Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have had this problem since December 2020. When I check with EFTPS all the information I entered is correct,. I've called EFTPS and they say they are getting a lot of complaints about this from QB clients. I have done everything QB recommends several times and still the problem persists. QB needs to fix this and stop telling everyone to follow recommendations that are not relative to this ongoing problem. Paying for a service that does not work is not acceptable!

Here's my experience: It started in the fall of 2019. We had multiple clients call us about rejected EFTPS payments. All of a sudden, QuickBooks was saying that passwords had expired, but the passwords were perfectly fine when we logged in to EFTPS. But, to please QB, we changed ALL of the passwords at EFTPS and in QB. That worked...until November of 2020 when QB started giving us the same message for the same clients. QB said that the passwords had expired, so we would need to change them AGAIN. However, never has EFTPS told us to update passwords. Why does QB require us to change passwords when EFTPS doesn't? If the password works to log into EFTPS directly, why won't QB make the payment? It sounds like a QB issue that needs to be fixed, and the 4 pages of messages on this thread should be a clue that it is indeed QB's issue that is causing unneeded stress on our clients and us, and costing them tax penalties when the rejection notices go unnoticed.

And the EFTPS protocols say the password must be "12 to 30" characters, so apparently it has to be EXACTLY 12 characters to please QB and EFTPS. Geez.

QB Rep had me change it to 13 characters for some reason and it still does not work. Before I had 13. I will try 12 exactly.

As others have said it seems to have started in the Fall of 2019.

I am beginning to absolutely hate QB in any form!

This is a duplicate same dumb response scattered throughout this thread.

Update, support ticket, still no fix!

Is the solution 12 character password?

By the way, EFTPS will only let you change a password once every 10 days.

After working with QB Desktop support and reading this thread. There is a solution.

1. QB was no help, they were to push my issue up the chain and call me back. They forgot, never called.

2. QB Desktop Premier Plus 2020; Password MUST be 12 characters and match on EFTPS website.

3. QB told me it should be 13, and so once I tried what they told me to do... EFTPS locks your account for 10 - TEN days for changing passwords. i.e. - QB Support does not have a clue on what to do. - 12 Characters ONLY!!

4. Once changed password to 12 and matched on EFPTS after 10 days waiting, it worked. 941 and 940 submitted and accepted. Now if only QB would refund my penalties back to me.

Best of luck to us all until Quickbooks can be repaired or replaced.

I've been having the same issue for several months. Did you get anywhere when you went to the Help Desk?

Hi CheChe.

I'm here to take care of your concern today and help you process your federal e-payments.

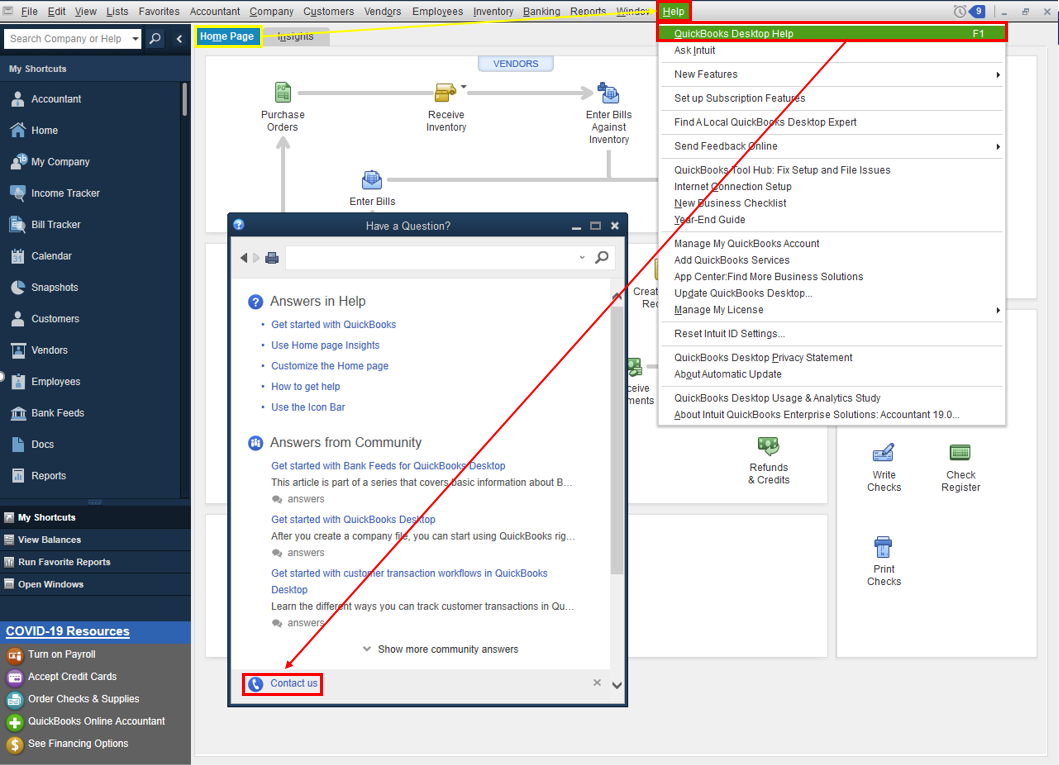

We haven't received new cases about this error message with trying to pay your taxes electronically. As an initial step, I recommend updating your password to isolate the issue. To change your password in QuickBooks Desktop when making an e-payment:

The next time you make an e-payment, re-enter your 4-Digit PIN and EFTPS Internet password, and select the Remember My Information for next Time option.

On the other hand, you can also go to the IRS website to send tax payment and forms electronically. Here's the page: Pay by Check or Money Order. From there, tap on the electronic payment options link.

You may refer to these articles to help you send your future tax dues:

Please let me know how else I can help you with handling your tax payments. I'm more than happy to provide additional assistance. Keep safe!

@Q-BisApain Take a minute to write the IRS and explain the situation. If you typically pay taxes on time, they will do a one-time penalty abatement, which appears to mean once in a while.

@JamesBCPA just an FYI, this was not QB changing policy - it was the feds. The powers-that-be at EFTPS decided that if you are using a 3rd party payroll system (like QB or GUSTO, or Paychex, etc....), you will have to change your password every 13 months. But if you go to log in at the EFTPS website, it allows the expiring password to work and doesn't TELL you that it won't work with 3rd party software access! How STUPID is that? Our government at work.

I did know this as the "government" did indeed inform me of this requirement via email warning me of this change before it happened. Additionally, I followed all of QB's recommendations several times after changing my password with EFTPS and still I am not able to process e-payments. I am amazed QB did not inform me of this change with EFTPS when they first began rejecting my E-payments and still do not effectively address this continued problem. Kudos if this fix worked for you but I remain unimpressed and yes, skeptical.

Yes, I have NEVER been able to efile/epay monthly EFTPS or Quarterly Form 941's through QuickBooks. I've tried all of the advise given concerning the "Expired Password Rejection" to no avail. However, I am able to efile/epay directly from the EFTPS website with no issues. QuickBooks will generate the quarterly Form 941 but then I have to submit it by mail because it is always rejected. I am able to efile/epay the TWC through QuickBooks. I am able to efile W-2's & 1099's from QuickBooks with no issue. I am thankful that they ae accepted. I meet all of the QuickBooks requirements to be able to submit 941 reports & pay but it simply will not allow me to do so. My enrollment statuses are all in order with the perspective federal and state agencies. I have started exploring other avenues as to why the forms are possibly being rejected. I started wondering if for some weird reason my Norton 360 wasn't allowing QuickBooks through the firewall for monthly EFTPS & quarterly Form 941 submissions but QuickBooks is being allowed through Norton 360's firewall. It's all so aggravating when your work day turns into being many hours longer just by trying to figure this problem out.

Somehow QuickBooks won't even allow me correct my severely misspelled Account Business Name under QuickBooks Account Details. This is what I have been told I have to do to correct the misspelling of my company name:

Yes, I have NEVER been able to efile/epay monthly EFTPS or Quarterly Form 941's through QuickBooks. I've tried all of the advise given concerning the "Expired Password Rejection" to no avail. However, I am able to efile/epay directly from the EFTPS website with no issues. QuickBooks will generate the quarterly Form 941 but then I have to submit it by mail because it is always rejected. I am able to efile/epay the TWC through QuickBooks. I am able to efile W-2's & 1099's from QuickBooks with no issue. I am thankful that they are accepted. I meet all of the QuickBooks requirements to be able to submit 941 reports & pay but it simply will not allow me to do so. My enrollment statuses are all in order with the perspective federal and state agencies. I have started exploring other avenues as to why the forms are possibly being rejected. I started wondering if for some weird reason my Norton 360 wasn't allowing QuickBooks through the firewall for only the monthly EFTPS & quarterly Form 941 submissions but QuickBooks appears to be allowed through the Norton 360 firewall. It's all so aggravating when your work day turns into being many hours longer just by trying to figure this problem out.

Somehow QuickBooks won't even allow me correct my severely misspelled Account Business Name under QuickBooks Account Details. This is what I have been told I have to do to correct the misspelling of my company name:

Thanks for sharing your insights with us, @GG64,

I know how it can be frustrating to be held up like this when you just want to get your account updates be resolved.

Also, we require supporting documents like government-issued ID's when updating your business information for your Intuit subscriptions. This is one way of safeguarding your account from fraud, and to confirm the primary person is processing the changes.

We're dealing with multiple customer accounts every day, and we have to make sure we're updating the right account to transfer the ownership successfully.

Don't worry. Your information is safe with us. We value the security of every customer's data and commit to secure their information by employing advanced security tools, service monitoring, and adapting to security events. See this link to learn more about how we handle your data: How we use your Personal Data in Intuit?

Since this community doesn't support account-related concerns for security, we would still recommend contacting our Live Support to check on your request. You can ask for a higher support to check on the Business Name Change request and why it isn't updated in your view.

They can also do a remote viewing session, so you can show them which part in QuickBooks or the Accounts page that isn't updated.

To get our support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

We ask for your patience while this is still unresolved. If you have other questions or concerns that needs immediate attention, please let me know in the comment below. I'll be more than happy to help. Have a nice day!

@GG64 I've been e-filing and e-paying in QB desktop for multiple clients for over a decade with very few problems.

I wonder, do you have a federal e-FILING pin and is it correctly entered when you try to e-file your federal forms? This is different from your EFTPS payment pin - completely different system. The process can be a little tricky. For e-filing, you have to apply for the pin, wait for it to arrive in the mail, confirm its receipt with the IRS, wait for them to activate it, and then enter it when you efile. There's no way to enter it and save it ahead of time in QB, and no way to hurry the process. If you want to efile for next quarter, you need to start now.

For EFTPS, you will need to go onto the EFTPS website, change your internet password to a 12 digit password, wait at least 24 hours, then make a payment and update the QB password to match the changed password. That process can be made more complicated if you have changed your bank account or your EFTPS pin.

If that doesn't help, you might try reaching out to a ProAdvisor for assistance. It would be worth the fee!

Yes, of course, I believe my previous posts have made that clear. I've talked to QB (when they bother to respond), and EFTPS (much more responsive & helpful than QB), and I have changed all passwords and pins as recommended several times. Why should I pay for an "Advisor" to assist with a service that does not function properly? Shouldn't the Software Engineers employed by Intuit do that? Like you, I have personally used QB for my businesses since 1995 and I have never experienced any significant problems with their software until now.

Obviously, at least to me that is, this particular issue remains a problem for many QB End-Users. For anyone to imply End-User ignorance is the problem is illogical. The complaints continue from those of us who have followed all advise received and we continue to be unable to use E-Pay. I do not believe the QB Community in general is unable to follow instructions and successfully use the E-Payment accounting application we've been able to use prior to the changes. Of course, this is only my opinion.

IT WORKED!! The 12 character password IS the answer.

The 12 character password IS the answer.

IT WORKED!! The 12 character password IS the answer.

Yes, My password did not change but two payments rejected and I did not notice till 10 days after the second one was over due. I am at $588 in penalties. Quick books is a big fail. I will discourage anyone in business from getting their records intertwined with this company going forward. Why do we not get a big red flag when a payment is rejected????????????

You need to log in to eftps and update the password every single year if you want to pay through QuickBooks. You must set up a password with no repeat initials and a number (no doubles in a row) and a special character. I just change the special character every year once it is changed.

I would also say it should be 12 characters in length, otherwise it won't work. At least it didn't for me!

Agree 100%. Payroll profit margins are thin enough without the need to cover the Penalty for a client due to this nonsense. I changed my clients password on 1/27/2021 when I noticed a reject email. Unfortunately, what I didn't realize was another payment for the 1st deposit in 2021 also rejected and because the payment was scheduled to post on 1/27/2021 I didn't see the reject and because the deposit are usually the amount or w/i a few cents I didn't notice the payment was missing. In late May the client received a notice he owes over $900 in penalty. 1st time abatement won't apply since we had the same issue in 2019 and had to use that up. I'm wondering if I should request abatement due to circumstances beyond m y control.

Yes this is a super easy fix. What you going to do is go on to EFTPS and log into with your old password. Then you can change your password and you cannot have any two letters the same back to back just FYI. I think you need a capital and a number and a symbol. When you use a third party like QuickBooks, EFTPS now requires that you change your password once a year.

Then, when you log back into QuickBooks you will enter your new password your PIN is the same. You need to do this every year.

As for the penalty the IRS will most likely waive it they have been very good at waving penalties this year.

I am an accountant and a QuickBooks pro advisor with over 30 years experience, with QuickBooks desktop.

I just had two requests denied as not being beyond our control. Almost $6000 in penalties. The QB notification was pointed at an unmonitored email account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here