Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'm here to provide some information on how you can pay an employee, @userjim-keaney.

When creating a paycheck in QuickBooks Online, a yearly payroll schedule is unavailable. You can only set up Weekly, Bi-weekly, Semi-monthly, and monthly schedules.

If you wish to set up a yearly payroll schedule, we can manually enter a payroll paycheck by creating a journal entry. By doing this, you will also need to manually calculate your taxes.

To begin, make sure to create a manual tracking account to help track your payroll liabilities and expenses. Then, after you pay your employees (yourself) outside of QuickBooks, create a journal entry.

Use the info from your payroll report to create the journal entry. For more information, please check out this article: Manually enter payroll paychecks in QuickBooks Online.

In case you want to get a closer look at your business's finances, and information about your employees, there are several payroll reports you can use to view them. For further information, you can check out this resource: Run payroll reports in QuickBooks Online Payroll.

Feel free to leave a comment below if you have other questions about creating a paycheck to pay your employee in QuickBooks. I'll be around to help you. Keep safe and have a good day!

This is a ton of work and frankly defeats the point of having this Payroll Add-on service. Can't QBO just add a 'yearly' option to their existing Payroll system that calculates accurate taxes?

Your ideas matter to us, userjim-keaney.

I can see how the ability to add a yearly option when paying employees would be beneficial to your business. I'd recommend sending a feedback request directly to our Product Development team. It helps us improve the features in the program.

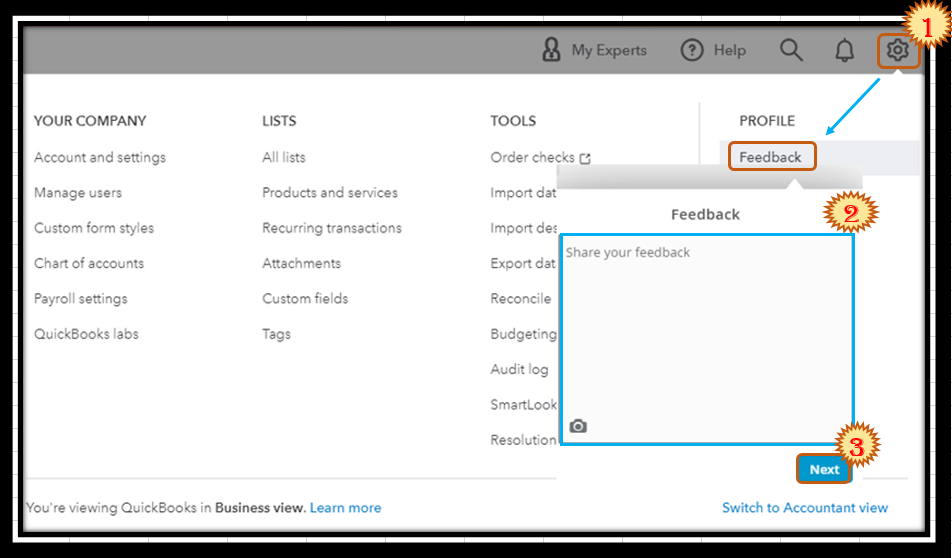

Here's how:

You can track the request through the Customer Feedback for QuickBooks Online website.

Additionally, here's an article that'll help you learn more about paying your employees: Create and Run your Payroll.

I'm only a few clicks away if you need assistance running payroll. It's always my pleasure to help you out.

Will Quickbooks still generate the W2, 940 and 941 if you use journal entry to create an the annual paycheck?

Will Quickbooks still generate the W2, 940 and 941 if you use journal entry to create an the annual paycheck?

Will Quickbooks still generate the W2, 940 and 941 if you use journal entry to create the annual paycheck?

Hello there, micah1054.

Let's ensure you'll get the correct information about populating forms within QuickBooks Online.

The W2, 940, and 941 forms will generate as long as your payroll subscription is active and you've run payroll.

When creating a journal entry for the annual paycheck, it'll not track all your employee's data in the forms. What we can do is work directly with your payroll service (if you don't have a QuickBooks payroll subscription). This way, we can get the year-end forms you need and file them outside our program.

We can run some of our payroll reports and use them as a reference when entering your employee details and other data outside QuickBooks. Feel free to utilize this link and review the payroll reports according to your needs: Run payroll reports in QuickBooks Online Payroll.

Here are some articles that you can read through for more tips about payroll forms:

Please let me know if you have additional questions about payroll forms and managing employee details. I'm always here to help in any way that I can. Take care and stay safe.

Hi SarahannC,

My payroll subscription is active, however, I have not ran payroll at all this year.

Are you saying I can make the journal entries and then quickbooks will still generate the W2, 941-4QT, and 940-annual or do I have to create those myself.

Also, any suggestions on how I can generate the correct taxes for federal and state to put into the journal entires, including the employer portion?

Thank you for getting back to us, @micah1054.

Allow me to chime in and share some information about generating forms using Journal Entries (JE) in QuickBooks Online.

Entering JE in QuickBooks can track your payment totals. However, it doesn't create data you'll need in payroll forms.

Are you a new user of QuickBooks Online Payroll? If yes, I advised you to create a Prio Payroll to generate the taxes in W2, 940, and 941.

You can follow these steps for the complete instructions.

I also recommend reaching out to our Payroll Support Team. They have available tools to help you get your year-end forms.

Here's how to contact them:

In addition, you can check these helpful links to learn how you can manage your payroll account: Help Articles for QuickBooks Online Payroll.

When you're ready to file and pay your payroll taxes, you can also open this article as your guide: Pay and file payroll taxes online.

Please let me know how else I can help you with your payroll transactions. I'm always here to help. Have a good one!

Did you find a solution to this?

Good day, @10990.

It's my pleasure to provide the help you need. To do so, I need more information about what concern you have. Are you having difficulty with running payroll? Do you need help with handling taxes? Please know that any additional data would help us get on the same page.

I'll be on the lookout for your response. Have a great day.

yes, I would like to know how to pay an entire salary in 1 payment. I don't see the annual as pay schedule option. Only weekly, biweekly, monthly. I read somewhere about creating a journal entry however I would like to do it so it shows a w2 and tax deductions.

Thanks for posting here, @10990. Let me share insights into paying or recording an entire salary in one payment.

Recording an annual payment with tax deductions seems essential in your business. I recommend editing your employee's pay type to ensure accurate recording of employee payments. It will include the W2 and tax deductions in the calculations. Also, this will help to streamline the payment process and minimize the risk of errors. Let me show you how:

Moreover, I suggest scanning this article to guide you once you file and pay payroll taxes: Pay and file payroll taxes and forms electronically in QuickBooks Online Payroll.

You're always welcome to post here in the Community space. Count me in if you need additional help managing payroll in QBO. I'm always ready to assist. Take care, and have a great day.

I realize this is a year later, but I just figured out a work around. I chose my salary frequency as monthly, and put in the entire year's salary amount. Then I put the employee's pay frequency as monthly as well. Hopefully this will help someone else!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here