Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowJust was notified IRS did not receive a 941 from 2015. CPA didn't file.... How do I put this form together in 2018 Quickbooks Pro?

Hey there, Cmccalla.

The available 941 form in QuickBooks is for 2018. You'll want to download the prior form on the IRS website. Then, manually enter the information.

You'll get the information by pulling up a tax form worksheet in QuickBooks. Here's how:

Once done, you'll manually submit the form to the IRS.

If you have other payroll concerns, you can always post anytime in the Community. Have a great day!

I get to #3 make a Macro and I can not get any further, can you please give me some help?

Cathy

Hello, @P71,

I appreciate you following the steps provided by my colleague so you can get a copy of your form 941 in 2015.

Let me provide you the step to keep you going. When you open the worksheet, the yellow message bar appears with a shield icon. Just click the Enable Content button to open the QuickBooks Tax Worksheets window.

Please see the attached screenshot below so you know what I'm referring to.

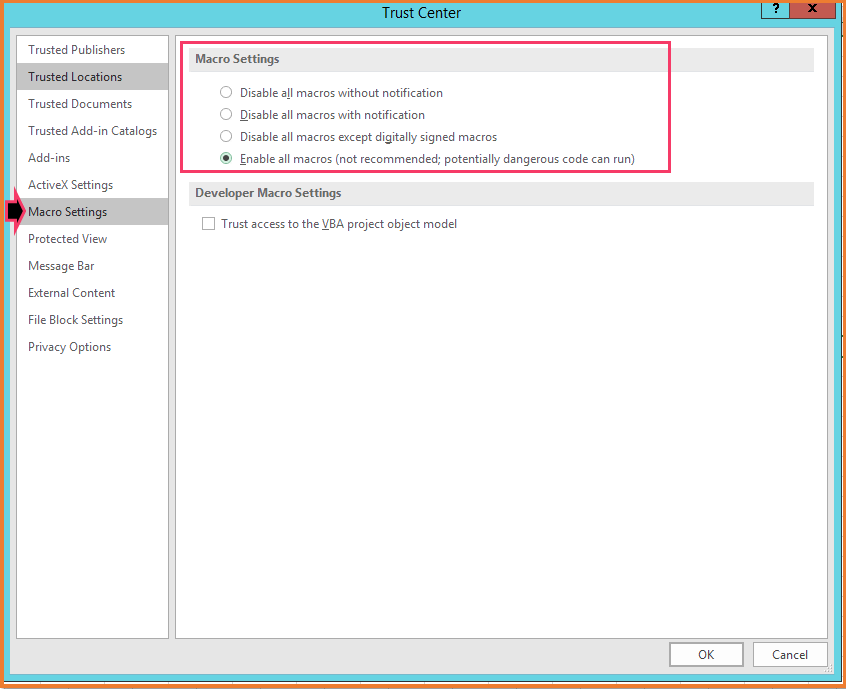

Another method to enable macros is to change the macro settings in the Trust Center page. Here's how:

Once you have the file and copied the information to the actual 941 form, you can then submit it to the IRS.

I've added this article for additional guidance on how to manage payroll forms in QuickBooks Desktop: Process, print, and save QuickBooks Desktop Payroll tax forms.

Should you need anything else with submitting payroll forms, please let me know, and I'd be glad to help.

Can you still e-file the form? Or do you have to paper file? None of you experts has made that clear.

If you have to paper file, what's the point? Quickbooks needs to fix that and allow e-filing of prior year forms.

We'll have to manually paper file previous tax forms, jorgebincpa.

We're unable to e-file late tax forms, and we'd suggest you to download the form on the IRS website and we can use the information in QuickBooks to fill it out. You can follow the steps provided by my colleagues. Let's just make sure that we pulled up the correct year or quarter, and the form.

You can also use these articles for more details in filing tax forms in QuickBooks Desktop:

Just leave a reply of your questions below, and we're here to help you through it. You take care always!

I had this same issue I went to https://www.tax1099.com/ it cost $4.95 form to file. I pulled all the numbers and had a 940 and 941 already completed from last year. So all I had to to was fill in the blanks. The IRS is so screwed up right now, they blame everything on COVID and if you manually send in any document it's 90 days before they will ever see it. I had previously submitted the 941 via US Mail 3 months ago and they still didn't have it. Bottom line the tax1099.com was simple and easy to use. It is stupid that Quicken doesn't allow you to e-file anything other than current year forms. Good luck!

Same here, been using www.tax1099.com for years no problem for our smaller businesses that just have 1099's and no payroll.

Thanks ChrisJS for reminding me they also handle the other tax forms! Mistakenly uploaded new QB tax table before closing out one of our businesses that had $0 payroll last year. Going around in circles figuring out how to report federal and state forms. All done now.

I am trying to download the 941 form for the year 2021 and I just tells me that I need adobe reader. I have it and I am able to download and view some of the other forms.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here