Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGlad to have you here today, banddenterprises. It's my top priority to help you initiate the owner's equity distributions accordingly.

Definitely! You can set yourself as a vendor to generate a check/bill entry. This way, you can track the transaction appropriately. To start:

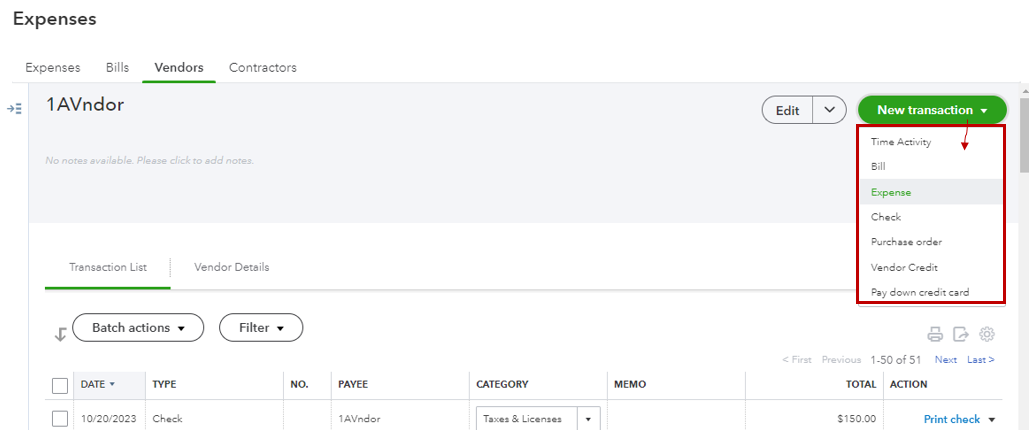

After completing the task, you can actively write a Check, enter a Bill, or record an Expense transaction from the New Transaction dropdown menu. Or else, go to the +New icon, then choose the appropriate transaction type you need to enter.

I'm adding this reference for more tips on paying back capital investment in QuickBooks: Record paying back an investment.

Moreover, here's how to account for capital investments to track money going into your company: Record an owner's contribution or capital investment in your business.

Please notify me in the comment section below if you have follow-up questions while tracking owner equity distribution in our system. I'm just a few clicks away to help you again. Have a good one!

Thank you for the response. I have successfully made our first distribution payments. So no to clarify. As long as these payments are categorized properly as owner equity payments "distributions". QuickBooks will know to account for those when we file business taxes, and give a K-1 report so we can properly account for this on our personal taxes?

Thanks Bryan Skipper

Thanks for the help. I have successfully scheduled the distribution payments. Now to clarify. As long as these payments are categorized properly as owner distributions, QuickBooks will know to account for those in our end of the year report so we can get a K-1 to do our personal taxes? Since no taxes are being taken out of these distribution payments.

Thanks [Removed]

Thanks for coming back here, @banddenterprises. Let me help you clear things up.

QuickBooks (QB) will only depend on the info you entered. Once the distribution payments are successfully scheduled, (QB) will automatically categorize them as owner distributions.

Since QBO doesn't support K-1 tax forms, we recommend reaching out to your accountant to help arrange the year-end report in getting the K-1 to do your taxes and take the taxes of the distribution payments.

We'll also share these articles for future reference:

You can always route back yourself here, @banddenterprises, if you have QuickBooks-related concerns. We'll be willing to lend a hand. Take care, and enjoy your day.

Can you give me the instructions on how to set that up for QB Desktop please?

Hi there, @AdminJLD. We'll help you set up an owner's equity distribution account inside QuickBooks Desktop (QBDT).Before anything else, we'll share what accounts we need to accomplish this feat. In this situation, we'll need an Equity account, Equity Draw, and Equity Investment sub-account. The Equity account will summarize all the amount you have inside those two sub-accounts. We'll outline the steps below to get you going and complete the task.

To create an Equity Account, here's how:

After setting up the main account, you'll want to proceed to create the two sub-accounts. Here's how:

See this page for more details: Add, edit, or delete accounts in QuickBooks Desktop.

Repeat the process for the other sub-account. Also, please know that the number of equity accounts you'll want to create will depend on the number of investors or partners you have in your business.

Furthermore, here's an article to help you review everything that you've entered inside your company file:

Thanks for dropping by here in the Community space today, @AdminJLD. In case you need further assistance setting up owner's equity distribution inside QuickBooks, feel free to comment below anytime. We'll be around to help you out again. Keep safe, and have a good one.

Thanks Kurt_M. I am wanting to set up a direct deposit for the distribution checks. Is there a way to do this without creating the members as a vendor?

Since you want to set up a direct deposit, you’ll need to add your member as a vendor to process transactions, @AdminJLD.

Before you can make any payments in QuickBooks Desktop, it's essential to add your member direct deposit information. Thus, setting them up as vendors is needed to track all transactions associated with them appropriately.

You can only create an event or entry without adding a member if you’re using the manual method.

These resources provide comprehensive information about managing vendors' direct deposit and how to pay them using the said method:

With this information, you can facilitate direct deposit for distribution checks in the program. If you have further queries, just let us know. We’ll always be here to help. Have a good rest, @AdminJLD.

I am also wanting to pay distribution check using direct deposit. When setting up the owner as a vender we are asked to check the box if they need to receive a 1099. I did not check that box as the owner does not need to receive a 1099. When I set him up to receive direct deposit and tried to pay him I got an error and the program would not send the distribution to his account. It said I had to check the box in the setup menu for the vender to receive a 1099. The owner does not need a 1099 for his distributions so why is this blocking his distribution from direct deposit. Is there a solution for this?

Thanks for laying out the details of your concern, @Jayceesh1.

I'll lend a hand in fixing this issue so you'll be able to pay distribution checks seamlessly via direct deposit.

Although the owner does not need 1099s for the distribution, you'll need to set them up and tick the box for you to pay them or receive the direct deposits. Thus, you don't need to send them 1099s if not needed.

You can check this article for detailed information: Pay a contractor with direct deposit.

To learn more about adding contractors and tracking payments you make to them, you can visit this link: Set up contractors and track them for 1099s.

You're always welcome to reply again on this thread if you need more help managing your direct deposits for distribution checks. It will be my pleasure. Stay safe always.

Thank you for the information above. Since I am already an employee, I want the partnership distribution to be paid by direct deposit, is that possible?

Yes, you can pay partnership distribution via direct deposit, but not as an employee, gsawko.

You'll have to set it up as a contractor. Then, set up a direct deposit payment after. But before doing so, you'll need to add your company's bank details and your contractor's direct deposit info.

You may also want to explore QuickBooks Live Expert Assisted for personalized support with your accounting needs. They'll help automate bookkeeping tasks like invoicing, expense tracking, and sales tax management. They can also assist with tracking partnership contributions, ensuring they are properly recorded and allocated in your equity accounts.

If you have any further questions or concerns, you can leave them in this thread.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here