Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowCreate an income account called gain/loss on asset sales.

Calculate and post partial year depreciation (if this asset is subject to depreciation).

Then journal entries

debit accumulated depreciation and credit gain loss for the amount in the accumulated depreciation account (if this asset is subject to depreciation)

debit gain loss and credit the fixed asset account for the total in the fixed asset account

enter the payment for the sale as a deposit and use the gain loss account as the source account for the deposit

Create an income account called gain/loss on asset sales.

Calculate and post partial year depreciation (if this asset is subject to depreciation).

Then journal entries

debit accumulated depreciation and credit gain loss for the amount in the accumulated depreciation account (if this asset is subject to depreciation)

debit gain loss and credit the fixed asset account for the total in the fixed asset account

enter the payment for the sale as a deposit and use the gain loss account as the source account for the deposit

How is the sales commission booked ? As the total sales income or slip btween sales income and commission expense

I'm glad to see you here, @cfvbookkeeping.

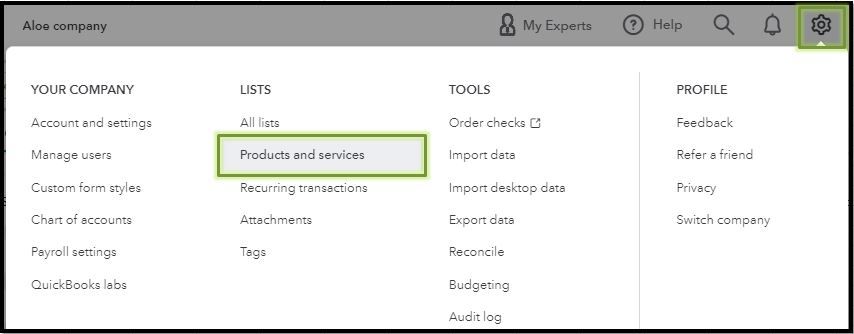

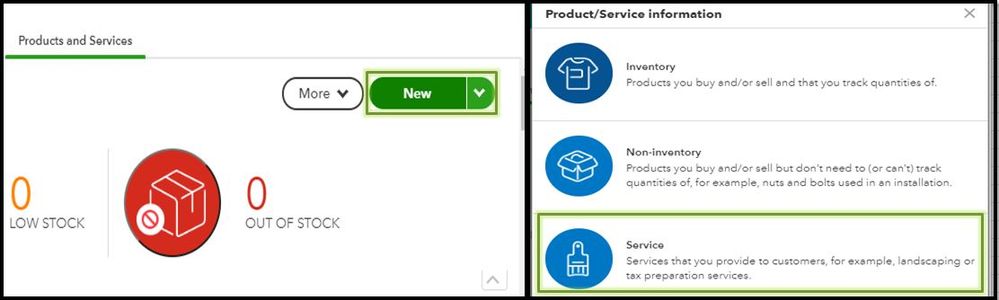

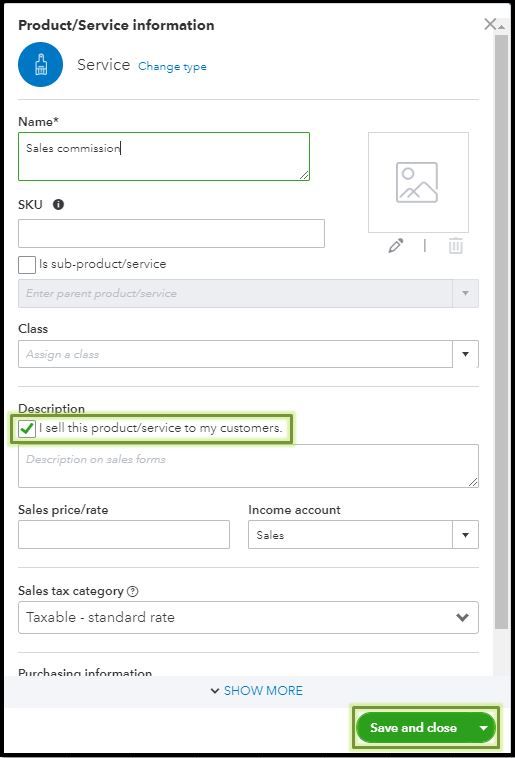

To record the sales commission in QuickBooks Online (QBO), you may create a service item named sales commission.

Here's how:

Use the service item on the sales receipt when you receive the commission and then deposit the funds.

For your future reference, you may open this article to help you track sales commission in QBO: Track sales commissions.

Should you need anything else, don't hesitate to comment below. I'm always around to help if you have other questions in recording sales commission in QuickBooks. Stay safe and take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here