Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowI have shared my QuickBooks online file with our CPA. Although they have access to our file, they informed me they have not touched anything yet.

I am trying to file 1st Qtr payroll returns and they are showing up as the paid preparer (3rd party designee). I cannot remove it.

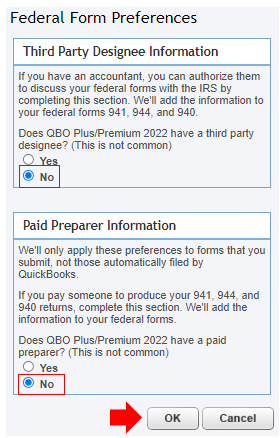

I can help remove the paid preparer information in your payroll returns, @WTB32960.

To do that, simply set your Federal form preferences to No. This way, no preparer or third-party designee will show up on your forms.

Here's how:

Once everything is good, you can now file your 1st Quarter payroll returns. Then, use this information to view your tax forms and payments in the program: Access payroll tax forms and tax payments.

If you have any other payroll questions or concerns, please don’t hesitate to leave a message. I’ll be here. Take care always!

It is already set to "no" in the setting for the Federal Form preferences. I need to file my quarterly returns and I must remove this information. I have looked everywhere. The CPA even told me that they didn't put this information in our QuickBooks Online file. How would it get there?

Please read my comment. This did NOT work. The Federal Forms section is already set to "No" for paid preparer and third party designee. I have contacted tech support and was disconnected. I need help with this TODAY!

Hi, did you ever get this resolved? I am having the same issue and need to remove the paid preparer from my forms so we can file them. We no longer have that preparer doing our filings. I have been on the phone with QB's several times and every time they have given me a different answer. None have worked.

Welcome to the Community space, @Emily200. I understand the urgency to remove the Paid in your payroll returns and appreciate you for contacting our payroll support team. Let me help you remove the Paid in your payroll returns so you can file your forms.

Have you tried performing the steps shared by my colleagues above? If you haven’t, I recommend following the steps since it's the only way to remove the paid preparer information in payroll returns.

You can also follow the steps below:

However, if you get the same results, I suggest contacting our payroll support team again to give further info and provide other instructions to remove the paid in your payroll returns. They can create an investigation ticket if other users experience the same issue. To reach them, click here to contact our Payroll Support Team.

Also, let me share these resources that will guide you in filing your taxes and accessing your tax forms in QuickBooks:

Feel free to let me know if you have any concerns. I’ll be around to assist further and make sure you taken care of. Take care.

Thank you for the reply. Yes, I have tried all of the listed suggestions above. And I have also contacted support 3 times about this, each time I have contacted support - they have given me a different answer - none of them have resolved the issue. That is why I commented above to see if the person had ever gotten a solution to this. So far, I have no resolution.

Yes, I have tried the above suggestions - they did not resolve it. I have also contacted support 3 separate times and received 3 separate answers - none of which have resolved this. That is why I commented to the person above asking if they ever found a solution.

The Federal Form Preferences is no longer an option in QBO Payroll Settings. It has Taxes and Forms, then Work Locations. This needs to be an option for accountants to continue using QBO and recommending to our clients.

Hello there, Tiffany.

I got your point on how this feature was useful for managing various federal forms efficiently and also played a significant role in our ability to recommend QBO to your clients confidently. I understand that the Federal Form Preferences option can help you manage federal forms in a streamlined manner.

For now, let's send your feedback to our Product Development team by following the steps below. This allows us to evaluate your suggestion and meet your requirements.

I look forward to hearing from you regarding QuickBooks payroll or progress made in response to this feedback.

Hi! Has anyone found a fix for this? I don't find a more recent article that addresses it, either. The option we're advised to click on still doesn't appear to exist.

I've replicated your concern, @CTatCD, and I was able to click on the federal form preferences.

In your case, let's access your QuickBooks Online (QBO) account using the private window to remove the paid preparer. Please know that only the Admins can complete the steps mentioned above. However, if you're still unable to do it. I suggest contacting our Payroll Support. This way, one of our agents can review your account in a secure environment and remove the third party payee.

Moreover, let me share these articles that will guide you on how to record payments made for prior tax periods and filing your taxes:

Let me know if you have further questions about paid preparers in QBO. I'll be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here