Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDid I do everything right to get direct deposit please help me out

Your employer handles the setup of your direct deposit, William.

In that case, reach out to your employer to ensure that all necessary payroll and banking information has been entered correctly in the system. Next, ensure you have completed the enrollment process for direct deposit with your employer.

On top of that, here are the steps you can take to verify this matter:

For detailed information on direct deposit funding times, visit these articles:

If you have confirmed that everything is configured correctly but are still unable to receive your direct deposit, contact our live payroll support team to investigate the issue. They are available to help resolve any issues and ensure you receive your payment promptly.

I’ve included an article about managing your self-employed taxes: File self-employed taxes.

If you have any questions about processing your direct deposit, let me know in the comments.

The payroll message that was sent out by Quickbooks said to process payroll by Wednesday. This was incorrect, and Quickbooks needs to own up to this.

Thanks for sharing your concerns, @hoosierdp.

Typically, the cutoff time for submitting a payroll is 5PM PST at least two banking days before the paycheck date. Paychecks submitted after the cut-off time will be processed on the next banking day and paid two banking days after that. However, it will depend on what payroll subscription you have and your direct deposit funding time.

Here's an example:

It's important to remember that federal holidays can affect the paycheck date. Direct deposit times will differ based on which payroll service you currently have.

Let's say you have QuickBooks Online Payroll Core and there's a holiday approaching as an example. If your payday falls on a Monday holiday, approve your paychecks by the prior Thursday. Your account will then be debited on Friday. Your employees will see their money on Friday.

Keep in mind that a Monday holiday will also affect a Tuesday payday. If payday is the day after a holiday, send your payroll one day earlier than usual.

If you have a 5-day lead time, you'll need to give yourself an extra day. Instead of submitting payroll on the Friday before payday, you'll need to submit payroll on the Thursday of the previous week.

For a better break down of deposit times and deposit times for holidays for your payroll subscription, please review the help articles I'm including below and click on your subscription:

Please let me know if you have any additional questions or concerns. We are always happy to lend a hand. Take care!

We are having the same issue. We followed the instructions that Intuit sent with regard to when to submit the payroll. We sent the payroll on Wednesday, 6/18 as instructed and it should have been direct deposited on Friday, 6/20. Now we are getting notified by employees that they did not receive their direct deposits today, 6/20.

We did not receive our direct deposits either! The QuickBooks message about Juneteenth affecting direct deposit states if you want direct deposit by Friday, 6/20/25, you need to submit payroll by 5:00 pm Pacific Time, Wednesday 6/18/25. See top half of attachment. I did submit payroll on 6/18/25 and received confirmation that says it was received on 6/18/25 at 9:56 am Pacific Time. BUT I did NOT notice until this morning, when everyone was asking why they did not get their direct deposits, that it goes on to say that the bank account would be withdrawn on 6/20/25 and paid on 6/23/25. See bottom half of attachment.

This is a QuickBooks problem and needs fixed ASAP!! You have our money today, 6/20/25, and you need to push the direct deposits through today, 6/20/25!

Mary

We also followed the notice by QuickBooks stating that we could send our direct deposits by Wednesday 5:00pm 6/18 also, and that is what I followed. I should have paid more attention to my calendar then the messaging in the payroll system apparently.

I called in and they told me that they accidentally sent the wrong notice to everyone. They sent everyone the notice that was meant for Assisted Payroll users who get their direct deposit funded in 1 day rather than 2 days. I don't understand why someone from Quickbooks can't post that in one of these threads. At this point, there's nothing that they can do to push it through any faster than Monday.

100% AGREE, all my employees are calling me and, yes, NO one was paid. All rules followed all submissions by their instruction and I too did not see the funding on 6/23 until my phone started ringing off the hook before the sunrise. This is UNACCEPTABLE QuickBooks, will you be paying all the fees my employees incur as a result because you are liable for that.

I understand the importance of receiving direct deposits on time and the inconvenience that delays can cause, hoosierdp, sgatlanta, Mary, Cindy, and Jennifer.

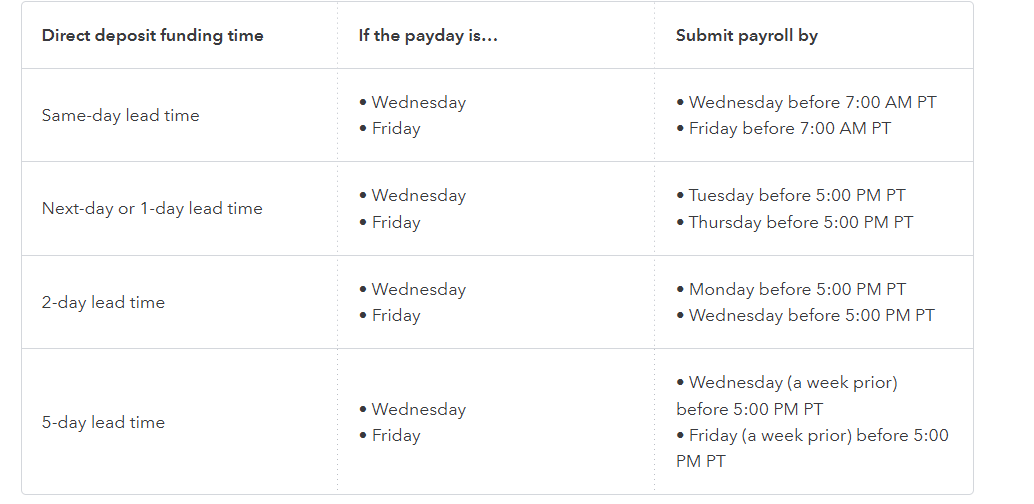

Please note that payroll requires two full business days of lead time between when the payroll is submitted and the paycheck date. For your reference, here is the paycheck schedule along with submission deadlines:

If you do not receive the direct deposit as outlined in the paycheck schedule, I recommend reaching out to our live experts for an update on the status of your direct deposit.

Here’s how you can connect with a live expert:

Support Hours:

You can refer to this article that explains how federal holidays can impact direct deposit processing: How do federal holidays affect my direct deposit?

For better tracking of contributions and deductions, you can generate a payroll reports directly within the program. Doing so will help you effectively manage payroll going forward.

If you have any further questions, please don’t hesitate to reply to this thread.

That's the information that was given to everyone. It said to process by 6/18 in order to get paid on 6/20. I attached a screenshot, but I don't know if it was visible. You can see the screen shot in another thread on the topic here:

Sorry, I meant to say that what you posted was NOT the information that was given to everyone.

I had the same issue and chatted with a QuickBooks representative. They were avoiding taking responsibility for QuickBooks issuing incorrect information to their customers which is the most annoying part of all this, especially when this is a significant issue with employees not getting their paycheck on time. I attached the chat.

I called and advised them that I too was recording the call and I received a full admission of fault by QB and I told them they are most certainly liable for the fallout about to happen. I have a case number and the recording of this conversation that took place this morning.

The fact that Intuit is not owning anything about improper information sent to users is disappointing at best. For the cost of a license to use these products, I expect that specific information sent regarding cutoffs for holidays and such to be accurate. To turn around and blame the users for following instructions as presented and failing to pay their employees in a timely fashion is sociopathic behavior. This is one more reason for me to continue searching for another software solution for our businesses. For such a well-known company to treat their customers so shamefully is abuse of our trust and the trust of employees for their employer. We are tasked with paying our employees in a timely fashion. I expect consultants to be correct in the information they provide. What a catastrophic failure.

If you followed the incorrect Quickbooks guidance and your payroll was late last week, then if you submit your payroll this week, you might be over your direct deposit limit. If two total payrolls put you over your limit, then the system might count the payrolls as being in the same week. You can call in, but you're not likely to get assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here