Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi all -- I'm in need of some help with my QBO account and recording Square transactions correctly.

My wife owns a retail clothing store. I have Square synced to QBO, along with the banking operating account. QBO correctly identifies/"matches" the multiple Square transactions that make up the banking deposits. However, I'm noticing that there is duplicate sales activity:

My "matching" of the bank deposits to the Square transactions results in "Sales" on the P&L report. However, all of the individual sales transactions, which are 100's-1,000's, are showing on the P&L as "Square Income".

Has anyone else run into this and what is the fix?

Along with this, the sale

It'd be my pleasure to help, @thedaisycollective.

All sales recorded within Square are brought over to QuickBooks. Bank deposit and transaction fees charged by Square are also automatically imported. You’ll need to identify where that income from Squares deposited to.

If you have a Square Bank account where the income is placed, you can create a bank transfer from the Square to your Business account to match the deposits.

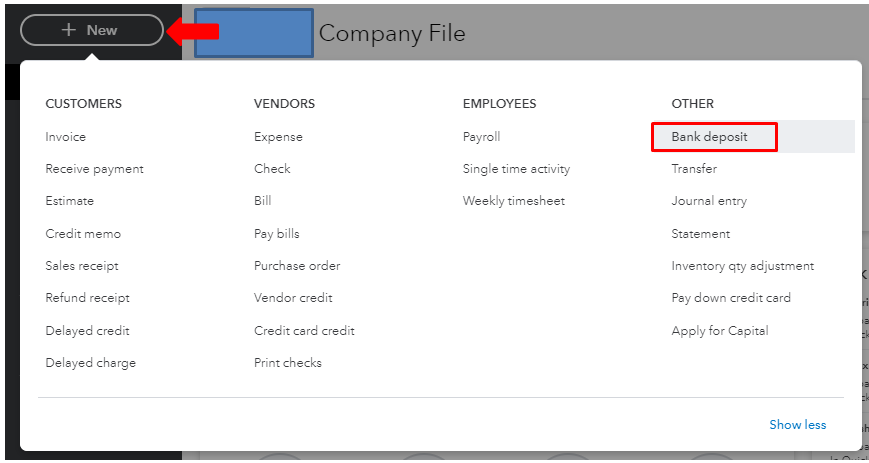

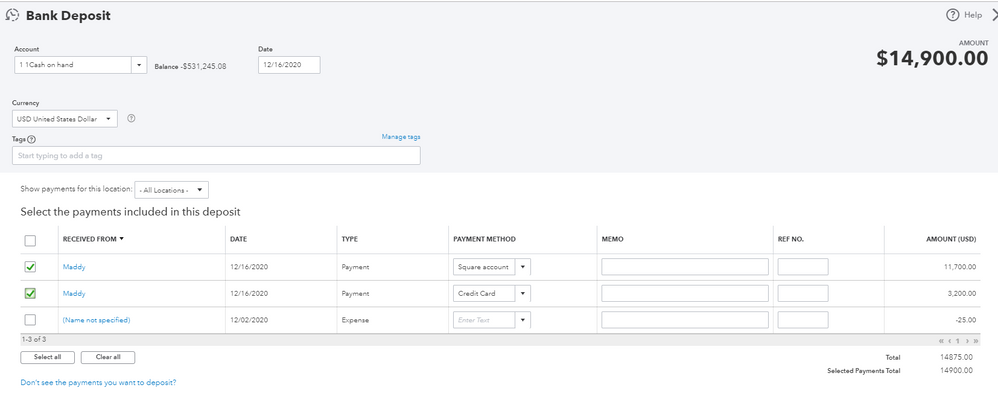

On the other hand, if you’re using the Undeposited Funds, you’ll need to create a bank deposit in QuickBooks and select those sales payments for matching. Let me show you how:

In case you need more tips and information on how to manage your business finances. We have available webinars to help you understand our product features, functions and benefits of QuickBooks.

I’m always here to help if you have any other concerns or follow-up questions with your sales transactions. I'll get back to you as soon as I can. Take care.

Hi @MadelynC -- Thanks for following up on this!

A few questions:

One more separate question:

Thank you!

Hello @thedaisycollective,

Transactions downloaded from Square will recognize a match once you created the entry with the same amount and date. This is the reason why it'll say you'll have to confirm the match to deposit them into your bank.

If the posting account of your sales activity is different from the once coming from Square, you can create a bank transfer to post your income into the correct bank account. Learn more about bank transfer with this article: Transfer funds between accounts.

Meanwhile, you can create an expense with your sales tax liability account as the category detail. Or enter a sales tax payment to offset the liability amount from the sales tax you collected. Follow the steps in this article for your reference: File your sales tax return and record tax payment in QuickBooks Online.

Additionally, I've also included this helpful reference for a compilation of articles you can use while working with your credit card account with us: Banking for QuickBooks Online.

If you have any other concerns, please let me know by leaving any comments below. I'll be here to lend a hand.

As another option, explore this connector to reconcile your Sguare transactions easily into your QBO account.

https:// synder.grsm.io/quickbooks

I am not currently creating any entries. Square is synced with QB, and my bank account is also synced with QB. When the deposit from Square hits the bank account, QB the identifies the deposit as a "match" from the Square transactions. When I confirm this match, that's when the duplication of sales activity posts to my P&L - it posts from the Square sync and also from the deposit/match.

The posting account is not different.

I am still unclear as to how to categorize these deposits, since the Square activity is already being recorded as Sales on the P&L.

Hello there, @thedaisycollective.

You can create a Bank deposit if the transactions were mapped to the Undeposited Funds account. Or a Transfer transaction if Square has its own checking account. This is done to avoid duplicate transactions in the Sales entry.

Here's how to create a Bank deposit transaction:

Also, you can check out this article to know more on how to manage the transactions being synced from Square account: Sync Square with QuickBooks Online.

I've added this article for your future task when you're ready to assess your business financials: How to Reconcile an Account in QuickBooks Online.

Please don't hesitate to let me know in the comment section if you need further assistance or other questions. Take care.

I am having the exact same problem as the OP. Is it pointless to have square sync with quickbooks if we already have a bank account synced with QuickBooks that the deposits from square are going into?

By having both of these systems synced into quick books, it is duplicating sales which cause incorrect inflation of sales on the profit and loss reports. The deposits into the bank account are categorized as sales and the sales from square sync are categorized as Square Sales, which is causing duplication. With the option to confirm a "match" between the transitions as they pop up the next day to categorized, this doesn't change the report.

I am not sure if the OP had his question answered correctly, but after reading over the responses to his question, I was not able to find an appropriate answer. So I guess the question is, if we have a bank account synced to quickbooks, should we not have square synced as well?

Hello there, @ParkerBru.

You can sync your bank account and create a separate account if you have other transactions there aside from the Square transactions. If there's none, you don't need to connect your bank account.

If your Square and bank account is connected in QuickBooks Bank feeds, you can exclude the transactions in your bank account and delete them. This is done to avoid duplicate transactions especially if you've integrated your Square application to your QuickBooks company to download the invoices and payments.

You'll have to check the default accounts from Square if your setup is the same as the scenario I've mentioned above. If you're not able to see that in the Chart of Accounts, you'll need to create accounts to track your Square sales, expenses, and fees. I'll show you how to do that:

I've added these articles to know more about the default account settings and how to manage the Square app:

I'll be here if you need further assistance. Feel free to tag my name in the comment section. Take care.

I'm having this same issue. I. have un-synced Square, which should help going forward. How can I delete ALL of Square's previous transactions? I can't figure out how to solve this problem. Square is duplicating all of my sales.

Thanks for posting here, sweetavenue.

One possible reason why your sales are duplicating is that the imported deposits from Square are added instead of matching them to entries that are already in QuickBooks Online. Allow me to help you in solving this issue.

Once done, go to the For review tab. Select the Square transactions to expand the view and tick the Find match button. On the Match transactions page, search the duplicate entry and checked it, then tap Save.

If you want to completely remove these transactions, go to For review tab after you clicked Undo. Then, check the corresponding box and select Exclude.

Need help to balance your accounts? Here's the link you can check: Reconcile an account in QuickBooks Online.

Keep on posting here and we'll respond as soon as we can. Take care!

The ONLY reason to sync Square to QB would be if you create invoices in Square only and not in QB. Square offers that capability. Syncing Square presumes that you do not already have those entries in QB.

It SHOULD be impossible for a synced Square transaction to exactly MATCH any or a group of transactions entered in QB UNLESS you also entered the Square fees in QB. A deposit of $96.35 in no way can display a green match to a $100 sale entered in QB, unless you deduct the $3.65 fee. But that is why, if entering slaes data in QB to use Undeposited Funds and deduct the fees in the deposit

Hello @AlexV , I'm having the same issue with Square and my bank feed duplicating sales. Following these steps you posted, but I cannot find "Find Match" or "Match Transactions" anywhere. In the column titled "Category or Match", every transaction shows "Multiple Categories" and when I expand it, I can only see Add or Exclude. I'd like to "match" them for the sake of keeping clean records, but I can't find that option. I can definitely see the same dollar amount in the bank feed and the app transactions feed. Thanks in advance!

Hi @john-pero - can you please elaborate on the last sentence "But that is why, if entering slaes data in QB to use Undeposited Funds and deduct the fees in the deposit". I can't match my transactions from my bank feed and square because of the square fees, but I'd prefer to do so instead of exclude if there is a way. Would you mind step-by-stepping what you would do in this situation? Appreciate your help!

I certainly understand your concern, @XL_Velo.

I'll be happy to help you figure out how to locate the find match option.

If your Bank is in Foreign Currency. There'll be no "Find Match" Option. You'll have to make sure that the Amount and dates match what's on the Bank and QuickBooks, so it will auto find and will allow you to Match.

Follow the steps below to match your transactions:

For more in-depth information about finding a match in QuickBooks, refer to these articles:

If you've encountered an error while in the process, you may reach out to our Customer Care Team. They have the tools to check on your transactions securely and help verify what's causing the issue.

Please leave a comment below if you have any questions. I'm always here to lend a hand and help further. Have a good one.

This does not work. There is no match because the deposit amount excludes the Square fees. For example, we charged a customer $60, and the Square fee is $2.04. The sale shows in the bank feed as $57.96, and it shows in the App Transactions section as $57.96, but the collected amount shows $60.00. So when I click on Find Match, it just tells me there are none (I guess because it's trying to match the collected amount verses the deposited amount?) - this is what John mentioned in his comment above.

If I elect to just exclude the Square transaction, then my Square fees come off the P&L report. Am I going to have to disconnect the app and then manually add back Square fees for every transaction daily? It seems like there has to be a better way to do this @LollyNino_C and @AlexV Please advise, thank you.

Thanks for coming back, XL_Velo.

I appreciate you for performing the steps provided by my colleagues. When receiving less than the due amount on the invoice because of Bank/Square fees, you'll first need to create an expense account for Bank Fees (if you don't have one already). Then resolve the difference when matching the transaction from the Banking page. Here's how to create an expense account:

Once you have an expense account for bank fees, you can resolve the difference between the invoice and the payment when matching transactions. Let me show you how:

Your transaction is now matched off against the invoice and the bank fees are accounted for. Feel free to visit our Banking page for more insights about managing your bank transactions.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

As another option, you should explore the trial version of the app as I mentioned in the earlier post to learn how it works. Once you sync the transaction from Square into your QBO, the Sales Receipt (or Invoice + Payment) for the total amount of sale and the Expense for Square fees will be created on QBO side. You may find fees are deposited into a clearing account and are categorized according to your settings.

Thank you @RCV. Initially this did not work - I was getting an error message:

"The selected and downloaded transaction amounts don’t match. To continue, resolve the difference."

However, I then noticed that the Bank Deposit was showing the account as my new business checking account, even though the deposit was actually made into a different account. I assume when we changed the settings to make sure that all the new transactions got into the new account, that it maybe changed the past charges as well? Seems odd, but that's the only thing I can think of. When I change the account back to the old account in the bank deposit section, I am then able to match the transactions.

Do you see any downside to updating these older transactions in that manner? It seems to be the only way that I can match off the transactions, and maybe also resolving a potential issue we didn't know we had with older transactions showing they were deposited into an account that did not exist at the time.

I appreciate you for sharing what works on your end to match your transactions in QuickBooks Online (QBO), @XL_Velo. With this, I'm here to share further details about this matter.

QuickBooks downloads transactions based on the data provided by your Square app. Based on your scenario above, I can see no downside in updating your older transactions with the appropriate account. I agree that by the time you've changed the settings to the new account, your past charges were updated as well. So changing the account back to the old one in the bank deposit section is the proper way to resolve the issue.

You're already on the right track in categorizing and matching your downloaded transactions in QBO. Doing so will keep your account updated and avoid duplicates. You just have to thoroughly check their details to match them to the appropriate ones.

Also, syncing Square with QBO makes it easy for you in managing your sales. To make sure your financial data is accurate, I'd recommend reconciling your Square account every month. This will effectively monitor your income and detect any possible errors accordingly. For the step-by-step guide, you can refer to this article: Reconcile an account in QuickBooks Online.

Let me know in the comments below if you have other banking concerns or inquiries about managing your transactions in QBO. I'm just around to help. Take care always.

Hello

I’m experiencing the same issue with duplicate sales. My company has square linked so that invoices and payments are created by QB. When the deposits import from the bank, how should they be recorded, (undeposited funds)? The deposits were previously categorized to Service income, but this caused duplicate sales entries. I need help...

Hello there, @TeeMc.

You can sync your bank account and create a separate account if you have other transactions there aside from the Square transactions. If there's none, you don't need to connect your bank account.

If your Square and bank account is connected in QuickBooks Bank feeds, you can exclude the transactions in your bank account and delete them. This is done to avoid duplicate transactions especially if you've integrated your Square application to your QuickBooks company to download the invoices and payments.

You'll have to check the default accounts from Square if your setup is the same as the scenario I've mentioned above. If you're not able to see that in the Chart of Accounts, you'll need to create accounts to track your Square sales, expenses, and fees. I'll show you how to do that:

I've added these articles to know more about the default account settings and how to manage the Square app:

I'll be here if you need further assistance. Feel free to tag my name in the comment section. Take care.

Good evening. Could you please explain how to add this bank account in QB desktop Pro 2021?

Hello, glnelson24.

Welcome to the Community. I'd be happy to show you how to add a bank account in QuickBooks Desktop Pro 2021.

In QuickBooks Desktop, you can use Bank Feeds to connect your bank and credit card accounts to online banking. This lets you download bank transactions so you don't have to record them manually.

Additionally, there are two ways to set up an account: Direct Connect and Web Connect. The way you connect depends on what's available at your bank.

Download your transactions with Direct Connect. Here's how:

Import Web Connect (.qbo) files. Here's how:

Once bank transactions are in QuickBooks, you can use the articles below to get more ideas on how to handle and keep them organized:

If you still need help along with the process, please go back here and let me know. It'd be my pleasure to help you further. Take care and stay healthy!

I'm having the same issue. It's so frustrating. My sales were fine UNTIL I matched the transactions per the Square sync and now the income is over-reporting. This is a nightmare and none of the steps above worked to resolve my issue. What's the point of a sync if it doesn't work and I still have to pay someone to fix this mess?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here