Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

I'm here to ensure that your Medicare and Social Security of your employees will calculate correctly, @robinerwin.

The following are reasons that can lead to Medicare and SS not to calculate:

- QuickBooks is not updated or there is an internet interruption during the update.

- Using the incorrect tax table version.

- The gross wages of the employees last payroll are too low.

- Total annual salary exceeds the salary limit.

If the same thing happens after QuickBooks and the tax table update, I recommend reviewing your employees profile to check if the taxes are set up correctly. QuickBooks calculates the federal withholding based on several factors such as taxable wages, number of allowances/dependents, pay frequency, and filing status.

Here's how to review your employees’ payroll info:

- Navigate to the Employees menu.

- Choose Employee Center.

- Double-click the employee’s name, one at a time.

- Click Payroll Info and make sure the Pay Frequency is correct.

- Select the Taxes button.

- Review the Filing Status and Allowances fields in the Federal tab. Make the necessary corrections.

- Hit OK and OK again.

Once confirmed that all info is correct, you have to run the Payroll Detail Review by following the steps provided by my peer, MaryJoyD. This is to see if there are any discrepancies for the MD and SS amounts on the paycheck, which may be the reason they're not calculating.

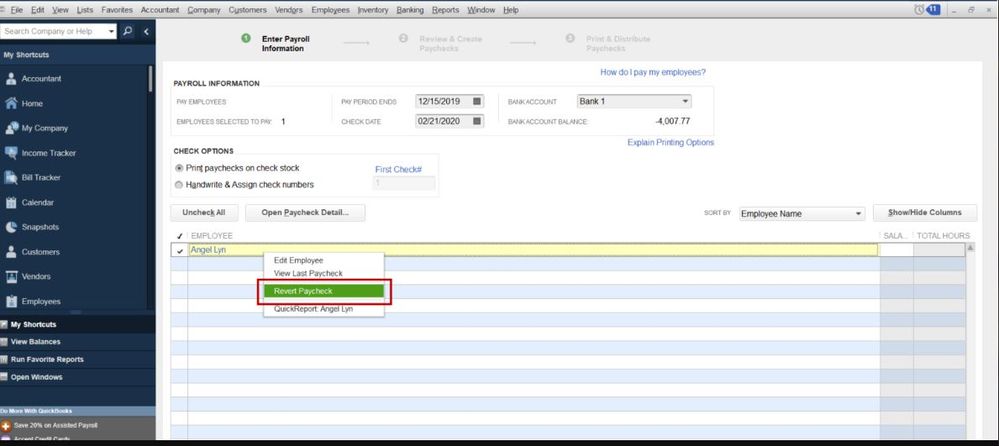

You can also revert the paychecks that you've created to refresh its tax calculation. To do this, right-click the paycheck, then select Revert Paycheck. When done, re-enter the paycheck details to verify taxes are calculated correctly.

To know more, please see this article: How to save or revert pending paychecks.

Here's a great source that you can open to help you correct year-to-date (YTD) additions or deductions on a paycheck: Correct year-to-date (YTD) additions or deductions on a paycheck when the wrong tracking type was us...

Please know that you're always welcome to post again if you have any other concerns about payroll taxes. I'm always here to help. Wishing you and your business continued success.