Correct or change 1099s

by Intuit•295• Updated 3 days ago

After you file your 1099-MISC or 1099-NEC forms, and they have been accepted by the IRS, if you need to correct an error or filing follow the below steps. If your form is rejected, see Fix rejected 1099 forms.

Important: As per IRS regulations, you must file corrections the same way the original forms were filed. If you e-filed your original form, you must e-file your corrected form. If you printed the original form, you must print the corrected forms. For more information see Understand the IRS regulations for filing 1099s and W-2s and E-file Forms 1099 with IRIS.

If you're using QuickBooks Desktop Payroll, and e-filed with Tax1099, you can correct your 1099-NEC or 1099-MISC in Tax1099. For instructions, refer to this Tax 1099 article, Different types of 1099 corrections after forms have been submitted.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

QuickBooks Online, QuickBooks Contractor Payments, or QuickBooks Online Payroll

- If the IRS rejected your 1099 forms, you can't correct rejected forms. See Fix rejected 1099 forms to learn how to void them and file new ones.

- If you need add a contractor or change an amount: Learn what to do if you need help adding a contractor or changing an amount when you create your 1099s.

- If you haven't filed yet: Learn how to fix missing info and e-file.

- If you've already filed: If you filed your 1099s in QuickBooks Online, you may be able to correct 1099s directly in your product.

Check out this video to see how to correct 1099s in QuickBooks Online Payroll

Step 1: Confirm the IRS accepted your 1099s

- Go to the 1099 filings tab

- For QuickBooks Online and QuickBooks Online Payroll : Go to All apps

, then Expenses & Bills, then 1099s (Take me there).

, then Expenses & Bills, then 1099s (Take me there). - QuickBooks Contractor Payments only: Go to 1099 filings.

- For QuickBooks Online and QuickBooks Online Payroll : Go to All apps

- In the Status column, look for Accepted.

Note: The IRS must accept the 1099 before you can correct it. If your forms were rejected, see Fix rejected 1099 forms to learn how to void them and file new ones

Step 2: Correct your contractor's information in QuickBooks

If you haven’t done so already, correct the contractor info in QuickBooks. The info for 1099 corrected forms comes from your contractor transactions.

Step 3: E-file your 1099 correction

- Go to the 1099 filings tab

- For QuickBooks Online and QuickBooks Online Payroll: Go to All apps

, then Expenses & Bills, then 1099s (Take me there).

, then Expenses & Bills, then 1099s (Take me there). - For QuickBooks Contractor Payments only: Go to 1099 filings.

- For QuickBooks Online and QuickBooks Online Payroll: Go to All apps

- Select Correct next to the form you want to fix.

- Important: Your business info must be the same as the original file accepted by IRS. If you’ve made changes since you filed, change them back.

- The accounts and boxes you previously chose will appear. These are the accounts that represent the QuickBooks Payments or expenses you paid to your contractors, and the corresponding 1099 box.

- If you want to change the 1099 box, select the dropdown ▼ next to the account and select the 1099-NEC or 1099-MISC box that represents the type of QuickBooks Payments made to your contractors.

- Select Next.

- If you make any changes to your accounts or 1099 boxes, you’ll get a message that other 1099 forms may also be affected.

- Check your other contractors' 1099 forms and fix if needed.

- Select Got it to continue.

- Confirm if the Corrected total reflects the accurate payment amount.

- Note: if the contractor payment total is now below the 1099 threshold, and they no longer need a 1099, the Corrected total will be $0.00.

- Check your contractors' personal info and email addresses.

- Select Edit ✎ to make any changes.

- Select Next.

- The next step may vary depending on what you need to correct:

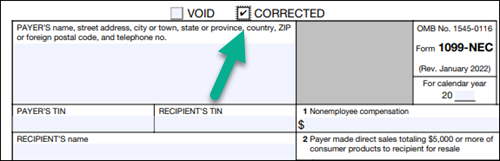

- If you updated the recipient's name or TIN: If you updated the recipient (your contractor or vendor) name or TIN, you’ll need to void their previous 1099 form, before you can continue to file a correction. Once voided, you can continue to file your 1099. Select Void and continue to void the previous 1099 form.

- If you’ve updated the recipient's address: The IRS doesn’t recognize address changes as part of the 1099 corrections. If the contractor's address is wrong, update their profile in QuickBooks for future filings. You don't need to file a corrected 1099 with the IRS for address changes only. Select Got it to continue.

- Select Preview to view each corrected 1099.

- Select Next.

Step 4: Check state filing requirements

- Review your state's filing requirements. You may need to take additional steps after we correct your federal form.

- We can e-file for states that participate in the Combined Federal/State Filing (CFSF) program.

- If your state isn't supported, you may be required to file directly with the state agency. Select Next.

Step 5: E-file your corrected form

- Select E-file corrected form.

- Follow the on-screen steps to file your corrected 1099.

Note: We won't email or mail copies of corrected 1099 forms to contractors. You must provide a copy to the contractor yourself.

FAQs

Related Links

More like this

- Understand the IRS regulations for filing 1099s and W-2sby QuickBooks

- Create and file 1099s with QuickBooks Onlineby QuickBooks

- Modify your chart of accounts for your 1099-MISC and 1099-NEC filingby QuickBooks

- Create and file 1099s with QuickBooks Contractor Payments if you use QuickBooks Desktopby QuickBooks