Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let's update the payroll settings, Matt162. I'm here to help you.

You can follow these steps:

If you're unable to update it, you may have the payroll core subscription. You'll want to reach out to our customer care support so an agent can make the update for you.

Once you create paychecks, the unemployment tax will no longer be deducted.

Don't hesitate to get in touch with us if you have other payroll concerns. We'll reply as soon as we can.

Thanks Kristine - I am a core subscriber so I cannot change this. Just to check before I contact customer support. I don't believe I have to pay FUTA in TX but I do in SC. Is the process the same?

Thanks for coming back for more support, @matt162. Yes, the process of paying FUTA in QuickBooks Online is just the same.

To ensure compliance with the state payroll tax regulations, check out this article: South Carolina Payroll Tax Compliance. There, you'll find details on tax forms, withholdings, unemployment, and other tax information.

Feel free to message here again if you have additional questions. We're always delighted to be of your service.

Hi folks

I don't think I am being clear here - apologies, let me ask again a different way.

We don't have to pay payroll tax in Texas even though that is where we are incorporated. The TX state documentation confirms it as we are a non profit with one employee.

We do have to pay payroll tax in SC as that is where our one employee is located.

QuickBooks is asking me for my TX tax account number (for withholding) but I don't have one or need one.

Why is QB asking for this info as part of payroll setup?

It is in the section in payroll that says:

Provide critical tax information ASAP.

We're missing some important information we need to pay and file your payroll taxes.

IMPORTANT: We can't pay or file your payroll taxes electronically until you provide the following information. If you need help applying for or finding this info, please contact the tax agency.

Thanks for getting back to us with more detailed information, matt162.

Yes, you don't need to file for Unemployment tax for the employees whose addresses are the same as your work location state. However, the employees working in a state outside your work location state, they are still subject to work-based taxes such as State Unemployment Insurance. These details are mentioned under the Multistate situations section of this article: About multistate employment payroll situations.

Meanwhile, I'd recommend contacting your state to get the tax account number. From there, we can reach out to our Payroll Support Team to update the details.

Keep us posted so we can assist you in any of these details that need to be updated.

Hi Folks

Really love the responsiveness here but I would question whether anyone is actually reading my question with an intent of understanding my problem. I'm sure that means I'm asking something stupid but let me try a third time.

I understand I have to pay State unemployment taxes in SC. I have registered. When I get the numbers I will put them in. All good.

To comlplete the payroll set up QuickBooks is asking me for my TEXAS tax account number (for withholding) but I don't have one or need one. Why is QB asking for this TEXAS info as part of payroll setup?

Can anyone help?

Thanks for adding more information about your concern, matt162.

I can see that the company is not subject to unemployment taxes. Since the business is based in Texas, QuickBooks will ask you for the tax details.

This is to ensure your taxes and forms have the correct information. Also, the data displayed on the tax forms is based on what’s entered in the online program.

If you don’t have the state account numbers yet, you can select No and enter them later. I also suggest contacting the state agency and check with them if you still have to get the account numbers.

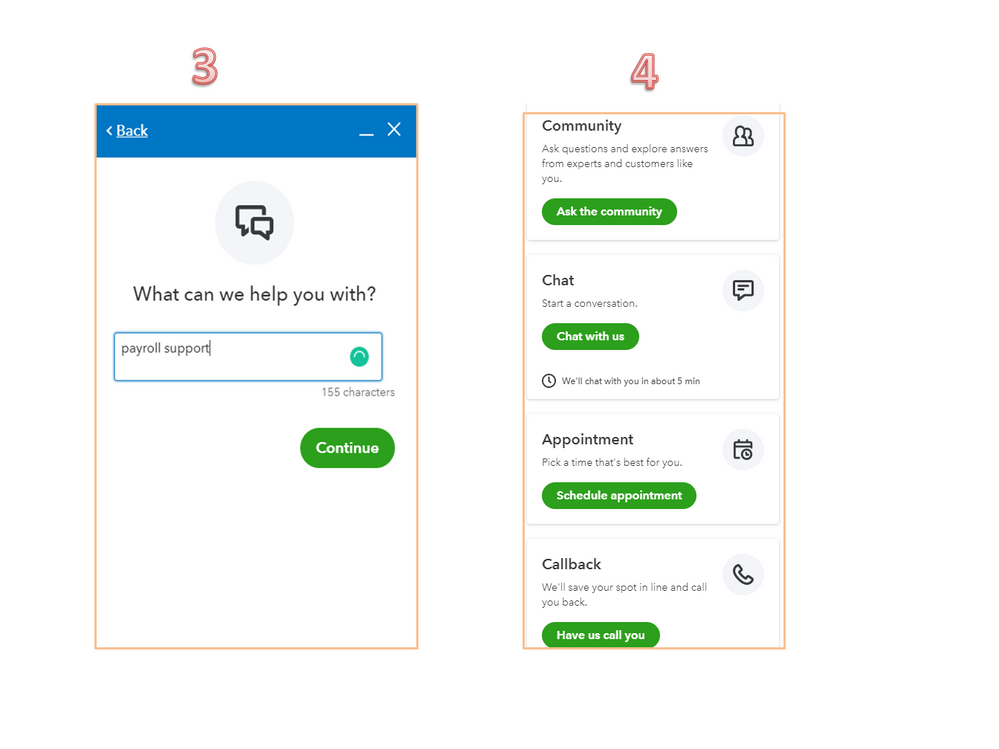

If still encounter any issues in setting up your payroll, I suggest contacting our Payroll Support Team for further assistance. One of our specialists will collect personal details to open an account. They also have tools to help you continue setting up the payroll service.

You can bookmark this link for future reference. It contains resources that will guide you on how to perform payroll tasks in QBO.

Feel free to visit the Community again if you still have other QuickBooks concerns. I’ll be around to help and make sure you’re taken care of. Have a good one.

i have a business only in MA, which borders CT, i have employees that live in CT but work at office in MA, how do i stop QB from asking me to setup a new state where an employee lives, not where they work. I confirmed this with my CPA.

Good day, @info933. I'll share info about the payroll prompts you're getting.

Where your employees live and work determines the state payroll taxes you and they are subject to. To prevent QuickBooks from displaying the setup message, you can add a work location for the employees, even if they don’t actually work in that state. Don't worry, you'll have the option to tax-exempt them if they aren't liable for taxes in that state.

Here's how:

Would you like an overview of your payroll totals, including employee taxes and contributions? You can generate a Payroll Summary report in QuickBooks for any date range or group of employees to get this information quickly.

Please let me know if you have additional questions about the prompt message you received in QBO Payroll. I'll be here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here