Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello -

I would like to be able to track employee labor to a specific project. However, I have employees who get paid different rates based on what they are doing on the particular day. For example, on the same day, one employee might be doing welding at $30 per hour for 3 hours and then operating equipment for 6 hours at $25 per hour. I know how to enter this in the weekly timesheet section assigning the hours to the correct project and payroll is working fine. When I go into the 'project' I would like to know the cost of labor for the specific project. I have read other posts that explain how to enter a 'hourly cost rate' for each employee...but this doesn't work if they have different pay rates depending on what they are doing? Why can't the project just pull in the information from the payroll system when I have assigned every hour to the correct project??? Please advise! Thanks!!!

Solved! Go to Solution.

Hey there, Krisabitz.

Let me guide you on how to run the Payroll Expense by project report in QuickBooks Online.

To run Payroll Expense by project report:

You can check out this link with the video tutorial on how to use project profitability report in QuickBooks Online.

I'm also adding this article to learn how you can personalize your report: Customize reports in QuickBooks Online.

Let me know if you still have other concerns about project reports. I'll be here to answer them. Have a wonderful day!

Thanks for providing us with in-depth details of your concern, Krisabitz.

We'll need to enter hourly cost rates for each employee. If you use QuickBooks Online (QBO) Payroll, you can just use your payroll expenses to see your labor costs. However, you won't see the costs in projects until after payroll is processed. If you want to estimate your labor costs between payroll runs or if you don’t have payroll, just use estimated hourly costs.

To estimate your fully-burdened hourly cost for each employee, enter employee wages, and other costs like taxes and workers' comp insurance, as an hourly cost rate. Then apply these rates to estimate your labor costs. Here’s how to set up hourly costs:

To view your labor costs, just switch between viewing payroll expenses or hourly costs. Let me show you how:

If time charges aren't calculating as you expect in your project, check this switch to see if you're using your preferred type of labor cost (hourly costs or payroll expenses). To learn more about Projects, check out these articles:

I'd like to know how you get on after trying the steps as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Have a great day ahead.

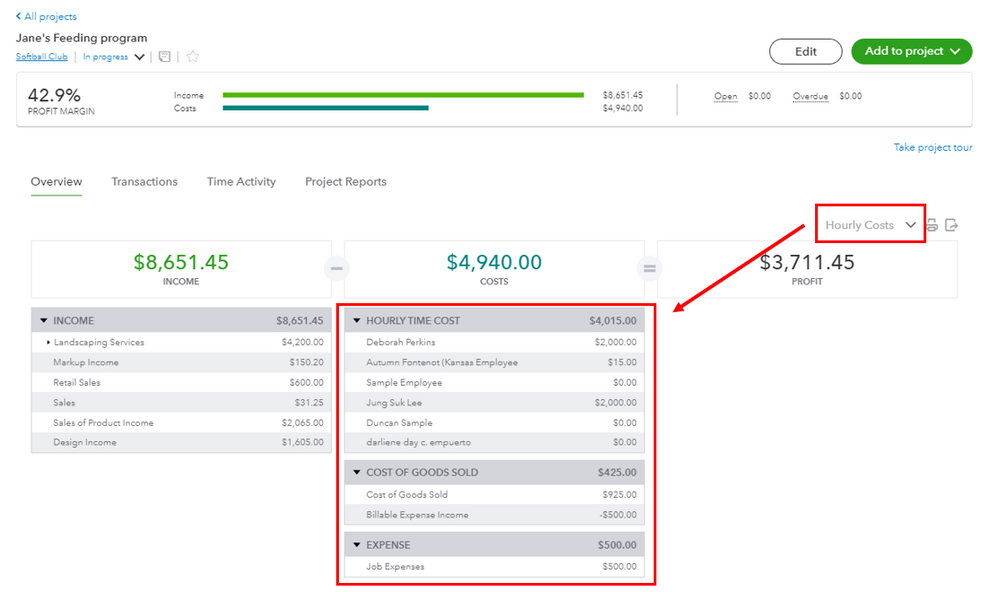

Hi - Thank you for your time. I do not need to estimate labor costs. I would just like to see the labor costs associated with a project after I have run payroll each week. When I am in my specific project I am using 'Payroll Expenses' instead of 'Hourly Costs', however I still can't find my labor costs anywhere? Here is a screen shot

Hello -

Thanks for your help. I do not need to estimate labor costs, just track them after payroll has been run. I went into my specific project and I am using 'payroll expenses' as you suggested, but I still cannot see my labor costs for this project? Is there another setting I need to modify to pull in the payroll for this project? I am trying to attach a screen shot....

I appreciate your for going through the steps above and for sharing a screenshot with us, Kris.

Allow me to chime in and provide additional details on how to view your project labor cost.

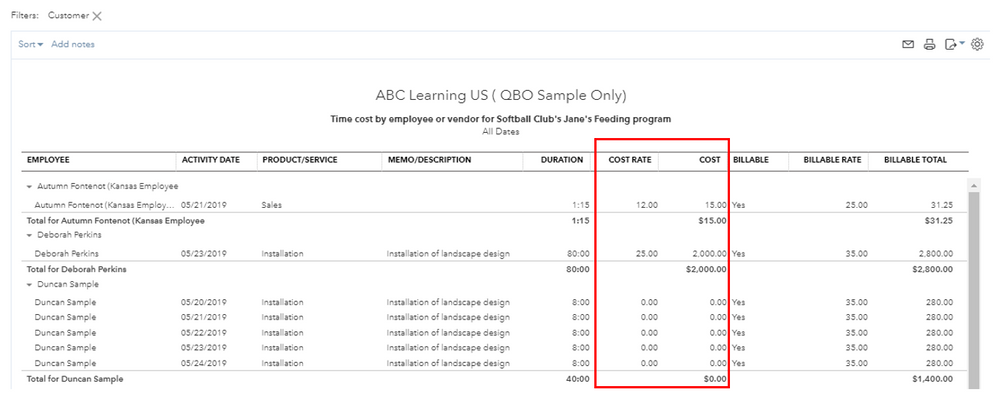

You'll want to change the view to the Hourly Costs of your project and select your employee in the HOURLY TIME COST field. This way, you'll be able to pull up the Time cost by employee or vendor report and view their labor cost. Let me show you how:

You can also utilize this link for more details: Track hourly labor costs and profitability by project in QuickBooks Online.

Once you're all set, you might want to modify the report to view the specific data you need. To be guided, you can refer to this article for the detailed steps: Customize reports in QuickBooks Online.

You can always count on me if you need more help supervising your projects and employee labor cost. Just add the details in your reply and I'll take care of it for you. Keep safe!

Hi - Thanks for getting back to me so quick. I don't think I can use 'Hourly costs' because I have employees who make different pay rates depending on what job they are doing. For example, an employee might do welding for 4 hours at $30 per hour and then on the same day operate equipment which pays $25 per hours. I have figured out how to enter this in the weekly timesheet and assign the hours to the correct project. Is there a way for the project to pull in this payroll information? thanks.

I can see how the benefit of being able to able to track employee labor (different pay rates) to a specific project would aid you in running the business with QuickBooks Online (QBO), @Krisabitz. That's why I'm here to share a few details about this.

For the time being, pulling up different employee pay rates depending on what job they do on a project isn't an option. However, you can either run Hourly Time Cost per employee or Payroll Expense by project reports to get the data you need.

We take customer suggestions as opportunities to improve the various features within our products. Therefore, I would encourage you to send suggestions or product recommendations.

Your valuable feedback will be forwarded and reviewed by our Product Development team to help improve your experience while using the program. Here's how:

I've attached screenshots below that show the first four steps.

Then, I'd recommend customizing your project reports to focus on the details that matter to you the most.

In keeping with this, I'm also adding this article to learn more about using projects to track your labor costs and profitability in QBO: Track hourly labor costs and profitability by project in QuickBooks Online.

I'm all ears if you have other concerns about creating and customizing invoices in QBO. You can drop a comment below, and I'll gladly help. Take care, and I wish you continued success, @Krisabitz.

Thanks. How do I run the 'payroll expense by project' report that you mentioned?

Hey there, Krisabitz.

Let me guide you on how to run the Payroll Expense by project report in QuickBooks Online.

To run Payroll Expense by project report:

You can check out this link with the video tutorial on how to use project profitability report in QuickBooks Online.

I'm also adding this article to learn how you can personalize your report: Customize reports in QuickBooks Online.

Let me know if you still have other concerns about project reports. I'll be here to answer them. Have a wonderful day!

When I am inside Projects and go to Hourly Cost rate and want to add the rate for an employee, there is no little calculator that pops up to help me calculate this. If QB Payroll know how much the employees get paid per hour (and related taxes), shouldn't it auto-populate the hourly cost rate?

I'll share insights about employee hourly rates in managing projects in QuickBooks Online (QBO), @cambita.

QuickBooks will get your employee's rates based on your employee payroll setup. Moreover, you can add overhead, including worker's compensation depending on your current project, to the total hourly internal cost. Know that changes from here won't affect the original hourly setup on your payroll. If there's no cost shown on your projects, let's ensure to add them to your employee's employment details:

If it's still unavailable in managing your transaction cost labor, I recommend performing troubleshooting steps that help address unusual behavior on a cloud-based application like QBO. We can begin by accessing your company file using a private window. A private window is a helpful tool for troubleshooting browser-related difficulties, as it won't preserve any history. The following are the keyboard shortcuts:

Once done, we clear your browser's cache or cookies to avoid similar issues in the future. Alternatively, opting for one of the browsers that are supported can also be a wise decision.

Concerning the calculator icon that aids the need to calculate and add your employee's hourly rate, this has been removed in the recent updates as QuickBooks will now auto-populate the cost of rates for the employee.

Learn more about Tracking hourly labor costs and profitability by visiting this article: Track hourly labor costs and profitability by project in QuickBooks Online.

Moreover, you can utilize various financial reports to get a snapshot of your business's financial growth. I also added a resource where you can refer to the complete guidelines for customizing it:

I’ll keep this thread open for your concerns and other queries about projects or any QuickBooks-related matters. I’m just a post away to guide you. Have a good one!

Thanks! I have actually already amended the two employees’ hourly pay rate after their raise and run the first payroll at that new amount. But when I go into projects, and then hourly cost rate, there is no change. For two employees, the hourly cost rate is actually listed as zero. So it is not auto populating as it should.

I think I’m going to have to call customer support (which I really hate to do because it takes forever) because I recently cleared the cache as I’ve had a recurring problem with the customer email not auto populating when I create a new invoice. So I’m not sure what’s going on…

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here