Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSummary of the issue:

Despite this, the Sales Tax Liability Report continues to misclassify several taxable sales as non-taxable. In some cases, the report displays zero values, even though the correct sales tax was calculated and included on the Sales Receipt.

I’ve confirmed the Automated Sales Tax module is active and configured properly, but there appears to be a disconnect between the underlying tax mapping and how the report is compiling the data.

You'll want to ensure those products or services on the sales receipts are taxable for the system to accurately detect, Rose. Otherwise, it'll reflect as non-taxable in the Sales Tax Liability report. More details will be provided below to ensure your inquiry is addressed.

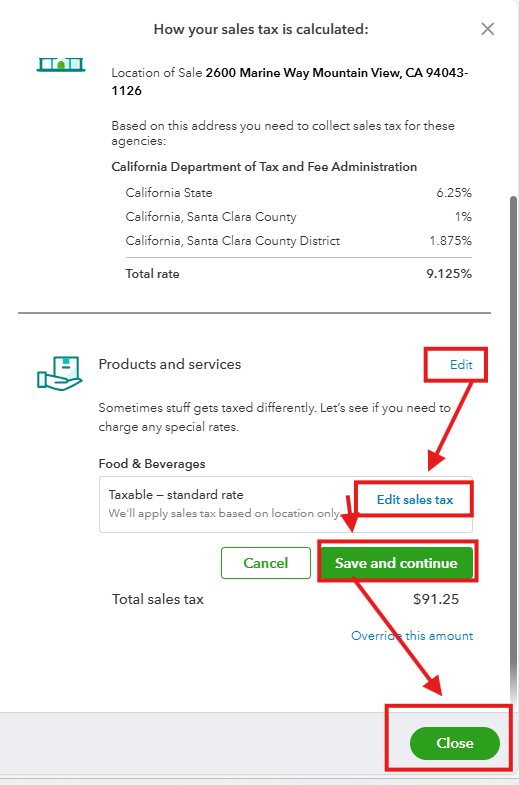

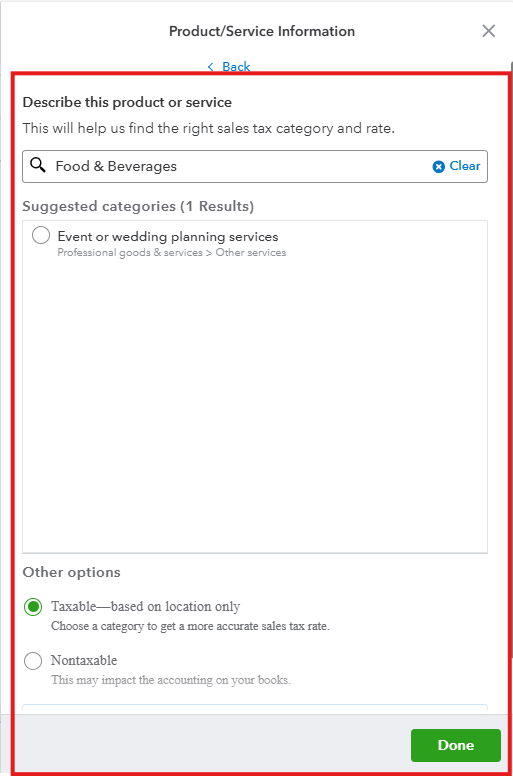

To begin, click the amount in the report to pull up the transactions. Then, manually review each of the sales receipts created. If it shows zero, select See the math and verify in the Products and Services section whether the item is taxable. If not, then you’ll want to modify it and refresh the report to see the changes. Here's how:

For visual reference, see the image below.

I also recommend checking this page to learn more about how the Sales Tax Liability report works in QBO: Understand the sales tax liability report in QuickBooks Online.

We encourage you to comment below if you have other questions about reports or need assistance performing specific tasks in QuickBooks. We'll make sure to be around and extend a helping hand.

Hi Kurt,

Thanks for the reply, but I need to clarify that I’ve already completed everything outlined in your response.

I’ve manually rebuilt every Sales Receipt from July 1, 2024 through June 30, 2025 with proper taxable item setup, location-based sales tax automation, and correct customer sales tax mapping. I’ve confirmed:

Every product/service used is marked as Taxable

No sales tax amounts were overridden

Non-taxable transactions (wholesale and out-of-state) are correctly flagged

The Automated Sales Tax module is enabled and configured correctly

Despite this, the Sales Tax Liability report continues to misclassify taxable sales as non-taxable, and in many cases shows $0 tax collected, even though the Sales Receipt clearly shows the tax was calculated and included. When I drill into the report, the transactions are listed—but without tax values, and in some cases, the Tax Name is missing entirely from the report line.

This is not a setup issue, and I’ve already reviewed every SR manually. The issue appears to be deeper—possibly a reporting sync problem or a breakdown between the transaction-level tax logic and the reporting engine. I’ve also worked with Support (Case #15140355764), but they were not able to escalate or resolve.

At this point, I’m requesting Tier 2 or Engineering escalation for a backend refresh or rebuild of the sales tax module. Is there a moderator or product team member who can assist with that request?

Thanks for the reply, but I need to clarify that I’ve already completed everything outlined in your response.

I’ve manually rebuilt every Sales Receipt from July 1, 2024 through June 30, 2025 with proper taxable item setup, location-based sales tax automation, and correct customer sales tax mapping. I’ve confirmed:

Every product/service used is marked as Taxable

No sales tax amounts were overridden

Non-taxable transactions (wholesale and out-of-state) are correctly flagged

The Automated Sales Tax module is enabled and configured correctly

Despite this, the Sales Tax Liability report continues to misclassify taxable sales as non-taxable, and in many cases shows $0 tax collected, even though the Sales Receipt clearly shows the tax was calculated and included. When I drill into the report, the transactions are listed—but without tax values, and in some cases, the Tax Name is missing entirely from the report line.

This is not a setup issue, and I’ve already reviewed every SR manually. The issue appears to be deeper—possibly a reporting sync problem or a breakdown between the transaction-level tax logic and the reporting engine. I’ve also worked with Support (Case #15140355764), but they were not able to escalate or resolve.

At this point, I’m requesting Tier 2 or Engineering escalation for a backend refresh or rebuild of the sales tax module. Is there a moderator or product team member who can assist with that request?

@RoseBalleras We understand how frustrating it is when your Sales Tax Liability report isn't accurate, especially after all the troubleshooting you've done. We've brought this to the attention of our Next Level Help team. They will carefully review your comments and support history to understand the full context of this issue. You can expect to hear from one of our experts soon with next steps.

I am having the exact same issue all day today. nothing is making sense.

Hi @cody_a and @Kurt_M,

It's now been a full week since I posted, and aside from the initial responses on Day 1, I’ve received no meaningful update. I appreciate the early replies, but they didn’t address the actual issue, and there has been complete silence from the Next Level Help team since then.

I followed up again on Tuesday asking for escalation or direct contact. That, too, has gone unanswered.

At this point, I need this escalated. Please provide a status update or connect me with someone who can speak to the specifics of my case. I can’t continue waiting without a clear path forward.

Hi there @RoseBalleras. I understand your frustration about not connecting with our Next Level Help team. I took a look at our records, and it appears they've tried to reach out a few times. Sometimes these messages can end up in spam or junk folders, so it might be worth a quick look there. If you're still not seeing anything, we can certainly help you get back on track – just let us know!

Hi @cody_a,

Thanks for the follow-up. I’ve double-checked my inbox, spam, and junk folders — there are no emails from QBO regarding this issue. I also haven’t received any voicemails, and I screen all unknown numbers. If someone called without leaving a message, that doesn’t count as outreach.

Please confirm:

The exact email address and phone number your team has been using

The dates and times of the attempted contact

Whether a case number has been assigned and who is handling it

At this point, I need actual contact — not just a note that it’s being reviewed. This has already gone on far too long with no progress.

@RoseBalleras It's definitely frustrating when you're expecting a call and don't receive one, and I appreciate you checking your junk folder.

I've passed your concerns along to our Next Level Help team again, so they'll be reaching out to you directly. Please keep an eye out for their call or email.

Just so you know, for your security and privacy, we can't share or confirm personal information like your email or phone number on this public forum. If for any reason you still don't hear from our team after this, the best way to get direct assistance will be to connect with an expert for help in your QuickBooks product. They'll be able to verify your contact details securely and make sure you get connected.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here