Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt's great to see you in the QuickBooks Community, jrcp! I wish you're doing well. Let me guide you on importing your QuickBooks Online to Turbo Tax.

Currently, there is no direct method to complete this process. However, we can import your QuickBooks Online account into QuickBooks desktop, and then transfer the data to your Turbo Tax Business Desktop account.

If you don't have a QuickBooks Desktop account. We can download your data using a free trial version of QuickBooks Desktop and access the latest version and edition.

After downloading the Desktop Version, you need to export the data to QBDT and transfer it to your Turbo Tax Business Account.

After doing so, you can check this article for the step-by-step guide on importing your Desktop data to Turbo Tax Business: How do I import QuickBooks data into TurboTax Business?

If you have any questions about importing your QuickBooks Online data to your TurboTax Business Desktop Account, feel free to reply to this thread or start a new one. Have a great day and take care!

You need to run the trial version of QB Desktop to convert data from QB Online and export your data to TurboTax Desktop. Did you encounter any issue?

I followed the steps and sucessfully imported all the data that the import tool would import. However, when I run my profit and loss report, all the numbers are wrong. The import tool does not import any payments, thereby requiring you to redo all the payment records in quickbooks online. These payments took several days to enter into quickbooks online. I don't want to have to redo all the payments. The import process said it would not import customer payment information to protect customer credit card numbers, but my payment records have no customer identifying information, just records about how much and what type of payment (zelle, square, check and cash payments). Why doesn't the import tool import this basic payment information, thus completing the import process automatically?

I followed the steps and sucessfully imported all the data that the import tool would import. However, when I run my profit and loss report, all the numbers are wrong. The import tool does not import any payments, thereby requiring you to redo all the payment records in quickbooks online. These payments took several days to enter into quickbooks desktop. I don't want to have to redo all the payments. The import process said it would not import customer payment information to protect customer credit card numbers, but my payment records have no customer identifying information, just records about how much and what type of payment (zelle, square, check and cash payments). Why doesn't the import tool import this basic payment information, thus completing the import process automatically?

I followed the steps and sucessfully imported all the data that the import tool would import. However, when I run my profit and loss report, all the numbers are wrong. The import tool does not import any payments, thereby requiring you to redo all the payment records in quickbooks online. These payments took several days to enter into quickbooks online. I don't want to have to redo all the payments. The import process said it would not import customer payment information to protect customer credit card numbers, but my payment records have no customer identifying information, just records about how much and what type of payment (zelle, square, check and cash payments). Why doesn't the import tool import this basic payment information, thus completing the import process automatically?

Hello there, ratkiley.

I can see how important to import all your data including all the payment records and transaction types. I'll be sharing details on how migrating data from QuickBooks Online to the Desktop version works and ensures you'll be able to complete the process smoothly.

Please know your books may look slightly different when you switch from QBO to QBDT. Some features also are not transferable from one program to another. With this, the preferred delivery method and saved credit card info don't move over to PCI compliance. I recommend considering entering the mentioned details in QBDT manually.

Export limitations and unsupported Internet Explorer versions can cause mismatches in reports such as profit and loss. To correct this, open the report on an accrual basis. If the numbers are still inaccurate, follow the steps below to obtain accurate numbers or amounts.

You can refer to this article to see extra details: Move your QuickBooks Online data to QuickBooks Desktop.

In case you need any related information about moving your data from QBO to QBDT to Turbo Tax Business Desktop account, you can read this article: How do I import QuickBooks data into TurboTax Business?.

Feel free to add a comment below if you have follow-up questions about importing your data to TurboTax. I'm always around to help, ratkiley. Take care!

I really do not understand why Intuit has not set QbO to Sync with TurboTax! The back-and-forth between QbO and QbDT is just a waste of time that never seems to work as expected. Intuit needs to fix this!

LawrenceJFA

For tax year 2023 we tried doing this 3 times. WASTE of effort. We just pulled reports from QBO and manually put in the data in TurboTax. Good grief Intuit....

Maybe a duplicate. Export import fails so many ways for TY 2023. Just grab the reports and enter the data manually. (Good grief Intuit. Get your stuff together)

Ok - so this worked for me the first time although it was really clunky. But now I'm trying to do it for my 2025 tax return, but my free trial of QuckBooks Desktop has run out - I'm assuming I'm not expected to also pay for QuickBook Desktop to make this work? What can I do?

Ok - so this worked for me the first time although it was really clunky. But now I'm trying to do it for my 2025 tax return, but my free trial of QuckBooks Desktop has run out - I'm assuming I'm not expected to also pay for QuickBook Desktop to make this work? What can I do?

Ok - so this worked for me the first time although it was really clunky. But now I'm trying to do it for my 2025 tax return, but my free trial of QuckBooks Desktop has run out - I'm assuming I'm not expected to also pay for QuickBook Desktop to make this work? What can I do?

You're right, Geoffrey. You do not need to pay for a QuickBooks Desktop (QBDT) subscription to import your QuickBooks Online (QBO) data into TurboTax. Let me discuss the specifics below.

Since your QBDT free trial has expired, please uninstall the software and perform a clean installation of a new QBDT free trial. This method allows you to convert your QBO data into a QBDT file, which you can transfer to TurboTax without incurring costs. Here's how:

First, remove your current QBDT free trial.

Then, do a clean installation of the new free trial of QBDT . After that, convert your files and move them to TurboTax Desktop.

Additionally, I will share this article to guide you about the Windows version compatibility for TurboTax Desktop, ensuring smooth integration: TurboTax Experience.

Following the steps above will help you efficiently complete the process for your 2025 tax return. If you have other questions about managing your data in QBO, click the Reply button below. The Community team is always around to assist.

Did you use the trial version of QB Desktop 2024 Enterprise last year? You will need a workaround to use it again this year on the same PC. You should contact @Fiat Lux - ASIA for details.

Is this process only for transferring to Turbotax Business? What about Home and Business?

Hello, Nod! I’m thrilled to see you making your first post here in the Community.

Moving QuickBooks Online data into TurboTax's desktop tax software is not limited to just TurboTax Business for Home and Business, I will provide additional details below.

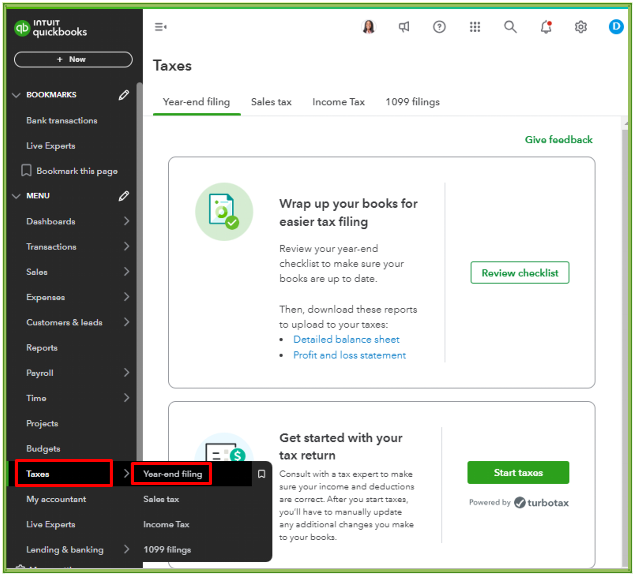

If you use QuickBooks Online, there’s no need to import your info. You can do your taxes directly inside QBO, without signing into TurboTax. Here are the steps to get started with Live Tax:

You can check this article for further details: QuickBooks Live Tax in QuickBooks Online.

However, if you are using QuickBooks Desktop and TurboTax Desktop for Windows, you can transfer some information, but not all of it. To complete your tax return, you need to enter certain expenses manually after the import process. Some of these expenses include:

Some income and expenses can't imported automatically. It's important to review and manually input any missing items.

Additionally, this feature is not compatible with Mac. Instead, Mac users can upload a .txf file to proceed.

Moreover, if you seek guidance to ensure your accounts are set up correctly, consider using QuickBooks Expert Live Assisted. This service can help streamline the setup process and effectively position your business for success.

I've also included this article about how to prepare and file your Federal and state 1099s with QuickBooks Online, which may come in handy moving forward: Create and file 1099s with QuickBooks Online.

The Community is always available 24/7. Fill me in if you need extra help in managing your home and business data or QuickBooks in general. Keep Safe!

When I called Quickbooks online support on February 17th, 2025 they informed me that the only way to transfer my QBO data to Quickbooks desktop is to hire a Pro Advisor to do it for me. I told QBO support I was getting a "1009 - Internal error: Unkown expection" when using the Quickbooks Desktop migration tool trying to import my .QBXML QBO export to Quickbooks desktop. QBO support told me this is a known issue with no known ETA for a fix (or if it will ever be fixed). They informed me that the only option to get my Quickbooks Online data into Quickbooks desktop is to hire a Pro Advisor to do it for me.

There is no longer any way for customers to get their QBO data into Turbotax on their own.

You can purchase a 3rd party service to convert 2024 data from QBO to QB Desktop for $300 + you can get $200 cashback.

@Chrea - What 3rd party QBO data conversion tool/service are you referring to? How can I find it?

You can contact @Fiat Lux - ASIA for details. They can help you about it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here