Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I need to close an old payroll account but I have several outstanding payroll checks how do I clear them or make a journal entry?

Hi Bangkok,

We're here to assist you with your concern. However, can you please explain more details about these outstanding payroll checks (paychecks) and why do you need to clear them out before canceling your payroll account? I mean did you process a direct deposit payroll in advance? Thanks in advance.

Checks were issued in 2018 and never cashed by former employees, have not been able to get a hold of the employees to issue replacements. We have closed the account for other reasons. I need to transfer the funds to the new account but the outstanding balance is not matching to the what the actual balance was.

Thanks for providing additional details about your concern, @Bangkok. Allow me to chime in and share ideas on how to transfer the funds.

You can void the check created and deposit the amount to the new account. Before doing so, voiding changes the amount of the transaction to zero but keeps a record of the transaction in QuickBooks.

To void a check, open the check and select Void from the Delete drop-down menu. See the screenshot below.

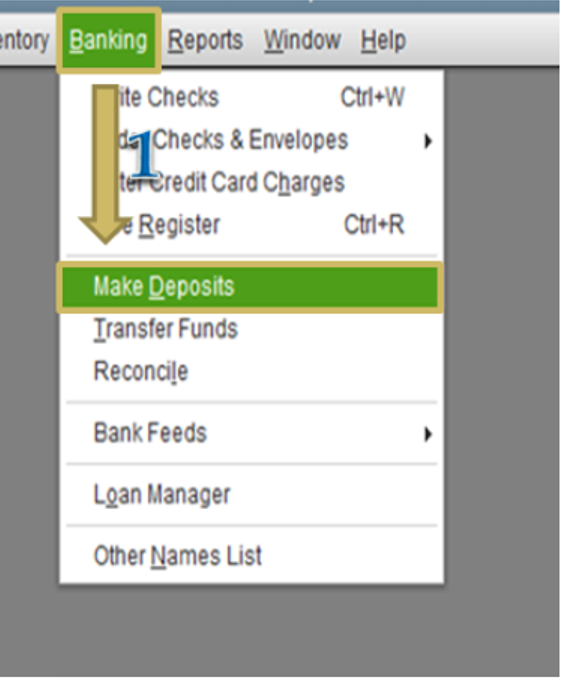

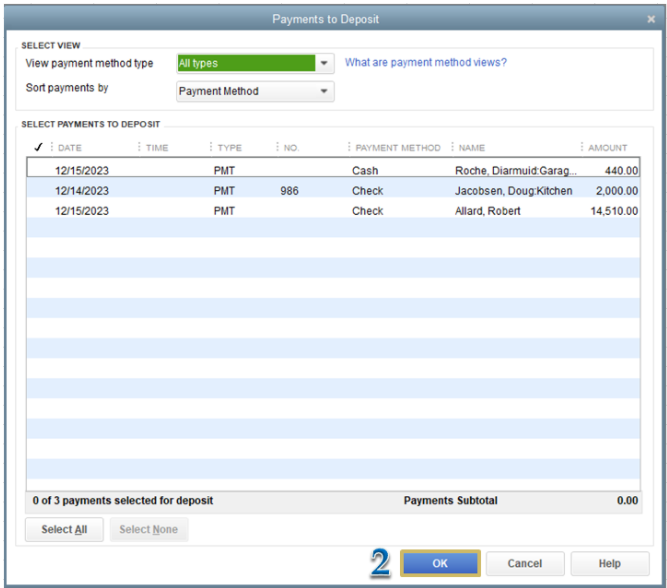

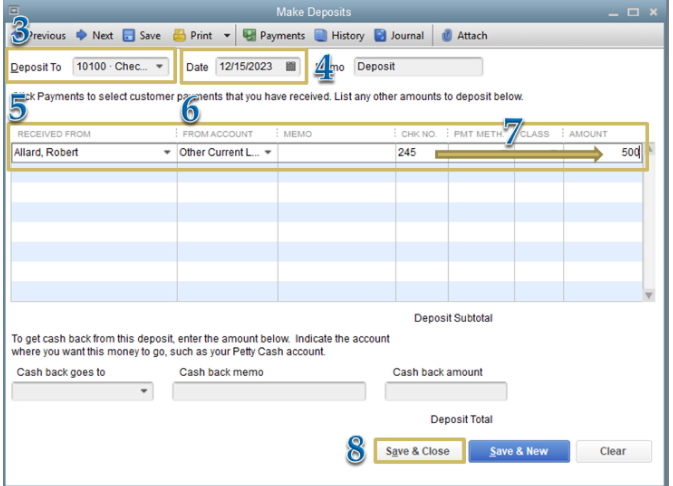

Once done, you can now deposit the amount to the newly created account. Here's how:

For more information, check out the following articles:

Also, in case you need to fix discrepancies balance upon reconciling you can visit these articles for reference:

I'm still here to help if there's anything else that you need. Just leave a reply below and I'll get back to you. Have a lovely day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here