Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for following this thread, amv.

I can see how important for you to be able to match the invoice to the deposit. This will help ensure your financial records are correct including the data shown on the report (Profit and Loss).

When deposits are downloaded via bank feeds, match them to the existing transactions in QuickBooks Online (QBO). Adding them will result in doubling your income.

Also, there are instances where some of the entries are unable to find their match from existing records. Let me share the reasons for this occurrence.

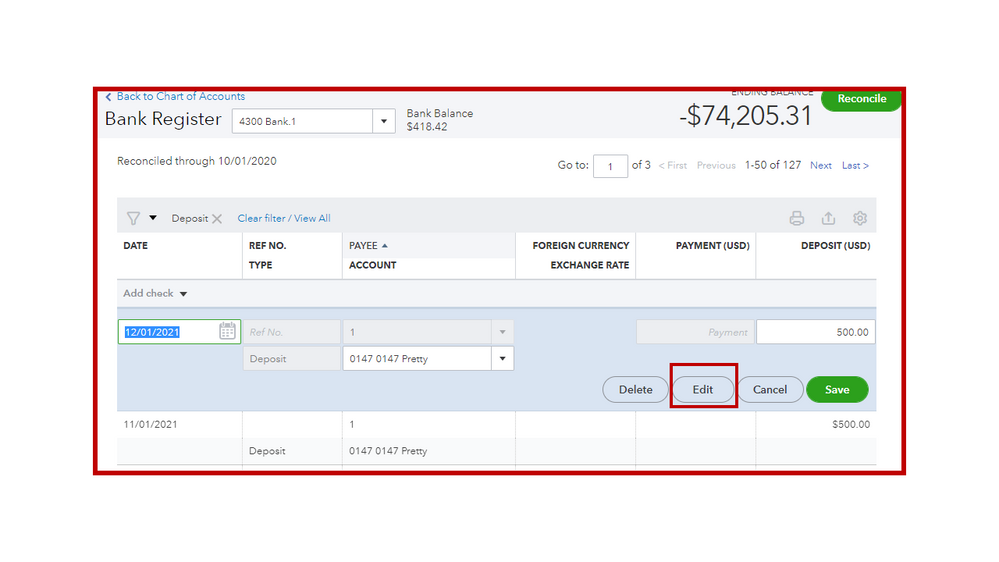

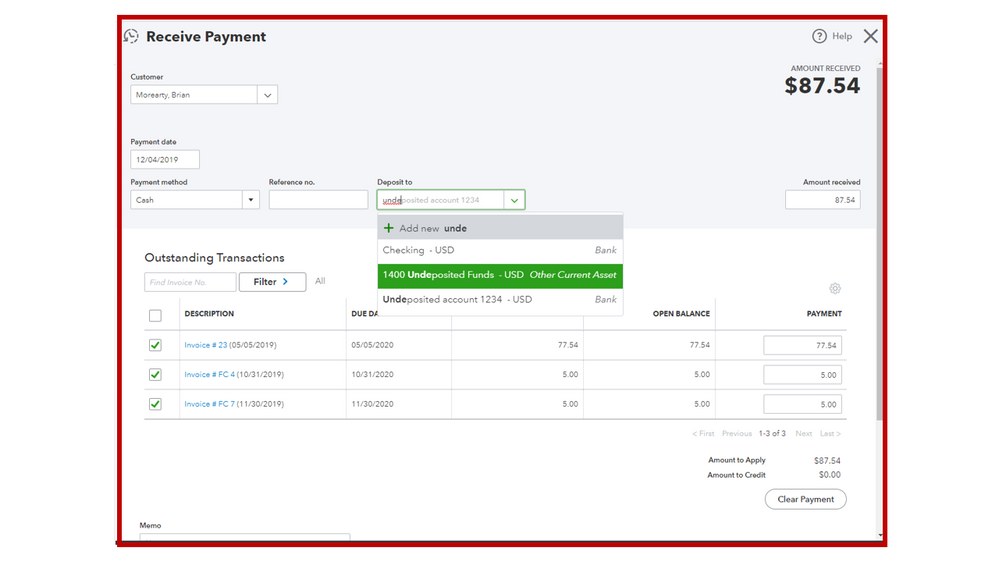

Since the invoice is already paid in QBO, make sure to use the Undeposited Funds as the posting account for your deposit. Let’s go to the Chart of accounts page to edit the information.

Here’s how:

After performing these steps, go to the Bank Deposit page to record the entry. In case there are bank or processing fees, don’t edit the original transaction. Instead, add the fee in the Bank Deposit window. Here’s an article that will guide you through the step-by-step process: Record and make bank deposits in QuickBooks Online.

Once done, you can match the bank deposit to your downloaded entry. Otherwise, exclude the one in your online banking to prevent duplication.

This reference will help in your future tasks. It outlines the complete steps on how to undo or unmatch transactions downloaded into QuickBooks Online. This way, you can categorize them to the correct account. Also, this link contains topics that will guide you on how to efficiently manage your bank activities.

Keep me posted below if you have other questions about managing invoices and deposits. I’ll get back to assist further. Wishing your business continued success.