Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Are sales tax tables available for download into the desktop version? If not why not?

Solved! Go to Solution.

Hello jimhess,

In QuickBooks Desktop, an easy way to import a list is by using an Excel file. Let me show you how:

However, importing sales tax rates/tables isn't possible. You'll need to manually set them up in the List menu.

If you have any other concern, please let us know. We'll be right here to help.

Hello jimhess,

In QuickBooks Desktop, an easy way to import a list is by using an Excel file. Let me show you how:

However, importing sales tax rates/tables isn't possible. You'll need to manually set them up in the List menu.

If you have any other concern, please let us know. We'll be right here to help.

@Anonymous

Since the link you posted states that you can not import sales tax items using an excel import, do you know something that is not referenced concerning how to do it?

@jimhess wrote:

Are sales tax tables available for download into the desktop version? If not why not?

QBDT does not work off of tables, so no, so sales tax tables are not available. In QBDT you create the sales tax items you need for what every jurisdiction, and if necessary combine them into a sales tax group item.

Not the solution I was looking for, but it is a solution. Is someone at Quickbooks working on a downloadable solution? Seems archaic to have to manually enter sales tax rates when they are easily found in charts.

Your feedback means a lot to us, jimhess.

We are always innovating all QuickBooks products to be in line with our customers' business needs. New updates are released from time to time to make the software more user friendly, and to keep up with the changing technology.

That being said, we always cater to the thoughts and suggestions shared by our customers. I'd encourage you to request this option to import sales tax tables into QuickBooks to our developers. This might get a chance of being added in a future update.

Here's how:

Please keep in touch if there's anything else you need.

If you have a source / list of the tax rates you want to import, and you can create an Excel file with this list, then you can import the sales tax items using our BRC List Importer

It supports most item types including sales tax items. It also supports other lists including customers, vendors, accounts, and classes.

Hello,

Setting up QuickBooks for our company, an online retailer based in CA. I have an excel file of all of the Tax Items we need to operate (we meet economic nexus in a quite a few states within US for online sales outside of CA). Just in CA we have 1786 different regions (City, County, State) with approximately 300 varying tax rates. How is it that QuickBooks recommends this data is imported then (manual entry is not a reasonable "alternative")?

Thanks for joining this conversation, mkaethe.

While you can import items from the Excel file, the option to include the sales tax items is currently unavailable in QuickBooks. You need to enter them manually as a workaround.

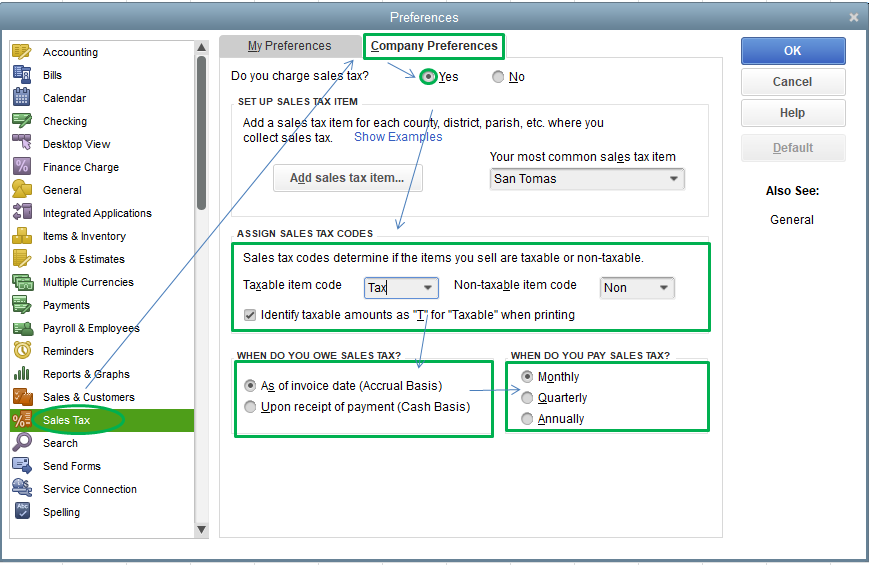

Before we proceed, ensure that this feature is turned on in the Preferences. Here's how:

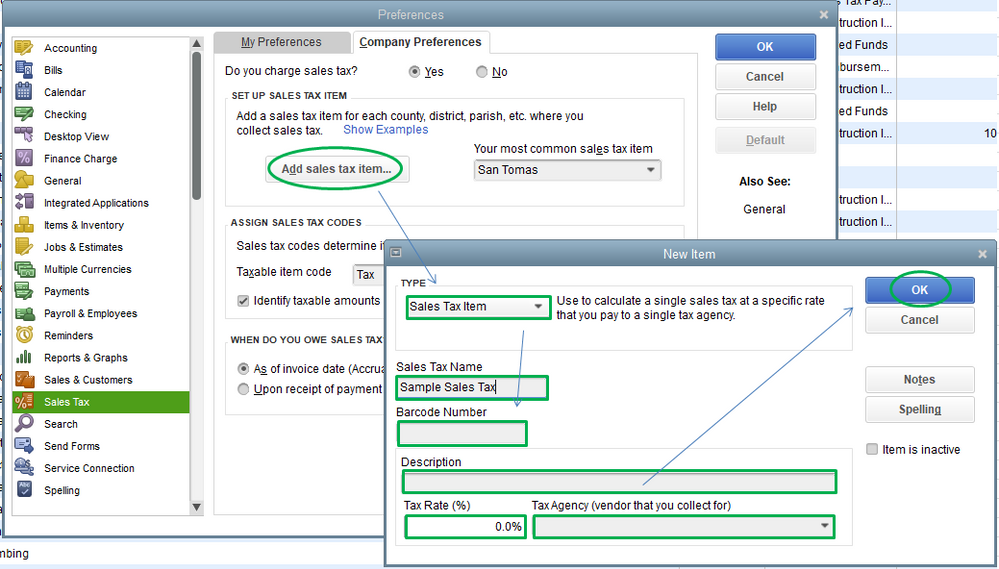

To enter new sales tax items, here's how:

For additional information, please refer to this article: Set up sales tax in QuickBooks Desktop.

Rest assured that I'll send this feedback to our Product Developers. They're always looking for ideas from users on how to improve QuickBooks.

Reach out to me if you have any other issues or concerns, so I can get back to you. I'm more than willing to help. Take care always!

I don't understand why something like this isn't already in Quickbooks. It seems bizarre that anyone would be expected to hand enter tax items when they can easily be accessed in excel form. To even ask someone to register this as a wish... I really don't get that at all.

Hello, pacificposition.

As FritzF referenced, you will need to manually to enter the sales tax items since including them when importing is currently unavailable in QuickBooks Desktop. You can add the items through the Sales Tax Preferences.

To learn more about sales tax and items, check out these articles:

I appreciate your time today. Please know that I've got your back if you need help with QuickBooks. Wishing you all the best!

Hello,

If I was importing a file with invoices, would it be possible to just have the tax amount that I have in my excel sheet to load into the quickbooks invoice instead of having the sales tax recalculate based on the QB's rate?

Glad to see you on this thread, @Nila1491.

You have to add your rate to QuickBooks for the program not to recalculate the amount on the invoices when importing the file. To do that, make sure to turn on the feature first.

Here’s how:

For more information, I recommend checking out this article: Set up sales tax in QuickBooks Desktop. On the same link, you’ll see some links on how to add and create tax items, groups, and code.

Once done, you can start importing the file to QuickBooks. Here’s an article to serve as your guide: Import and export data in QuickBooks Desktop.

Leave a comment if you need anything else. I'm more than happy to help. Take care!

Hello,

I am just wondering if there has been any update on this issue?

From what I have found so far in my research here in the community, the only way to get updated sales tax items into Quickbooks Desktop is to manually enter them.

So if our company is selling online I am looking at potentially 3,600 manual entries to get all the sale tax rates for sates, cities, counties, etc. Is this correct? And when these tax rates change I will have to manually update those rates as well?

Is there not a plug in or app that can keep this information up to date for me?

Thanks for your help in advance.

Hi there, @amyg4.

Yes, you're right. Your sales tax entries won't update at once. You can manually update them. Here's how:

Also, you might want to visit Apps for QuickBooks Desktop to look for a third-party app to help update your sales tax.

I've also added an article that helps you view your sales tax payable, so you can make sure everything is accurate before paying the taxes: Review sales tax reports.

If you have other concerns, please don't hesitate to leave a message in the comment section. I'll be happier to help. Keep safe, and have a good day.

Thanks so much for your help.

I will look into those third party apps.

I think I found a way to get the sales tax onto my Quickbooks invoices without having to input all the tax rates.

I am imputing the sales tax as a line item via WooCommence and not using the programmed sales tax from Quickbooks.

I will still have to figure out how to report the tax to the difference agencies, but I am hoping WooCommence will have a report for me.

Thanks again for your help.

I know. It's ridiculous. I'm going through this thread thinking, why hasn't this been resolved yet? And why are the replies from them so nonchalant? It's a software that helps you with taxes and they ask you to manually enter tax rates. As if you are going to only enter a few. E-Commerce solutions all cover this issue as they realize the importance of this critical necessity and easily solved this from the beginning and then there's this software which has been around for so long and cannot solve this simple problem. Strange

Importing these sales tax lists was a feature that previously worked in earlier versions. Has it been suspended???

We have a ton of tax rate variances from area to area in Washington. I deal regularly with at least 100 or more different tax rates within a 30 mile radius. Given that my list of tax rates (by county, municipality, etc...) needs to be in the thousands does this mean I must create these individually as well as edit them individually when they change?

If so... stunning.

I believe I have an answer to this dilemma.

Most states publish these sales tax lists in a Quickbook friendly IIF file format. You should be able to import this if you can find it. For reference, here is the info for the State of Washington: https://dor.wa.gov/get-form-or-publication/quickbooks-quarterly-tax-rate-table#2022

To import the IIF file...

FILE >> UTILITIES >> IMPORT >> IIF Files

To activate sales tax for your company file...

EDIT >> PREFERENCES >> SALES TAX >> COMPANY PREFERENCES >> then make the appropriate settings.

Quickbooks Enterise has always been an econimical solution for us compared to the next tier if ERP / Tax software but when nothing play real nicely with it or it costs a fortune to add it becomes a head scratcher. There are service out the like Avalara that will do all of this but our quote on this was $11000+ for less than 2000 transactions a year. This is frustrating. There are over 11000 sales tax codes nation wide.

In texas, we just collect the maximum amount and pay it even if some cities have a lower code. Is this an option for other states? It so, this becomes a lot easier. Even so, states like Colorado the swing from city to city can be as much at 8%.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here