Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWelcome aboard to the Community, @joe116.

Let me show how you can record the contribution in QuickBooks Online.

You can use an equity account and add your partner as a vendor to track the contributions to your business. It allows you to check what someone invests and makes from a business through your Chart of Accounts.

To create a vendor:

In case you need to create another equity account:

Once done, we can now proceed with recording the deposit into the system. Please follow these steps:

I've also included the following articles you can use to handle the partner's contributions, like the deposit process:

Please know that I'm just a post away if you have any other questions. Have a great day ahead.

Obviously if you have a partner in the company then you do not need a NEW equity account as @AlcaeusF shows you

use make deposits and select the equity or better the equity investment account for the partner

For a company taxed as a sole proprietor (schedule C) or partnership (form 1065), I recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership)

[name] Equity (do not post to this account it is a summing account)

>> Equity

>> Equity Drawing - you record value you take from the business here

>> Equity Investment - record value you put into the business here

Dear Friend,

I have a small business.

May I use Quicbook from Banglaesh?

Hey there, @Forkan Uddin.

Thanks for following the thread.

Yes, you can use QuickBooks from Bangladesh. You can see a list of our available countries in Choose your country for QuickBooks. I've included the link to our purchasing page below.

Don't hesitate to let me know if you have further questions or concerns. You can reach out to the Community at any time. Take care!

Dear,

I am Md. Forkan Uddin from Bangldesh. I want to pay subscription from my American express card for purchase quick book online plus plun, but I can not to pay the subscription.

please help me to buy the plan.

Thanks for choosing QuickBooks Online, Forkan Uddin1 .

We offer different ways and payment methods for your QuickBooks Online plan. Here are the lists of accepted credit and debit cards for QBO subscriptions. Please be reminded that the card must have a US-based billing address. US territories are excluded.

You may also want to use a personal credit card and get reimbursed later.

Please check out these articles for additional guide and reference:

Please let me know if I can be of any additional assistance. I'd be glad to help.

@AlcaeusF thank you so much for the steps of a contribution. That’s just what I needed. Would you be so kind as to add steps to pay back that contribution. I am the sole owner of an S corp. I advanced money from my personal account to establish the business account. I want to pay myself back for that advance. Thank you!

Thank you for visiting again the QuickBooks Community, Grovegal. I'll ensure to share steps so you'll be able to pay back the contribution.

To start with, you'll have two options on how you can pay back a capital investment after you record an investment or contributions. First, you can pay with an actual check if you’re going to send someone a paper check.

Here's how:

However, if you’re paying someone back with a debit or credit card, you can record the repayment as an expense. You can click this article to see the detailed steps on how to perform the process: Enter and manage expenses in QuickBooks Online.

Lastly, you may refer to this article to view details on how you can record a loan from the officer or owner of the company by setting up a liability account in the QBO: How to record a company loan from a company officer or owner.

If you have any other questions about recording entries in QBO, please let me know by adding a comment below. I'm always here to help. Keep safe!

@ChristieAnn @Thank you so much for the reply. The article you link sets out instructions for setting up the loan or contribution but those instructions differ from the instructions of AlcaeusF whose steps included setting up the contributing officer as a vendor first. Would you please explain which one to follow. Thanks again so much.

Let me provide some clarification of what my colleague provided answer, Grovegal.

The equity account is used to record the capital investment and withdrawals to pay back the funds from the investment. In the Equity Drawing, you enter the value you take from the business. Then the Equity Investment, you record value you put into the business. Use the drawing account as the expense for the fund transfer and use the investment account as the source (from) account for a deposit. So your chart of accounts could look like this.

You can use an equity account and add your partner as a vendor to track the contributions to your business. It allows you to check what someone invests and makes from a business through your Chart of Accounts.

I'm also adding these articles for more tips about the process:

Please know that I'm just a post away if you have any other questions. Have a great day ahead.

I’m afraid that confused me more. Just need simple steps to repay an owners advance. Also, your link about owner draw is broken and cannot open the page. Thank you.

Thanks for the clarification, @Grovegal.

Allow me to step in and provide additional information about your concern.

You can follow the steps provided by my colleague @ChristieAnn in order to repay an owner in advance.

If you have a partner in the company, you don't need a new equity account. Instead, use make deposits and select the equity or better the equity investment account for the partner.

I also got here the article about the owner's draw, for reference: Set up and pay an owner's draw

You may refer to this article to view details on how you can record a loan from the officer or owner of the company by setting up a liability account in the QBO: How to record a company loan from a company officer or owner.

You'll want to consult your accountant to make sure your transactions are accurately recorded.

I'm always here if you need more help in recording your entries in QuickBooks. , I’ll be more than happy to help.

When I select the dropdown for Account, I only see my bank accounts and credit card accounts. I don't see any other accounts in my chart of accounts, such as the equity account I created for this. Is it possible my version "QuickBooks Simple Start" does not allow for this?

Thank you for following this thread, rhlindeman.

I’m here to help and guide you on how to show all accounts in your Chart of Accounts. This way, you’ll be able to choose one and add it to the transaction.

When you create your company in QuickBooks Online Simple Start and other versions (QBO), specific default accounts are added in the chart of accounts (depends on the business entity). Please know that one of these is the Equity account, which should be on the list.

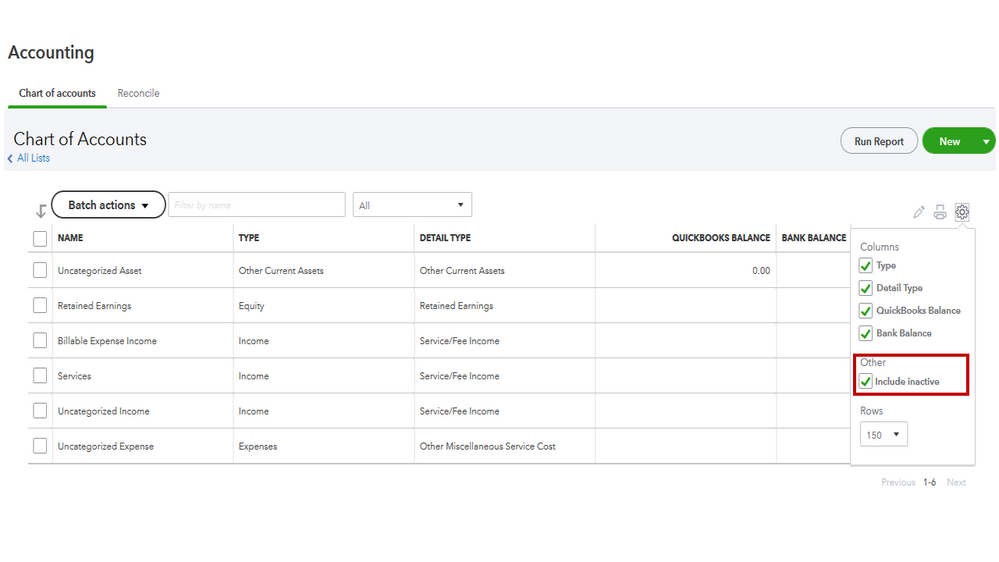

Since you’re only seeing your bank and credit card accounts, let’s tick the Include inactive box. This is to check if the Equity and other accounts are set to inactive.

Here’s how:

You can browse to this learn article for more details: Make an account inactive on your chart of accounts in QuickBooks Online. It includes tips on when to inactivate or delete an account.

After setting this option, you should see all the accounts. If it’s been deactivated, go to the Action column and click the drop-down and select Make inactive.

If none of these suggestions work, I suggest you set up the Equity account and other ones in the chart of accounts. The following reference outlines the steps on how to create it in QBO: Add an account.

For additional resources, this article will you which default accounts are created for each business entity, and which accounts you can edit, merge, or make inactive: Manage default and special accounts.

To learn more about keeping your chart of accounts organized, click here to view the complete details. From there, you’ll see the steps to create a new subaccount in the Account or New Category window.

Keep in touch if you need further assistance on how to manage your transactions and accounts in QuickBooks. I’ll be around to help and get this taken care of for you. Have a great weekend.

I figured out the issue is that I was on Business Mode (the default) instead of Accounting mode. Drove me nuts until I figured that out because every how-to article assumes you are in Accounting mode, but of course I was still in the default Business mode as a new user.

Additional related question.

Here is the situation:

$185,000 cash was received into a business with a $200,000 value purchase of stock. It is not a loan but, equity purchase.

I recorded the $185,000 as a deposit against an equity account, how do I record the $15,000 additional valuation?

Hello, Tiffiny.

I'll show you how to record this additional valuation in QuickBooks Online.

If you are buying or investing in stock, you should do so under asset account. QuickBooks Online doesn't support investing or purchasing equity.

As a workaround, you can record it as an expense to track the equity purchase. Before proceeding, you can designate the equity purchase or stock investment as a vendor, and the posting account should be asset so that it does not affect the profit and loss statement (P&L).

Here's how:

I also recommend that you contact your accountant. They may have a different method of recording the transaction to ensure your books remain accurate.

If this is a capital investment, you can learn more about how to record it in QuickBooks Online by reading this article: Record an owner's contribution or capital investment in your business.

I've included this resource for future reference to learn how to personalize your report to show only the data you need for your business: Customize reports in QuickBooks Online.

You're always welcome to post again if you have further questions or other QuickBooks concerns. We're here to help you.

Thank you!

You're welcome, Tiffiny.

It's always our pleasure to help you here in the Community space. You can also visit our Help articles page for other references. Here you can find some topics and discussions to help complete some of your QuickBooks tasks.

Have a great day, and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here