Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I set tax-line mapping for an account to Form 4797?

Thank you for posting here, @User44.

In QuickBooks, the option to edit the selections under the Tax-Line Mapping when creating an account is unavailable. To ensure you select the accurate tax line mapping in an account, I'd recommend reaching out to your accountant. If you don't have one, you may use our Find an Accountant tool. Then, here's how to set up an account in QuickBooks Desktop:

For your future reference, I've added an article that will guide you in setting up sales tax for specific goods and services that you offer: Set up sales tax in QuickBooks Desktop.

Feel free to post a comment below if you have other questions about tax line mapping. I'd appreciate any response and I'm always here if you need more help. Take care always.

Divina,

I want to print out a full list of all available tax-line mapping options. When editing an account I see a drop down, but I need to capture/print the full list and the drop down gives only limited visibility. It shows only about 20 items. I need to capture/print them all so I can send it to my accountant. Thanks.

You can pull up the Account List report, User44. Let me guide you.

It will show you the list of all accounts in QuickBooks. Here's how:

You can customize the report so you can focus on the details that matter to you.

Feel free to get back to this thread if you have more questions. We'll reply as soon as we can. Keep safe!

I don't see any helpful article about tax line mapping under that link.

I don't see anything in the linked help article about tax line mapping.

Hello there, ajd123. I appreciate you for following the recommendation by my colleague above.

I can see how important to get a link where you can found the explanation why you need to consult your account for the tax line mapping. When doing the tax line mapping, it's important to consult your accountant. They help clarify and make sure the posting of the tax form for the payroll is accurate. This will avoid issues in the future and able to submit forms easily.

Still, I'd recommend checking the articles provided above for additional reference:

Please stay in touch if you have other questions. The Community is always here to help. Take care always.

I am the accountant and the QB file was set up without the schedule F tax codes.

How do we add them?

Why should I go look for another accountant??

Hi there, laurajh.

Allow me to join the thread and provide information about Schedule F.

Right now, QuickBooks Desktop only support the reporting but not the filing of Schedule F. You can use the Profit and Loss report to have the information you need when filing the form,

To pull up the report, here's how:

For you to file a Schedule F, you can do so by using TurboTax Deluxe Desktop (CD/Download) or TurboTax Self Employment Online. You'll also want to check with the IRS on how to file the Schedule F.

To learn more about Schedule F, see the below links:

If you have any other QuickBooks related questions, you can post them here again. I'm more than happy to help. Have a wonderful day ahead.

I am filing in a completely different software.

I just want the Sch F tax codes (which I know exisit) to be able to populate the report that comes from QB.

ANY UPDATE TO THE 2022 QB Desktop Accountant version to handle "Tax Line Mapping" for form 1065 or form 1041?

Thanks

Thanks for checking this with us, TAX15

We don't have an exact time frame as to when will the Tax Line Mapping option for Form 1065 or Form 1041 will be available. Once this is available, it will be included in the QuickBooks updates.

To give you more insight and visual guide on how to update QuickBooks Desktop, please check out this article: Update QuickBooks Desktop to the latest release.

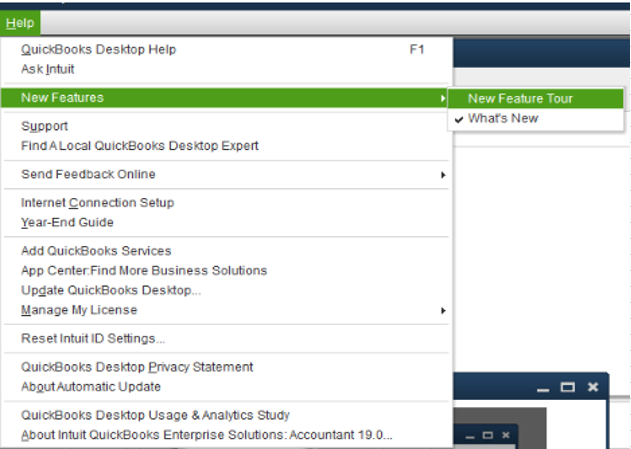

While we continue making improvements with the product, I want you to be updated with the new features added to the software by following the steps below:

Here's how:

Another way to get you in the loop about the latest news and product developments in QuickBooks Desktop is to visit our Firm of the future site. To narrow down your search, you can go to the Product & Industry News tab.

As always, you can find me here if you have any other concerns or further questions about Tax Line Mapping. Have a great rest of the day.

Thank you for the quick response. Familiar with the process you suggest.

I wish to add tax line mapping for 179 depreciation capital expense items. This is form 4562 line 2.. But I don't see that form on the drop down menu or tax line mapping fwhen establishing a new account expense time. How do I add this form? If this is a software change what is needed, when would it be expected?

TaxLineIDTaxLineName

| 1537 | B/S-Assets: Accts. Rec. and trade notes |

| 1567 | B/S-Assets: Accumulated amortization |

| 1561 | B/S-Assets: Accumulated depletion |

| 1557 | B/S-Assets: Accumulated depreciation |

| 1539 | B/S-Assets: Allowance for bad debts |

| 1555 | B/S-Assets: Buildings/oth. depr. assets |

| 1535 | B/S-Assets: Cash |

| 1559 | B/S-Assets: Depletable assets |

| 1565 | B/S-Assets: Intangible assets |

| 1563 | B/S-Assets: Land |

| 1549 | B/S-Assets: Loans to shareholders |

| 1551 | B/S-Assets: Mortgage/real estate loans |

| 1569 | B/S-Assets: Other assets |

| 1547 | B/S-Assets: Other current assets |

| 1553 | B/S-Assets: Other investments |

| 1545 | B/S-Assets: Tax-exempt securities |

| 1543 | B/S-Assets: U.S. government obligations |

| 1573 | B/S-Liabs/Eq.: Accounts payable |

| 1585 | B/S-Liabs/Eq.: Capital stock |

| 1581 | B/S-Liabs/Eq.: L-T Mortgage/note/bonds pay. |

| 1579 | B/S-Liabs/Eq.: Loans from shareholders |

| 1577 | B/S-Liabs/Eq.: Other current liabilities |

| 1583 | B/S-Liabs/Eq.: Other liabilities |

| 1587 | B/S-Liabs/Eq.: Paid-in or capital surplus |

| 1575 | B/S-Liabs/Eq.: S-T Mortgage/note/bonds pay. |

| 1591 | B/S-Liabs/Eq.: Treasury stock |

| 1279 | COGS-Form 1125-A: Add'l section 263A costs |

| 1277 | COGS-Form 1125-A: Cost of labor |

| 1295 | COGS-Form 1125-A: Other costs |

| 1275 | COGS-Form 1125-A: Purchases |

| 1321 | Deductions: Advertising |

| 1307 | Deductions: Bad debts |

| 1302 | Deductions: Compensation of other officers |

| 1301 | Deductions: Compensation of shareholder/officers |

| 1319 | Deductions: Depletion |

| 1325 | Deductions: Employee benefit programs |

| 3034 | Deductions: Employee disability insurance |

| 3033 | Deductions: Employee medical insurance |

| 1318 | Deductions: Interest expense |

| 1316 | Deductions: Licenses |

| 1313 | Deductions: Local property taxes |

| 3025 | Deductions: Meals and entertainment (100% deductib |

| 1369 | Deductions: Meals and entertainment (subj to 50% l |

| 1317 | Deductions: Other miscellaneous taxes |

| 1315 | Deductions: Payroll taxes |

| 1323 | Deductions: Pension/profit-sharing/etc. |

| 1309 | Deductions: Rents |

| 1305 | Deductions: Repairs and maintenance |

| 1303 | Deductions: Salaries and wages |

| 3024 | Deductions: Shareholder disability insurance |

| 3023 | Deductions: Shareholder life insurance |

| 3022 | Deductions: Shareholder medical insurance |

| 1311 | Deductions: State franchise or inc. tax |

| 1378 | Fm 8825-20a: Income-other rental real estate |

| 1384 | Fm 8825-A: Advertising |

| 1386 | Fm 8825-A: Auto and travel |

| 1388 | Fm 8825-A: Cleaning and maintenance |

| 1390 | Fm 8825-A: Commissions |

| 1382 | Fm 8825-A: Gross rents |

| 1392 | Fm 8825-A: Insurance |

| 1396 | Fm 8825-A: Interest expense |

| 1394 | Fm 8825-A: Legal and other prof. fees |

| 1406 | Fm 8825-A: Other miscellaneous expenses |

| 1398 | Fm 8825-A: Repairs |

| 1400 | Fm 8825-A: Taxes |

| 1402 | Fm 8825-A: Utilities |

| 1404 | Fm 8825-A: Wages and salaries |

| 1412 | Fm 8825-B: Advertising |

| 1414 | Fm 8825-B: Auto and travel |

| 1416 | Fm 8825-B: Cleaning and maintenance |

| 1418 | Fm 8825-B: Commissions |

| 1410 | Fm 8825-B: Gross rents |

| 1420 | Fm 8825-B: Insurance |

| 1424 | Fm 8825-B: Interest expense |

| 1422 | Fm 8825-B: Legal and other prof. fees |

| 1434 | Fm 8825-B: Other miscellaneous expenses |

| 1426 | Fm 8825-B: Repairs |

| 1428 | Fm 8825-B: Taxes |

| 1430 | Fm 8825-B: Utilities |

| 1432 | Fm 8825-B: Wages and salaries |

| 1439 | Fm 8825-C: Advertising |

| 1441 | Fm 8825-C: Auto and travel |

| 1443 | Fm 8825-C: Cleaning and maintenance |

| 1445 | Fm 8825-C: Commissions |

| 1437 | Fm 8825-C: Gross rents |

| 1447 | Fm 8825-C: Insurance |

| 1451 | Fm 8825-C: Interest expense |

| 1449 | Fm 8825-C: Legal and other prof. fees |

| 1461 | Fm 8825-C: Other miscellaneous expenses |

| 1453 | Fm 8825-C: Repairs |

| 1455 | Fm 8825-C: Taxes |

| 1457 | Fm 8825-C: Utilities |

| 1459 | Fm 8825-C: Wages and salaries |

| 1466 | Fm 8825-D: Advertising |

| 1468 | Fm 8825-D: Auto and travel |

| 1470 | Fm 8825-D: Cleaning and maintenance |

| 1472 | Fm 8825-D: Commissions |

| 1464 | Fm 8825-D: Gross rents |

| 1474 | Fm 8825-D: Insurance |

| 1478 | Fm 8825-D: Interest expense |

| 1476 | Fm 8825-D: Legal and other prof. fees |

| 1488 | Fm 8825-D: Other miscellaneous expenses |

| 1480 | Fm 8825-D: Repairs |

| 1482 | Fm 8825-D: Taxes |

| 1484 | Fm 8825-D: Utilities |

| 1486 | Fm 8825-D: Wages and salaries |

| 1259 | Income: Gross receipts or sales not on line 1a |

| 1269 | Income: Other income |

| 1261 | Income: Returns and allowances |

| 3001 | Other Deductions: Accounting |

| 3002 | Other Deductions: Auto and truck |

| 3003 | Other Deductions: Bank charges |

| 3004 | Other Deductions: Business gifts |

| 3005 | Other Deductions: Commissions |

| 3030 | Other Deductions: Continuing/professional education |

| 3031 | Other Deductions: Credit & collection costs |

| 3006 | Other Deductions: Discounts given |

| 3007 | Other Deductions: Dues and subscriptions |

| 3008 | Other Deductions: Independent contractors |

| 3009 | Other Deductions: Insurance |

| 3036 | Other Deductions: Janitorial & cleaning |

| 3010 | Other Deductions: Laundry |

| 3011 | Other Deductions: Legal & professional fees |

| 3012 | Other Deductions: Office expenses |

| 1373 | Other Deductions: Other deductions |

| 3013 | Other Deductions: Parking |

| 3014 | Other Deductions: Postage & delivery |

| 3015 | Other Deductions: Printing |

| 3038 | Other Deductions: Security |

| 3016 | Other Deductions: Supplies |

| 3018 | Other Deductions: Telephone |

| 3019 | Other Deductions: Tools |

| 3020 | Other Deductions: Travel |

| 3021 | Other Deductions: Utilities |

| 1510 | Schedule K-Deductions: Charitable contributions |

| 1516 | Schedule K-Deductions: Other deductions |

| 1513 | Schedule K-Foreign Tax: Reduction in available taxes |

| 1523 | Schedule K-Foreign Tax: Total foreign taxes |

| 1519 | Schedule K-Inv. Interest: Interest exp.-investment debts |

| 1507 | Schedule K-Other Income (Loss): Other income |

| 1529 | Schedule K-Other Items: Nondeductible expenses |

| 1528 | Schedule K-Other Items: Other tax-exempt income |

| 1530 | Schedule K-Other Items: Prop. distribs.(incl.cash) |

| 1526 | Schedule K-Other Items: Sec. 59(e) expenses |

| 1527 | Schedule K-Other Items: Tax-exempt interest income |

| 1499 | Schedule K-Portfolio Inc (Loss): Dividend income |

| 1497 | Schedule K-Portfolio Inc (Loss): Interest income-CD's/etc. |

| 1498 | Schedule K-Portfolio Inc (Loss): Interest income-U.S. Treas |

| 1501 | Schedule K-Portfolio Inc (Loss): Royalty income |

| 1494 | Schedule K-Rentals (not Fm 8825): Expenses-rental |

| 1492 | Schedule K-Rentals (not Fm 8825): Income-rental |

| 1596 | Schedule M-1: Depreciation per books |

| 1597 | Schedule M-1: Expenses on books not on return |

| 1601 | Schedule M-1: Income on books not on return |

| 1595 | Schedule M-1: Net income(loss) per books |

TaxLineIDTaxLineName

| 1537 | B/S-Assets: Accts. Rec. and trade notes |

| 1567 | B/S-Assets: Accumulated amortization |

| 1561 | B/S-Assets: Accumulated depletion |

| 1557 | B/S-Assets: Accumulated depreciation |

| 1539 | B/S-Assets: Allowance for bad debts |

| 1555 | B/S-Assets: Buildings/oth. depr. assets |

| 1535 | B/S-Assets: Cash |

| 1559 | B/S-Assets: Depletable assets |

| 1565 | B/S-Assets: Intangible assets |

| 1563 | B/S-Assets: Land |

| 1549 | B/S-Assets: Loans to shareholders |

| 1551 | B/S-Assets: Mortgage/real estate loans |

| 1569 | B/S-Assets: Other assets |

| 1547 | B/S-Assets: Other current assets |

| 1553 | B/S-Assets: Other investments |

| 1545 | B/S-Assets: Tax-exempt securities |

| 1543 | B/S-Assets: U.S. government obligations |

| 1573 | B/S-Liabs/Eq.: Accounts payable |

| 1585 | B/S-Liabs/Eq.: Capital stock |

| 1581 | B/S-Liabs/Eq.: L-T Mortgage/note/bonds pay. |

| 1579 | B/S-Liabs/Eq.: Loans from shareholders |

| 1577 | B/S-Liabs/Eq.: Other current liabilities |

| 1583 | B/S-Liabs/Eq.: Other liabilities |

| 1587 | B/S-Liabs/Eq.: Paid-in or capital surplus |

| 1575 | B/S-Liabs/Eq.: S-T Mortgage/note/bonds pay. |

| 1591 | B/S-Liabs/Eq.: Treasury stock |

| 1279 | COGS-Form 1125-A: Add'l section 263A costs |

| 1277 | COGS-Form 1125-A: Cost of labor |

| 1295 | COGS-Form 1125-A: Other costs |

| 1275 | COGS-Form 1125-A: Purchases |

| 1321 | Deductions: Advertising |

| 1307 | Deductions: Bad debts |

| 1302 | Deductions: Compensation of other officers |

| 1301 | Deductions: Compensation of shareholder/officers |

| 1319 | Deductions: Depletion |

| 1325 | Deductions: Employee benefit programs |

| 3034 | Deductions: Employee disability insurance |

| 3033 | Deductions: Employee medical insurance |

| 1318 | Deductions: Interest expense |

| 1316 | Deductions: Licenses |

| 1313 | Deductions: Local property taxes |

| 3025 | Deductions: Meals and entertainment (100% deductib |

| 1369 | Deductions: Meals and entertainment (subj to 50% l |

| 1317 | Deductions: Other miscellaneous taxes |

| 1315 | Deductions: Payroll taxes |

| 1323 | Deductions: Pension/profit-sharing/etc. |

| 1309 | Deductions: Rents |

| 1305 | Deductions: Repairs and maintenance |

| 1303 | Deductions: Salaries and wages |

| 3024 | Deductions: Shareholder disability insurance |

| 3023 | Deductions: Shareholder life insurance |

| 3022 | Deductions: Shareholder medical insurance |

| 1311 | Deductions: State franchise or inc. tax |

| 1378 | Fm 8825-20a: Income-other rental real estate |

| 1384 | Fm 8825-A: Advertising |

| 1386 | Fm 8825-A: Auto and travel |

| 1388 | Fm 8825-A: Cleaning and maintenance |

| 1390 | Fm 8825-A: Commissions |

| 1382 | Fm 8825-A: Gross rents |

| 1392 | Fm 8825-A: Insurance |

| 1396 | Fm 8825-A: Interest expense |

| 1394 | Fm 8825-A: Legal and other prof. fees |

| 1406 | Fm 8825-A: Other miscellaneous expenses |

| 1398 | Fm 8825-A: Repairs |

| 1400 | Fm 8825-A: Taxes |

| 1402 | Fm 8825-A: Utilities |

| 1404 | Fm 8825-A: Wages and salaries |

| 1412 | Fm 8825-B: Advertising |

| 1414 | Fm 8825-B: Auto and travel |

| 1416 | Fm 8825-B: Cleaning and maintenance |

| 1418 | Fm 8825-B: Commissions |

| 1410 | Fm 8825-B: Gross rents |

| 1420 | Fm 8825-B: Insurance |

| 1424 | Fm 8825-B: Interest expense |

| 1422 | Fm 8825-B: Legal and other prof. fees |

| 1434 | Fm 8825-B: Other miscellaneous expenses |

| 1426 | Fm 8825-B: Repairs |

| 1428 | Fm 8825-B: Taxes |

| 1430 | Fm 8825-B: Utilities |

| 1432 | Fm 8825-B: Wages and salaries |

| 1439 | Fm 8825-C: Advertising |

| 1441 | Fm 8825-C: Auto and travel |

| 1443 | Fm 8825-C: Cleaning and maintenance |

| 1445 | Fm 8825-C: Commissions |

| 1437 | Fm 8825-C: Gross rents |

| 1447 | Fm 8825-C: Insurance |

| 1451 | Fm 8825-C: Interest expense |

| 1449 | Fm 8825-C: Legal and other prof. fees |

| 1461 | Fm 8825-C: Other miscellaneous expenses |

| 1453 | Fm 8825-C: Repairs |

| 1455 | Fm 8825-C: Taxes |

| 1457 | Fm 8825-C: Utilities |

| 1459 | Fm 8825-C: Wages and salaries |

| 1466 | Fm 8825-D: Advertising |

| 1468 | Fm 8825-D: Auto and travel |

| 1470 | Fm 8825-D: Cleaning and maintenance |

| 1472 | Fm 8825-D: Commissions |

| 1464 | Fm 8825-D: Gross rents |

| 1474 | Fm 8825-D: Insurance |

| 1478 | Fm 8825-D: Interest expense |

| 1476 | Fm 8825-D: Legal and other prof. fees |

| 1488 | Fm 8825-D: Other miscellaneous expenses |

| 1480 | Fm 8825-D: Repairs |

| 1482 | Fm 8825-D: Taxes |

| 1484 | Fm 8825-D: Utilities |

| 1486 | Fm 8825-D: Wages and salaries |

| 1259 | Income: Gross receipts or sales not on line 1a |

| 1269 | Income: Other income |

| 1261 | Income: Returns and allowances |

| 3001 | Other Deductions: Accounting |

| 3002 | Other Deductions: Auto and truck |

| 3003 | Other Deductions: Bank charges |

| 3004 | Other Deductions: Business gifts |

| 3005 | Other Deductions: Commissions |

| 3030 | Other Deductions: Continuing/professional education |

| 3031 | Other Deductions: Credit & collection costs |

| 3006 | Other Deductions: Discounts given |

| 3007 | Other Deductions: Dues and subscriptions |

| 3008 | Other Deductions: Independent contractors |

| 3009 | Other Deductions: Insurance |

| 3036 | Other Deductions: Janitorial & cleaning |

| 3010 | Other Deductions: Laundry |

| 3011 | Other Deductions: Legal & professional fees |

| 3012 | Other Deductions: Office expenses |

| 1373 | Other Deductions: Other deductions |

| 3013 | Other Deductions: Parking |

| 3014 | Other Deductions: Postage & delivery |

| 3015 | Other Deductions: Printing |

| 3038 | Other Deductions: Security |

| 3016 | Other Deductions: Supplies |

| 3018 | Other Deductions: Telephone |

| 3019 | Other Deductions: Tools |

| 3020 | Other Deductions: Travel |

| 3021 | Other Deductions: Utilities |

| 1510 | Schedule K-Deductions: Charitable contributions |

| 1516 | Schedule K-Deductions: Other deductions |

| 1513 | Schedule K-Foreign Tax: Reduction in available taxes |

| 1523 | Schedule K-Foreign Tax: Total foreign taxes |

| 1519 | Schedule K-Inv. Interest: Interest exp.-investment debts |

| 1507 | Schedule K-Other Income (Loss): Other income |

| 1529 | Schedule K-Other Items: Nondeductible expenses |

| 1528 | Schedule K-Other Items: Other tax-exempt income |

| 1530 | Schedule K-Other Items: Prop. distribs.(incl.cash) |

| 1526 | Schedule K-Other Items: Sec. 59(e) expenses |

| 1527 | Schedule K-Other Items: Tax-exempt interest income |

| 1499 | Schedule K-Portfolio Inc (Loss): Dividend income |

| 1497 | Schedule K-Portfolio Inc (Loss): Interest income-CD's/etc. |

| 1498 | Schedule K-Portfolio Inc (Loss): Interest income-U.S. Treas |

| 1501 | Schedule K-Portfolio Inc (Loss): Royalty income |

| 1494 | Schedule K-Rentals (not Fm 8825): Expenses-rental |

| 1492 | Schedule K-Rentals (not Fm 8825): Income-rental |

| 1596 | Schedule M-1: Depreciation per books |

| 1597 | Schedule M-1: Expenses on books not on return |

| 1601 | Schedule M-1: Income on books not on return |

| 1595 | Schedule M-1: Net income(loss) per books |

Thank you. But how do I add individual form or list to the Tax-Line Mapping drop down.

Hi there, Random4.

Being able to add an individual form from the Tax-Line Mapping drop-down isn't an option. Those tax line items are created by default in QuickBooks.

If you want to see all the line items assigned to each of your Charts of Accounts, you can either customize the column. Or run the Account Listing report.

Here's how to customize the column:

To access the report, here's how:

Additionally, you can review this article about how to handle default tax codes, non-taxable status items, and other related topics: Set up sales tax in QuickBooks Desktop.

Keep me posted if there's anything else you need about the Tax-Line Mapping. I'll be right here to help you.

Which industry can I choose to get these tax lines?

Thanks for joining the thread, @SierraCon.

Let me provide answers to your query about tax-line mapping in QuickBooks Desktop (QBDT).

Based on what I've checked, you can select any type of Industry in QuickBooks to add these tax lines. Simply follow the steps that were shared by my colleague MaryLandT to show this column in your Chart of Accounts.

If you need help in mapping your accounts, please reach out to your accountant. That way, we can ensure that your book is accurate.

You can also search for a ProAdvisor in this link: https://quickbooks.intuit.com/find-an-accountant/

Feel free to post a comment below if you have other questions about tax line mapping or other QuickBooks queries. I'd appreciate any response and I'm always here if you need more help. Take care always.

I'm sorry I didn't understand this question initially or else my list was presented as the answer to another question.

As far as your desire to add Section 179 Tax Line Mapping, it doesn't seem to be an option. I imagine you could certainly create an account named "Section 179 Assets Expensed" and assign it to the "Depreciation on Books" tax line item. Not sure if that would confuse your tax accountant or make her jump for joy.

I am looking for a free template for a dairy farm chart of accounts for Quickbooks Simple Start.

Grateful for any information on this topic. Preferably a chart of accounts that maps to the Schedule F. I am an expert in farm taxation and a former dairy farmer. Thank you, Sean Fogarty CIA EA

Hi there, @fogarty777.

Every item of account in QuickBooks is mapped according to the corresponding detail and account types. Forging a new template, however, is different, and I highly recommend looking up this type of information through the internet.

Here's a reference you may find interesting to read and learn more about the formatting requirements of your accounts: Import your Chart of Accounts to QuickBooks Online.

I've got you covered if you have other questions aside from working with your chart of accounts in QuickBooks. Use the Reply option below to leave a comment and don't forget to include my name, @JonpriL. Take care always and stay safe!

I don't see any Tax Line Mapping to any of the accounts that were set up by Quickbooks for my LLC that rents residential property. My Quickbook Desktop 2022 also does not have an "Accountant" drop down menu (or at least I'm unable to find it). My accountant has given me the tax lines I should map to, but I don't see anyway to do this, and as best as I can tell, none of my accounts are mapped to Schedule E which is where all my expenses and revenue goes. Can you clarify how I might map to Schedule E?

I appreciate you for joining this thread, @ptyler441.

The Accountant tab in QuickBooks Desktop is only available to the users who subscribed to QuickBooks Desktop Accountant. Since you're using the regular version of it, that's the reason why the option isn't available on your end.

If you want to use the accountant version of QuickBooks, you can install and activate it. To get started, you can open this link: https://downloads.quickbooks.com/app/qbdt/products.

To get started with QuickBooks Desktop Accountants, check out the topics from this link: Find QuickBooks help articles for QBDT Accountants.

If you're now in QBDT Accountant, you can start the schedule E mapping. Here's how:

For your future reference, I've added an article that will guide you in setting up sales tax for specific goods and services that you offer: Set up sales tax in QuickBooks Desktop.

If you have additional questions about managing your QBDT account, never hesitate to reply to this thread again. We'll be willing to help you. Keep safe, and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here