Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Greetings, @bigrc20.

QuickBooks Online allows you to set up the Florida County Discretionary Surtax in addition to the State Sales Tax. Additionally, this feature will allow your customer to see only one sales tax rate on the invoice.

Here's how:

For more information, I recommend checking these articles:

However, if you don't see the settings I provided at the top, you may be using the Auto Sales Tax feature. If so, the calculation is based on a variety of information entered during the set up.

The following article contains additional information about this: Set up and use Automated Sales Tax.

If it didn't calculate the discretionary surtax, I recommend reaching out to our Customer Care Support. They have the tools to check your account in a secure manner and verify the sales tax setup.

Here's how:

That should point you in the right direction today.

Keep me posted how it goes. I'll be happy to help you further. Have a great day ahead.

@MaryGraceS wrote:

Greetings, @bigrc20.

QuickBooks Online allows you to set up the Florida County Discretionary Surtax in addition to the State Sales Tax.

Additionally, this feature will allow your customer to see only one sales tax rate on the invoice.

Here's how:

- On the left pane, select Taxes.

- At the top left, select the Sales Tax tab.

- Under the Related Tasks list on the right, select Add/edit tax rates and agencies.

- Select New.

- Select Combined tax rate.

- Enter a Component name for the combined rate and the different sales tax requirements.

- Click Add Another Components, if needed.

- Click Save.

discretionary sales tax means that it is ONLY used under certain conditions.

If you include it in a combined tax rate, it will be used under ALL conditions

QBO will not do Florida discretionary sales tax, not even auto sales will do it

QBDT can sort of do it with a very complicated work around.

How would one handle the discretionary sales tax if one only has QB Online? Any way around similar to the desktop version?

Hello, @agrossauer.

I'm here to help share some information on how to handle the discretionary sales tax in QBO.

In the Auto sales Tax feature, the calculation is based on a variety of information entered during the set up as mentioned by my colleague @MaryGraceS. You cannot add this to your tax agency and standard rate, however, you can override the amount/rate.

I'll be here to help if you have other questions about your sales tax. Have a good one.

Hello, I was wondering if this is also for Quickbooks Desktop Pro? Thank you.

It's good to see you here in the Community, HHA, I'd be happy to answer your post.

In line with your concern, the steps provided above are only applicable in QuickBooks Online.

As of now, the QuickBooks desktop version doesn’t have the option to automatically change the rate when it reaches the sales tax limit.

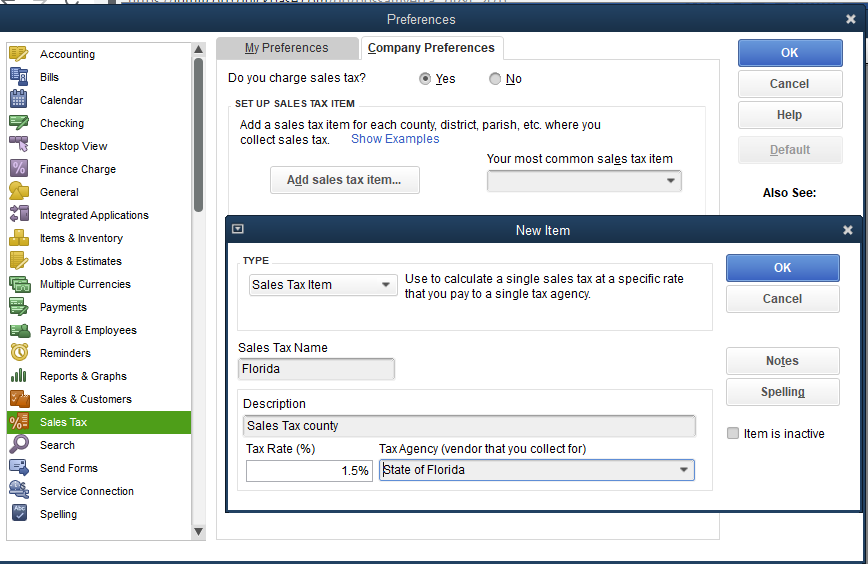

What you can do is, create two tax items to follow what your state mandate. One for the state tax and other one for the local tax.

To create a new sales tax item, here's what you'll to do:

For more detailed steps, I've attached a great resource that you can check: Set up sales tax in QuickBooks Desktop.

If you have further questions, please feel free to visit the Community again. I'm always here to help.

Where are the instructions for surtax by county in Florida for desktop.

Hi there, JKFlorida.

You'll have to manually set up the sales tax for state of Florida in QuickBooks Desktop. I'll show you how.

You can read our rundown and learn more about sales tax-related tasks in this link: Set up sales tax in QuickBooks Desktop.

Let us know if you have further questions. Have a wonderful day.

Hello Jane D

That step I knew and is in the system. The problem is that each county in Florida can have their own surtax above the state tax and you have to charge by shipping address. There is only one tax line and in qbo this is done automatically but they have to have enterprise because of their manufacturing. So how would I set up each counties individual % above the state tax.

Thank you

That part I did but the problem is each county has a surtax on top of the 6% state rate when they needs to be charged and there is only one sales tax line. In qbo it recognizes it and does it automatically by county

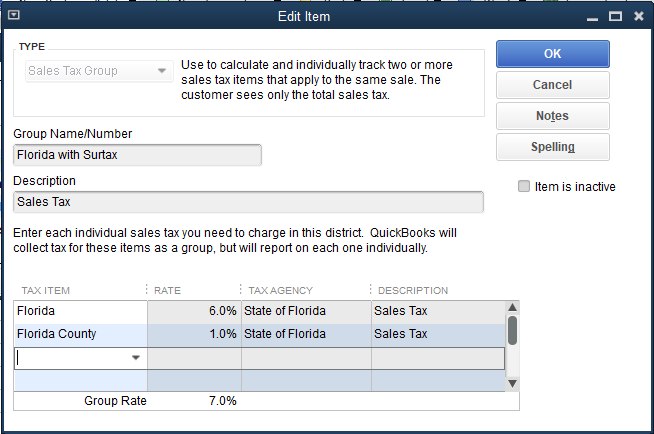

You'll want to create a sales tax group item instead, JKFlorida.

Although they show as a single line item on your invoices and sales receipts, you can track and report sales taxes individually when setting up a sales tax group. Beforehand, you'll have to create the surtax item.

To set up a sales tax group item:

For further reference, you can check the articles above that I've provided previously.

Keep us posted if you need anything moving forward. We'll be here to help.

How do I set up the discretionary surtax limit 1% or 0.5% on the first $5000.00? We are working with quickbooks Desktop.

Hi there, @SJ201.

I'm here to assist you on how to set up your discretionary surtax limit.

At this time, you'll have to manually set up a discretionary surtax limit in QuickBooks Desktop.

Here's how:

I've attached this article for the detailed process: Set up sales tax in QuickBooks Desktop.

Also, you can navigate our Help articles on how to manage your accounts in QuickBooks.

Please post again if you need any other help. Wish you all the best.

the problem with this is the Sur tax is only on the first $5000.00. The way your saying to do it, charges the Sur tax on the entire invoice amount. I am also needing a fix for this

How is this done in QuickBooks Online version? I am trying to set up multiple different county surtax rates to be used in addition to the 6% Florida sales tax rate.

Hi there, sarah1979.

Thanks for dropping by the Community. Adding the county tax can easily be done in your account. Let’s go to the W-4 information page to enter it.

Here’s how:

After setting it up, QuickBooks will calculate the taxes for you.

For more in-depth information about the setup process, here’s a link with a breakdown of the supported local taxes in QBO Payroll. Simply click on the article to view the complete information: Local tax.

Thank you for your time and if you have any other questions, feel free to post here anytime. Thank you and have a nice weekend.

We are talking about a sales tax sur tax on only the first 5k of sales. Not a payroll tax

Thank you for the response and clarification ggc2.

I'm glad to help, in QuickBooks Online, you'll want to set up automated sales tax. This will automatically handle all sales tax calculations for you and your business on receipts, invoices and more for easy and accurate filings. Here's how to set it up:

Step 1: Learn how QuickBooks calculates sales tax:

QuickBooks automatically calculates the total tax rate for each sale based on the following:

Learn more on how QuickBooks makes each sales tax calculation accurate.

Step 2: Tell QuickBooks where you collect sales tax:

QuickBooks Online keeps track of your state’s tax laws to accurately calculate sales tax and returns. If you charge sales tax outside of your state, you can also add other tax agencies you pay.

There are two ways to set up where you collect sales tax:

Step 3: Add tax categories to your products and services:

Rules for how to tax a product can change depending on where you sell. Check our blog on how the sales tax of a lemon can change depending on the final product and where it’s sold.

When you’re ready, you can assign tax categories to anything you sell. This lets QuickBooks know how much tax you need to charge based on what exactly you’re selling.

Step 4: Double-check your customers’ info:

Tax rates can also change if you ship products or perform services at your customer’s address. And some customers are not required to pay sales tax, like churches, schools, and other non-profit organizations.

Make sure you have your customers’ correct tax status, billing address, and shipping address. Here’s how to double-check your customers’ info in QuickBooks.

Step 5: Track sales tax from your customers:

When you’re done setting things up, you can start using the automated sales tax feature. We’ll show you how it works and where you’ll see it when you create an invoice or receipt for your customer.

Step 6: Check how much you owe and why:

Get a detailed look at the taxes you owe and why you owe them. This helps you make sure everything is accurate before you file and pay your sales tax return.

Learn how to run the Sales Tax Liability report to view your sales tax info anytime.

Step 7: File your sales tax return:

QuickBooks Online tracks your payment due dates in one place so you can avoid late returns and extra fees. Once it’s time to file, it’s easy to review what you owe to make sure everything is accurate. Then, you can e-file on your tax agency's website or send your return by mail. After you file, you can track your new sales tax payment in QuickBooks to keep your records up to date.

Learn how to file your sales tax return and record your tax payment.

Should you still need to track your tax manually, I would recommend this helpful tutorial video:

Let me know if that helps, if you have any other questions, feel free to post below. Thank you for your time and have a nice Friday.

Automated Sales Tax has the ability to automatically apply the surtax for you -- you just need to set up a taxable product (surtax doesn't apply to services or leases, so the automated system needs to be told you are selling a product). Once you have that product set up, run a transaction for $10,000 and you will see the surtax is automatically applied. If you do not wish to have the surtax applied, you need to map your product to the tax category that states no surtax to be applied.

Click on the tax drawer "See the math" and click on the carrot next to your calcs all the way at the bottom and you will see that only $50 sales tax is charged at the local level. Please note this is via line item only level and not invoice level.

I am having the same issue. When I set up the separate surtax for each county, it charges on the whole invoice instead of just the first $5,000. Not to mention that it makes it a nightmare filing my monthly sales & use tax report. If I let Quickbooks Online automatically calculate it, it is also wrong. It charges on the whole invoice. How can I fix this? I'm tired of getting penalties from the State of Florida when it comes to this.

Hi there, MDJ0314. Thanks for joining the thread and bringing this to our attention.

In QuickBooks Online (QBO), the tax on per item showing on the invoice is based on location. It is the reason why we're unable to have the tax per line item. In the meantime, you can create a separate invoice for another county. This way, the calculations won't be messed up.

While the feature you're looking for is unavailable, you may wish to consider looking for a third-party app. I can route you to the website where you can look for an application specific for your business needs. From there, you can integrate the app to QuickBooks Online (QBO).

Additionally, I'd encourage you to visit our QuickBooks Blog, so you'll be updated, with our latest news and updates including, product improvements. Just go to https://quickbooks.intuit.com/blog/.

Here are some resources for more information about using automated sales tax in QuickBooks:

Please feel free to get in touch with me here for any additional questions. The Community always has your back. Have a great day.

same Florida question but for QBDT or Enterprise.

Thanks for joining this thread, rgose.

The steps for setting up discretionary sales tax by county can be found in MirriamM's post.

You'll additionally be able to find many detailed resources about using QuickBooks in our help article archives.

I'll be here to help if there's any questions. Have an awesome day!

Does anyone know of a resolve for this yet?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here