here's how:

If you're still getting the same result, run the Verify and Rebuild Data tools. This will help us identify the most common data issues within a company file and fix it.

I'll also add our Year-End Guide for QuickBooks Desktop. This will provide you with some info on what you'll need to do when closing your books and preparing for the new one.

Let me know how else I can help you with QuickBooks by adding a comment below. I'm more than happy to lend a helping hand. Keep safe!

Yes, I know all of that. I am more specifically asking how the "Assembly Builds" calculate average cost.

Thanks for reaching out to the Community, amooreCRS.

The average cost calculates the sum of the cost of items in your inventory, divided by the number of items. If you have further questions about an assembly's average cost, the best way to find out is by running your Inventory Valuation Summary report. It will show you how QuickBooks got the item's average cost.

Here's how it works:

I've also included a couple detailed resources about working with average cost which may come in handy moving forward:

Please feel welcome to send a reply if there's any questions. Have a wonderful day!

Again, I am specifically asking on Inventory Assembly . Our inventory assemblies have no inventory in them until we build something. How does that effect the average cost? Does it even effect the average cost?

I have a particular item, the BOM is $200 higher than the average cost.

How does the BOM effect the inventory assembly build average price?

I have been trying to reach someone in Tech Support for the past 2 days to do some screen sharing/run some scenarios to help make sure we are doing this correctly but have had no such luck.

Thanks for getting back with the Community, amooreCRS.

Since you're not able to find the information you're looking for in your Inventory Valuation Summary report, I'd recommend getting in touch with our Customer Care team. They'll be able to pull up the account in a secure environment and conduct a screen-sharing session with you.

They can be reached while you're using QuickBooks.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

If there's any questions, I'm just a post away. Have a great day!

Hi - we are running into the same problem with assemblies - average cost is too low.

Did you ever get a resolution?

Hi there, @kimb2662.

Let me help you determine how you came up with the number.

You may have purchased items in a lower amount giving you a low average cost. You can get the amount by dividing the total cost of all of your inventories by the number of items. You'll want to follow our guide here on how to calculate it: Understand Inventory Assets and COGS Tracking.

You may also refer to your Inventory Valuation Summary report on how QuickBooks got the item's average cost.

Here's how:

On the other hand, if it's not calculating correctly, I recommend running the Verify/Rebuild tool. By verifying, QuickBooks will detect any damaged data, and rebuilding will help fix it. It also allows your software to refresh the data inside the company file.

Please come back and post questions if you need help with inventory tracking. We'll be right here every step of the way.

Has this issue in the thread ever been resolved? We are encountering the calculated average cost is not updating even if you say set the new cost to be .01 with 1010 in stock on valuation summary it should be 10.10 value however it says over 18,000 why? We have tried all that customer service has suggested yet they cannot even give answer as to why it keeps picking a value of 117.00 for average calculated cost in item listing and valuation.

I need answers to complete and finalize my inventory for financial purposes.

Hi there, @howard1144. I want to make sure you get the help you need.

To ensure we're on the same page, can you add a screenshot of how you've set up the assembly as well as the reports or any important details that can help us fix the problem? Any extra information is appreciated.

In addition, if you're experiencing other problems within your company file, please let me know. I'm here to lend a hand.

Looking forward to your reply.

There are no other issue within my company file. QB Support had me run verification of files; updates, reboot, and tons of other diagnostic stuff to reboot everything to sign in and same issue still appears...calculated value in many items is not accurate. example is a spacer that legit cost in market 1.17 but we make it and have it set at cost of .01 (example) with 1010 in stock but when we run valuation summary stock value is at 118,000 rather then 10.10. I am have issue getting screen shot to paste here.

Thanks for getting back here, Howard1144. Allow me to route you to the right support team to help you get this resolved.

Beforehand, to ensure we've got the right solution for you, it would be much appreciated if you could provide us with a screenshot that would help us determine what's happening on your end.

On the other, I'd recommend contacting our Customer Care Team again to help you assist further with the calculated average cost not updating. They have the ability to check and pull up your account using the screen sharing tool. Also, they'll provide workarounds once this issue is identified.

Moreover, you can check out this article if you wish to have adjustments in your stocks: Adjust your inventory quantity or value in QuickBooks Desktop. Also, this will help you keep your inventory status more accurate.

If you have any additional QuickBooks-related concerns, feel free to leave a comment below. We'd be glad to help you. Have a good one.

I'm having an issue where our inventory value doesn't seem to get relieved properly when building an assembly, which then causes our inventory value to be insanely overstated afterwards.

See attached image where the Calculated Avg seems to be 'fine and normal' throughout October.

November hits and we build an assembly, yet the inventory value doesn't get properly reduced.

Anyone have any idea what's going on?

Hi jsharpe,

Thank you for joining the conversation. I'll share the information why the average cost is not calculated properly when building an assembly and guide you to fix it.

The Average Cost of an assembly item is calculated based on the cost of inventory parts. Therefore, you need to make sure that the individual parts have their own costs. Otherwise, you won't get an average cost, like in the screenshot below.

After knowing which item it is, edit it, and add the cost. Then, go back to the assembly item and deselect and reselect that item.

On the other hand, if you want to find references for QBDT, just click the Topics menu above and select a topic.

Please let me know if you have questions as you do some edits. I'm just around to help.

Hi there, PAlcala.

Welcome to the thread, and thank you for adding a screenshot. I'm here to lend a hand in correcting your average cost.

Changing the cost of an item prior to the created transaction doesn't affect the average cost. That's the reason why it's showing as zero. To get this resolved, you can create an inventory value adjustment. Before doing so, you may consider reaching out to your accountant for guidance in adjusting your inventory. Doing this helps ensure your cost average is calculated correctly.

For steps in creating an inventory value adjustment, check out this article: Adjust your inventory quantity or value in QuickBooks Desktop.

In case you want to make data entry easier and faster, you can use a barcode scanner and barcodes. For more details, see this article: Set up and use barcode scanning in QuickBooks Desktop.

If there's anything else I can help you with, let me know in the comment section. I'll be happy to answer them for you. Have a good day!

This what I did and yes it gave me an average cost after I did inventory adjustment see attachment.

Original before inventory adjustment.

But i still don't understand why, COGS is not picking you BOM to calculate cost. It keeps using Avg Cost. when i made sure every assemble item cost is using BOM cost. Please explain.

I apologize for any confusion, @PAlcala. Allow me to clarify things by sharing some information.

QuickBooks Desktop typically uses the average cost method to calculate the cost of goods sold (COGS) for assembly items. This means that it takes the average cost of the component parts used in the assembly to determine the cost of the assembly item. The cost you see on the assembly item screen is usually the most recent purchase cost and is not necessarily the average cost.

If you want to ensure that the BOM cost is used for calculating COGS, you may need to explore third-party tools or extensions that integrate with QuickBooks Desktop and provide more advanced features for managing bills of materials and inventory. These tools can offer more flexibility and customization options for tracking and updating costs based on your specific needs. You can find one in this link: Apps help QuickBooks run better.

It's also important to consult with your accountant or financial advisor to ensure that you are using the appropriate costing method and accurately tracking your inventory costs in QuickBooks Desktop. They can provide guidance based on your specific business requirements and industry practices.

Furthermore, once your client has approved your estimate and agreed to a predetermined sum instead of paying based on actual time and expenses, you have the option to convert the entire estimate into an invoice. If you'd like to gain further insight on this topic, please feel free to check out this article: Create an invoice for an estimate in QuickBooks Desktop.

I'll be around here in the Community if you have further assistance managing your inventory in QuickBooks Desktop. Just hit on the Reply button

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here