Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy now If a customer overpays their account and we don't put the full payment amount in we can not reconcile the bank deposit. If we put the full payment in we can only give the customer a credit and not a credit memo. but it is non-posting and difficult to work with.

Solved! Go to Solution.

you have to put the full amount received in. that's what you got. QB allows you to do one of two things with the overpayment:

1. Leave the credit to be used later

2. Refund the amount to the customer

If you choose to leave the credit to be used later, QB asks if you want to print the credit memo.

you have to put the full amount received in. that's what you got. QB allows you to do one of two things with the overpayment:

1. Leave the credit to be used later

2. Refund the amount to the customer

If you choose to leave the credit to be used later, QB asks if you want to print the credit memo.

"It asked me if I want to print it, I said no when I should have said yes. Is there a way to go back and print that now?"

That isn't really a "Credit Memo" but a Payment Credit document. There is only that Payment as the transaction type. There is no Transaction holding the Overpayment; it is part of the Math from that payment.

There is no Delayed Credit when you got actual Money. That money over what they owed is a Credit already. And don't create a credit memo when you already have a Customer Overpayment condition. The overpayment is Negative AR; a credit memo now is another Negative AR = you doubled it.

Hi there, @tsd81,

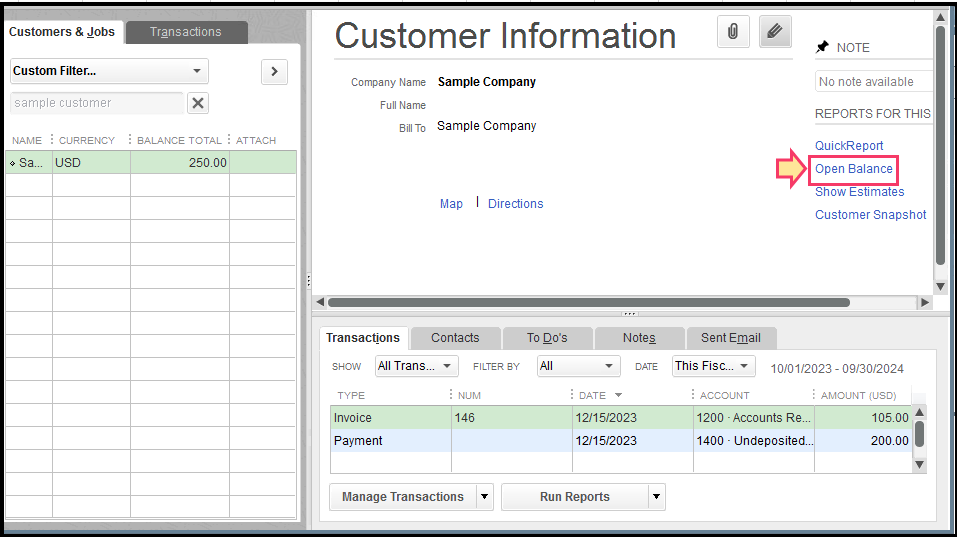

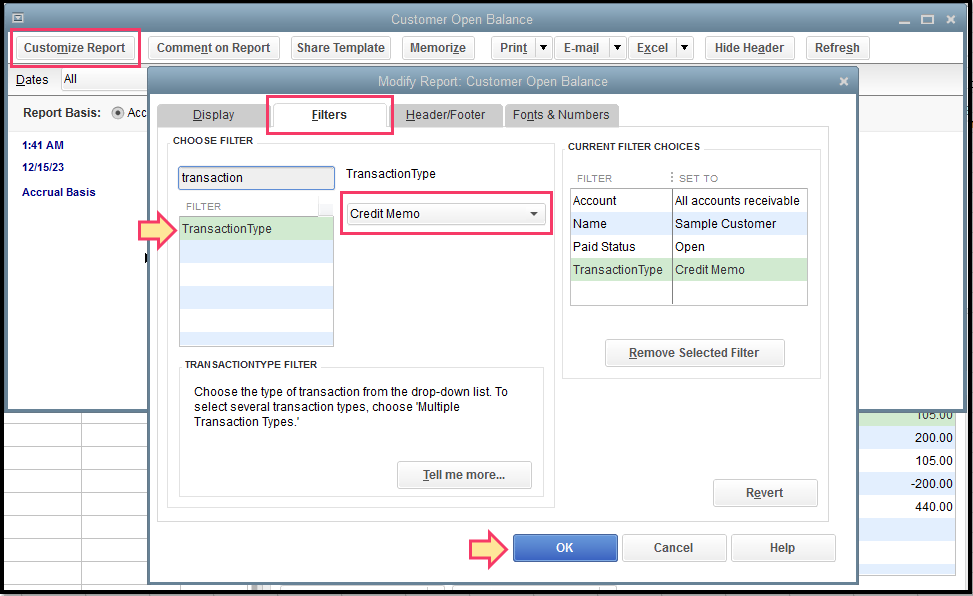

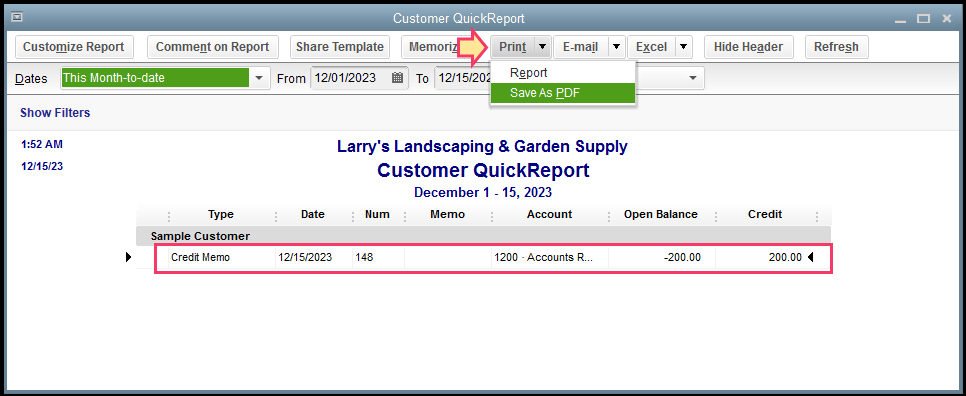

You can print the list of credit memos and send them to your customer. Just make sure to filter the transaction type by Credit Memo.

Let me guide you through on how to accomplish this:

You can now print the credit memo of your customer.

If you have any other questions, I'd be glad to help them. Thank you and take care.

Thank-you. However, this does not work for the case in question. Try in this circumstance:

1. A customer sends a payment that is greater than the open invoice.

2. When you enter the payment, QB will ask if you want to apply the overpayment as a credit on the Customer's account or give a refund. If you opt to apply the overpayment as a credit, QB will ask you if you want to print a credit memo, which you can print to a PDF if you know this is your only chance to do so. However, the PDF credit memo does not have a Credit Memo number, reference a PO number, or even allow you to include any information in the memo that gets printed. Even worse, the credit is NOT saved as a credit memo in the system so it DOES NOT show up when you filter by Credit Memo as you have shown above. It is stored as a "delayed credit" which is handled differently than a Credit Memo and cannot be displayed ever again as a credit memo from within QB. You can send your customer an account statement with an explanation of what happened but this is a poor solution (in my opinion). The better solution is for QB to allow you to create a Credit Memo in this situation so you can enter information about the circumstances of the overpayment and can look at and send it like a Credit Memo. In my case, the customer overpaid an invoice because the invoice originally sent had the wrong amount for an item purchased. The invoice was corrected but the customer paid the original amount so there was an overpayment. I would have liked to be able to send them a Credit Memo that explained which Invoice had been overpaid and why. It would also provide a good record within QB to explain what that credit was all about in case someone needed to try to figure it out. When it is stored at "delayed credit", you cannot see anything about it except the payment that was made at the time it was created. I figured out how to get around the problem but I am not the first user to have this problem and hope that QB developers will fix it in a future release.

Greetings tsd81,

I want to thank you for providing the complete details of your concern. This will help us isolate the situation.

Let me help create a printed record for the customer's overpayment.

Print the transaction history of the payment, so you can see the invoice, amount, and overpayment. To enter a note, write it in the Memo field and it should be included once you print it.

Let me show you how:

Then, send the transaction history to your customer, so they'll have a good view of their payments.

I'll share this article too for reference: Accounts Receivable workflows in QuickBooks Desktop.

That should get you on the right track. Please let me know how that works. I'm here to provide any additional assistance if needed. Have a good one.

Thank-you. This is another workaround, which is fine. However, I do hope that, instead of being content with workarounds to solve the problem, a future version of QB will implement this the right way and allow the overpayment to generate an actual Credit Memo.

We value your time doing business with us, @tsd81.

While customer's overpayment isn't automatically created as a credit memo, I can pass along your feedback to our product developers.

This way, they'll be able to know your sentiments and needs for product enhancements.

They can consider adding this feature for future product updates that can greatly help other users like you.

Please let me know in the comment section below if you have any other questions. I'll be always around here in the Community ready to help.

I could have used this feature today... customer overpaid and needs a credit memo issued...

Thank you for joining the thread, @ARKadmin.

The feature to turn a credit into a credit memo is currently unavailable in QuickBooks.

However, you can follow the workaround given above which will allow you to record an overpayment. I want to let you know that we're taking note of your feedback and suggestions to improve the experience we're providing.

In case you need tips and related articles in the future, visit our QuickBooks Community help website for reference: QBDT Self-help.

Fill me in if you have any other questions managing your credit memo. I'll be around if you need any help.

I echo the comment about this flaw in QB. It needs fixing as it is clearly causing problems for QB Users.

I have had 3 overpayments by customers over the last few months. These were all entered to their accounts as a credit on account to offset against future orders.

However, each of these customers has emailed us asking if we could issue a credit note.

We use QuickBooks Online.

Could you please raise this issue as a matter of some urgency for your developers to fix. Thank you.

In the meantime, what is the best workaround fix in QBO?

Thanks for the complete details, @MartGD.

I'd like to verify, when you say "entered to their accounts as a credit on account", did you enter the overpayment through the Receive Payment or Credit Memo screen? If so, the credit should be posted as a negative balance on the customer's account.

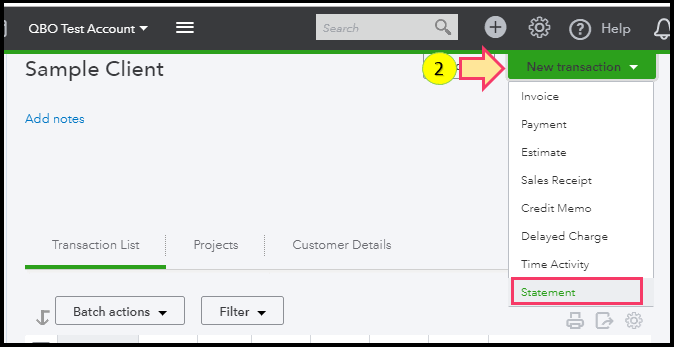

Sending the available credits to your clients works differently in QuickBooks Online.

To issue a credit note/memo, you can send a statement to your customer. By doing so,they'll be able to see their available credit which they can use for their next invoice.

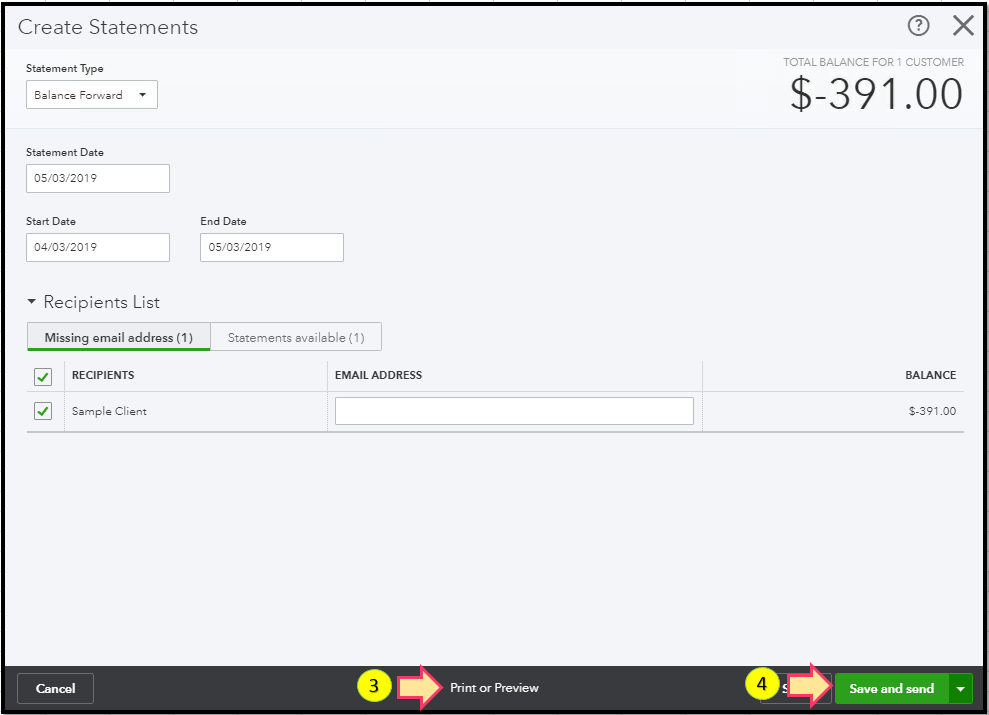

Let me walk you through on how to accomplish this:

To learn more on how to give a credit memo to your customer, please check this out: Enter and apply a credit memo or delayed credit.

Let me know if there's anything I can help you with sending credit notes to your client. I'm always glad to help.

I also vote for this feature. It simply makes sense. If there is a credit then there should be a traceable credit memo. That is what our customers want, not a Transaction History report, not a Payment Receipt, an actual Credit Memo that is numbered and holds references for their accounting software. BTW, when I entered the payment and selected to apply as credit I never received a pop-up asking if I wanted to print a credit memo. We just upgraded to Enterprise Solutions Pro 2019 desktop, so that might be another avenue needing this feature.

I'll take note of your feedback, Designer2009.

I'll forward your suggestions to our developers to let them know that this is something that you need.

When you enter the payment and selected to apply the credit, it won't give you a pop-up or option to print it. If you'd like to print the credit memo, you can go to the customer's profile. From the list of Transactions, double-click the credit memo to open it, then select the Print icon to print it.

Please reply to this thread if you have other clarifications.

Hi there, @Designer2009.

I appreciate you taking the time to provide us with an update on the steps you've tried and the outcome. Allow me to join the conversation and share additional steps to print the credit memo.

Here's how:

However, if you're referring to the pop-up notification asking to print a credit memo, this option is only available when you receive an overpayment.

For your additional reference about credit memo and QuickBooks Desktop, you can check the following articles:

Please keep me posted with the result. I want to make sure this is taken care of. Thanks again for dropping by, I'll be looking forward to your response.

Mary did my earlier file attachment not show that there was NOT a credit memo available? Please see attached after following your instructions. There is NOT a credit memo for our customer Western Digital. There is a credit on the account for the over payment but a Credit Memo was NOT created.

Or am I simply not understanding your instructions?

Thanks for getting back to us, @Designer2009.

I appreciate the details and the screenshots you've provided. Allow me to chime in and share some additional information about the credit memo in QuickBooks Desktop (QBDT).

I read through your conversation with my colleagues to better understand the issue. What I've found out is that you'll only see the pop-up notification asking to print a credit memo at the time you receive an overpayment.

Here's a sample screenshot from my test file.

On the other hand, I can see how having QuickBooks automatically create a credit memo for an overpayment would be helpful for you and your business. While this option isn't available yet, rest assured that I'm going to submit a feature request from my side, which is sent to the Product Development Team.

In the meantime, you need to manually enter them as a workaround. Please refer to the article provided by my colleague @MaryGraceS above for the detailed steps.

Thanks for being a part of our QuickBooks family. Please feel free to post again or leave a comment should you need anything else. I'll be happy to answer them. Have a great weekend.

I'm glad we got on the same page. Hopefully this feature will be added sooner than later. Or at least be able to create the credit memo from the payment window if someone accidentally clicks cancel on the one-time pop-up. That would also be helpful if it is not possible to have QBs do it on its own.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here