Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHi @ChameleonIT,

It's great to know that the steps provided by my peer above have helped sort out your query.

As for the SEP IRA amount, I suggest reviewing the setup of this deduction. I've tried replicating this on my test account and it does calculate the paycheck total - SEP.

I recommend following the steps listed in this article for the deductions: Massachusetts Paid Family Leave.

If ever you encounter issues setting up this deduction, please feel free to contact our Technical Support team for assistance.

Here's how:

Have other questions in mind? Post them in the comments below, and I'll be sure to get back to you.

Sorry this answer does not help me at all. I have had the SEP set up for 20 years! What would I possibly be checking here?

Hi there, ChameleonIT,

The calculation of SEP will depend on how you set up its tax tracking type in the system.

You need to check and ensure this item is entered correctly so QuickBooks will calculate taxes correctly. Here's how:

Learn more about setting up benefits in QuickBooks Desktop through this article: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.) for more details.

Let me know if you have follow-up questions. I'm always around whenever you need assistance.

Hi there-

I have not seen yet that you found out if Quickbooks Desktop Payroll will be handling the contribution entries or if we must enter a manual entry.

Does anyone know? We have QB perform all our Payroll functions/taxes/ filing etc. Just not sure if they will now file for this or not.

Thank you,

Susann

Hi Susann,

If you're using QuickBooks Assisted payroll, Intuit will file your Paid Family and Medical Leave taxes to your state agency.

You can reach out to our Assisted Payroll Support Team. They can pull up your account and will be able to verify the status of your return.

Otherwise, you'll have to file and pay it manually if you're using the regular payroll. You can visit the MA Paid Family Leave for employers website for additional information on how to file your taxes.

You can learn more in this link about how QuickBooks handles Massachusetts Paid Family Leave.

For future reference, check out this article that will serve as guide to help prepare your tax forms: Year-end checklist for QuickBooks Desktop Payroll.

Leave a comment below if you have further questions. We'll be around.

@JaneD wrote:Hi Susann,

If you're using QuickBooks Assisted payroll, Intuit will file your Paid Family and Medical Leave taxes to your state agency.

You can reach out to our Assisted Payroll Support Team. They can pull up your account and will be able to verify the status of your return.

Otherwise, you'll have to file and pay it manually if you're using the regular payroll. You can visit the MA Paid Family Leave for employers website for additional information on how to file your taxes.

You can learn more in this link about how QuickBooks handles Massachusetts Paid Family Leave.

For future reference, check out this article that will serve as guide to help prepare your tax forms: Year-end checklist for QuickBooks Desktop Payroll.

Leave a comment below if you have further questions. We'll be around.

THANK YOU JaneD !!!!

Quickbooks setup all four payroll items, but still hasn't calculated anything.

1. How do I activate it?

2. How do I change the rate, as I only have 3 employees and pay a lower rate than the default.

Thanks

Hi @builders wife,

Thanks for reaching out on this issue. To make sure I understand, you have the items set up for the Massachusetts Paid Family Leave, you've run a payroll, and nothing is calculating, is that correct?

If that's the case, we will want to make sure they items are set up correctly. I would reach out to the payroll support team so they can review each item with you and make sure everything is as it should be.

This link will provide you with all the support options, based on the payroll service you are using: Contact Payroll Support

They will have to get it going for you!

It is over a year later and I still do not see that QB has fixed the MA PMFL rate for small employers for medical leave tax. It is still showing as .62% and I do not see any way to change it.

Hi there, BobC108.

I'd suggest contacting our QuickBooks Support Team. They'll be able to help you with this.

You can also visit our Help articles page for reference. There, you can read some of the helpful articles that will guide you in your future tasks.

Please let me know if there's anything else I can help you with. I'd be more than happy to assist you. Take care always.

I'm having similar Paid Family & Medical Leave issues! I'm a small business with 2 employees, so the company doesn't cover any of the FML cost. For me, QBD is calculating a deduction of $0.09 on a gross paycheck of $1,400.00, the correct amount is $8.68. I have been on the phone & in glance sessions with QBD Payroll one 3 different occasions for over an hour each time & each time they disconnect the session as they have no idea how to fix the QBD calculation. Considering I pay every month for their Enhanced payroll subscription I expect better. This is a simple calculation & it doesn't work, now I question all of their payroll calculations.

Has anyone found a solution that works!

My 2019 Quickbooks Pro desktop version not calculating any Massachusetts Family Medical Leave or Paid Sick Leave. I only have 2 employees so I'm not liable for the company portion but nothing is being calculated even after I set it up under the employee's "Other Taxes"??

I'm not getting ANY calculation of the MA Paid Medical Leave??

There are a couple of reasons why a certain tax will not calculate, TViega.

Let's go each one of them to make sure it's taking out in the employee's paycheck.

First, make sure you have the latest maintenance release for the software and download the most recent payroll update. Follow the steps in these articles for more details:

Second, make sure it has an assigned tax rate in the employee's setup. Here's how:

Once done, create a sample paycheck to see if it's already calculating. Let me share these articles for more details:

Let me know if you need anything else.

As of 5/3/2021 Quickbooks Rep.... HELP! This issue has not been fixed yet. It's very time consuming to make these adjustments on every employee every quarter. How can we get this resolved please?

Sincerely, AT

Who can we speak with to resolve this issue? Whom ever you reported the problem to did not correct it.

This is not the impression I want to have, angtaylor.

I'll route you in the right direction. This way, the Massachusetts Paid Medical Leave issue will get corrected as soon as possible.

But before that, have you tried the workaround steps provided by my colleagues in this thread? If the issue persists after following the troubleshooting steps, I recommend contacting our Technical Support. They have tools capable of pulling up your account in a secure environment and send a ticket to our engineers for analysis. Please follow the steps outlined by CharleneMae_F on how to contact support.

I'd also encourage you to visit these links about tax regulations and how to fix payroll tax calculation errors.

Don't hesitate to tag my name if you have other questions on this matter, @AT. I'm always around to help. Keep safe.

Agree that this worked in prior years, but the Box 14 infomation for MA PFML does not populate on the 2022 Form W-2. Any ideas why? I am running desktop payroll enhanced and have not modified the PFML set up (other than to have the system calculate using the most up to date tables).

I agree that in prior years, the combined PFML contribution paid by the employer correctly transferred to box 14 on the form W-2. However, these amounts are not showing up on the 2022 W-2 in any area of the form. I cannot find any check box to include these amounts. Should I just manually adjust each W-2 before submitting?

I’ll be delighted to share guidelines about rectifying your concern with MA PFML on W-2 forms in QuickBooks Desktop (QBDT), @David24_7.

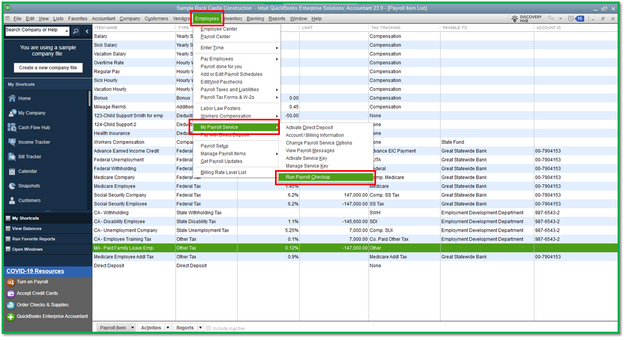

I know how important for these amounts to reflect on your payroll forms. In this, we can run a payroll checkup diagnostic tool on your company file. This option will help us determine the leading cause of why the amounts aren’t showing on the W-2 forms.

The option also allows you to:

Before we proceed to the steps, please ensure to create a backup of your data file. Then, you can start using the tool by following the steps below:

If you found any discrepancies, please check out this article for each fix provided: Run payroll checkup.

Once done, you can create an adjustment payroll liabilities after correcting the item rate. Here’s how:

You can also check this article for more information: Adjust payroll liabilities in QuickBooks Desktop.

Furthermore, you can check out this article to know how QuickBooks handles MA PFML: Massachusetts Paid Family Leave.

Don't hesitate to leave a comment below if you need more help with your concern. We're available 24/7 to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here