Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSomeone PLEASE hold my hand! I see all this advice to attach memos, etc. When I run a report or open the unpaid invoice my only option (as far as I can tell) is to receive payment and input a monetary amount in the amount paid block before I have the choice to write the unpaid balance off. I'm not going to get the unpaid balance so my only option I can see is to show a payment of at least 1 cent and then write off the remaining. I run a heavy equipment business and I'm good at that but not QB. Thanks for any clarification.

Solved! Go to Solution.

There are a couple of ways to write off bad debt (if you are on an accrual basis). This is what I do.

First, be sure you have recorded all attempts to collect the money, including your notes and any correspondence to the debtor.

There are a couple of ways to write off bad debt (if you are on an accrual basis). This is what I do.

First, be sure you have recorded all attempts to collect the money, including your notes and any correspondence to the debtor.

I prefer an Other Charge type item for write offs, since I use noninventory items for real work.

I followed these steps, but it's not putting the amounts into the bad debts account. Before looking this up, I did receive payment and had it deposited to the Bad Debts account. Showed up fine. However, doing a credit memo in this manner is not keeping them in that account.

Hello there, @RogLand18.

Thanks for the trust in resolving your concern. I can help write off your unpaid invoices.

There are a few steps to follow, so the amount will show into the bad debts account. Here's what I know on how to write off bad debt.

Since you're following the above steps given by @Lexiesmemere. Make sure to use the same account when:

Creating the non-inventory item.

Receiving the payments.

Also, verify if you have use the bad debt item when creating the Credit Memo.

Additionally, you can refer to the following article for other way to write off the unpaid invoices: https://quickbooks.intuit.com/community/Help-Articles/Write-off-bad-debt/td-p/203413.

This should provide you information on how to show amounts in the bad debt account. If there's anything else you need from me, feel free to comment below. I'm always here to help in any way I can. Have a great rest of your day!

This part is an error: "I did receive payment and had it deposited to the Bad Debts account. Showed up fine. However, doing a credit memo in this manner is not keeping them in that account."

There is no Payment to process, and it doesn't get "deposited" anywhere. That is Banking, but for a write off, there is no Banking going to happen. That's the problem, right? No Money from them.

The Credit Memo is an AR entry, which will make it available to apply to the invoice, which is creating the unpaid AR balance you intend to write off. You use a Charge item that links to an income account for Write off, because you want it to show it offsets the income that was on the Invoice. And you use it on the credit memo to result in Value, for the AR credit.

How do you write them off if you're on cash basis?

Hi there, @MohicanMomma.

Thank you for joining the Community. I'd be happy to help you write off bad debt if you're on a cash basis.

You can enter a credit memo instead of receive payments. The credit amount can be issued in your customer's account as a return and apply it to their invoice. This way, it clears the amount out from your accounts receivable and reduces your net profit.

Here's how:

After that, you can run a Cash Basis Profit & Loss Detail report to make sure the total is 0.

For more details, please check the articles below:

Also, The phone support agents will be able to assist you in getting this resolved.

That should get you back on track.

I'm just a post away if you should have any other questions about how to write off bad debt. I'll be happy to help you out. Wishing you well.

You Always use Credit memo.

"How do you write them off if you're on cash basis?"

The invoice is going to show, washed away by the credit memo, which Also Shows. You use CM to have all this controlled by date, appear to affect Sales reporting, and if you need it to, you also get to control how this affects Sales Tax reporting. Set the date on the Credit memo = your date of Write off.

You don't use Receive Payment and pretend Banking, you don't use JE for Names, so never for AR.

Please see my attachment for how Cash Basis works Fine for this.

Ditto.

I cannot make a credit memo - it gives me an error " can't have a negative value" - suggests I make a credit invoice. No clue what to do now. I never saw "credit invoice". Why does QB have to be so frustrating? Thank you for any help you can give! I've spent an hour already trying to get an answer.

Hi @Diane1308,

I completely understand where you're coming from and I know how it feels when you're experiencing errors when working in a certain task. I'm here to share a few insights you can consider in creating your credit memo.

First off, you can simply create receive payment transaction without selecting your outstanding invoices. This way. it'll create a credit memo for your customer.

That being said, here's how you can create a credit memo from the receive payment window:

In addition, you can check the screenshot I've added below for your visual reference.

As always, You can visit our Help Articles page for QuickBooks Desktop if in case you need to learn some "How do I" steps.

I'll be always my pleasure to help if you have any other questions. I'll be keeping an eye for your response.

Thank you for taking time to reply. I needed to make a credit memo (per QB suggestions), was to write off an unpaid invoice. And QB won't let me write a credit memo. So I'm still not understanding how to "write-off" a bad debt. Thank you.

Yes, you'll have to make a credit memo to write off an unpaid invoice, Diane1308.

When creating an credit memo, you can't enter a negative amount. That's why you're having that can't have a negative amount error. Please follow these steps on how to write-off a bad debt.

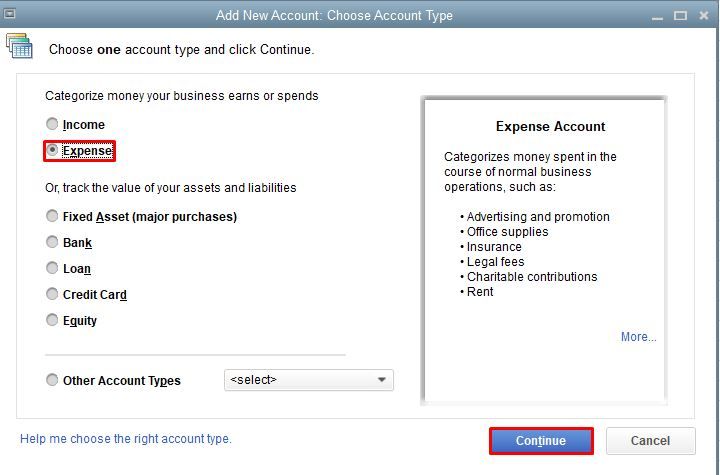

First, you'll have to create an expense account for the bad debt.

Next, create a credit memo and used the bad debt item.

Lastly, on the Available Credit window, select Apply to an invoice and then OK.

To check if you have successfully applied the credit memo, check on your customer's profile.

I'm just a post away if you have other concerns with your QuickBooks file. Take care always!

I followed the instructions and did everything from the list but at the end, when I opened the profit and loss report to see if it showed the amount as expense, it does but it also shows as income which means that it cancels itself out. That should not be the case. It should only show as an expense.

Thanks for coming to the Community, cgonzalez.

Bad debt is an income that won't be paid anymore. Since a credit memo was applied to the invoice, it'll show as an income and expense in the Profit and Loss report to offset the amount.

However, if you want to show it only as an expense in the Profit and Loss report, simply use the Discounts and Credits button to increase the balance in your bad debt account and decrease your net profit by the amount of the unpaid invoice.

I'll be glad to show you how:

Once done, open the Profit and Loss report to check the bad debt account.

As always, you can refer to this article for the detailed steps: Write off bad debt.

I'd like to ensure that you're able to resolve this concern, so please let me know how that works for you. Best regards.

If a customer left without paying balance, why is that a Credit Memo, Refund? We never received the funds and they left.

It's nice to hear from you in this thread, maryluketich.

We use a credit memo/ refund when the customer returns the item. In this scenario, we can put towards the existing balance to reduce the total amount. Another one is when you have received the money back from them. You're right, maryluketich!

In your case, we can record the balance of the customer as bad debt. It means, the customer owes you money but you can't collect it.

Recording the remaining balance as a bad debt expense account will zero out the balance. To do it, you can follow Lexiesmemere's instructions above.

You can also refer to this article: Write off bad debt in QuickBooks Desktop. This article provides you steps on how to handle the money you can't collect.

Visit there again if you additional questions. The Community is always here to help you more! I hope you're good! Take care!

What is the best way to clear out old unpaid invoices on a cash basis?

Good Afternoon, @Kt0987.

Good news, you've reached the right place and I have the tools to help.

After reviewing this thread, my colleague @MaryGraceS has provided the correct information you're looking for with writing off bad debt.

If you'll follow the steps above, those will be able to get your issue resolved and squared away.

Please know I'm only a post away if you need me. Have a good weekend!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here