Manually enter payroll paychecks

by Intuit•93• Updated 3 months ago

Learn how to create journal entries for paychecks you create outside of QuickBooks.

If you use QuickBooksfor accounting and another service to run payroll, you still need to keep track of those paychecks in QuickBooks. We call paychecks made outside of QuickBooks with services like ADP or Paychex third-party paychecks.

Some payroll services let you import paycheck data directly into QuickBooks. If your service doesn't have this feature, we’ll show you how to manually track these payments as journal entries. This keeps your payroll and account data all in one place.

| Important: Manually entering payroll paychecks into QuickBooks Online tracks your payment totals. However, it doesn't create the data you'll need for your employee's W-2s. You'll need to work directly with your payroll service to get your year-end forms. Keep in mind, journal entries require an understanding of debits and credits. If you have specific questions about your Chart of Accounts, reach out to your accountant or find a ProAdvisor. |

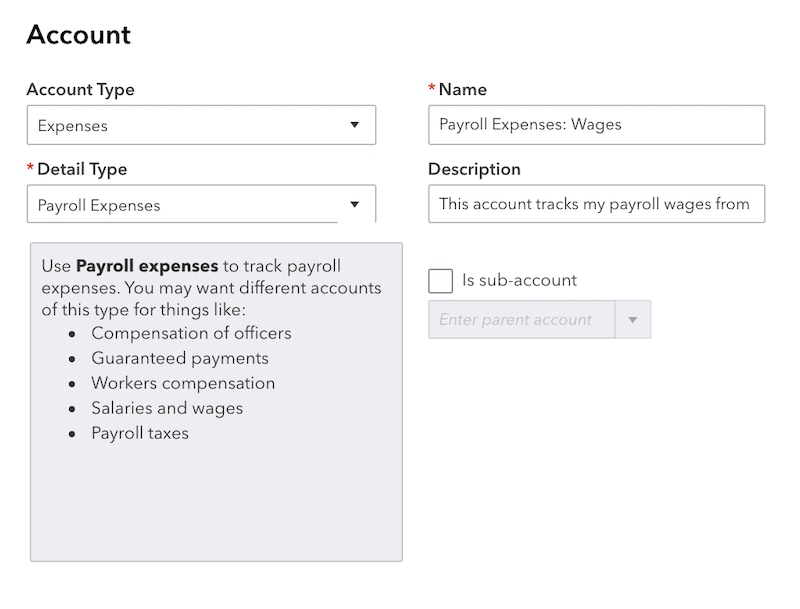

Step 1: Create manual tracking accounts

If you haven't already, follow the steps to create new accounts in your Chart of Accounts to track your payroll liabilities and expenses.

Create these expense accounts. Select Expense as the account type:

- Payroll Expenses: Wages

- Payroll Expenses: Taxes

Create these liability accounts. Select Liabilities as the account type:

- Payroll Liabilities: Federal Taxes (941/944)

- Payroll Liabilities: Federal Unemployment (940)

- Payroll Liabilities: [State] SUI/ETT

- Payroll Liabilities: [State] PIT/SDI

Note: These accounts cover most common payroll tax situations. You may need to create additional accounts for taxes specific to your state or locality.

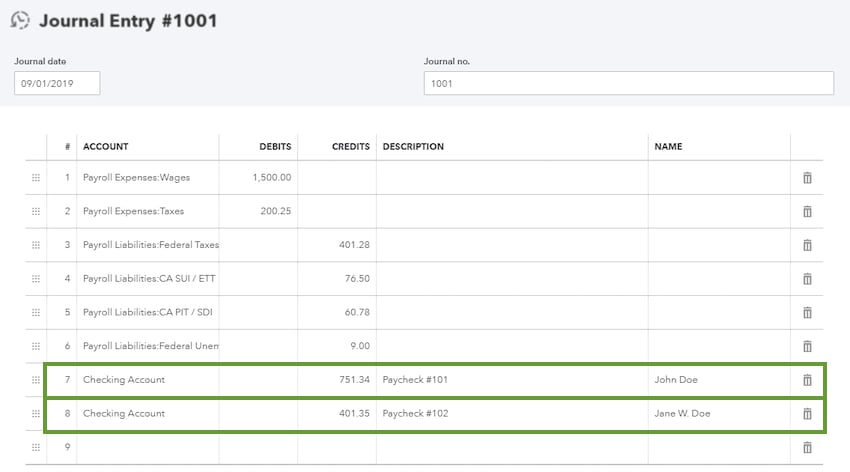

Step 2: Enter the payroll paychecks into QuickBooks Online

After you pay your employees outside of QuickBooks, create a journal entry.

- Get your employees' payroll pay stubs or a payroll report from your payroll service.

- Select + Create.

- Select Journal Entry.

- Under the Journal date, enter the paycheck date.

- If you want to track the paycheck number, enter it in the Journal no. field.

Use the info from your payroll report to create the journal entry. If you paid multiple employees for the pay period, you can combine all of their paycheck totals into one journal entry. You can also create separate journal entries for each employee if you need to break out the details.

Add gross wages

- Select Payroll Expenses: Wagesfor the account.

- Enter the amount as a debit.

Add employer payroll taxes

- Select Payroll Expenses: Taxes for the account.

- Enter the amount as a debit.

Note: You can combine the following taxes into one debit, or add each tax item as separate debits: Social Security Employer, FUTA Employer, Medicare Employer, State Job training taxes and State unemployment insurance.

Add taxes paid towards 941 or 944 taxes

- Select Payroll Liabilities: Federal Taxes (941/944) for the account.

- Enter the amount as a credit.

Note: You can combine the following taxes into one debit, or add each tax item as separate debits: Federal Income taxes, Social Security Employee, Social Security for Employer, Medicare for Employee, and Medicare for Employer

Add state unemployment insurance taxes.

- Select the Payroll Liabilities: [State] SUI/ETT Liability for the account.

- Enter the amount as a credit.

Note: You can combine the following taxes into one debit, or add each tax item as separate debits: State Unemployment Insurance and State Employment Training Tax

Add state income taxes

- Select Payroll Liabilities: [State] PIT/SDI for the account.

- Enter the amount as a credit.

Note: You can combine the following taxes into one debit, or add each tax item as separate debits: State Personal Income Tax and State Disability Insurance.

Add federal unemployment taxes (FUTA).

- Select Payroll Liabilities: Federal Unemployment (940) for the account.

- Enter the amount as a credit.

Add net wages

- Select the checking account you're paying your employees from.

- Instead of combining them, enter each individual paycheck on separate lines. Enter the amounts as credits.

When you're done entering the debits and credits, select Save.

More like this

- Pay and file your local taxes in payrollby QuickBooks

- Report third-party sick payby QuickBooks

- Handle a direct deposit paycheck that was not received by an employeeby QuickBooks

- Set up and manage Massachusetts Paid Family and Medical Leaveby QuickBooks