Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, I need some help.

Last month, we updated our workers comp costs. Since then, workers comp/pacheck items have started showing up on the "unbilled costs by job" report. A picture of how it looks on the report is attached. I can't figure out how to get rid of them! When I open the items they take me to the employee's paycheck. Help!

Let me welcome you first to the Intuit Community, Shane McCarthy.

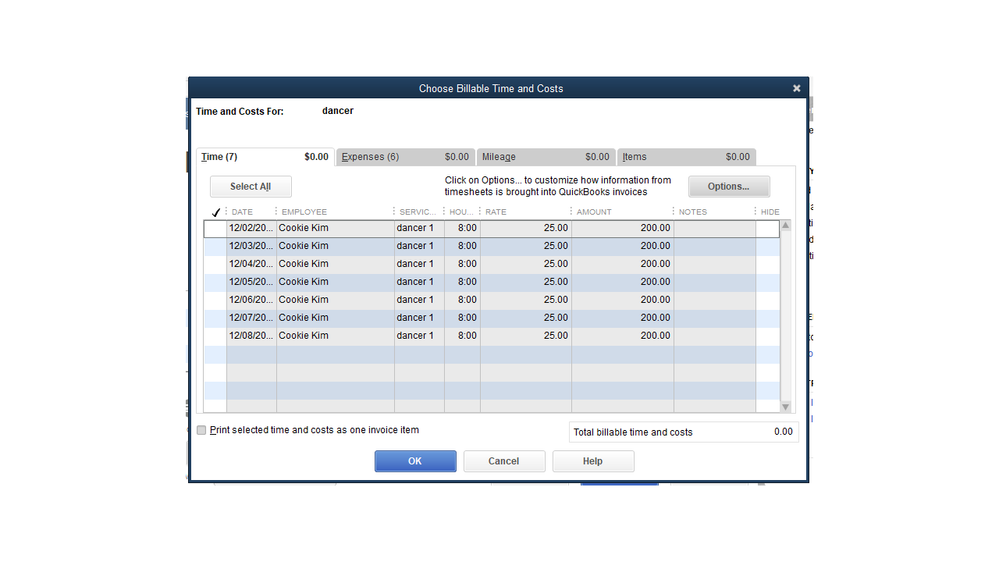

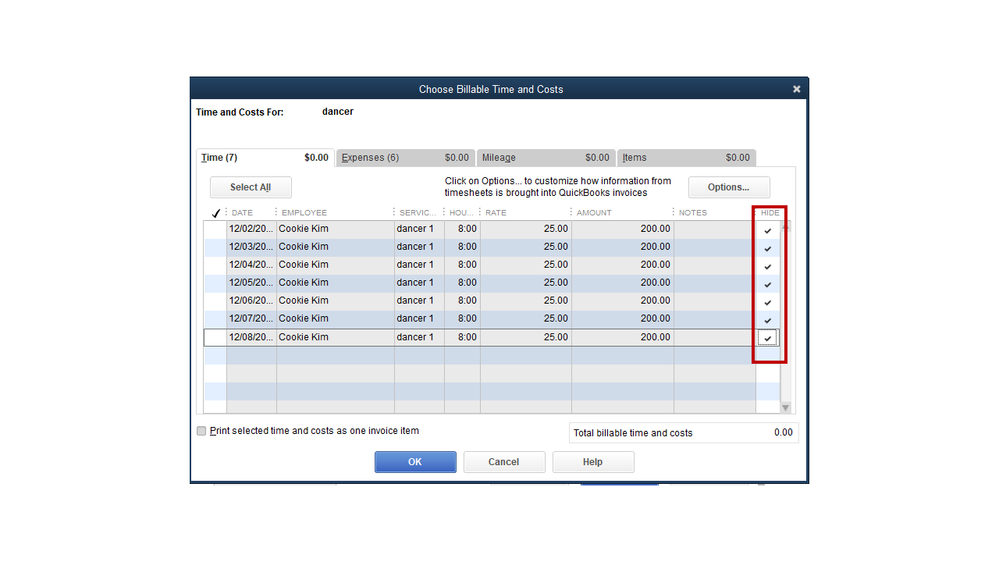

When creating paychecks and associate the wages to a job, the transactions will automatically be tracked as unbilled costs in your account. To remove them, select the Hide feature in the timesheet.

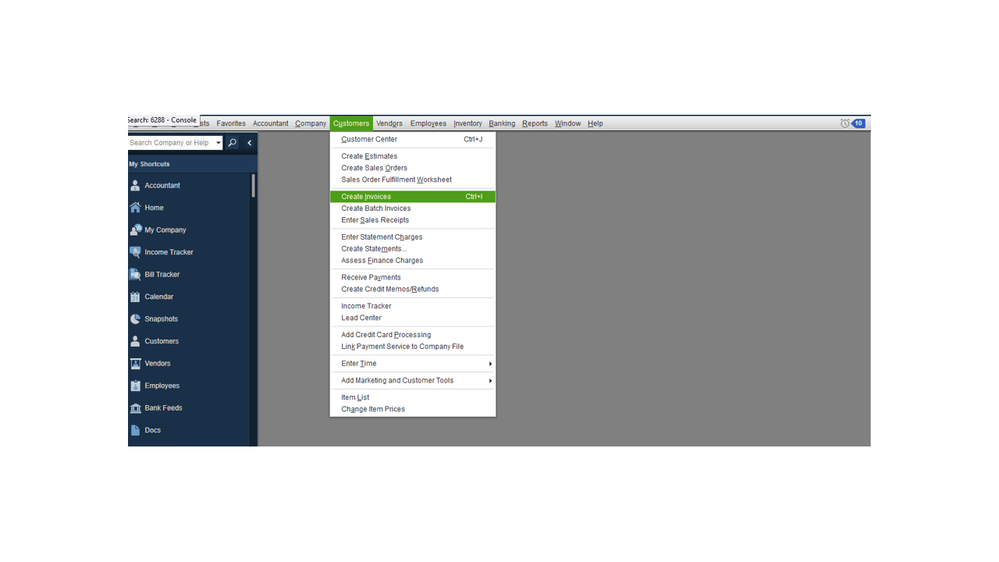

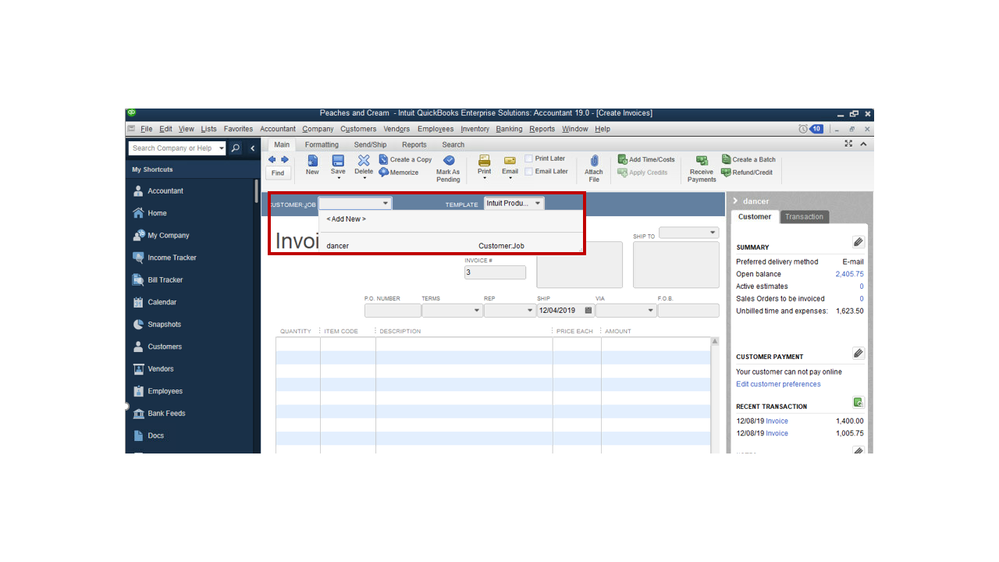

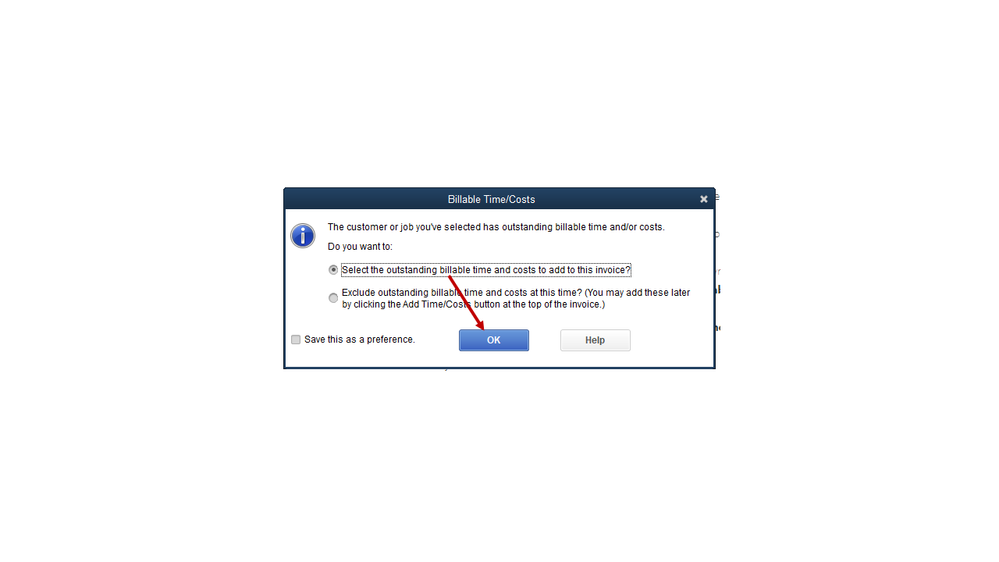

With just a few clicks, you can easily perform this task in QuickBooks. Here’s how:

To learn more about the common tasks you can perform in QuickBooks Desktop, check out the following article. It also contains links for each process. How do I?

Stay in touch whenever you have additional questions or concerns. Please know I’m here to help and make sure you’re taken care of. Have a good one.

Hi Rasa, thanks for your response. The only problem is that these items don't show up in the "items" tab at the invoice. They only show up when I run the "unbilled costs by job" report. Is there another way?

Just checking in, anyone able to help with this problem?

Thanks!

Thanks for checking this with us, Shane McCarthy.

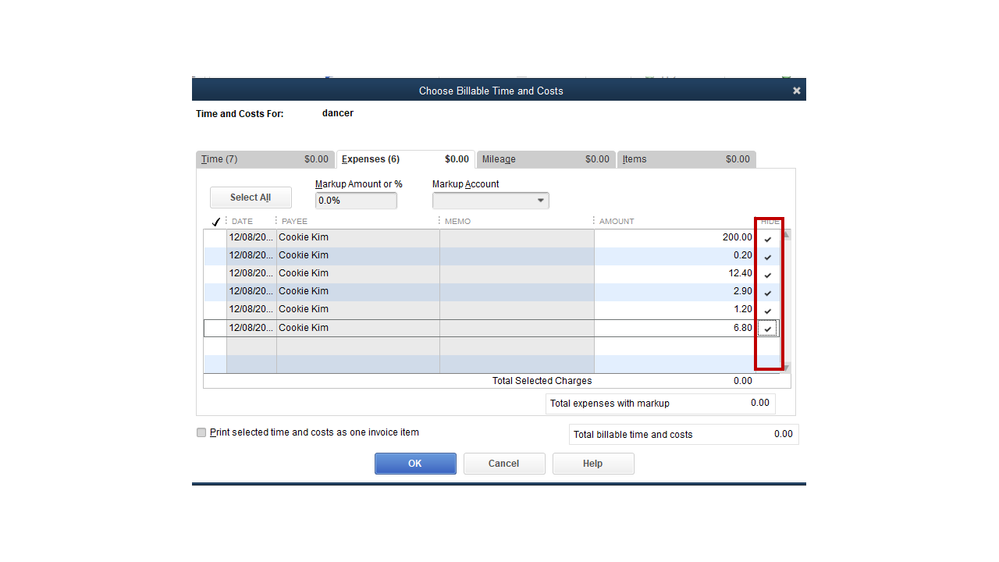

It's possible that categories are assigned to the transactions instead of items. Which explains why nothing shows up on the Items tab on the Choose Billable Time and Cost window.

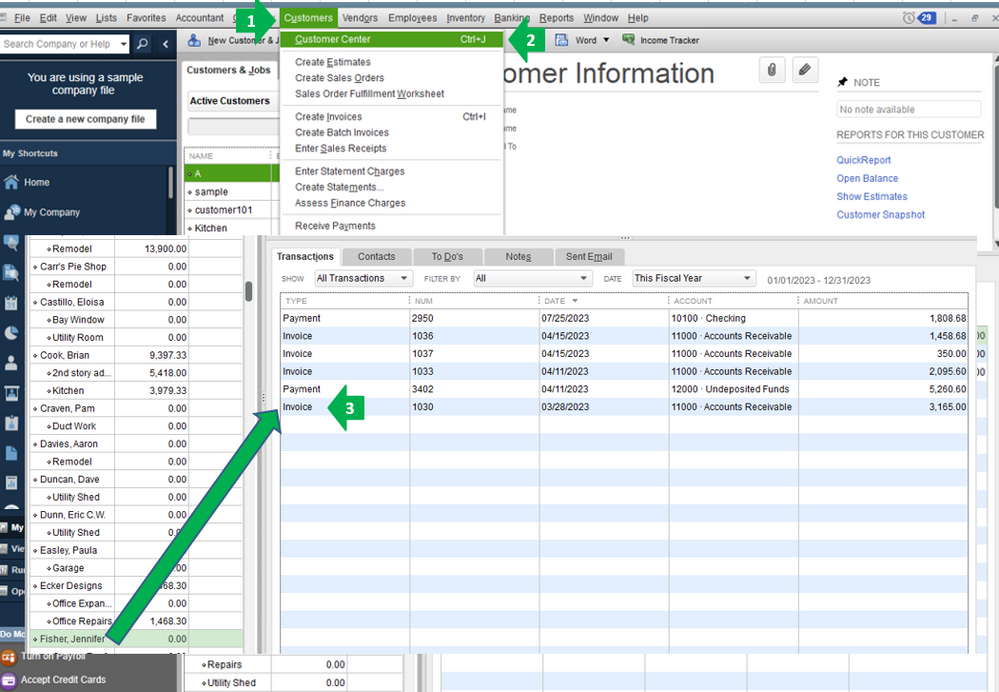

Let's try to review your invoice transactions and make sure you're using the correct items. To do this, please follow the steps below:

If you have follow-up questions, just let me know. I want to make sure this is taken care of. Have a good day.

Hello!

I have the same situation as you. Did you find a solution for the Unbilled Worker's Compensation?

Thank you

Welcome to the Community, @North Shore Homes.

I’m happy to help you with the Unbilled Worker’s Compensation. I recommend doing the following steps provided by my colleague @Charies_M.

If you are still having problem’s I’d suggest to reach out to our Support Team.

Should you have other questions, reach back out. I hope you have a great evening.

I am having a similar issue. The "Hide" technique works but when you have 500+ customers that you need to

"hide" the information it is not a cost effective use of time. Hours later I am still "hiding".

Your feedback will help us to stay in tune with what our customers need and want, rkutschied.

I definitely understand how a batch action option in hiding the transactions would help you manage your business. Though, having this feature will greatly save your time. At times, we roll out updates based on the request that we received from our customers. Rest assured, I'll be sharing this post with our product developers for consideration.

For now, you can follow the steps provided by my colleague Rasa-LilaM in hiding the transactions.

I also encourage you to visit our blog to stay current on all the QuickBooks News.

Feel comfortable to get in touch with the Community Team if you have any other concerns or require further help in managing your transactions. We'll always have your back.

I was trying to make an invoice and try to add cost/time so that the Unbilled Worker's compensation can be hidden. Unfortunately, it won't show up coz it's not an item neither an expense its a worker's compensation. Even though I want to hide it , it wont be possible. I hope you can find a solution for this. I called the support and they suggested to delete it, but it was a paycheck with a worker's compensation and it might affect a lot of accounts.

Hello Shane! Did you find a solution for the case? I am in the same situation too.

Thanks for checking this with us, @North Shore Homes,

When you assign a customer or job name on paychecks, the system will automatically tag it as an Unbilled transaction. To prevent them from showing up on the reports, remove the client name manually.

Doing this is safer than deleting multiple transactions and messing up your books.

See this sample snapshot:

Let me know how it works out you for by adding a new comment below. I'll be right here to provide further assistance and insights whenever you need one. Have a wonderful day.

Thank you for the reply. I have the job information assigned to commission's and bonus' for reporting purposes.

Hello @Jen_D . Thank you so much it works. What i did is removed the job and save the changes. Then when I look back to my unbilled cost by job, the worker's compensation unbilled amount was gone. Then I went back again to the paycheck and put the job's name again then everything looks good. Thank you so much.

Ok, so I understand how to go in and "hide" from the Unbilled costs by customer. However, maybe there is a better solution for what I am looking for? We prepay bills for clients. When clients settlements come in, we aren't taxed on those bills, so I edit the deposit transaction to specifically relate each line item to a line item in that clients job number in the Unbilled costs by customer. I do see that the account for the bill that we pay decreases (ie, court costs or dr. fees) but that doesn't also zero out the unbilled costs by customer amounts. Therefore, but looking at that report, it looks like we are still owed everyones expenses when that isnt the case. Does this make sense? Is there anyway when I receive a deposit to have both the Acct item and the unbilled costs by that customer to both decrease? or do I just need to add the other step of going in and hiding the Unbilled costs for that client? Thank you!

Good evening, @skb1.

I'd like to provide some of my insight about tracking job costs in QuickBooks Desktop.

This is when you track the expenses for a job and comparing those expenses to your revenue. With QuickBooks Desktop tools, you can see how much money you spend and make for each job. Here's how to properly set them up:

To ensure that you get the best advice for your books, I recommend reaching out to your accountant. They can look further into your account and help you with the tools that they have.

If you have additional questions, please let me know in the comments! Until then, have a great rest of your week. Best wishes.

Thank you Ashley. I do assign all expenses to each customer job, however we don't invoice them. The payments come to us in form of settlements from insurance companies. It seems creating invoices would just be a full extra step for something that never really goes to the customer? When the payment comes in on those expenses, I line item them out against the bills we paid so it shows the difference between expenses (don't pay taxes on) and fee income to us (which we pay taxes on). We would just like to see their unbilled costs go to zero as we get our settlement for them. Is this why the "hide" feature works? Or is there a better way to zero those out?

Intuit Team - you have to find a solution to the unbilled cost proliferation issue. There needs to be a default option that we select that turns-off the automatic "billable" check box and create billable costs throughout our books. Not every company utilizes the billable-cost function due to the way we do business with our customers. But WE DO track costs by job for management/reporting purposes. So your team needs to find a fix. Like many others on this forum, I have THOUSANDS of unbilled costs in the Unbilled Cost report. And it takes HOURS to make a dent in the list. Not only that, some cannot be easily cleared, like the WC and tax allocations that are from our payroll. So we gave up. Those thousands of transactions clutter the data in our books and I am sure don't help with efficiency of the processes. Not only that I really can't afford to be paying my staff to go around and uncheck boxes in the books for HOURS. That is not cost effective, plus it is absolutely ridiculous. PLEASE figure out a way to DISABLE the automatic default of "BILLABLE" while allowing us to still track costs by job.

This solution did not work for me. As expected, removing the job info from the paycheck removes the "Unbilled Cost" for Workers Compensation, but when I add that job (or any other for that matter) into the paycheck, there it is again... Can someone let me know what is going on? Why am I suddenly getting hundreds of unbilled costs associated with WC? There must be another setting triggering just the Workers Comp piece. I reviewed my payroll item set up, and we do track labor and costs by job, but this is only happening for Workers Comp. I would greatly appreciate any help.

Good day, MelTilk.

I understand that you want to get rid of the unbilled costs.

As discussed on this thread, you'll want to remove the customer or job name on paychecks. This will create unbilled costs on the account.

Additionally, you can reach out to our Customer Support Team so they can further assist you with this. They can also check your Workers’ Compensation set up.

I've included these articles for your reference. These links will give you more info about Workers’ Compensation and related reports you can use.

Keep your posts coming if you need anything else. I'll be right here!

Hi AlexV. These items are NOT invoice items, they are only on the paychecks. It is Workers Comp. And it is THE ONLY paycheck item that is showing up as "Unbilled Cost." Removing the customer/job from an invoice is therefore not a solution. Additionally, removing the customer/job from the paycheck is also not a solution because if we did so our job costing would not be accurate. And, just to be thorough, removing the customer/job from the paycheck, saving it as such, and then going back and re-adding it as another user recommended (above), also does not work. It just reposts the WC amount to Unbilled Costs. So, none of the above are solutions that work. Trust me, I am not a novice user and I have tried them all. I have also reviewed the WC set ups. Perhaps someone else has had success.

Any solution or ideas as to why only WORKERS COMPENSATION from paychecks is showing up in my Unbilled Cost report? There appears to be no place to "hide" these or setting to disable this. Removing a job code from a paycheck is not an option since we track costs by Job. Removing it, saving and then adding it back did not resolve it either. It just added the WC back to the unbilled cost report. None of the other payroll items post to unbilled costs, only WC. Very odd. Additionally, this did not occur in our prior data file, only in our new data file...and the settings appear to be all the same. I am guessing there is something going on with the WC wizard/set up. Calling the support line has not been helpful. Any ideas?

Appreciate the complete details about your concern, @Mellane.

The Unbilled Costs by Job Report provides an instant feedback to you concerning expenses your business has incurred that have not yet been billed back to your customers. Let me share some information on how to remove your workers compensation from the Unbilled Costs report.

Here's how:

You can read through this article for more detailed steps: About Workers' Compensation in QuickBooks Desktop.

Stay in touch whenever you have additional questions or concerns. Please know I’m here to help and make sure you’re taken care of. Have a good one.

Thank you for trying to help. Unfortunately your solution above does not work, primarily because the issue is not with the WC code itself, but with the payroll item "Workers Compensation" that is posting as an unbilled cost. If I clear out the WC code on the paycheck, instead of posting a $ value to the Unbilled Cost report, it posts a $0. So, clearly the problem is with the payroll item. But, as you probably know, the payroll item is automatically set up by the WC Wizard tool, so when I go to edit the payroll item (to try to figure out why it is posting to unbilled cots) there really isn't much to look at/edit. So I am stumped as to why ONLY this one payroll item is posting to the Unbilled Cost report. My company preferences are all set up to NOT mark all time (and expense) entries as billable. And, the billable checkbox in the timesheets is also no checked. So I cannot figure out what is triggering the WC payroll item to post as unbilled.

PS - just FYI, you don't have to unlock the paycheck to edit a WC code (that is not a locked feature).

So, I'm stumped... any other ideas from the team of experts out there?

Hi there, @Mellane.

I appreciate you for getting back to us here in the Community. I'm here to share some information about the report in QuickBooks Desktop.

To remove worker's compensation in the Unbilled Costs by Job report, you can either remove the job code from a paycheck or bill the job by creating an invoice.

If it only happens to the new file, I recommend running the Verify and Rebuild Data utility. This feature help fix data issues in the company file and self-resolve them on your behalf.

To verify data:

For rebuild data:

For additional reference, you can use the following article to personalize a report: Customize reports in QuickBooks Desktop.

Drop me a comment below if you have any other questions about running reports in QuickBooks. I'll be happy to help you some more.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here