Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Wow, thank you for providing this workaround, as unnecessary as it should be. I was on the phone with QB support while reading through. The CSR came back on the line to tell me that I would need to purchase a 1099 subscription from QB in order to pull the reports. Not sure if anyone else got that response but I was not happy. Glad this hack seems to be working.

Fascinating -- When I first signed on with this concern, I was asked if I would take a survey. I read through these three pages of non-fixes and then the work-around. As I went to take the survey, gave my input, and at the end it wouldn't accept my comment - not authorized. So I'll put my comment here:

YES - it has taken an extremely long amount of time for Intuit to fix the problem with the 1099 kerfuffle. Such an integral part of our tax season and it comes up with ZERO on our reports. Ridiculous. We should be compensated in some way for that time spent trying to fix it and getting no answers, beyond the repetitive steps that we have already done, year in and year out. Not happy with Intuit software fixing this the first time.

Thank you @Kendra H ! Finally we have some useful info:

Choosing Accounts for 1099 Tracking and Reports

Sorry for this question but I hope you can help me. QB Desktop 2020

So we used Paypal Credit Card to pay subcontractors. I set up the Paypal Credit card as a regular credit card. and the payment to subcontractors I did it through "enter credit card Charges" on the HOME page.

The problem is that I am about to do 1099, and those Paypal credit card payments are not showing on 1099. Can you please help?

Thanks

Help has arrived, @Emy1881.

Once you paid your contractors with a credit card, debit card, gift card, or PayPal through your Payroll product account, the payment won't be recorded. You'll need to edit those transactions and use a different method like check or expense.

Here's how you can change the account:

For more insights about fixing issues in the 1099 reports and forms, please scan through this link: Fix missing contractors or wrong amounts on 1099s.

Keep me posted if you have any other questions. I'll be right here to help. Have a good one!

Thank you so much. I will try this tomorrow.

Thanks again

Thank you so much. I am working on your answer. I forgot to add that we did "many regular payments" to this subcontractor but only a "few payments" were done via Paypal credit card. And those PayPal credit card payments are the only ones that are not showing in the 1099 report. Can I still use your instructions to add those PayPal payments to 1099?

When I reach the last point of your instruction, see below, I get a list of all the payments made to the subcontractor but the credit card still not showing (let me know)

Thanks for getting back to us here, @Emy1881.

I have some information about creating 1099 forms in QuickBooks. With the new IRS update, you do not need to report payments you made electronically, such as by credit card, debit card, gift card, or PayPal payments. QuickBooks Desktop automatically excludes these for you. The payment companies will report those payments so you don't have to.

To create your 1099s:

For more information about the 1099 filing, check out these guides:

Feel free to browse this link if you need help with other tasks in QBDT. Just look for responses that fit your concern.

I'll be around if you still have questions or concerns with 1099. Don't hesitate to reply anytime. Stay safe and have a wonderful rest of the week.

Thank you for your response I will check it right now. My last question is, when I go to: File/Print Forms/1099, it shows the 10 vendors I need to issue 1099 and the amount. Then I go continue. Then Print Forms, I select the dates. But only shows 1 of the 10 vendors. How can I fix this? Thank you so much

Thanks for posting here again, @Emy1881,

What's happening in your end is quite unusual, given that you have done the correct steps to process 1099s. In this case, let's check if the problem is caused by minor issues in the program.

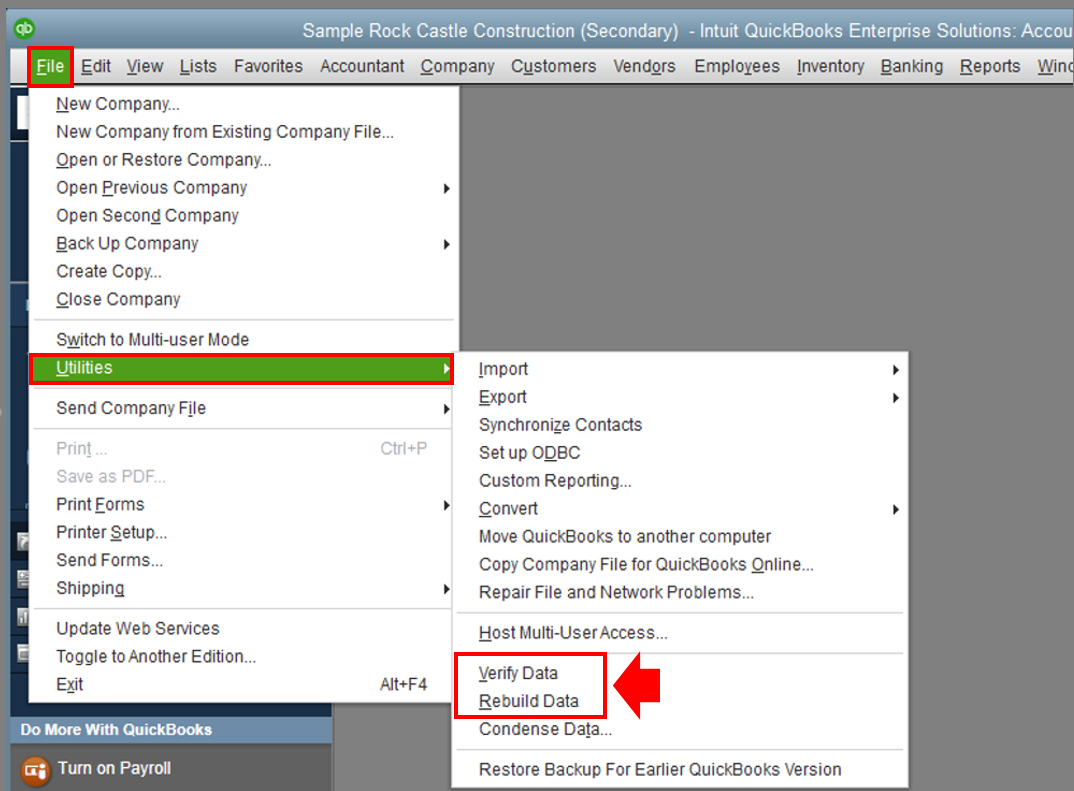

Run the Verify/Rebuild Utility to diagnose the company file. This built-in tool automatically fixes minor program data issues like the one you experience when running reports.

Here are the steps to do it:

For your reference, see the following link to learn more about this tool: Resolving Potential Data Issues

Once done, try printing the 1099 again and see if the problem is fixed.

Kindly reply to this thread with the update on what happens after trying out the steps. I want to make sure this is resolved so you're able to file and print the forms.

Thank you SO much!!! I will try this tomorrow.

I'm having the same issue, and in order to map the accounts as suggested, Quickbooks requires a backup be done first and won't allow the change without one. IT runs backups nightly, and the file is on a network, so I don't want to run a backup. I need another option....

Thank you for joining the thread, @Kathy888. I'll take care of this issue for you.

QuickBooks Desktop (QBDT) doesn't prompt for a backup when you map accounts for 1099 contractors. With that said, I suggest running the Verify and Rebuild Data utilities. These tools can identify data issues within a company file and resolve them for you.

Here's how to run the Verify Data tool:

Next up is the Rebuild Data tool:

Proceed with mapping your 1099 accounts after running these utilities to see if you still get a prompt.

If you're done with the troubleshooting steps from this thread, I suggest contacting our Technical Support team for further assistance. They can pull up your account information within a secure environment, and investigate this issue for you.

See this article for the steps: Contact QuickBooks Desktop support. Please take note of their operating hours, so you know when they're available.

Don't hesitate to drop a comment below if you have other questions about mapping accounts for 1099. I'll be around to help you out. Have a pleasant day!

Actually, it does require a backup to proceed. I tried a number of ways around doing a backup (since I'm on a network and it is backed up every evening, and I have to do this work after hours in single user mode). I even tried to start a backup and cancel it, but that didn't work either. I can't move forward to mapping unless I run a backup first. I really just want the 1099 report, I don't print the forms from QB. Is there a back door way to get that report? I want to determine how many 1099's I need and if any tax ID's are missing.

I am trying to prepare 2021 1099-NECs. When I run the reports, all I get is 2020 information.

Is the 2021 update ready yet?

Do I have to wait until the end of the year to print these 1099s.

This company has finished operations for 2021.

Hello PLB!

I understand that you need to file your 1099s on time. Allow me to help you in preparing it.

You can file Form 1099-NEC in QuickBooks Desktop until January 31. Also, the 1099 reports and forms will be available at the end of the year. This is the reason why you're still seeing the 2020 data.

Our team would like to ensure that once you file the 1099s, it'll be seamless. I added some links you can check on how to prepare and e-file the said form in QuickBooks Desktop as well as answers to the commonly asked questions:

Comment again below if you have more questions about year-end filings. I'll help you. Thanks!

here it is jan 2022 and same issue happening ...erg

Hi Alex, sorry to step here but I have a question:

-I am doing reconciliation

-I downloaded the bank transaction into Quickbooks and it was accepted. Now I am in the Transaction List screen where I am supposed to start allocating each transaction

-Somehow, the screen is split so its very hard for me to do the allocation, it's very confusing

-Can you please tell me how to change the screen to only 1 screen and not to 2 split screens.

Please see the picture below to explain my situation

Note: this only happens every time I am going to reconcile "one" of my 5 accounts. With the other four accounts, this does not happen.

Thank you SO much

Hi, Emy1881.

I'm here to help you reconcile your account in QuickBooks Desktop.

Let's run the verify and rebuild data to ensure your company file is free from potential data issues. Please follow the step in this article for the complete details: Verify and Rebuild Data in QuickBooks Desktop.

Once done, you can allocate each transaction depending on the bank mode you use.

Here's how to review your transactions:

Check out this article for the steps for each bank mode: Add and match Bank Feed transactions in QuickBooks Desktop.

Also, you can adjust your view preference to only one view in QuickBooks Desktop if you still see split-screen. I'll show you how.

After that, you can close and reopen QuickBooks so that changes will take effect. I've included this resource for more details: Fix screen issues in QuickBooks Desktop.

For future reference, I've added this material to guide you in reconciling your account: Reconcile an account in QuickBooks Desktop.

You're always welcome to add any details below if you need further assistance with reconciliation. I'm always here to help you.

Wow!! IT WORKS!! THANK YOU SOOOOOO MUCH!!!!!!!! thank you for going above and beyond your duty by adding more information to make sure it works correctly. THANK YOU AGAIN!!!

It works!! thank you so much! you are a genius!!

Hi Giovanni, I have another question: 80% of my reconciliations are transferring money between accounts. So I normally go to :

Transfer funds/Transfers funds from/transfers funds to

and that's all.

The question is:

When I download the bank transactions into Quickbooks, I am hoping that those transactions that are "money transfers between accounts" can be automatically registered as such, if this does not happen, I have to do each transfer by hand, and sometimes there are too many. Sometimes QB doe it correctly but most of the time it does not. What can I do, so QB does the transaction automatically correctly every time there is a transaction that involves "transferring money between accounts via:

Transfer funds/Transfers funds from/transfers funds to

Thank you so much!!

QB Desktop 2020

Emma

Hello there, Emma.

I can help you troubleshoot your bank feeds transactions.

For your bank transactions be added to your register automatically, you can create bank rules. In QuickBooks Desktop (QBDT), you can use the Renaming rules feature to help manage bank transactions in which this is available if you are in the Express Mode. However, if you're in Classic Mode, you'll use payee aliasing instead.

To create a renaming rule, here's how:

Once done, you can now add transactions using the renaming rules created.

For more information about this process, check out this article: Use renaming rules for Bank Feeds.

For additional knowledge, you can also visit our Banking and bank feeds page to learn some tricks on managing your bank feeds.

You're always welcome to post a reply here to keep us updated or if you have any other concerns. We're here to help. Take care and stay safe.

ThANK YOU SO MUCH, I will read this more carefully tomorrow to make sure I understand how to do this. I know how to create rules but never created a rule for "transfers" between accounts. Thank you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here