Cash and accrual accounting are like sibling rivals in the accounting realm—one clashes with the other, but you can definitely see the resemblance. Even if you don’t handle your own financial reporting, it’s vital to know how each one works so you can choose the best bookkeeping practices for your business.

Overview: What is the difference between cash and accrual accounting?

Cash accounting records income and expenses as they are billed and paid. With accrual accounting, you record income and expenses as they are billed and earned.

As long as your sales are less than $25 million per year, you’re free to use either the cash basis accounting or accrual method of accounting.

Why should you choose one over the other? We’ll explain the basics of the cash accounting and accrual accounting methods, as well as the pros and cons of each so that you can make an informed decision.

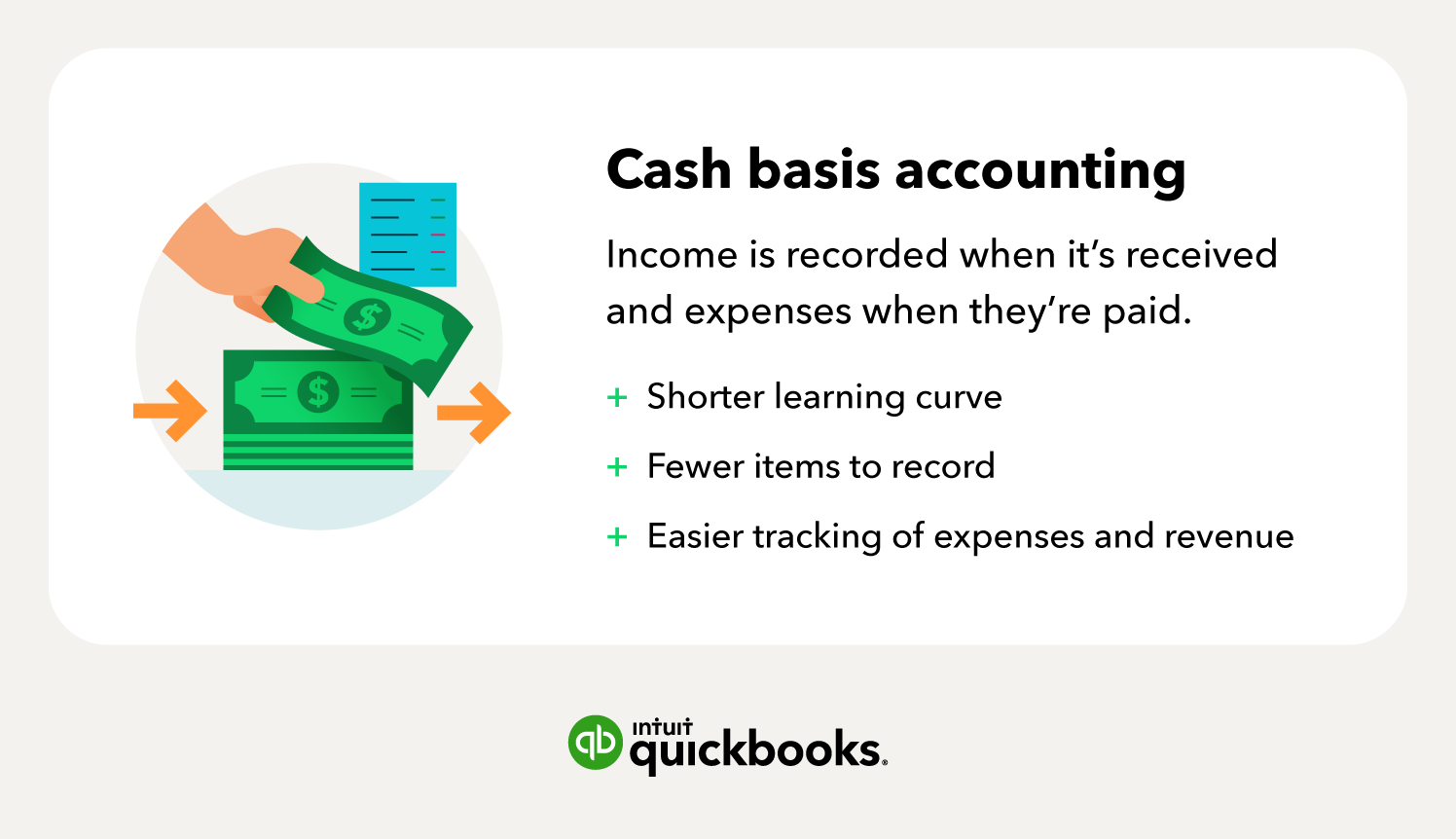

What is cash basis accounting?

Let’s begin with cash basis accounting. With this method, you record income as it’s received and expenses as they’re paid. Cash basis accounting only records your expenses when money leaves your account to pay suppliers, vendors, and other third parties.

In other words, if you have a small stationery business that purchased paper supplies on credit in June, but didn’t actually pay the bill until July, you would record those supplies as a July expense.

It’s important to note that this method does not take into account any accounts receivable or accounts payable. This is because it only applies to payments from clients—in the form of cash, checks, credit card receipts, or gross receipts—when payment is received.

Who uses cash basis accounting?

Because of its simplicity, many small businesses and sole proprietors use the cash basis method as their primary method of accounting. If your business makes less than $25 million in annual sales and does not sell merchandise directly to consumers, the cash basis method might be the best choice for you.

Some of the benefits include:

- Shorter learning curve

- Fewer items to record

- Easier tracking of expenses and revenue

Example of cash basis accounting

If you invoice a client for $1,000 on March 1 and receive payment on April 15, you would record the income as received for the month of April, since that’s when you actually had the money in hand. So the breakdown looks like this:

- The invoice is sent for $1,000 in March

- You do nothing in March

- You receive payment in April

- You record the income in April

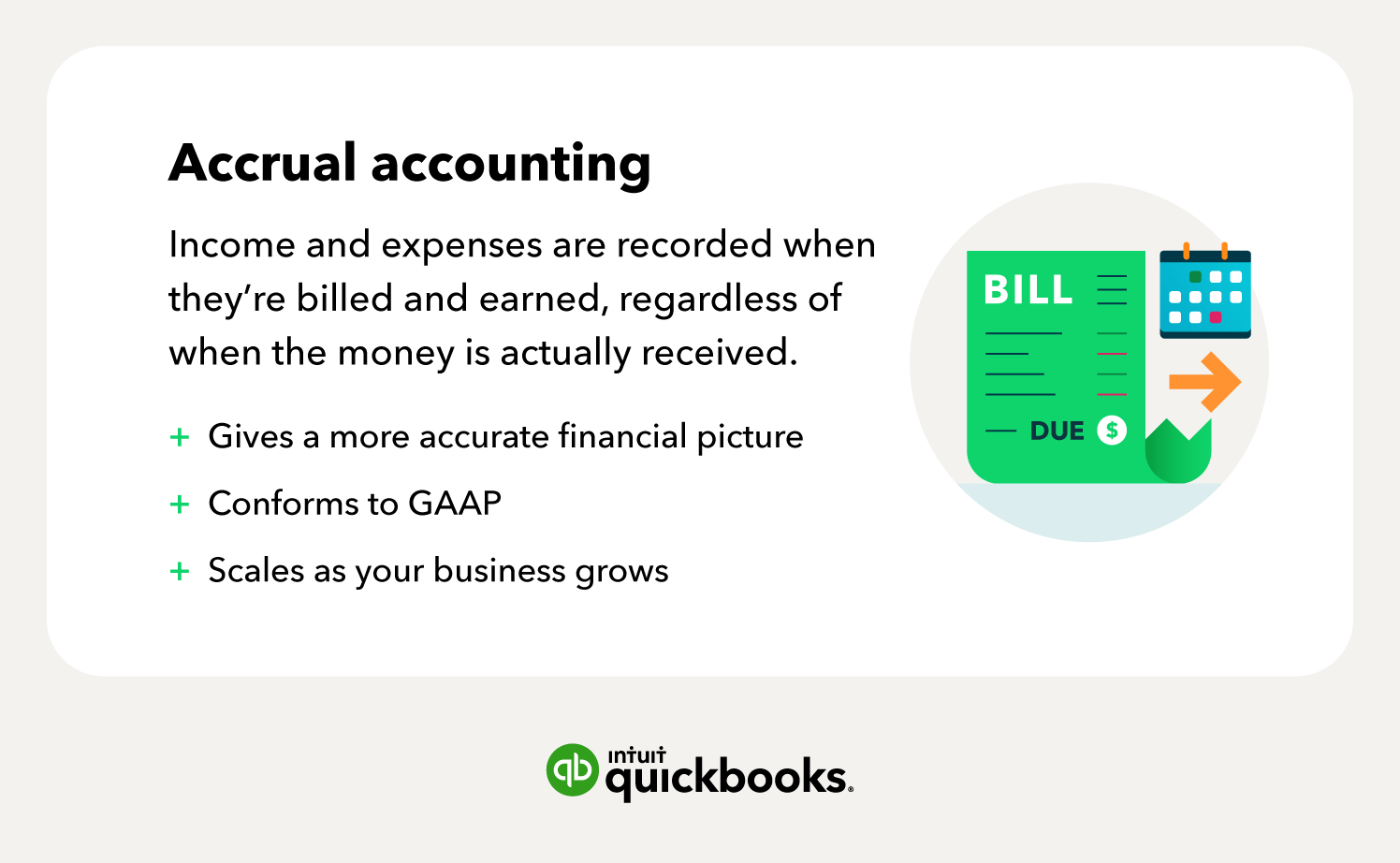

What is the accrual method of accounting?

With the accrual accounting method, income and expenses are recorded when they’re billed and earned, regardless of when the money is actually received. Accounting standards outlined by the generally accepted accounting principles (GAAP) stipulate the use of accrual accounting for financial reporting, as it provides a clearer picture of a company’s overall finances.

Who uses accrual accounting?

While it’s perfectly acceptable for small businesses to use accrual accounting as their primary method of accounting, it’s not required. However, according to GAAP regulations, any business that is either publicly traded or produces over $25 million in sales revenue over a three-year period is required to use the accrual method.

Example of accrual accounting

Using the example from above, if a small business bills a client $1,000 on March 1, you would record that $1,000 as income in March’s bookkeeping—even if the funds didn’t clear your account until April 15.

- The invoice is sent for $1,000 in March

- You record revenue in March

The same holds true for accrued expenses. In this case, if your small stationery business buys paper supplies on a credit card in June, but doesn’t actually pay that bill until July, you would still record that as a June expense. Let’s break this down:

- You bought paper supplies in June

- You record the expense in June

Accrual vs. cash basis: Which is better?

Accrual accounting is the winner if you’re looking solely at popularity, as it’s the most widely used as well as the most accurate when it comes to portraying a holistic view of a company's financial health. Cash basis accounting is still a popular option, however, due to the simplicity of the overall process.

Advantages and disadvantages of accrual accounting

Unlike cash basis accounting, which provides a clear short-term vision of a company’s financial situation, accrual basis accounting gives you a more long-term view of how your company is faring.

This is because accrual accounting gives an accurate picture of how much money you earned and spent within a specified time period, providing a clearer gauge of when business speeds up and slows down over the course of a business quarter or a full year. Additionally, it conforms to nationally accepted accounting standards. This means that if your business were to grow, your method of accounting would not need to change.

Advantages:

- Creates a more accurate financial picture: It can give small business owners a more realistic idea of income and accrued expenses during a certain period of time. This can provide you (and your accountant) with a better overall understanding of consumer spending habits and allow you to plan better for peak months of operation.

- Conforms to GAAP principles: Because the accrual method conforms to GAAP, it must be used by all companies with more than $25 million in annual sales. Since the $25 million sales revenue mark can be high for most small businesses, most will only choose to use the accrual accounting method if their bank requires it.

- Scales with your business: You may not be there now, but in a few short years you could double or triple your revenue, pushing you over the $25 million mark. If you already use the accrual accounting method, there’s no need to change—it simply grows with you.

Disadvantages:

- More resource-intensive: Many small business owners view it as more complicated and expensive to implement due to complexity and extra paperwork. Since a company records revenues before they actually receive cash, the cash flow has to be tracked separately to ensure you can cover bills from month to month.

- Inaccurate short-term view: The cash method gives you a better picture of the funds in your bank account. If you don’t have careful bookkeeping practices, the accrual accounting method could be financially disabling for a small business owner. Your books could show a large amount of revenue when your bank account is completely empty.

Advantages and disadvantages of cash basis accounting

The cash method of accounting certainly has its benefits, including ease of use and improved cash flow. While the cash basis method of accounting is definitely the simpler option of the two most common accounting methods, it has its drawbacks as well.

Advantages:

- Simplified, familiar process: Cash basis accounting is a simplified bookkeeping process that is similar to how you might track your personal finances. It’s easy to track money as it moves in and out of your bank accounts because there’s no need to record receivables or payables.

- Income taxes: For tax purposes, you don’t have to pay taxes on any money that has not yet been received. For instance, if you invoice a client or customer for $1,000 in October and don’t get paid until January, you won’t have to pay taxes on the income until January the following tax year. For individuals and extremely small businesses, this can be crucial to keeping your business afloat when cash flow is restricted.

Disadvantages:

- Inaccurate financial picture: Since it doesn’t account for all incoming revenue or outgoing expenses, the cash accounting method can lead you to believe you’re having a very high cash flow month when in actuality, it’s a result of a previous month’s work.

- No accounts receivable or accounts payable records: Because the method is so simple, it does not require your CPA or bookkeeper to keep track of the actual dates corresponding to specific sales or purchases. In other words, there are no records of accounts receivable or accounts payable, which can create difficulties when your company does not receive immediate payment or has outstanding bills.

- Doesn’t conform to GAAP: If your business were to grow larger than $25 million in annual sales, you would need to update your accounting practices. If you think your business could exceed $25 million in sales in the near future, you might consider opting for the accrual accounting method when you’re setting up your accounting system.

How to choose the right option for your business

For small companies that do business primarily through cash transactions and do not maintain large inventories of products, the cash accounting method can be a convenient and reliable way to keep tabs on revenue and expenses without the need for a great deal of bookkeeping.

However, for the most accurate and updated accounting view of your financial health, accrual accounting might be the better choice. There are also some other factors to keep in mind.

The complexity of your business

Depending on your industry and the complexity of your books, one accounting method may be more sustainable than the other. For example, a business with multiple accounts, hundreds of employees, and various LLCs will probably want to stay away from cash basis accounting because it won’t give the company the big picture view it’s looking for when it comes to financials on the income statement, balance sheet or cash flow statement.

Sales revenue

Another reason to choose one over the other would be based on your sales revenue. According to GAAP, if you exceed $25 million in annual revenue, then you are required to use the accrual method. For many small businesses, this isn’t an issue at the moment but maybe in the future, so it’s something to keep in mind.

Publicly Traded

Having a publicly-traded company or one that may go public is another stipulation of the GAAP guidelines. Publicly traded companies have a duty to report an accurate view of their financial well-being to shareholders. The best method for this is the accrual system of accounting.

Moving forward

Before moving along through your small business accounting checklist, understanding which accounting method to use is, without a doubt, an imperative decision for your business. That’s not to say it can’t be changed later—only that it’s harder to switch once you get comfortable with one way or the other. Accounting software and tools like QuickBooks Live can help with either method, with virtual accountants available to help you every step of the way.

Bottom line, whether you choose cash or accrual accounting, remember to understand both options and stay within compliance with GAAP for your state.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.