Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, Shoplady2.

Can you share more details about your concern? We just want to make sure that we're giving you the troubleshooting steps or information that can resolve the issue.

Please add a reply below to share more details. Thanks!

I have just spent over three hours on 2 different phone calls with tech support which offered NO support! The first tech gave up quickly and suggested I hire someone. The other tech was trying but she had no clue to what I was even talking about.

I tried to tell her the QB generated "Sales tax liability report" was COMPLETELY WRONG! She said, "Well how do you know it's wrong?" I said, "Because it doesn't coincide with my P&L statement. She said "Why are you going by the P&L statement?" LOL UMMMMM "Because my gross sales on the P&L should match the gross sales on my Sales tax liability report!

I basically wasted my day today, just to hear her say it might be an imputting issue. She asked me if my bank account was linked to my QB because it may be showing some of my purchases as "UNcategorized ".

What on earth does my purchases have to do with my SALES??????

UGH!!!!!!!!!!!!!!!!!!!!! I am beyond frustrated!

Yes having same problem!!

Absolute pain in the butt

I am having the same problem. The amounts on the Sales Tax Liability report don't make sense. I spent two hours with QB support just to find where the number came from. Our company takes deposits on future furniture sales. The deposits aren't taxable. When the furniture sale goes through the entire amount is taxed and the deposit goes on as a negative to record the actual cash or credit sale. Quickbooks is reducing the taxable sales by the redeemed deposits. I'm afraid to call support again because it takes so long to get an answer. If anyone has a fix for this please let me know.

I agree. It is totally broken. It has added my state to my local tax so instead of charging 7.25% it is charging 14.5%. Fortunately in the end it makes the correct calculation... Now, but for months I had to manually change it. Now my gross sales on the dashboard (which seems much more correct) does not agree with the tax report that is laughably low. So I'm unsure if the taxable invoice number is even correct at all. (Not all of my customers are taxable). Then when you calculate the tax in the state online system, what I owe and what QuickBooks says I owe, is completely different. As in 30 bucks off. (QB calculated it too low). Dump this STUPID automated system and go back to the one that worked!!!!

It is a hot mess. The system doesn't work. It even disagrees with itself. On my dashboard the total sells for Q1 are completely different compared to the gross sales run in the Q1 sales tax report. (19k vs 5k). The automated system says my local tax rate is 14.5 when in reality it is 7.25, however at least it calculates it at 7.25 when i save the invoice. QuickBooks calculated my tax owed to the state at 385+ bucks what I really owed was 403+. So how is it not able to calculate the proper rate. Take the total taxable Invoices and multiply it by 7.25, pretty easy. The system is completely broken and does not instill confidence. If not corrected soon, I'm going to have to give up and go somewhere else. This is rediculous. Dump the automated system and give us back the manual system that worked.

OMG... YOU JUST SUMMED UP MY QBs ONLINE LIFE lol I have been going rounds with this since Ive switched last March to QBs online, after 18 years of QBs desktop!

About 2 weeks ago I found Intuits CEO on Twitter and messaged him!!!

I was so excited because he had the "Office of the CEO" to contact me. I thought YAY.. finally!

But here we are...after being handed off to...i believe I last spoke to the 4th PERSON since then. (the first person was a 3 hour and 20 minute call, .and still NOTHING! The last one was actually a really nice bookkeeper for QBs named Margaret and she could see EXACTLY what the problem was, but even she said there was no fix that she knows of. She promised to put a ticket in...but honestly...this puts me back to the same place I started last MARCH!!!

The reports dont match up!! Anyone paying their sales tax using these reports is truly rolling a pair of dice! DONT DO IT!! Calculate it separately! Its a hot mess!!! You will overpay or underpay. Either way...its scary!!

Please keep posting on this everyone until its resolved!!!!

I'm having the same issue. So much for getting three months discounted software! Now we are paying for the Desktop, and Online versions. It is quite the gig they have going. My Onboarding Specialist I'm working with for the Online Payroll has been great. I cannot say the same for the Online Plus though.

EXTREMELY FRUSTRATING!

I’m having the same issue! Deposits are taxed?? Makes literally zero sense.I’ve spent hours with my QB bookkeeper and he told me to call the 800 number for help. Was on the phone after being transferred for over 20 minutes, then call got disconnected. Beyond frustrating 🤨

Hi, userprice.carrie.

I'd like to check this for you and get it taken care of myself. However, as much as I would like to get this handled directly, deposit and tax issues need the assistance of our phone support for security purposes.

I know you've already called in. However, I still suggest getting in touch with QuickBooks Online Support. They'd be able to help review the transactions. You can check out our support hours to ensure we address your concern on time. Here's how to get in touch or chat with us:

1. Click the Help (?) icon.

2. Choose Contact Us.

3. Enter a brief description of your situation in the What can we help you with? area, then click Let's talk.

4. You'll be presented with a few options for connecting with Intuit. Select Chat with us.

In the meantime, you can always visit our Help Articles page for QuickBooks Online in case you need some reference for your future tasks.

I'm always around to lend a hand if you have more questions. Just tag my name in the comment section so I can assist you further. Take care and have a good one.

hi! it is too automated. how can i get rid of it.

I'll share some information concerning the sales tax, SM1952.

The Automated Sales Tax feature calculates the total tax rate automatically based on the following:

We're unable to turn off or get rid of the feature. No worries, though. QuickBooks ensures each sales tax calculation is accurate.

If there's anything else that we can do for you, don't hesitate to let us know. Keep safe!

I'm having a problem on mobile. I create an estimate and add a line item. I change the sales tax jurisdiction to the correct one, save, and when it saves it removes sales tax. I reopen the estimate to edit, and the sales tax jurisdiction is set to an arbitrary test one.

Thanks for joining this conversation, @Unclesam87.

I’m here to share with you a few troubleshooting steps so you can add the correct tax for items on your estimate.

To start, let's make sure that your mobile app is updated to the latest release version. This is to prevent any issues when running the program.

If verified that the mobile app is updated and still experiences the same thing. Let's now check if you can easily add the sales tax on your estimates using the web browser. If it does, go back to your mobile app and clear the data. Refer to the steps below.

For Android

For iOS

After that, create estimates again.

In case you want to add new sales tax rates using the QBO mobile app, below are the links that can help you depending on the device you use:

If there is anything else I can do to further help you apply sales tax on your estimates, please post a response below. I am always available in case you need it. Take care.

It does. Not work for me either I want to go back to the old sales tax system. When I make the invoice it made my florida sales tax inactive and all my invoices say florida inactive and you are forced to use the custom one. When I run a report it shows all the invoices inactive with my sales tax. When I go the the sales tax setting it show that my tax agency is active not inactive. How can we go back to the old version. Not only is it causing extra hours at work to figure out it threw off all my invoices. Very disappointed with this change

Hi there, @3fifi. I'm here to share some details about how sales tax works on QuickBooks Online (QBO).

With the new automated sales tax in QBO, it automatically calculates the total tax rate for each sale based on the following:

The tax agency and rate will depend on the customer's address. You can check the location set up on the customer profile. Then, enter the correct address to allow QuickBooks to calculate taxes correctly.

Here's how to verify the address:

Additionally, you can run the Sales Tax Liability report to view your sales tax info anytime. When the calculation of taxes does not coincide with the actual rate, you can override the sales tax rate. Click the See the math or Sales tax link below the tax amount. Then, choose the Override this amount hyperlink on the pop-up window

The Community is always ready to listen and assist you with your concerns. We'll always have your back. Have a great day.

QBO's tax system is completely out of whack. Now if I go based on location it gives a completely different calculation than if I go based on the state tax. Yet, they are the exact same tax base. And when I look at QBO's math they state they are using the same tax base. BUT EVERYTHING IS CALCULATED DIFFERENTLY at the final calculation.

Wow, Now it is even more confusing. I am entering a non-taxed service invoice and I get this huge banner: "This date and sales tax rate don’t mix—kind of like oil and water. The sales tax rate for 01/11/2022 is different from what's selected. Make sure you update it before you save."

The whole "Oil & Water Comment" is extremely weak and only adds to the QBO's disastrous tax management calculations.

AND YET THERE ARE NO TAXES on this invoice!!!

Hello, @muenstermann

Thanks for taking the time to follow the thread and sharing your concerns here in the QuickBooks Community.

I recommend contacting our QuickBooks Online support team. This way, an agent can review your account in secure environment and use their tools to screen share with you so they can investigate this matter further. You can use the link that I've included below to connect with an agent.

Please let me know if you have any questions or concerns. Take care!

I agree. I spend hours trying to find out why sales on my GL doesn't match sales on my sales tax liability report. The customer settings are all over the board. I am sure my client is not consistent on checking the tax box and using one or two standard sales tax rates (the %, exempt, and out of state).

Anyway, I am trying to find a way to export all the customers (there are hundreds), fix the sales tax fields so they are consistent, then import them back in.

Has anyone tried this and how do you do it? The new "Based on location" is very confusing as you need to know what trumps what (i.e. the tax box can be checked on an invoice and a tax type indicating there should be tax can be entered, but if the customer has the "tax exempt" box checked, there will be no tax.

Hello @bmeteyer,

I appreciate you for reaching out to us regarding updating the customer information. Allow me to chime in and help you perform the process to ensure the sales tax fields are accurate and correct in QuickBooks.

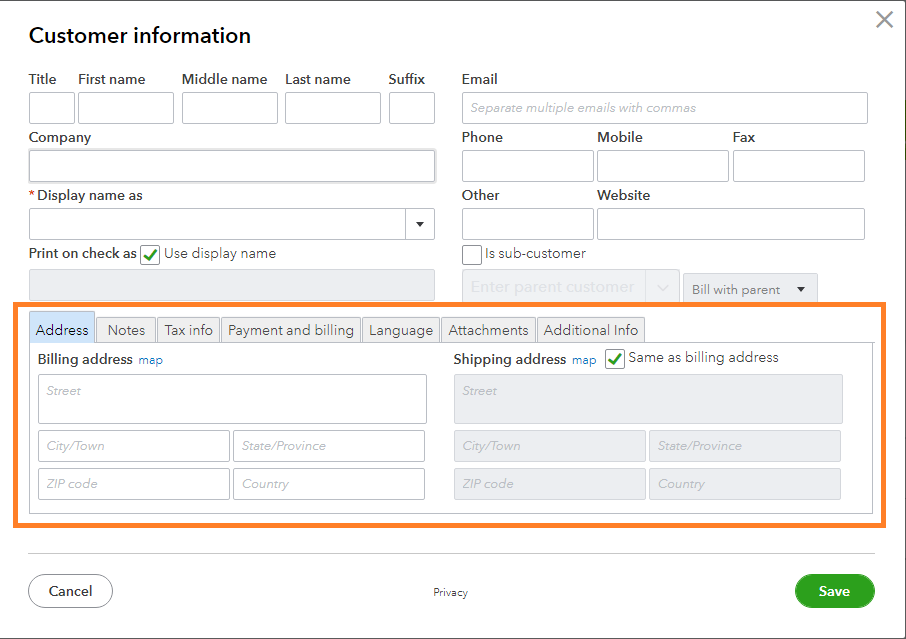

Currently, a direct way to export and import customer data for the sales tax information is unavailable. There are specific fields that the system allows when mapping the details within the system (see screenshot below).

The only workaround within QuickBooks is to edit the customer information one by one. You'll need to go to the customer list section and update the details manually.

Here's how:

Alternatively, you can check for a third-party app that offers an import service. However, we can't suggest a specific application you can use for your data.

Though, I've found an app online which offers migration or import services for QBO. You can check out their website to check if it fits your business needs.

Here's the link: https://support.saasant.com/support/solutions/articles/14000053140-how-to-import-customer-list-into-....

Additionally, I've attached an article you can visit about how to fix common errors when importing lists in the Online version: Move your lists to QuickBooks Online.

Hit me up by leaving a comment below if you have further questions about importing data or updating customer information. I'll be happy to lend a hand.

If you don’t sell your products to different locations (ship them) have brick and mortar business like mine (auto repair) I Figured it out…

Find your "Standard" Custom Form Style

Steps to do this...

1. Gear Icon

2. Click on Custom form styles

3. Click on Edit under Action of your Standard form

4. Click on Content

5. On the mockup of the form on the right click on the Pencil icon and Edit the header information

6. Under the heading Display, uncheck Shipping

7. Click on Done

Thanks to RenjolynC for this suggestion if you have more styles that you use other than the standard one.

8. "If you're going to use the Standard form as default for all of your invoices, you can follow these steps:

1. Go to the Gear > Custom Form Styles.

2. Find the Standard template and click the Edit drop-down.

3. Select Make default."

Now when you create a new invoice QuickBooks will use the address of your business as the Based on location default tax for All the new invoices that you create or import. If you need to have a shipping address for the invoice, click on Shipping Information under the Billing Address Quickbooks will calculate tax on the Shipping information.

Thank you for sharing your solution, Fixer32.

I'd also like to add some additional steps on how you make the template default.

If you're going to use Standard template as default to all of your invoices, you can follow these steps:

To learn more about the template customization, feel free to check out this article: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Please stay in touch with us if you have other questions or concerns. We're always available to help you out. Have a good day ahead!

I only have one form the Standard one. I could see that would be a problem if you had more than one, I'll update my post.

It is horrible and inaccurate. Wondering how to submit a formal complaint so the software engineers will fix this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here