Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- How do i fix payroll after a restore of old file

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do i fix payroll after a restore of old file

Payroll was created and printed and directly deposited. Then a company restore was done with an old file. How do i get this information updated. Taxes where also e filed

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do i fix payroll after a restore of old file

Let’s work together and go through the necessary steps so we can successfully update and correct your payroll records, bejah.

Since you've processed and printed your employee's payroll already, you can recreate their payroll and ensure to enter a 0 net pay to avoid duplicate payments.

Here's how:

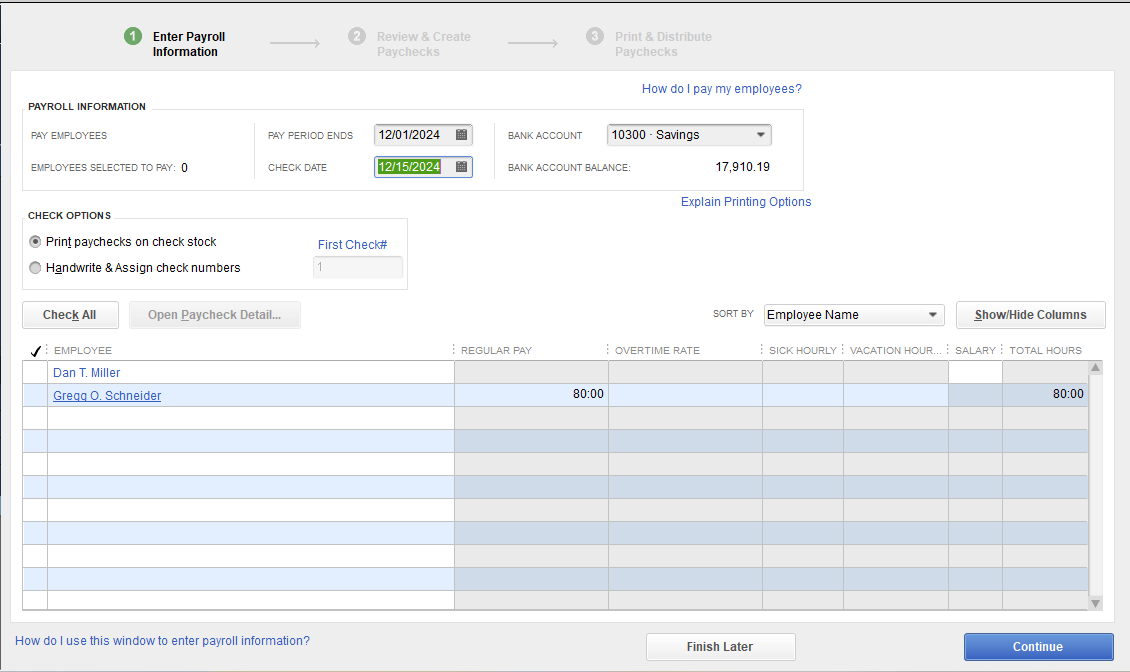

- Go to Employees and choose Pay Employees.

- Click on Unscheduled Payroll.

- Enter the check date and pay period to match the voided paycheck.

- Check the box next to the affected employee(s) and click Open Paycheck Detail.

- In the Preview Paycheck window, uncheck the Use Direct Deposit box.

- Enter the original payroll item, rate, and hours.

- In the Other Payroll Items section, add the DD Offset payroll item.

- Enter a negative amount for the DD Offset item equivalent to the net amount of the paycheck.

- Press the Tab key to change the net pay to 0.

- Click Save & Close, then Continue.

- Finally, click Create Paychecks.

Furthermore, you can refer to this article to learn how to record the tax payments: Pay and file payroll taxes and forms manually in QBDT Payroll. Then add a note to record that you're done paying.

On the other hand, if you've already e-filed and wanted to record it in your QuickBooks account you'll have the option to file it or not. You can refer to this article for detailed steps: Fix overdue or red scheduled liabilities in QBDT. This way, it will show all the forms you've recently filed.

For the latest updates and important news regarding employment taxes and payroll, be sure to check out QuickBooks' latest payroll news and updates in this article: Get latest payroll news and updates in QBDT Payroll.

Let's make sure you're getting the best out of QuickBooks, Bejah. If you ever have any questions or need help managing your payroll, I'm here to support you and find the best solutions together.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do i fix payroll after a restore of old file

Thanks, I did find a much more detailed instruction online. It explained how to set up the Direct Deposit offset item also.