Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowSolved! Go to Solution.

@ will

the only way to use different sales tax rates for different items is

create a sales tax item with a 0% rate and assign that to the customer

on the invoice, list all items for rate 1, follow with a sub total item, follow that with sales tax item for rate 1

list the items for rate 2, sub total item, sale tax item for rate 2

etc etc

@ will

the only way to use different sales tax rates for different items is

create a sales tax item with a 0% rate and assign that to the customer

on the invoice, list all items for rate 1, follow with a sub total item, follow that with sales tax item for rate 1

list the items for rate 2, sub total item, sale tax item for rate 2

etc etc

I am in texas and i have a simple question.

in my area we need to charge 8.25 percent on actual merchandise and 6.25 on our service. why cant it allow me to set 6.25 on all services and 8.25 on merchandise. I had quickbooks online for a few years and it did it very easy. so if i charged line item of 100.00 parts and 100.00 in service the tax would show up 14.50 total due. it charged 8.25 on the parts and 6.25 on the service automatically and very easy. i cant figure out how to simply apply that to quickbooks enterprise.

please help

Welcome to the Intuit Community, Neal.

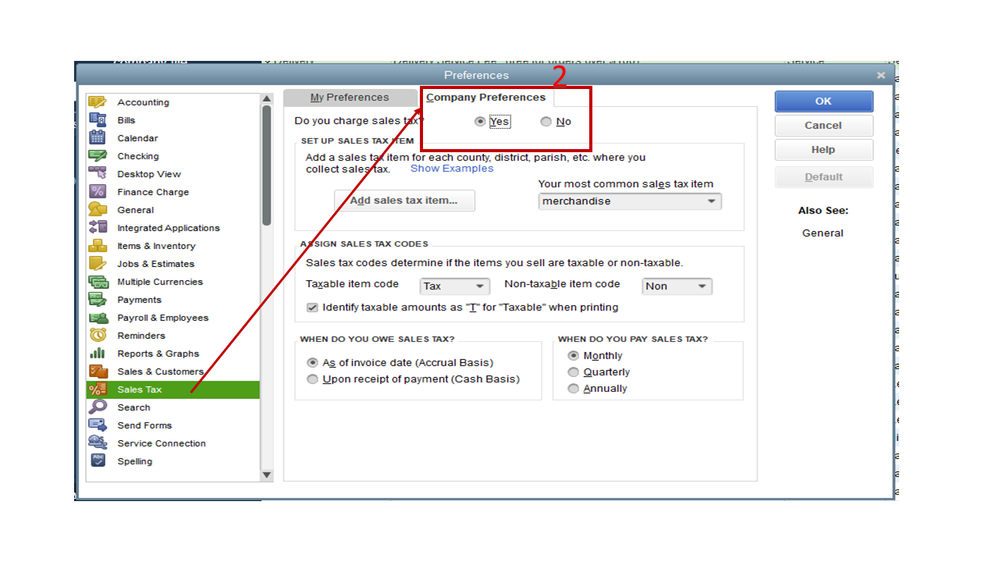

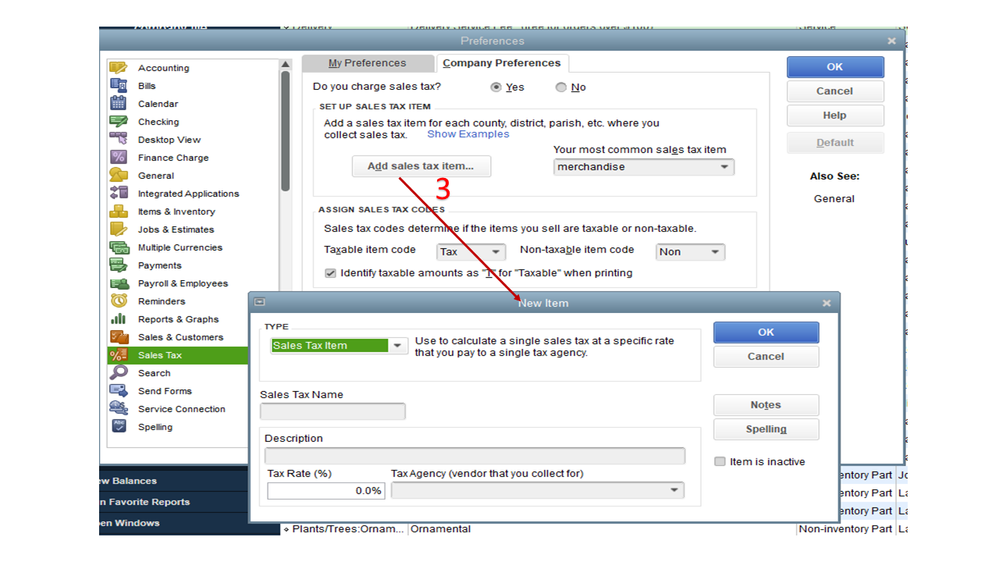

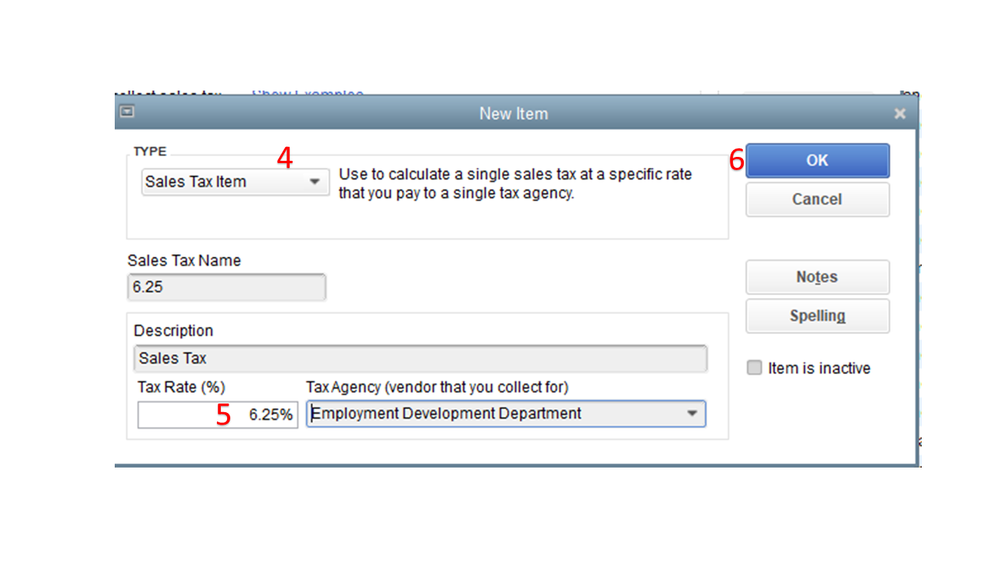

Let’s create a specific sale tax for each item and then set up a 0% rate. We’ll use the latter in the Tax section for QuickBooks to calculate the correct amount.

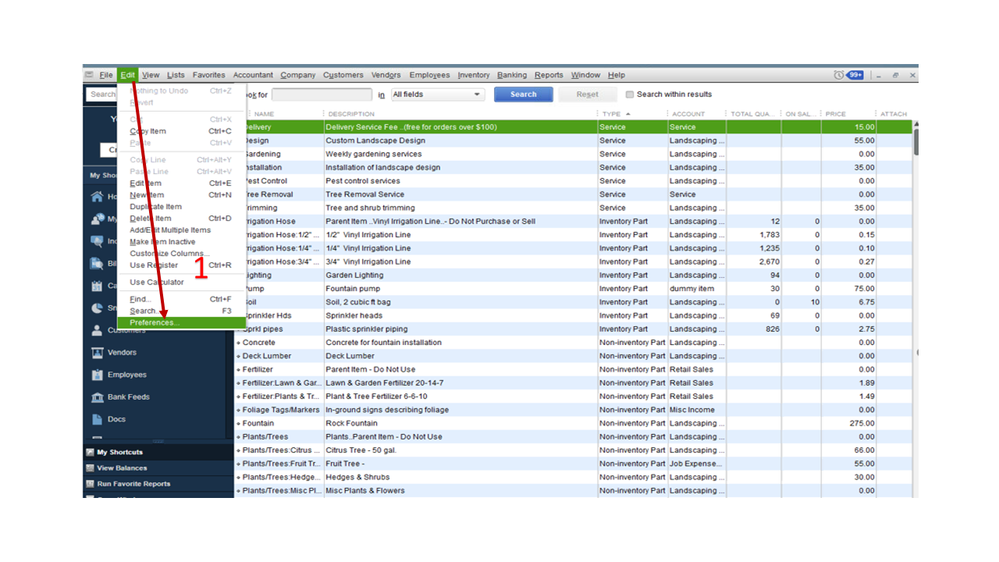

If you haven’t turned on the Sales Tax feature, go to the Preferences page to set it up. Here’s how:

When creating an invoice, input the service/merchandise on the first line item. Next, go to the next line and select the appropriate sales tax rate (8.25% or 6.25%).

We’ll have to perform the same procedure for the remaining product/service. Once done, click the Tax drop-down to choose 0% and then tap the Save and close button.

I’m also adding an article with a breakdown of the links for each topic about the Sales Tax option in the desktop version: How do I?

Stay in touch if you have any other concerns or questions about the product. Please know I’m here to help you. Have a good one.

Does this process reflect on monthly sales tax reports and liabilities?

Hey there, somerandomguy.

If you follow the steps provided above by my colleague, then yes this will reflect on your monthly sales tax and liabilities reports. However, I would suggest reaching out to an accountant just to be sure everything is set up accurately and just as it should be. If you don't have one yet, you can check out our Find an Accountant tool. Following that link and entering the required information will help you to find a local accountant to go over your books.

If there's anything else I can help with, feel free to post here anytime, night or day. Thanks again and I hope you have a nice day.

Generally speaking this forum is for accountants trying to figure out how to post something in QB from how to use the software inquiry and not asking for accounting principals. Any comment to contact an accountant seems ridiculous, useless and unhelpful.

Is it possible to use a sales tax group and a sales tax item on the same invoice?

Hello there, @JC3000. I'm here to ensure you're able to show sales taxes to your invoices in QuickBooks Desktop (QBDT) .This way, you can keep your financial data accurate.

In QuickBooks Desktop (QBDT), using a sales tax group and a sales tax item on the same invoice is unavailable. QBDT does not support the use of sales tax groups.

Instead, you can only apply a single sales tax item to an invoice. If you have different tax rates for additional items or services, you would need to create separate line items on the invoice and apply the appropriate sales tax item to each line item individually.

To learn more about sales tax in QuickBooks Desktop (QBDT), you may check this article: Set up sales tax in QuickBooks Desktop.

Also, you may want to check out these articles as your reference to learn more about A/P workflows you can use and how you can troubleshoot issues you may encounter while managing sales taxes in QBDT:

If you need help with other tasks in QBDT, go to this link to go to our general topics with articles.

Let me know if you have other concerns about setting up sales tax and managing sales transactions in QBDT. I'm just around to help. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here