Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

There is still NO resolution on efiling NC W2. No notification of when QB is to resolve this problem. Have been given all the instructions and I have tried all but still failed. It is b/c QB is still trying to fix

This isn’t the experience we want to leave to you, @105274462. Let me provide information and help you send feedback about your E-file situation.

The filing and payment methods in QuickBooks Desktop Payroll depend on your state. At the moment, the E-file and E-pay methods for the state of North Carolina are unavailable.

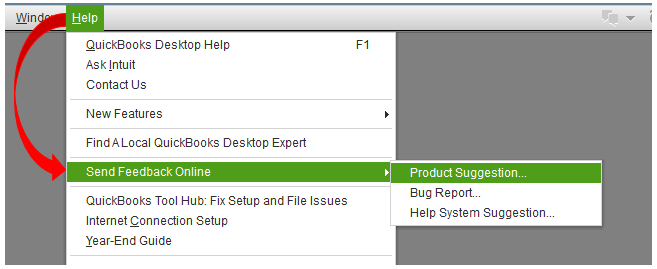

I know how convenient it is to file your payroll tax forms and pay your state taxes electronically. You can use the Feedback feature to send this matter straight to our concerned teams. This way, they could take action to help improve your experience. I’ll show you how:

Here are some helpful links that can help you access your state agency websites and learn how to stay payroll compliant:

Don’t hesitate to tap the Reply button below if you have any other payroll questions or concerns. I’ll be here to help.

To say that "at the moment" efile for North Carolina is unavailable is NOT an acceptable answer.

This method has been previously provided before the last update removed it. There has been no notice nor any explanation, yet you did not hesitate to charge for the renewal. North Carolina requires the NC-3 data be uploaded within a .txt formatted flat file. If you can provide this in the enhanced version of Payroll then you certainly can allow/provide it in the standard desktop payroll. The only question is when are you going to allow us this option through another update. We are running out of time as these must be filed by Jan. 31, 2022 and there are large fines which the state of NC will institute if this is not satisfied.

We want an answer from someone qualified to give it.

Yes I agree this is a real problem for NC subscribers. Help if needed ASAP

Hi, @sb81. I'm here to share with you some information about the NC W2 E-file status.

With the 22209 release, the W2 Excel upload option was removed for Desktop DIY NC customers. However, an easier e-file method was added for NC customers. At this time, you can file directly inside the product following these steps:

For more instructions about sending your state W-2s to your state agency, open this article: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

To get some answers about W2s, you can also check out this link: Get answers to your W-2 questions.

Please let me know if you have any other questions about the NC W2 E-file. I'm more than happy to help. Have a good one!

I followed all the instructions provided - updates, get the worksheet... and nothing works and all failed.

You said that for efiling NC W2, QB now allows you to just submit the worksheet for efiling (no .txt file generated). However the efile button is greyed out and the following instruction appears.

Where is the Payroll Setup Interview??? I am using Microsoft Edge and QB Desktop Payroll.

How do I get the Payroll Setup Interview?

Only 10 days left for me to upload 15 NC companies' W2 - by Jan. 31. Tech Support (getting a live agent) is useless as they have NO clue of what's going on.

Need an expert to work thru the process with me to efile the NC W2.

If nothing works by Jan. 25, can QB generate the .txt files for me to submit to NC?

My phone # is 919-423-1928

Instructions form QB -

You can't e-file this form because of ONE or MORE of the following issues. Before you attempt to e-file this form, be sure that you have:

Set up this form for e-file in the payroll setup interview. The payroll setup interview guides you step-by-step through the process. How do I set up forms for e-file?/Intuit/QuickBooks%202021/QBFormhelp.chm::/button_expand_green_open_lo.gif)

I understand the urgency, 105274462.

After you update the software, you should be able to work with the NC W2 seamlessly. Since this was not the case, I suggest contacting our QuickBooks Care Team. This needs to be investigated in a secure environment so they can find a solution as soon as possible.

Please take note that our support hours for QuickBooks Desktop Pro, Premier, and Plus start from M-F 6 AM to 6 PM. For QuickBooks Desktop Enterprise, we're available any time, any day.

You can also get our direct phone number on this link: Contact QuickBooks Desktop support.

Feel free to check this article to see the method you need to use for your state:

You might also want to visit our help page to browse articles that can guide you with your QuickBooks tasks. To get started head to our QBDT help articles at this link.

Get back to me if you need help with anything about QuickBooks. I'll be around to further assist. Enjoy the rest of the day.

As of date (21Jan2021), the NC W2 efile still does NOT work. My subscription is QB Desktop Payroll.

I did follow all the instructions provided and also called Tech Support but all failed. No one can help so far.

I am at a loss now with efiling the NC W2 (2021) and only have 10 days to do it.

I am at the point when QB says the the efile worksheet has to go thru the Payroll Interview but the Payroll Interview does not appear. How do I get to the Interview?

I need a high level Tech Support expert who knows QB DeskTop Payroll to efile NC W2 ? I could efile other states but NOT NC.

I have to efile NC W2 for 12 companies. Please help

Performing some troubleshooting steps and none of them works is hard to deal with, 105274462.

Let's make sure we downloaded the latest payroll updates (Tax Table 22202 and Payroll Version 01140204). Then, look for the release note under the E-File and Pay tab for North Carolina. It will indicate that “E-file for North Carolina State W-2, Wage, and Tax Statements, has been updated. (22201)”.

Once done, go to the Employees Payroll Center and at the very bottom, there is an area called Other Activities. Just click the link for Manage Filing Methods and a Choose filing methods box will come up. Clicking the link on the left for Filing methods, please highlight the North Carolina Form NC-3 row and pressed the Edit button, selected the E-file option, and clicked Finished.

If the same thing happens, there may be damaged data on the company file you've been working with. We can run the Rebuild Data tool is built-in to fix any company file data issues. Just follow the steps and detail in this article: Fix data damage on your QuickBooks Desktop company file. We can also repair the software to fix any damaged components in the software.

If the problem persists, I'd suggest contacting our Payroll Support Team. I know you already contacted us, however, this is the best option we can have for them to further investigate what's causing this issue. Just provide the reference number provided by the previous agents for them to review the case.

Please take note that our support hours for QuickBooks Desktop Pro, Premier, and Plus start from M-F 6 AM to 6 PM. For QuickBooks Desktop Enterprise, we're available any time, any day.

You can also get our direct phone number on this link: Contact QuickBooks Desktop support.

Feel free to browse this link here if you need help with adding and managing your tax forms. It'll route you to our general payroll topics with articles.

The Community always has your back, and I'm just a post away should you ever need anything. Just leave a comment below and I'll get back to you. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here