Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello all.

I have the following problem. My product has a long production time (2-3 weeks). But we demand upfront payment or 50% deposit from our clients. That means I receive a lot of payments on my bank account, which i need to book as current liabilities and then once the product is delivered to the client I create the invoice (dated on the delivery date) in order to record the revenue once the service has been rendered. But since qbo always takes the invoice creation date as the revenue recognition date, that also means I cannot really create invoices for my customers without correcting the invoice date once the order has been fulfilled. Does anyone have an easier work around to this?

Thanks so much

Solved! Go to Solution.

Hi Elena,

When you invoice upfront for products/services to be delivered later over time (possibly with payment received upfront too - though for accrual accounting and reports the payment transaction is irrelevant), then your company has generated a liability which gets cleared with the future delivery and its associated revenue recognition. Accordingly, the deferred revenue account is a liability account.

If your company delivers services/products prior to invoicing the customer, then an asset account would be the correct type of account to use for the journal/transaction to recognize revenue ahead of invoicing - the pre-deliveries are considered assets. If the invoice is raised mid-way during the delivery period, the contract amounts that are to be recognized post-invoicing should again go to a liability account.

Beyond consistency, using the correct type of account is also important when you conduct analysis that includes balance sheet numbers (e.g. ratios).

Anyway, I have seen sales receipts proposed as a solution for revrec on other threads in this forum so most likely some do it that way. And your management and auditors may be OK with using an asset account instead.

If you do go that route, consider using a different asset account thereby cleanly separating transactions to it from other true assets.

If implementing journals instead of sales receipts, consider mirroring the invoice line description on each journal line description and include the invoice number too. That way a tie-back to the original invoice and line (with its details on quantity, unit price) etc. will be maintained.

Best regards,

Kamal.

Good info here. I hope this thread is still being watched.

Our approach here has been an Unearned Revenue liability account as others have noted. The problem is that Inventory items can't be pointed at an unearned revenue liability account (like a service or non-inventory item). To get around this we either have to 1) use only non-inventory items or 2) invoice to the revenue account, journal over to unearned inventory, then journal back to revenue when we ship the product. Neither seems to make sense.

Why can't we set up inventory items to go directly to unearned revenue liability account?

Anthony, it is going to depend on whether you keep your books on cash basis or accrual. You may have to ask your tax professional which way you have been filing. Cash basis is the simplest and used by most small businesses. In Cash Basis revenue (income) is recognized by the date of received payment and nothing else. An Invoice created today is not income to you until you post payments against it. Most of us simply create an invoice and collect payments against it. 50% down today is income today of 50% of the invoice total. Only under accrual accounting is income date the same as the invoice date.

But I can see your desire to not book income until after you have had expenses related to the income since you are production based. You don't want February income to reflect time and material costs that you may not incur until April.

So you are on the right track already, posting customer payments to current liabilities. You should do so, in my opinion, in the form of customer credit memo, which if you simply receive a payment against nothing a customer credit is created. You do not even have to use that credit to the next upcoming invoice you create - it just sits there but here is a tutorial on using an Estimate and properly receiving deposits against upcoming jobs.

http://www.quickbooksnow.com/customer-deposits/

Hi John,

thanks, your answer and the article are super helpful.

We actually run on accrual basis, so the moment we fulfill an order counts. From testing QBO, I have only managed to make a sale count towards the month of the invoice date. So I can only create the invoice/sales receipt once I have shipped the product. However, it would be much simpler to create the "order" in QBO as soon as the customer places his order and just add a date at fulfillment which then attributes the sale/revenue to the month of fulfillment!

But I guess, I will input the customer when he orders, attribute a deposit to his account and then create the sales receipt when we have fulfilled it, turning his deposit into a sale.

Does that sound like the right way to go?

Hi Anthony,

Invoicing the customer the day you confirm the sale is definitely the way to go - and even with accrual accounting. By invoicing on the correct date your payment due dates, A/R aging etc will be consistent and accurate in QuickBooks.

Then use a revenue recognition process (manually or by using a revrec product - you can learn more here) to generate the correct PnL (and balance sheet) numbers.

The mechanics of the revrec process after the invoice is raised, say for $300 in March, which you want to recognize in its entirety in April is:

Debit Credit

Invoice raised Mar 12, 18 A/R 300 Revenue 300

Defer Mar 12, 18 Revenue 300 Deferred Revenue 300

Recognize Apr 3, 18 Deferred Revenue 300 Revenue 300

By entering the last two "revrec" manual journals you would have moved the revenue of 300 on the PnL from March - the invoice month - to April when you deliver the product.

One alternative setup to consider is to set the Income Account for the Product/Service that needs to be recognized in a different period directly to a "Deferred Revenue" account - a current liability account which holds "unearned revenue" until earned. The revrec mechanics would then be

Debit Credit

Invoice raised Mar 12, 18 A/R 300 Deferred Revenue 300

Recognize Apr 3, 18 Deferred Revenue 300 Revenue 300

With this upfront setup change for the Product/Service, the invoice date stays the correct date and the number of revrec journals is reduced (the Defer journal is not needed, you'd just enter the Recognize manual journal). It may also be the way to go when you do not know in advance the recognition date. The tradeoff to consider while evaluating if this setup works for you is that it can complicate generating some reports. And revrec validations can be more involved too.

While the revrec processes highlighted above can be done manually, an investment in a revrec tool may be worthwhile to consider too. You can review the benefits of the revenue recognition tools on the app cards at the appcenter.

Thank you for your very detailed response. Books representation is very useful to understand the concept and not to miss anything behind. I have a related question to you: Would it be very wrong to set Deferred Revenue account as an Asset account (with negative effect) and not a Liability one?

The thing is, to recognize the revenue I want to use a Sales Receipt tool instead of a Journal, because the Sales Receipt tool would keep track of my product quantities, whereas the Journal would only track just the dollar amounts and not show up in Product Sales reports. The problem with Sales Receipt tool is that it only allows depositing to an assets account. Book-wise, it would look like this:

Debit Credit

Invoice raised Jun 01, 18 Acc. Receivables $100 Def. Rev asset $100

Invoice paid Jul 01, 18 Bank $100 Acc Receivables $100

Recog. (Sales Recpt.) Jul 30, 18 Def. Rev asset $100 Revenue $100

Thank you,

Elena S.

Hi Elena,

When you invoice upfront for products/services to be delivered later over time (possibly with payment received upfront too - though for accrual accounting and reports the payment transaction is irrelevant), then your company has generated a liability which gets cleared with the future delivery and its associated revenue recognition. Accordingly, the deferred revenue account is a liability account.

If your company delivers services/products prior to invoicing the customer, then an asset account would be the correct type of account to use for the journal/transaction to recognize revenue ahead of invoicing - the pre-deliveries are considered assets. If the invoice is raised mid-way during the delivery period, the contract amounts that are to be recognized post-invoicing should again go to a liability account.

Beyond consistency, using the correct type of account is also important when you conduct analysis that includes balance sheet numbers (e.g. ratios).

Anyway, I have seen sales receipts proposed as a solution for revrec on other threads in this forum so most likely some do it that way. And your management and auditors may be OK with using an asset account instead.

If you do go that route, consider using a different asset account thereby cleanly separating transactions to it from other true assets.

If implementing journals instead of sales receipts, consider mirroring the invoice line description on each journal line description and include the invoice number too. That way a tie-back to the original invoice and line (with its details on quantity, unit price) etc. will be maintained.

Best regards,

Kamal.

@KamalVarma Thank you Kamal, you always give such detailed answers! Yes, you are right, having a liability as a contra asset account (of course separate from all other receivable accounts) would definitely create other troubles for me, ratios is a good notice.

How about this solution then: after I am done with recognizing monthly sales via the Sales Receipts, I would create one simple journal which will move the total contra asset balance to the correct Liability account? This way I will always keep the contra asset account 0 for ratios to work, but still will be able to dive in the details of the Sales Receipts kept there and have my Product Sales reports pulling off the sold quantities.

Debit Credit

Invoice raised Jun 01, 18 Acc. Receivables $100 Def. Rev asset $100

Invoice paid Jul 01, 18 Bank $100 Acc Receivables $100

Recog. (Sales Recpt.) Jul 30, 18 Def. Rev asset $100 Revenue $100

At the end of July, Def Rev asset has a monthly ending balance of -300:

Debit Credit

Move balance (Journal) Jul 30, 18 Def. Rev asset $300 Def. Rev Liability $300

I shared this comment on a different post but thought it might be helpful to others to share it here:

I read quite a few posts/articles about how to do this, so after meeting with my CPA, I'm sharing how I'm doing this for my business (I bill most of my clients ahead of time and need to track earned vs unearned revenue).

I found that experimenting in a sandbox Quickbooks account helped me figure this out.

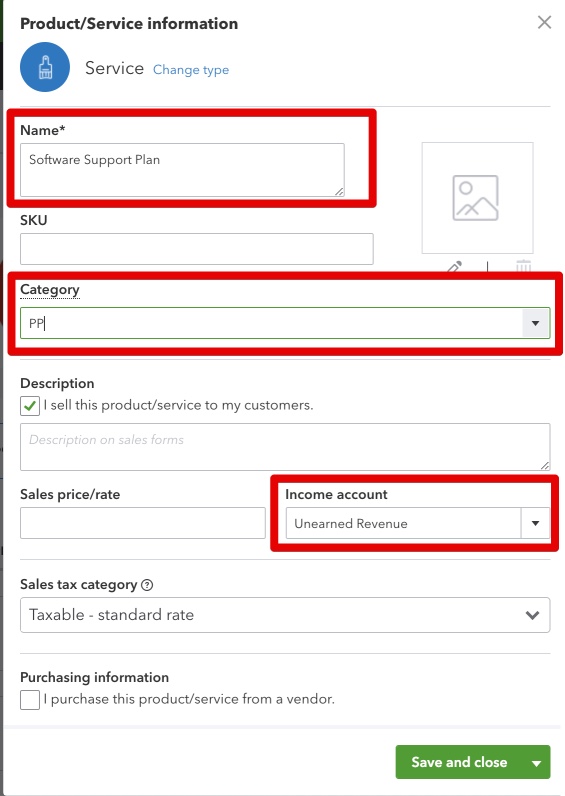

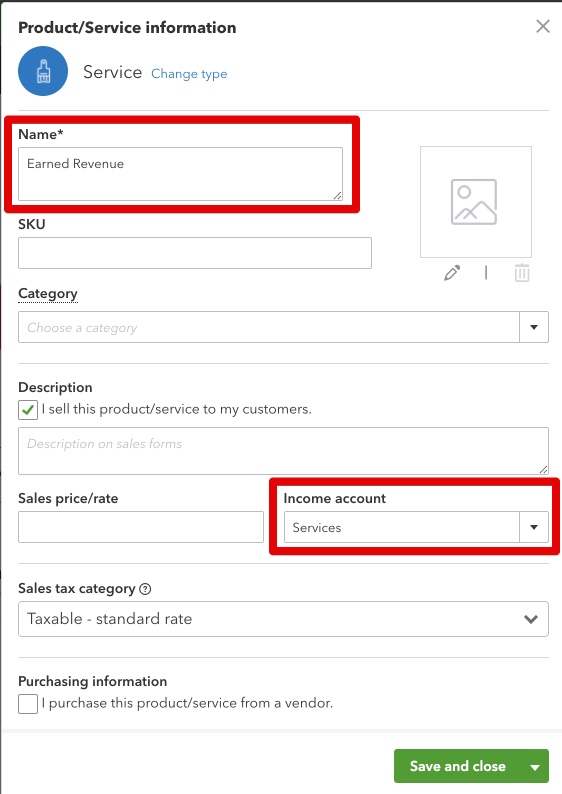

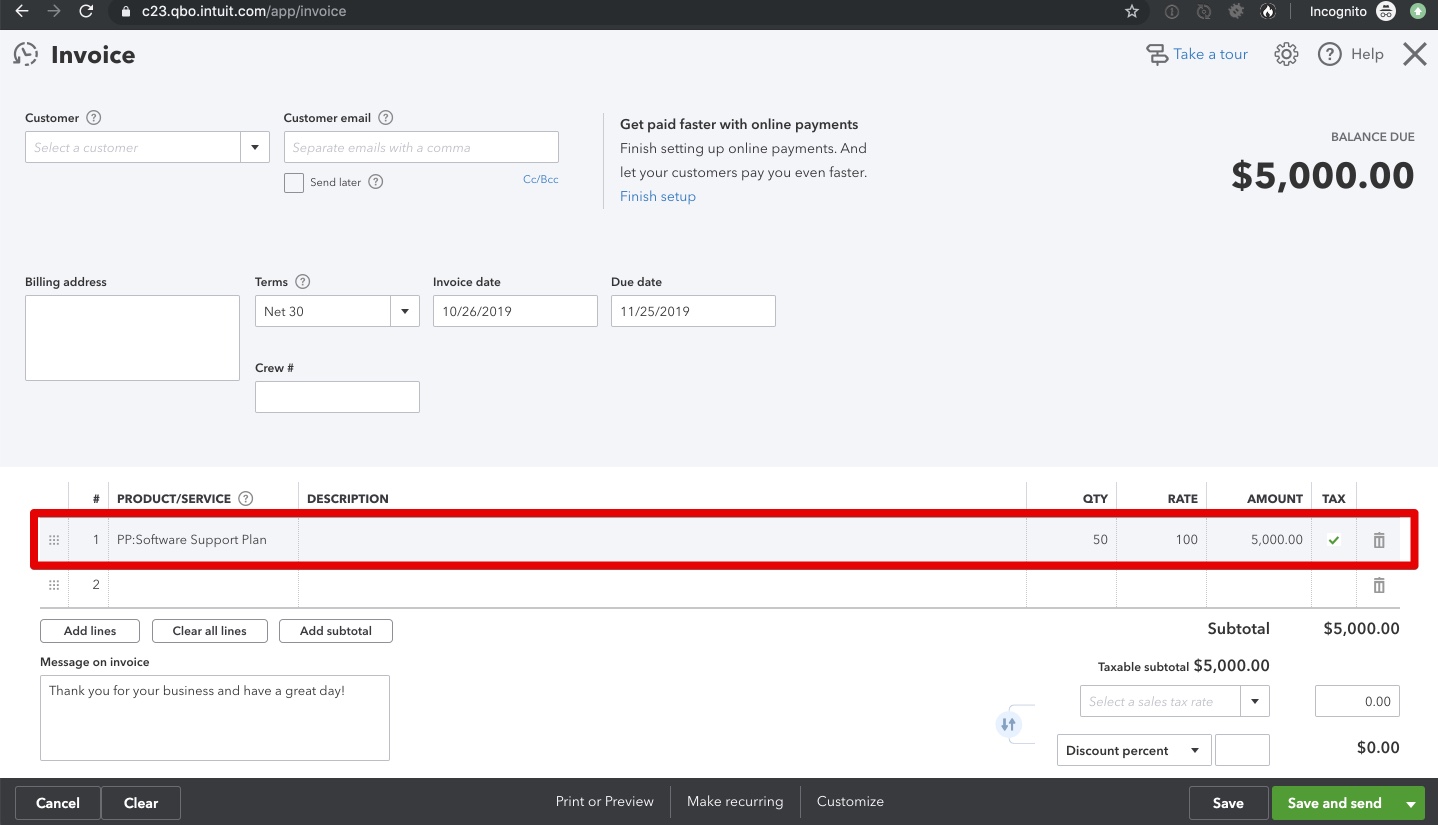

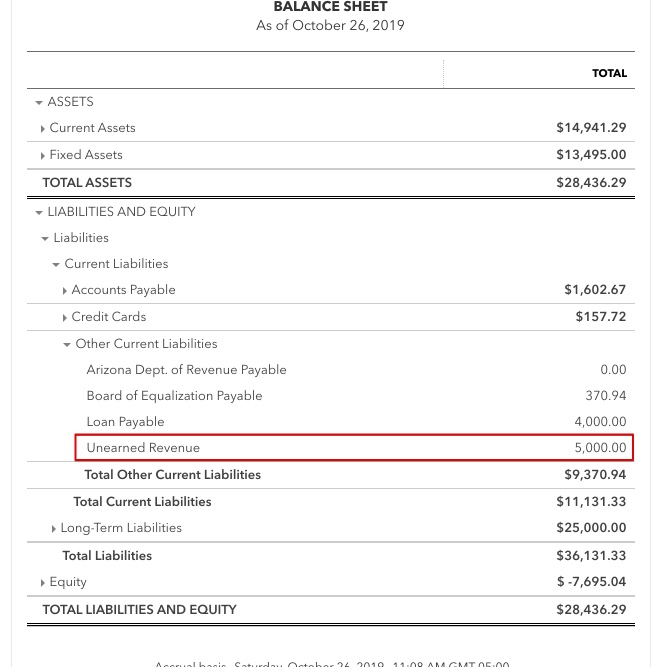

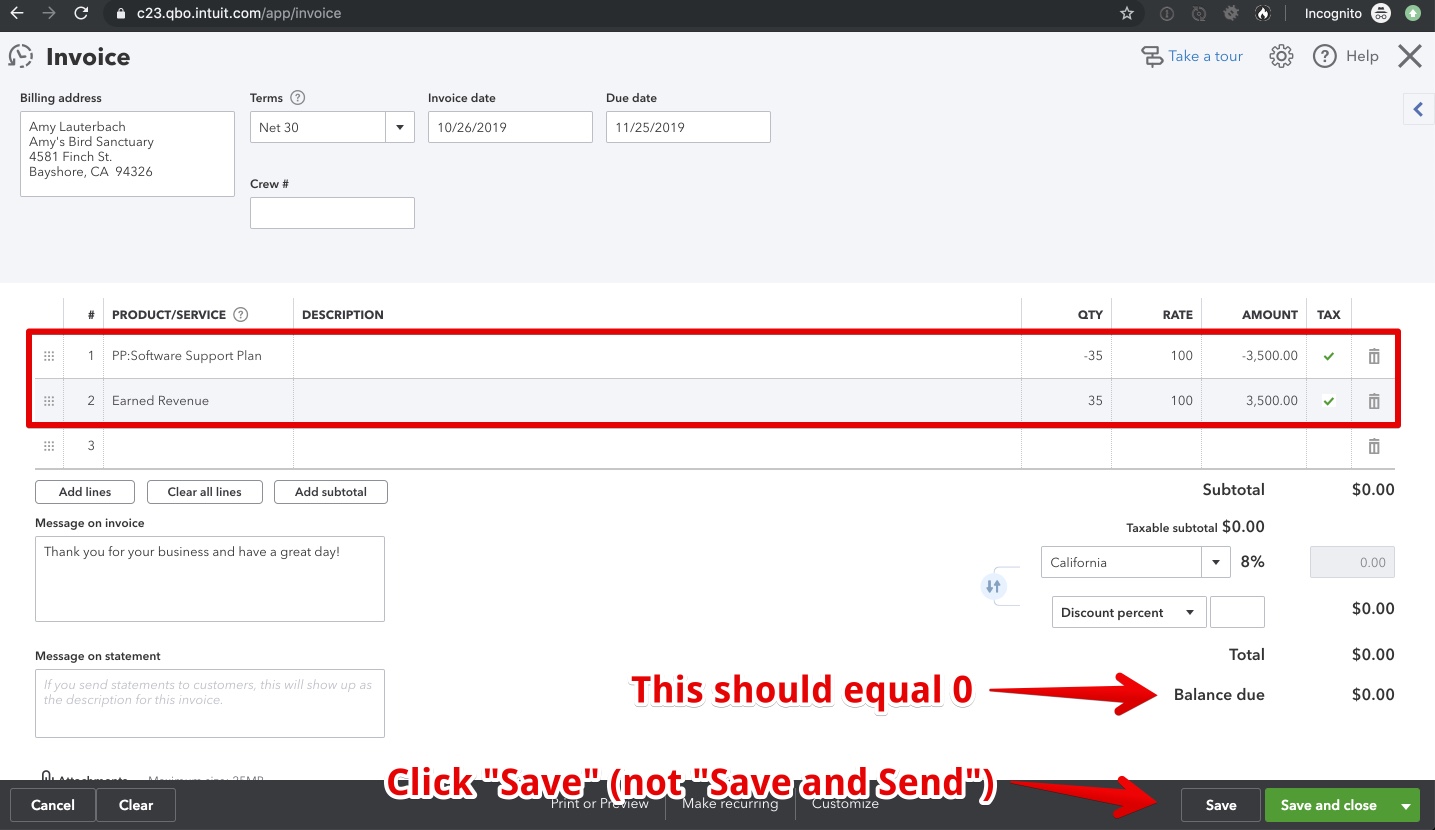

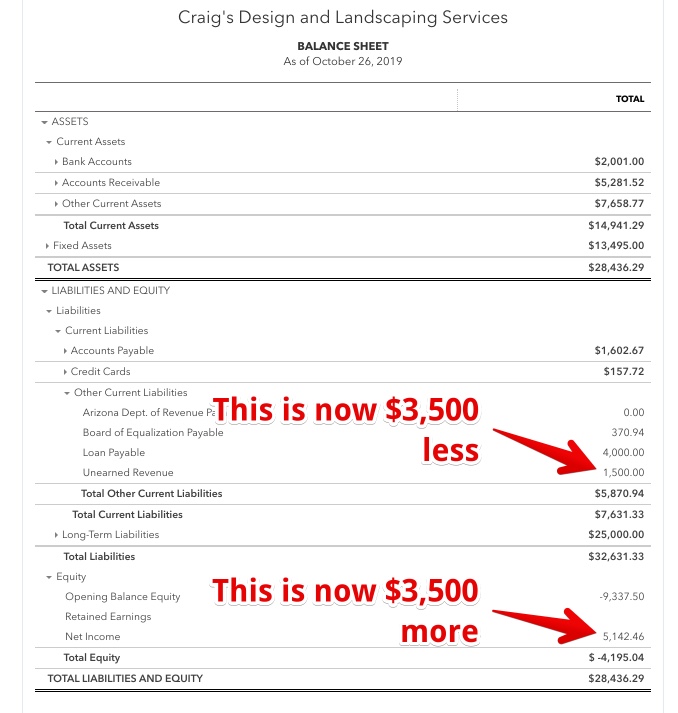

In this scenario, you're a software developer whose clients pay you $5,000 "blocks" at a time and you bill against those blocks. You need a way to invoice and receive payment, without showing that payment as having been "earned" until you actually log the time against it each month.

Steps I took:

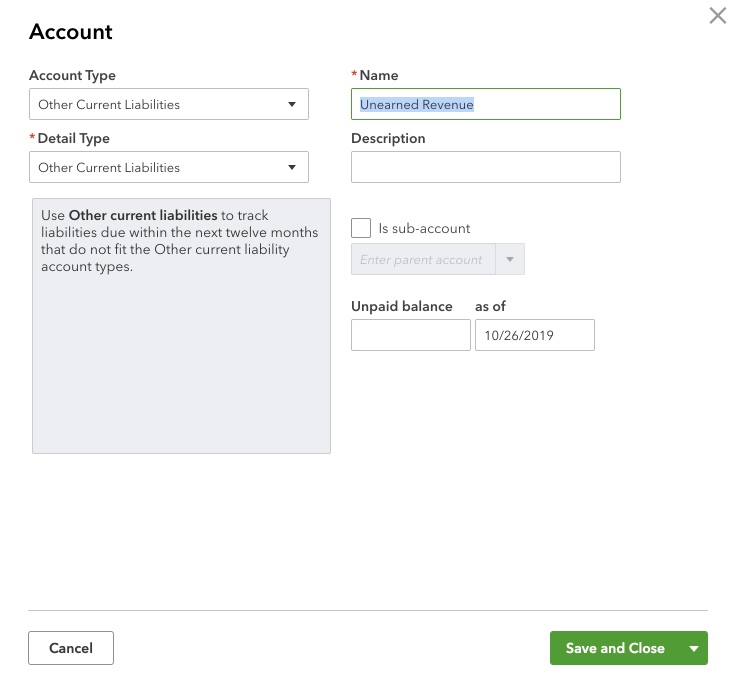

Initial Setup:

Now that we've completed the initial setup, let's look at what it will look like to run this process on an ongoing basis…

Ongoing process:

Hopefully this helps clear up any confusion for people like me without an accounting background.

Good info here. I hope this thread is still being watched.

Our approach here has been an Unearned Revenue liability account as others have noted. The problem is that Inventory items can't be pointed at an unearned revenue liability account (like a service or non-inventory item). To get around this we either have to 1) use only non-inventory items or 2) invoice to the revenue account, journal over to unearned inventory, then journal back to revenue when we ship the product. Neither seems to make sense.

Why can't we set up inventory items to go directly to unearned revenue liability account?

Hi,

Could you please write the same instruction for the case if the services are rendered prior to invoicing. For example, we provide services in June, and issue the invoice on the 1 day of July. We use the ship date (June), but in reports this revenue goes to July.

How can we manage to book the income in PL in June and what would be the date of AR?

Thank you!

Hi,

Could you please write the same instruction for the case if the services are rendered prior to invoicing. For example, we provide services in June, and issue the invoice on the 1 day of July. We use the ship date (June), but in reports this revenue goes to July.

How can we manage to book the income in PL in June and what would be the date of AR?

Thanks for joining this conversation, @vshulakova.

I see that you've posted the same question twice, and the other one was already answered by my colleague. Just in case you haven't been notified of the new response, here's the link: https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/recognize-revenue-for-licen....

To keep the conversation streamlined and provide you with the best resolution, I'll ask that you post any follow-ups there.

Please let me know if you have any other issues or concerns in the comment section below. I want to make sure everything is taken care of for you. I'm always here to help. Have a good one!

Hello

Can anyone guide about the VAT treatment for unearned revenue.

Case:

Year Close 31-Dec

Raised invoice for rent (6000 Dollars) plus VAT 15% 900 Dollars and received payment in full

Invoice covering the period from (Oct 1st 2020 till March 31st 2021)

However VAT is due quarterly for Q4 the vat is due at 31-jan-2021

so we have three month earned revenue for 2020. and unearned also 3 months at end of 2020.

please guide in this scenario.

Thanks in Advance

You may need to create a sales tax adjustment, ArslanAkhtar.

In QuickBooks Online, you can process an adjustment if there's a need to reduce or increase your sales tax liability. But before you do this, I suggest reaching out to your accountant so they can further assist you in handling this situation.

You'll need to set up an account to track the sales tax adjustment. Expense account to increase your sales tax due and income account if you need to decrease. You can create two adjustments, one for Q4 2020 and another for Q1 2021. Please check these articles for the detailed steps:

Keep on posting here if you need anything else. Have a great day!

We are an events business, and we just started qbo this year. Since 1/1/21 I have about 50 invoices that have been paid and the money designated to our deferred revenue account. My questions:

1) If I enter a service date on the invoices, will qb automatically move money from deferred to realized revenue after the service/event date?

2) If not, post-event, what should I do? Is there a batch action whereby I can choose all the invoices for our sponsors/exhibitors and move them, or do I need to go into each invoice?

Thanks for your help!

I appreciate you for choosing QuickBooks Online (QBO), @MR88.

I'm here to share with you some information about how invoices work in QBO.

QBO supports two accounting or reporting methods. Thus yes, the system will automatically post your sales or invoices to the designated accounts by the time you record them (service date or transaction date). Given that your run your reports on an Accrual basis.

By the time you record a payment, the invoice amount will eventually show as income on a Cash basis.

I'm adding this link for more hints about cash and accrual accounting: Cash vs. accrual accounting: What’s best for your small business?.

For more hints about running reports and managing your invoices, you can also open the topics from our help articles.

If you have any follow-up questions about your invoice transactions, please let me know by adding a comment below. I'm always here to help. Keep safe!

Attempting to set up item linked to liability account for customer deposit however QB blocks it. I’ve tried non inventory items and inventory. My company set up is accrual. How is that the qb community provides instructions that are blocked by the program? How do I fix or work around. This company relies on customer deposits before production begins.

Let's ensure that you'll be able to successfully set up items that you can link to the liability account, bb100.

When setting up an item in QuickBooks Desktop, you'll want to make sure to select Service if you collect upfront deposits for services, or Other Charge if you collect upfront deposits for products. To do this, you can follow the steps below.

Please read this article for more information and detailed steps: Manage Upfront Deposits or Retainers.

In addition, QuickBooks offers a variety of reports so you'll know where your company stands, You can run and customize these reports according to your business needs. Customize Reports in QuickBooks Desktop.

Reach out to us if you have any questions about setting up an item. We're always here to help you all the time.

Thank you but I have been following the procedure wildly available about setting up an item, then service or other charge, then liability account. My problem is that QB is blocking me from selecting a liability account and I get an error message that says I can only link the item to a revenue account. QB blocks me from selecting customer deposits (liability). How do I fix this or work around this? I need this to work as client deposits are the dominant in our business.

Thanks for keeping us updated, bb100.

Since you're still unable to create a Service item or Other Charge to link to a Liability account, to isolate the issue, let's go ahead and re-sort your item lists. This process resolves any odd behavior in your master names list, Item list, or Chart of Accounts in the system.

Before doing so, I recommend switching to single-user mode. Click the File menu, then choose Switch to Single-User mode. Let's also ensure to update QuickBooks to the latest release to avoid issues in the program.

After that, here's how to re-sort the list:

For more details about this, click this link: Find out how re-sorting helps you with your lists in QuickBooks Desktop.

If the issue persists, a data integrity issue could be the reason for this. In this case, let's run the Verify Rebuild Data tool that helps identify and repairs data issues within your company file.

Once done, check to see if everything is working now.

Please let me know how things go on your end. I want to ensure this gets resolve for you. Take care.

John just an added question. I am a cash business. When i invoice a client in december and don't get paid until january, the revenue is always applied to the invoice date in december. is there a way to "move" the revenue out of december (prior year) and move it into january (current year)?thx

Thank you!

Hi there, YTK.

I am pleased to hear that the information shared in this thread has been helpful to you. It is always satisfying to witness valuable insights having a positive effect.

Please let me know if you need assistance with anything else. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here