Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI can provide some information about adding new categories in QuickBooks Self-Employed (QBSE), @moh-gaafar88.

The categories we have in QuickBooks Self-Employed are in line with the Schedule C categories the IRS has for self-employed individuals. The feature to create a new category isn't available yet.

However, our Product Development team is now working on how to approach dynamic categories while maintaining their main use as tax categories for self-employed individuals.

For now, you can visit the QuickBooks Blog to check for new updates and features that we have.

See this article for more information about schedule C and expense categories in QuickBooks Self-Employed.

Here's a detailed guidance on how to manually add transactions in QuickBooks Self-Employed and on how to categorize transactions in QuickBooks Self-Employed.

Let me know if you still have questions about the categories that we have in QBSE and or anything else by leaving a reply below. Take care and have a wonderful day!

How about personal transactions?

How about personal transactions

Any advice?

Hello there, moh-gaafar88. Thanks for getting back to us.

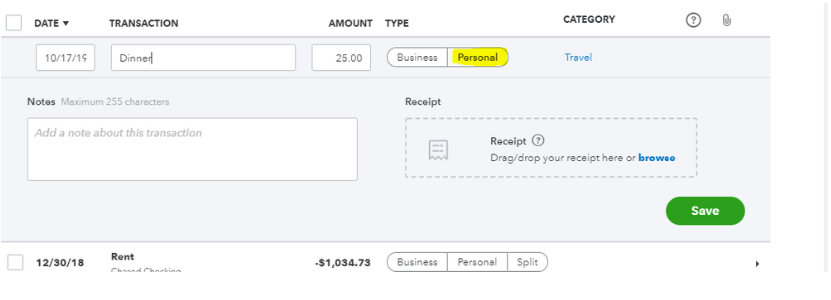

For personal transactions, you can add them directly in QuickBooks Self-Employed. Within the Transaction menu, you can record your personal transactions. To guide you further, please follow these steps:

Anytime, you can check this reference to learn more about categories in the program. If ever you're unsure on what category should be assigned to a transaction, it would be best to reach out to a tax expert. This helps you ensure you'll be keeping your data accurate in your QuickBooks Self-Employed account.

I'm adding this article as an additional guide when you're using your mobile device: Manually add a new transaction.

Please let us know if you have other questions about QuickBooks. Anytime, we're here to assist you further. Take care always.

I'm from South Florida and we are dealing with losses from Hurricane Ian. One of my clients has QBO Self-Employed. We would like to add a dedicated category to set apart his transactions he made because of business losses. We aren't sure what is going to be tax deductible but it would help to have these trans all in one place. Since you are not allowing me the capability of adding a specific category - do you have any suggestions?

Hi Debbi,

Hope you and your clients are fine.

We're unable to give out advice on what category to use on your clients' transactions. However, we have an article that you can use as a reference when categorizing their losses. Please check this out: Schedule C and expense categories in QuickBooks Self-Employed. We would normally advise posters to refer to an accountant about accounting questions.

If you want to see more references for QB Self-Employed, you can visit the main support page, scroll down a bit, and click More Topics.

Let me know if you have more questions about your client's transactions. Take care!

I think the reply from 2021 missed the actual point of the question. Like the previous poster I want to add a personal category.

Quickbooks Self-Employed is advertised as perfect for those people who are managing a small business AND managing their personal finances in one application. Part of that will be adding categories for PERSONAL expenses

You can create a new category by creating a new transaction, then in category dropdown , click on Add category , then a category will be added in your quickbooks.

This is currently not possible with QB Self Employed. People have been requesting this for several years, but it has still not been added.

It seems obvious that self employed businesses will need custom categories for their business accounts.

If anyone using QBSE would like this to be added please add your vote here: https://quickbooks.intuit.com/learn-support/quickbooks-idea-exchange/allow-users-of-qb-self-employed...

If the post gets 50 votes, apparently Quick books will 'consider' it. Please add your vote & hopefully something will be done to resolve this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here