Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, I need to correct a 2024 1099 filed in Jan 2025 on QB online. It gives instructions on how to do it but there is no check box or "correct" box" next to it. The 1099 has been "accepted" . Any help or insight would be appreciated.

Hi, Mikenearman!

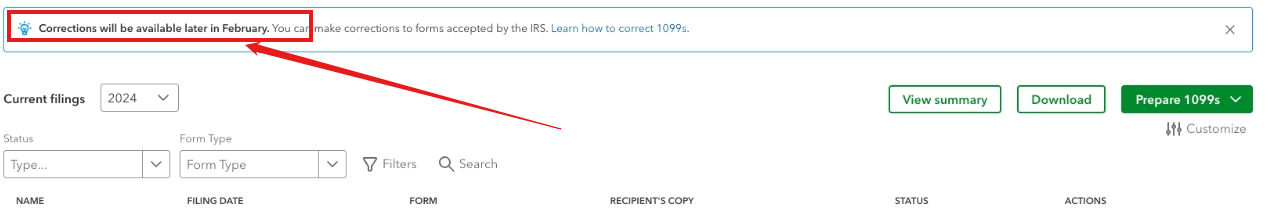

The ability to change the 1099 form you had e-filed will be available in mid-February. We will provide the specific date for updates as soon as it becomes available. For the latest information, please monitor the Corrections Banner at the top of the Tax Center page in QuickBooks Online. This will give you information about when you can begin making changes. I'll provide below how to locate the Corrections Banner.

For a better understanding of how corrections to the 1099 form work, you can refer to this article: Correct or change 1099s in QuickBooks.

Use this guide as a reference to enhance your ability to manage returns more efficiently in the future: Online ordering for information returns and employer returns.

You may also explore QuickBooks Payroll for you to gain more insights on how 1099 form works, and also information about Payroll related features.

The QuickBooks Team is at your service to address any questions or concerns you might have regarding the 1099 form or any payroll feature. Please don't hesitate to reach out for any clarifications or support you need. We're here to assist you.

The correct option is now available. I'd like to correct the form type from 1099-misc to 1099-nec. It doesn't seem to like that. How can I simple change form type?

It's great that you can now correct the 1099 form, John. I can walk you through submitting the right one to ensure accuracy in your tax reporting and full compliance with IRS regulations.

You can correct the form after the IRS accepts your 1099s. We can then switch the form type from 1099-MISC to 1099-NEC by following these steps as we e-file the correction:

Additionally, please refer to this article for more ways of rectifying the forms: Correct or change 1099s in QuickBooks.

Furthermore, you'll need to provide a copy of the corrected 1099 forms to contractors: Print your 1099 and 1096 forms.

You can return here whenever you have more questions about the correction process of the 1099 forms. We'll help you maintain accurate financial records and comply with tax obligations.

The option to correct the recipient name or TIN on your 1099 is unavailable, Jay. You can write a letter to the IRS to correct an incorrect company name, EIN, SSN, or TIN, as these modifications are unavailable in QuickBooks Online. I'll provide further details below.

The following details in your letter. And all corrections must be finalized within the three-year IRS deadline from the original e-filing date. This adherence is important for maintaining compliance and accuracy in your financial records.

Moreover, for detailed instructions on adjusting 1099 forms in QuickBooks, consider referencing the article: Correct or change 1099s in QuickBooks.

Furthermore, you can follow this article on how to print your 1099 to keep a copy of your forms: Print 1099 forms. It also contains tips on what to do if you've filed or haven't e-filed your 1099.

We aim to keep you informed about 1099 corrections. If you have any questions or need additional help, our support is available 24/7. Don't hesitate to reach out.

Hi. They are available. I tired to make changes. It walked me through and then said “sorry, the feature to correct the name of the person, which I’m sure is what you wanted to do, is not quite fixed yet”

Thank you for the update, @JayCulberth. I truly appreciate the effort you've put into resolving this issue. I’d like to offer some insights and recommendations regarding the name change on your 1099.

You can send a letter to the IRS to request corrections for an incorrect company name, EIN, SSN, or TIN, as these changes are currently not supported in QuickBooks Online. Below is a list of information you should include in the letter.

Please keep me posted on your progress with correcting the name on your 1099 or let me know if there are any additional questions. I’m here to assist you and will respond as quickly as possible. Have a great rest of your day.

I went in to correct the name on the 2024 1099 and the error box is showing that the Name or TIN is currently unavailable but actively working to enable the feature. Do you have a date of when you expect that to be updated and we can correct the name through your website?

Thank you for joining the thread, TheAmerican. Currently, QuickBooks has yet to update the feature to correct the recipient's name or TIN. Let me direct you to the appropriate support.

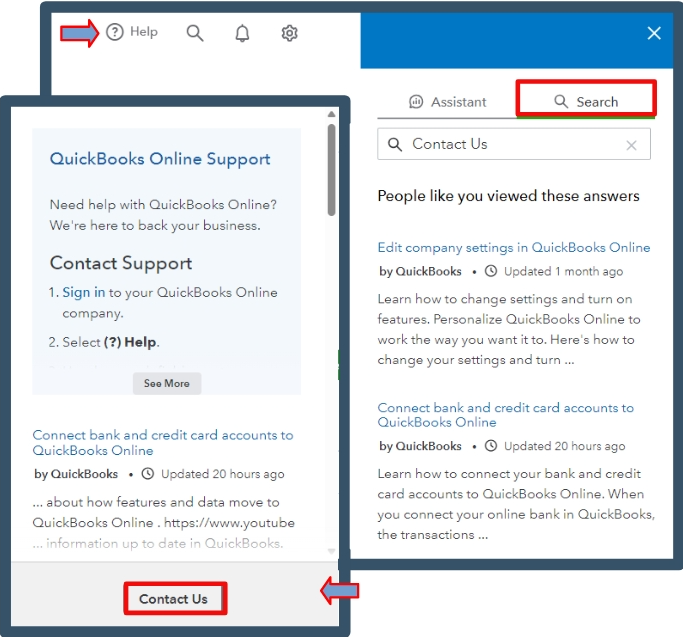

If you have tried the troubleshooting steps provided above by my colleagues and the issue persists, I recommend contacting our live support team. They can arrange a screen-sharing session to help identify the reason behind the error, 'Correcting the recipient name or TIN is currently unavailable.' Additionally, they can open a ticket to further investigate this issue.

Here's how to contact our live support team:

Also, correcting or changing your 1099s in QuickBooks helps maintain accurate financial records, ensure tax compliance, prevent issues for businesses and recipients, and prepare for year-end reporting and audits.

Moreover, printing your 1099 forms helps maintain compliance, ensures the accuracy of reported information, and provides tangible records for your business and tax purposes.

Correcting the recipient's name or TIN in QuickBooks is crucial for compliance, accuracy, and avoiding tax issues, which ultimately improves your overall business operations. For further assistance with managing your 1099s, click the reply button. I'm always here to help.

the feature to file a corrected 2024 1099 with a different amount also does not work. it does not let me proceed here. the name is correct in QBO and we just want to file a corrected 1099 with a new amount. pls advise

I appreciate your efforts in exploring alternative methods for filing the corrected 1099 form, mlasar. I can provide detailed information regarding the possible causes of the error you are encountering. Let me guide you through the correct process to successfully file the 1099 form.

There are a few specific situations that may trigger this message:

I recommend following the steps outlined in point 1, as this is typically the root cause of the issue when correcting or change the 1099.

If the problem persists even after following these steps, I suggest contacting our live expert support for additional assistance. Our experts have specialized tools that enable them to delve deeper into the issue and develop customized solutions.

Here's how to contact our live support:

I've also provided link of article that could be beneficial in similar situations down the line.

Your success in smoothly filing the corrected 1099 is our priority, mlasar. Please don't hesitate to reach out if you need further assistance – we're just a message away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here