Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have four separate credit cards issued by the same bank. I want to link all four credit cards into one GL account within the QBO file, as the bank issues one statement for all four cards (and applies all payments to the one master account, rather than to the four individual accounts). How do we do that? We do not want subaccounts.

Hi JLW10!

Thank you for reaching out to us again. Let me help you in linking your credit cards.

You only need to set up and link the account where the transactions are downloaded. You don't need to link all four credit card accounts.

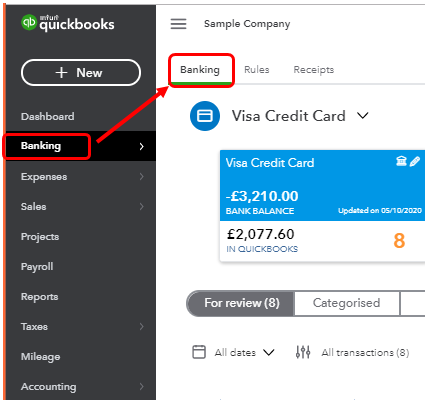

Please follow these steps on how to set it up on your Chart of Accounts:

Once done, you can follow the steps in this article on how to connect it to your online banking: Connect bank and credit card accounts to QuickBooks Online.

Also, you can review this link: About bank or credit card subaccount setup. The Connect the accounts to Online Banking section will explain more on how to link multiple subaccounts in QuickBooks Online. The last section will show you the step-by-step guide in balancing your accounts.

Comment below if you need more help with banking. Take care!

Hi - when we do this, it only imports one of the four credit cards. We need activity from all four cards going into one GL account. How do we do that?

Thanks for following up with the Community, JLW10.

Before connecting accounts to your books, you'll need to know how the bank sends your downloaded records. If transactions download to one account, you'll only need to connect its parent account. In the event that transactions download to each individual account, you'll want to connect every subaccount instead of their parent account.

If you try to connect both a parent account and its subaccounts at the same time, QuickBooks will notify you that your account's already connected. When initially connecting the account(s), your same opening balance transaction may download to all subaccounts. You must delete all but one of these balances when reconciling.

Some banks may show an overall bank balance at each subaccount level. This is because financial institutions provide Intuit with a static balance of accounts in their entirety, instead of the balances of each subaccount.

I've included a tutorial video on how to go about connecting credit card accounts which may come in handy moving forward:

Please feel welcome to send a reply if there's any additional questions. Have a lovely day!

Thanks for the link, but unfortunately it didn't discuss how to add four separate credit cards into one GL account. Can you please send a link that addresses this specific scenario?

Thanks for getting back to us, @JLW10.

I'll share the steps on how to add sub-accounts. Let's go to your Chart of Accounts to see it.

For details about the steps, check out this guide: Create subaccounts in your chart of accounts in QuickBooks Online.

I'm also adding this link if you need further help with reconciling accounts: Reconcile an account in QuickBooks Online.

Drop a reply anytime if you still have questions or concerns with credit card accounts. I'll be around for you. Take care and stay safe.

Hi

We do not want to use sub-accounts (this was explicitly stated in our original post). Can you please provide a solution that does not involve subaccounts.

Thanks

Let me provide you a few information about linking multiple credit cards that don't include subaccounts and guide you on what to do, JLW10.

Ideally, you'll have to create a parent account and have each individual card set up as subaccounts if you're using multiple credit cards in QuickBooks Online (QBO). If you don't want to use subaccounts, you'll have to set up each card and connect them to your bank. Then, every time transactions are downloaded to each card, you'll have to manually exclude those that aren't associated with the specific credit card. Apart from this, there's a possibility that you'll have to transfer and adjust balances to correct the individual account balances. But, I still recommend reaching out to your accountant for other ways on how you can link your credit cards.

However, in case you'll change your mind and use the subaccount instead, read this article for more information: About Bank Or Credit Card Subaccount SetUp.

In addition, QuickBooks downloads the latest transactions automatically and matches them with those that you've already entered. Go through this article for your guide: Categorize And Match Online Bank Transactions In QuickBooks Online.

Fill me in and keep in touch if you have any concerns about linking credit cards. I'll always be here to help you anytime.

Hey JLW, hopefully you've already figured this out, or found a different solution, if you haven't this is what I did...

I know you don't want sub accounts. If you found a way not to use them let me know, I couldn't. I had the same issue, I have an amex platinum, and two employees with golds. On the desktop version everything came through to one account (as it should). Online, I had to stop thinking of my platinum as the main account. I created a ParentAmex account, I put all three cards as sub accounts, connected all three cards at the connection screen and then I reconcile the ParentAmex account when it comes time to reconcile. Hope this helps! It's a workaround that works until I can find a better way.

What if the main account is already being uploaded into the banking section? How do I get the other 2 accounts to upload?

Thanks for joining this thread, shady5.

Are the two other accounts connected to online banking? If so, you might want to check with your financial institution first and see how they send the downloaded transactions.

We'll only need to connect the account where transactions are downloaded. If all transactions go to the parent account, just connect the parent account. If they are downloaded to the sub-account, then we can connect the sub-account.

We can go through this article to help us manage your accounts in QuickBooks: About bank or credit card sub-account setup.

However, if the other 2 accounts are not connected to the banking, we can exclude the transactions from the main account and enter the transactions from the register, or import them manually.

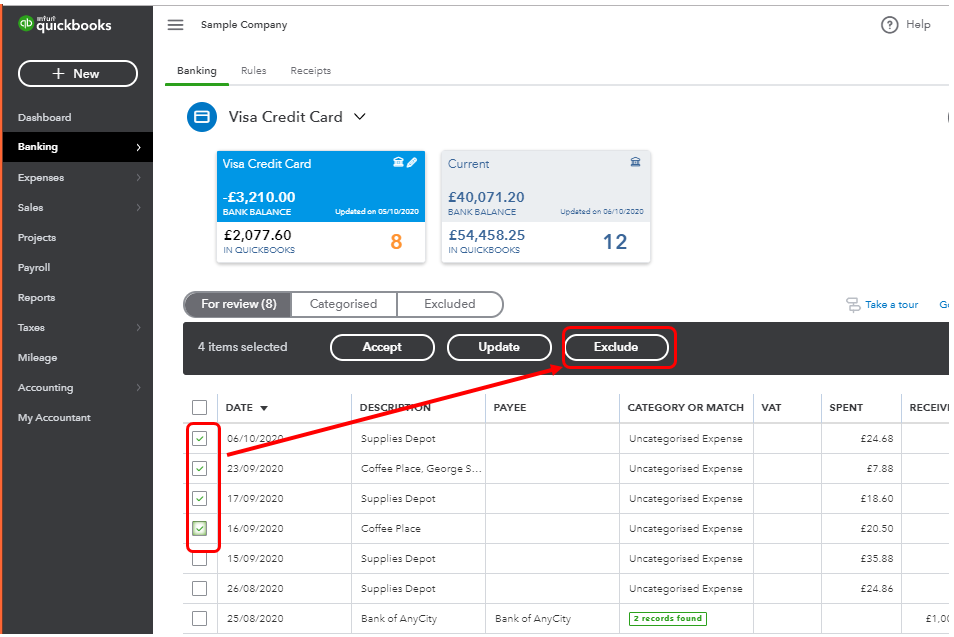

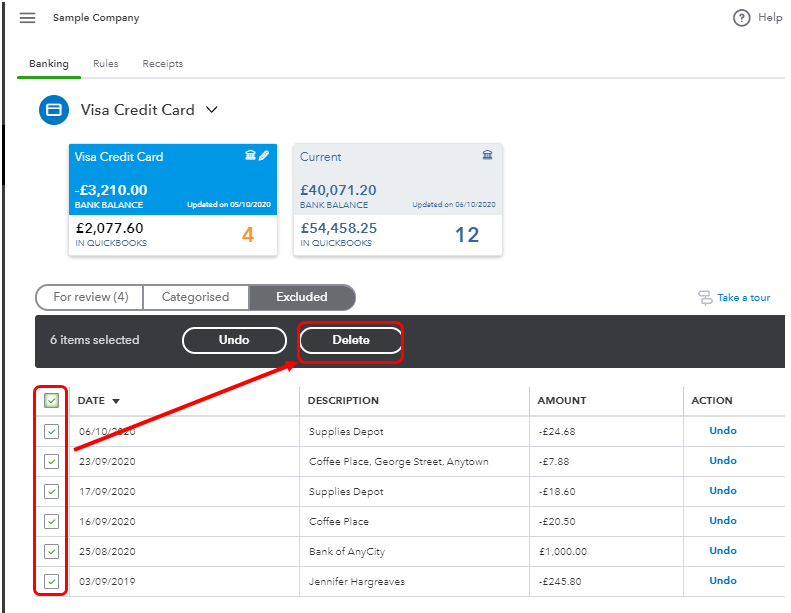

Here's how to exclude:

After that, we can refer to the following articles to enter or import transactions in QuickBooks:

Manually add transactions to account registers in QuickBooks Online.

Manually upload transactions into QuickBooks Online.

Keep me posted if you need further assistance with your bank transactions, shady5. I'll be here to help. Have a good one.

I'd love to be able to do this with AMEX but it seems like there is a ton of confusion about what we're asking.

What makes this even more frustrating is that I have one client where this works and I can't figure out how we pulled it off. Still AMEX too. There are 5 different company cards and they all roll into a main GL account. The description says who made the charge, but they're all happily lumped together.

Other client - Two AMEX cards and the only solution I can get to work is subaccounts.

I have the same issue, and I'm surprised the QB has not had a fix for this. We have two cards on our AMEX statement, but only one of the cards transitions download into QB. I can set up a subaccount that downloads transitions from the second card on the account, but this creates another problem as I'm only receiving one statement from AMEX. Is QB going to solve this issue?

Thanks for following this thread, @nate the great.

I understand you want to download the transactions from the second card. Since you're receiving one statement for both cards, you'll only connect the parent account as stated by my peer Rose-A in her post.

Then, the other card will e set up as a sub-account. Here's how to add your second card as sub-account after connecting the parent account:

For more insights, you can check out this article to learn more about creating subaccounts in your chart of accounts in QuickBooks Online

For future reference, keep this article for a step-by-step guide in reconciling your accounts in QBO.

Feel free to visit again if you have more questions about managing your bank and credit card accounts. I’d be right there to help you again.

Thanks for following this thread, @nate the great.

I understand you want to download the transactions from the second card. Since you're receiving one statement for both cards, you'll only connect the parent account as stated by my peer Rose-A in her post.

Then, the other card will e set up as a sub-account. Here's how to add your second card as sub-account after connecting the parent account:

For more insights, you can check out this article to learn more about creating subaccounts in your chart of accounts in QuickBooks Online

For future reference, keep this article for a step-by-step guide in reconciling your accounts in QBO.

Feel free to visit again if you have more questions about managing your bank and credit card accounts. I’d be right there to help you again.

when I follow through with your recommendation and create a sub-account, it also forces me to reconcile both credit cards separately and does not treat the credit card as one account. however, I only want to reconcile one credit card account that has two credit cards. Is this possible or am I doing something incorrect?

Again, I'm fine with having a subaccount and the account can be independent under my transition lists, but when I reconcile, it should be one account and not two.

You should have one statement for your two cards, nate the great. Hence, when you reconcile an account with a sub-account, you only need to reconcile the parent account as all of the transactions in the subaccounts are already rolled up into it.

Then, follow the steps to reconcile outlined in this helpful article: Learn the reconcile workflow in QuickBooks.

Come again if you need further assistance in reconciling your accounts. I’m always around to assist in any way I can.

I have completed this as you have recommended and I have a new subaccount under the parent credit card. Now, how do I link it to my CC statement so it automatically downloads all the transitions????

Again, for mare clarity, I can click "Link an Account" and set it up such that both CC's (under the one account) will be downloaded. however, I then cannot link one of the cards as a Sub- Account and they behave as two different CC accounts and must be reconciled separately. when I try to link one of the CC's to the other an error pops up that reads:

"Something's not quite right - You can't change the parent of this account to American Express XXXXX because it or its parent is already set up for Online Banking or Web Connect."

likewise, I can create a subaccount as you have suggested above, but I cannot find a way to link it to my CC account where it downloads the transactions for me.

I have completed this as you have recommended and I have a new subaccount under the parent credit card. Now, how do I link it to my CC statement so it automatically downloads all the transitions????

Again, for mare clarity, I can click "Link an Account" and set it up such that both CC's (under the one account) will be downloaded. however, I then cannot link one of the cards as a Sub- Account and they behave as two different CC accounts and must be reconciled separately. when I try to link one of the CC's to the other an error pops up that reads:

"Something's not quite right - You can't change the parent of this account to American Express XXXXX because it or its parent is already set up for Online Banking or Web Connect."

likewise, I can create a subaccount as you have suggested above, but I cannot find a way to link it to my CC account where it downloads the transactions for me.

Hello, nate the great.

Before connecting your bank to online banking in QuickBooks Online (QBO), we need to check how your bank sends the downloaded transactions. If the transactions download to one account, let's connect only the parent account. But if the transactions download to the credit card, we'll have to link it to CC.

Please know that we’re unable to link both a parent account and its sub-accounts. To learn more about the parent and subaccounts setup, see this article: About bank or credit card subaccount setup.

Once everything looks good, check out these resources to help you with reviewing your credit card transactions and matching them to your statements:

If we have any other questions about recording transactions in QBO, let me know, and I'll lead the way.

Chase CC: (parent) card one (sub), card two (sub) etc... then connect subs to the bank and reconcile only Chase CC(parent).

the only downside: the balances on banking tabs will never match to GL balances... but it will be correct on the Balance Sheet

Exact same issue with QDT Accountants version. Client uses Elan, 2 employee cards and I'm having a heck of a time getting the account to reconcile. Way too many transactions to enter separately. I may have to resort to a CVS file import.client has 2 employees with ELAN ccc.. I have a QBO client with Amex. 2 employees. Download separately and I simply reconcile the master (2 subs). I really don't care if I need subs I just want the darn thing to reconcile.

I don't know if anyone has found this solution or not. But, I just happened upon it while trying to figure this out. I set up a sub account for the credit card. When I attached the main credit card account to the sub account, all of the other cards came through the bank feed under that one sub account. They wouldn't come through when I attached the credit card account to a parent account. But, for some reason, they all came through when I used a sub account. Hope that helps someone.

I also was having the same issues. I now have the main card linked to the two cards in sub accounts. My problem now is on the register I have double entires for everything. Unfortunately I must have reconciled one of the sub account when I first started, I’m a newbie, so my bad but now it seems to have made everything off balance when reconciling. I only want to reconcile the main cc. I’m in some sort of crazy duplicate transaction maze when trying to reconcile the main account. So my question is this- 1. Is there a way to delete the sub account reconciliations 2. It appears that the sub accounts are throwing off my actual numbers because of the duplicates, for example in my expense account for fuel. Since I have a trucking company and fuel is the biggest expense it is making it look like I’ve paid twice as much for fuel than I actually have. This is due to the sub account having a fuel transaction and the main account having the same duplicate transaction as well. I’m wondering if there’s a way to possibly remove the sub accounts transactions since they are being recorded twice. This is making the entire process extremely time consuming and confusing. TIA for any assistance

I appreciate you for joining in on this thread, CLB hauling.

I'll share information to help you correct the reconciled subaccount and ensure these balances are zeroed out.

You'll need to undo the reconciled subaccounts and reconcile only the main account. This way, reconciliation for the subaccounts won't cause discrepancies when doing the reconciliation process. With that, I'd suggest consulting your accountant to guide you with the best appropriate approach when deleting reconciled accounts.

Also, to manually undo the reconciled subaccount transactions, you may follow the steps below.

After ensuring the subaccounts are recorded correctly, you'll want to reconcile the main account. You can refer to these articles to guide you further about the reconciliation processes:

Moreover, you can print or export a reconciliation report once you've finished reconciling your books. It includes a summary of your beginning and ending balances and lists of transactions that were cleared and left uncleared when reconciled.

Keep us updated if you have further clarifications about reconciliations. We'd be delighted to assist you. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here