Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI submitted my 1099-NECs for successfully but realized that I missed one person (because her account was not included in the account list). How do I go about submitting that one person?

Solved! Go to Solution.

Good morning, @dbland07666! Hope your week is going well so far. :)

Thanks for coming back to the Community and clarifying. Yes, you'll follow those same steps you did for the other contractors. Just in case, here they are:

As always, if you have any more questions, don't hesitate to reply to this post. We're all happy to help!

Hello, dbland07666.

Congratulation on successfully submitting your 1099-NECs in QuickBooks Online. I'm here to ensure that you'll be able to submit another 1099 of your contractor.

First, you'll need to add your contractor in QuickBooks Online to be able to include her account in the list. I'll guide you on how to do it:

Second, let's create your 1099s in QuickBooks Online. You can refer to this article for more detailed steps and information on how to create and e-file it: Create and file 1099s using QuickBooks Online.

Lastly, you'll be notified of your filling status through email.

If you have any other questions, don’t hesitate to comment below. Stay safe!

Thanks AileneA ,

To clarify, am I correct that you're saying I just need to follow the normal steps of submitting 1099s and QBO will be smart enough to know that I'm just adding a new contractor? In other words, same exact procedure as what I do to begin with?

Good morning, @dbland07666! Hope your week is going well so far. :)

Thanks for coming back to the Community and clarifying. Yes, you'll follow those same steps you did for the other contractors. Just in case, here they are:

As always, if you have any more questions, don't hesitate to reply to this post. We're all happy to help!

That really doesn't answer the question. I have the same problem. But I do not want to submit all 1099's again. So the question is will QBO just submit the one contractor that was missed?

You’ll need to file the 1099 form for that contractor, @Romansjen.

AS mentioned above, you’ll want to follow the usual instructions of submitting 1099s. When you file with us, we also take care of mailing printed 1099 copies to your contractors so they can use it for their tax filing.

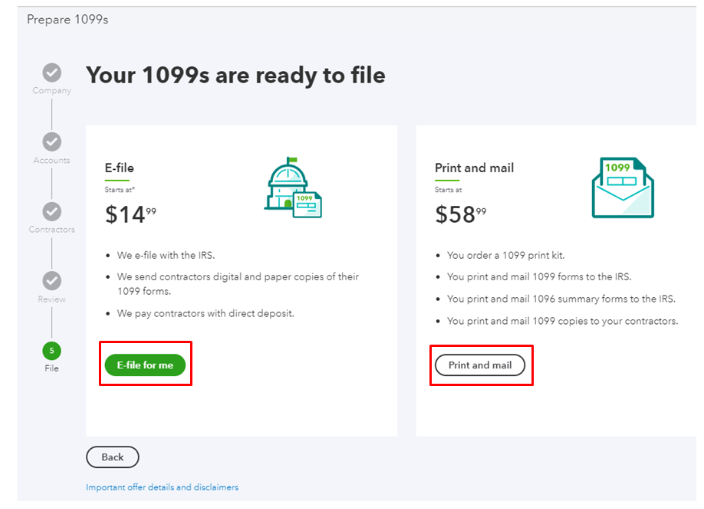

You can refer to my peer instructions above to prepare the form. Then you follow these steps to get them ready to e-file or print:

You can check this article for complete instructions when preparing and filing the 1099's using QuickBooks Online. This reference also includes steps to check your filing status.

Please let me know if you have other 1099 questions. It's our pleasure to be of great help. Have a good one!

I too have this issue. I found out I have another contractor to submit after an e-File was performed. I added the contractor in Quickbooks online, Prepare-1099, Verified the contractors are correct this time, Clicked on E-File for me, then the Intuit e-file service does not list the added contractor.

How do I e-file the added contractor??

Hello there, @rossmedia.

You'd want to make sure to select only those newly-added contractors. Also, you'd want to make sure that it meets all the necessary criteria.

Once you have reviewed your vendors information, you can try viewing your vendor or contractors 1099 list. Here's how:

Lastly, I've added these articles to further assist you with managing your 1099-related transactions:

Swing by here again if you have other questions or concerns. The Community always got your back!

After I select only those newly-added contractors per your instruction, are you referring that selection in step 7? "Mark the tick box of all the vendors you want to include."?

The issue is after your Step 9- I click on "Finish preparing 1099s", "E-file for me", I'm redirected to a site "Intuit 1099 E-File Service". There, I do not see the additional contractor I want to include. Just the one I've submitted in the past.

ok, I was able to figure this out now. I needed to click on "Review your info" on the 1099 E-File Service menu and saw the added contractor where the status was not-submitted. I was able to continue from there and submit that 1099.

I need to file a 1099 that I missed after filing already. Ive added contractor. Followed the 1099 procedure Company/Accounts/Contractors/Review. Upon completion, the pop up window states your 1099s are ready to file. It does not progress to pay method etc. How do I get to the next step Payment then actual filing?

Thanks for following this thread, @Tempest. I'll be your QuickBooks guide today.

Since your 1099 has already been filed, you will need to manually amend it and work directly with the IRS. You can use these IRS instructions to do so.

For further information, see Correct errors on Forms 1099-MISC.

Once corrected, you will need to provide the corrected return to the recipient or contractor yourself.

I'll be here if you need more help. Take care!

I tried the steps to add a contractor and to file the additional 1099, but it keeps tell me that it has already been done successfully. I only see the original 1099 that was filed not the additional one that I am trying to add. What do you suggest?

I appreciate you joining in this thread, mhdenman. Allow me to share some information regarding filing an additional 1099 in QuickBooks Online.

At this time, QuickBooks Online only allows you to file your 1099 once. However, any updates, additions, or corrections can be made in a printed copy and sent in by mail to the IRS.

Here's how to file the amended form:

Please refer to the IRS general Instructions for Certain Information Returns for the information you'll need to prepare. Additionally, you can visit this link for more details about this process: How to correct or change 1099s in QuickBooks

In case you need help with printing your 1099s, here's an article for your reference: Create and file 1099s using QuickBooks Online. On the same link, you'll find the steps on how to E-file your forms as well as a guide on how to check the filing status.

I want to make sure your concern is fully addressed and I'm here to provide further assistance if you have any other 1099 questions or QuickBooks related concerns. Have a great rest of the week!

Yes

Is this a robot answering this question with a non-answer? Let’s get with it guys and only reply with usable information!

How can I send a 1099 to one contractor without sending them all at the same time.

You simply need to select the contractor's name when preparing your 1099, @bkb17890.

Let me go over and discuss further details on how you can achieve this task.

You can prepare 1099 for that contractor using the usual way. I'd be happy to guide you how:

I'd also recommend reaching out to the IRS so they can assess the fees.

I've got a compilation of commonly asked questions about 1099 that you'll find handy: Get answers to your 1099 questions.

Accessing 1099 reports is easy with QBO. To do so, you can pull up the 1099 Transaction Detail report.

I'm still willing to lend a hand if you need more assistance in preparing 1099. Just leave a reply below and I'll circle back to help you out.

Hello. I just want to be sure that all of the 1099s will not be resubmitted if I am only trying to add one additional. Is the program smart enough to just see that new vendor and only file that one?

I can assure you that only one additional vendor will be re-submitted, SamIAm.

You need to follow the same steps when you first submitted the first batch. And, I'm glad to provide the steps:

After submitting the additional vendor for 1099, we’ll notify you of your filings’ status through email. Check the status anytime and view previous field forms through your 1099 E-File account.

Don't hesitate to leave a comment below if you need further assistance with submitting an additional 1099. I'll be right here to help you. May good luck always follow when running your business.

Prepare 1099s does not appear in the upper right corner.

Good day, 9130 3477 0035 5936. Thanks for joining this thread.

I'll help figure out why the option to prepare a 1099s doesn't appear on your end.

A cache-related issue can be the reason for this. When a browser's cache is full, it can cause some odd behaviors within QuickBooks.

Let's confirm this by using an incognito or private window:

Log in to QuickBooks, then check if Prepare 1099s feature appears on your Expenses window. If you do, go back to the regular browser and clear the cache. This deletes the webpage data that's causing the issue. Alternatively, we can use another supported browser to submit the forms.

I'm adding this articles for further information about 1099:

Keep us posted if you need a hand with filing other year-end reports or any QuickBooks concerns. I'll be here to help.

What about an amended 1096 - please confirm we do not need to send a 1096.

I don't see PREPARE !)(( IN THE RIGHT HAND CORNER. CAN YOU POST A SCREEN SHOT

Thanks for joining this thread, erakala.

You can find your Prepare 1099s button on the Vendors screen.

Here's a screenshot showing where it's located:

If you're still not seeing it, I'd recommend checking your browser. It's possible this could have something to do with temporary internet files. Browsing applications store these types of records, but sometimes they can cause issues with certain webpages. You can open a private window and check to see if you're able to see the Prepare 1099s option.

Here's how to access incognito mode in some of the most commonly used web browsers:

If you're able to see your Prepare 1099s button while browsing privately, it's safe to say this problem's being caused by the browser. It can be fixed by clearing cached data and Intuit-specific cookies.

In the event it continues occurring while you're browsing in incognito mode, you'll initially want to try switching to another browsing application.

Here's a list of supported browsers

You can also check a browser's compatibility with QuickBooks by utilizing our browser health checkup tool. QuickBooks supports the current and two previous versions of browsers. If you find that you're using an unsupported version, make sure to update it to its latest release. Steps for doing so can be found on the particular company's website.

In the event you've found no problems that could be causing this with your browser, I'd recommend using a different device and/or internet connection. If it continues happening on other devices and/or internet connections, you'll want to get in touch with our Customer Care team. They'll be able to pull up the account in a secure environment, conduct further research, and create an investigation ticket if necessary.

They can be reached while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

I've also included a detailed resource about system requirements for QuickBooks which may come in handy moving forward: System requirements

If there's any additional questions, I'm just a post away. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here