Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I tried that and it does not fix the issue

Hi, Tacoma. I understand the inconvenience this issue has caused you. I've got you covered and let's work this out so you can complete your tasks in QuickBooks Online (QBO).

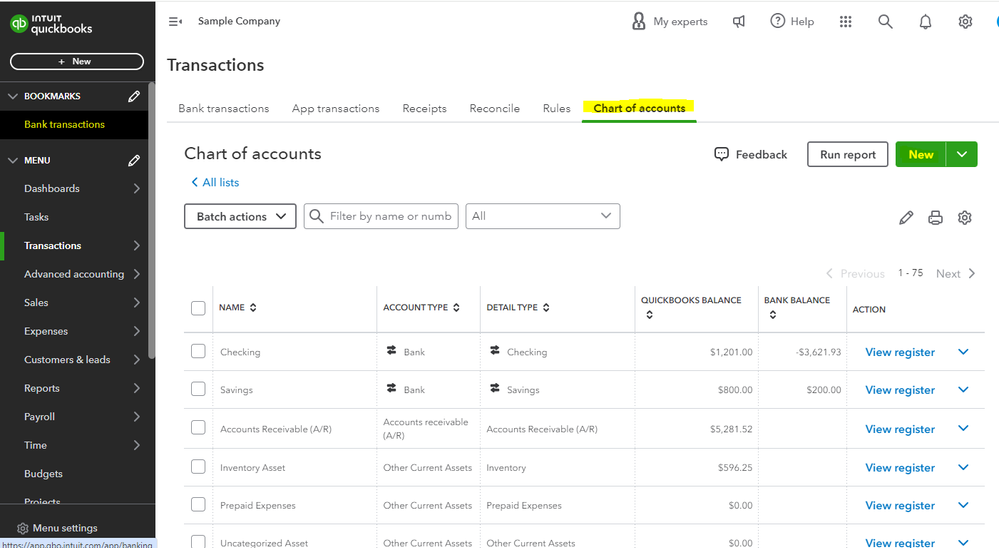

Before we do so, can you tell me the exact details of your concern? What specific workaround you've performed? I would greatly appreciate it if you could send screenshots to the Chart of Accounts (COA) where the affected account is, a screenshot of the transaction, and the reconciliation page that affected the transaction.

That way, I can provide you with an accurate resolution to your query.

I'll be here in the Community space. Don't hesitate to get back to me by clicking the REPLY button below. I'm determined to help you get through this. Take care.

please read the previous messages describing the problem that apparently has not yet been solved in QBO. I do not remember having this issue with my BofA accounts in the desktop version and have just now switched to QBO. If BofA business CC subaccounts do not play well with main BofA account this will probably be a dealbreaker for me.

Hello there, @RedwoodDenizen.

I'd love to help you achieve your goal, but would you mind sharing more details about it? Are you having the same issues with Ericgille with the credit (payment) shown in one account that oversees 4 credit cards( debits ) and wondering how to reconcile in QuickBooks? It can help us get on the same page and provide accurate resolution.

I'll wait for your reply, or if you have any other questions, please let us know. We're always here to help. Have a great day.

Hello, I'm new to this.

How did you connect the credit cards?

Only the 2 sub or all 3?

Hello there, @VegasGio. I'm here to help connect your credit card accounts to QuickBooks Online (QBO).

I recognize how convenient it is to connect QBO to your credit card account. It guarantees that your transactions are recorded on time and categorized properly.

Please know that when setting up an account in the Chart of Accounts, your bank won't automatically show up in your bank feeds unless you're connected to your online banking. I'll show you how:

Please visit this article for more detailed information about the steps given above: Connect bank and credit card accounts to QuickBooks Online.

Once you're all set, feel free to visit these handy articles on what's next after connecting your bank account in QuickBooks:

Please let me know how it goes. I'd be happy to help if you need further assistance with connecting credit card accounts, @VegasGio. Have a wonderful week ahead.

Unfortunately, during the initial setting when I connected with Bank of America, QuickBooks suggested to select all the bank accounts and placed them as single independent accounts; now I cannot change it anymore... Should I cancel the linked account and re do that manually?

Are you sure it won't duplicate expenses? I haven't categorized any yet.

Connecting your account seamlessly is crucial for efficient transaction management, @VegasGio.

Rest assured, I'm here to help you resolve this matter.

When connecting credit cards in QuickBooks Online, you'll need to know how your bank sends the downloaded transactions. If the transactions download to one account, connect only the parent account.

If the transactions are downloaded to the individual accounts, connect the sub-accounts and not the parent account. Please know that you can’t connect both a parent account and its sub-accounts. If you try to connect both parent and sub-accounts, you’ll get a message that the account is already connected.

To do this, create a parent account and then have each card set up underneath as a subaccount. Here's how to create a sub-account:

For more details about this, see this article:

I also suggest checking this article: Manually Download Online Bank Transactions. There, you can learn how to get the latest transactions from your bank and credit card accounts.

Additionally, I've added an article that'll guide you in reviewing your bank transactions after you download them into QuickBooks Online. This helps you ensure your books are accurate: Categorize and Match Online Bank Transactions.

Let us know if you have other QuickBooks-related concerns. Doing so helps us provide an exact solution.

DebSheenD,

Respectively, connecting the accounts and/or sub accounts is not the problem we are trying to solve. To recap:

BofA uses a "parent account" for credit cards. There is no actual plastic credit card linked to this account. Online, this account ONLY shows CREDITS, which is what QB sees.

BofA "sub accounts" are the "real" plastic credit cards. These accounts ONLY show DEBITS online. This is also what QB sees.

As in previous posts, there does not seem to be a way to reconcile. There is a "workaround" that JenoP (please read previous post) suggested, however, this is time consuming and would not allow transactions to be recorded correctly.

Please let me (us) know if you do not understand the issue here and we will further explain.

Thanks for joining this thread, @BumpDaddy. We hear your sentiments.

It's important to note that QuickBooks relies on your bank's process when importing transactions.

Currently, the steps shared by JenoP are the closest workaround you can use to resolve your issue with unmatched balances due to the downloaded transactions from your parent and sub-accounts.

For further assistance, we recommend consulting with your accountant to receive more guidance on handling your situation.

Moreover, I'm adding these helpful articles that you can use as a reference for reconciling your accounts:

Should you have any other concerns besides reconciliation, please get in touch with us again. We're here to help you in any way we can.

When the credit card payment comes through bankfeeds, you have to split the transaction and apply the payment to each card. This will have zero apply to the main card number and will apply payments to the individual cards. I do over 50 accounts and this is only a problem with Bank of America due to their processing system. This is not a QuickBooks error. No other card processing has this problem.

I could use some help with this issue, too.

I'm the Treasurer for a small nonprofit and we have one credit card. Still, BoA rolls up that one card into a "Parent Card" (sweep) account and accepts payment towards our expenditures into there.

After reading some of the earlier posts on this topic, I finally managed to make the credit card a sub-account of the Parent Account (the sweep account).

Now my balance sheet looks more realistic, but on the other hand, my QBO balance in the credit card account (the child account) is huge! Not sure I can reconcile it. I disconnected the sweep account, as this was the only way that I could make it the parent account.

Have talked with my CPA, they aren't able to help with the way that QBO handles this. And I really want to start pushing our balance sheet, etc. off QBO instead of the way it was done prior to me. Any help is welcome!

I appreciate your troubleshooting efforts to manage your accounts effectively in QuickBooks Online (QBO), mass_awi. Let me help you clear things up on your handling transactions.

Please note that if you have created subaccounts, you only need to reconcile the parent account because all transactions in the subaccounts come into it.

Moreover, when you manually categorize and add the transactions to the parent account's register (sweep), they can't match this to the child account's recorded expenses or payment since the payment account used is different. That could be why the QBO balance in the credit card account (child) displays a huge quantity.

Since you already disconnected the sweep account to make the child account a parent account, you can proceed with reconciling it. You'll want to consult your accountant beforehand for assistance with accurate recordkeeping.

I suggest contacting our Live Support Team for more guidance with QuickBooks navigation. They can perform a screen-sharing session to assist you further. Here's how:

I've also included these articles that you can refer to when handling your transactions after the reconciliation process:

I'll jump back into this thread to provide the necessary information and instructions if there's anything else you need to know about reconciliation. You can count on me 24/7. Have a good one.

I need to know how to get the "child" accounts to download the transactions from Bank of America. I'm not worried about the payments. I can make that work. But how do I get the transactions to download without putting them in one at a time?

Hello, @hanescpa. I can guide you on how to download your child accounts from Bank of America to QuickBooks Online (QBO).

Before we proceed, it's important to know how your bank transfers the downloaded transactions. Connect only the parent account if transactions download to one account. If the entries are downloaded to an individual accounts, link the sub-accounts (child accounts) and not the parent account. Please know that you're unable to connect both parent and sub-accounts at the same time. If you try to link them, you'll receive a notification indicating that the account is already connected.

Furthermore, to automatically download your bank transactions to QBO, here's how:

For more information, refer to this guide: Connect bank and credit card accounts to QuickBooks Online.

Once you've successfully download your child accounts, you'll want to match and reconcile to avoid financial discrepancies.

Please let us know if you have further questions when downloading your bank transactions or any other concerns inside QBO. We're always here to support you. Have a good one.

Thank you @SirielJeaB and sorry for the delay in responding.

We are a completely volunteer-run entity, so I do not look at the books daily and have not had a chance to get back to your message until today. Your message was extremely helpful. At least for now, I am set, and will check the resources that you mention should I need further help, or will message back on this thread if those don't get me where I need to go.

I am actually quite comfortable with QBO, having taken one of its certifications for a previous part-time employer's purposes. One thing I did not deal with when working for that employer was a sweep account, hence the issue.

Also, have to say that since the days when I used QBO for my own small business, there have been vast improvements in the software and it makes for great small business accounting!

Thanks so much.

We appreciate this kind of response from our valued customers like you, mass_awi.

It's great to hear that you're eager to carry out the response provided by my colleague. We are dedicated to your success and are always here to assist you every step of the way.

We can see that reconciling accounts is crucial for managing your books. That is why we're making sure that we provide an accurate way of solution. Also, seeking advice from an accountant is helpful to ensure reliable financial management.

Please feel free to ask any questions or raise any concerns you may have in our supportive and vibrant Community. Thank you once again for choosing QuickBooks as your financial software. Have a wonderful day.

Bank of America did not give the option to link the "child" accounts. It only gave me the choice of the parent account. I will try to delete the connection for the parent account. But I don't believe it gave me the option of linking the child accounts. Thank you.

Was this problem ever resolved?

I am having the same problem. Was this problem ever fixed?

Managing a business credit card account with multiple cards can be a bit complex, Harrisjinc. Let's work together to ensure everything is balanced and organized efficiently.

Before connecting to online banking, it's important to understand how your bank sends the downloaded transactions. If the transactions download to one account, connect only the main (parent) account. Conversely, if transactions are distributed to individual accounts, ensure you connect the sub-accounts instead of the parent account.

For more information, please review this article that explains the process of setting up your account: About bank or credit card subaccount setup.

After successfully verifying and properly setting up the account, if the issue continues, I recommend you contact our customer care team for further investigation. Here's how:

I'm adding this link if you want to balance your books In QuickBooks Online: Reconcile an account in QuickBooks Online.

You can check this reference which contains the reconciliation report: How do I view, print, or export a reconciliation report.

Please know that we are always here if you need more assistance with reconciliation. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here