Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Would you please let me know what they say?

How did you correct it for the W2's? I fixed what happened on the back side but how do I fix 9 months of checks that didn't take the tax out?

I am curious too

Moving forward - I rechecked the boxes for Medicare and Social Security. I will need to run a payroll report to validate this has not been changed in the background from some bug in QB.

QB was absolutely no help. Because I only have enhanced payroll I cannot speak to their tax correction team. The other assistance has no clue what to do.

I am looking for a tax representative I can speak to, basically what to do with the employees W2's - they will owe back medicare and social security as will the company.

I think I will be looking for a new payroll company. We have had so many problems with bugs in QB like this.

What do we tell employees when they ask why there was no withholding???

Hello there, @natashasmith.

There are reasons why Medicare and SS do not calculate. These are due to the following:

You can review the Payroll Detail report to verify the taxes withheld and the difference. Then, if QuickBooks over withheld the Social Security and Medicare taxes, there are two ways to resolve this.

Here's how:

For the steps on creating adjustment, see this article: Adjust payroll liabilities in QuickBooks Desktop.

If there's anything else you need help with, visit the Community again. I'm here to answer it for you. Have a good day!

Thanks - it was not overpayment of taxes, Social Security taxes were not withheld...

I really wish that the QB people on this thread would understand that their system failed and caused an issue.

4 out of 136 employees were affect for 2021 - I did not change anything. These employees were with the company for years. 2 of which are salary so their pay does not change. The other 2 did make their normal amount of pay.

Please stop saying the system needs to be updated or the pay is too low. QB has a problem when it changed the tax!!!

So I corrected QB error, now I need to know what to communicate to my employees and how to correct this with the IRS?

We are in the same boat, need to know what to tell our employees!

I called the IRS - they sent me to Social Security, who said to call the IRS. I did a test system with filing taxes and not taking out Social Security or Medicare did not affect the return. QB did force me to use the earnings at the time the deductions stopped coming out. I filed the W2's and printed them out. My CFO stated because it does not affect the employees, no need to concern them. Social Security and Medicare will come at the company for the underpaid taxes.

Can you clarify the meaning "Social Security and Medicare will come at the company for the underpaid taxes"?

And what do we tell employees about why no SS and Medicare was taken out???

I would recommend calling social security. When they audit, they will want the company to pay it.

I can't tell you what to tell your employees. That is up to you.

We had the same issue and not because our file wasn't "updated". May I ask how you communicated to employee on why there was no Social Security withheld?

Hi there, natashasmith.

I'm here to ensure you'll get the right support in correcting the calculation of your payroll items.

If your QuickBooks Desktop program is already the latest release and you have the latest payroll tax table, and still getting the same issue. I suggest contacting our Customer Care Team. They have the tools available to investigate this issue further and figure out what's causing the unusual behavior.

Here's how to reach them:

To make sure you get prioritized on your concern. Please check out our support hours and contact us at a time convenient: Support hours and types.

To get more information about correcting payroll items when it's not calculating or is calculating incorrectly on a paycheck, feel free to visit this article: Payroll items on a paycheck are not calculating or are calculating incorrectly.

You can count on me if you need further assistance fixing payroll items calculations. I'd be happy to assist you further. Have a good one.

I have checked everything on his paycheck and it’s all correct but still not enough social security and Medicare taken out!

Quick books is not taking enough social security and Medicare tax out of only one employee !

Hello @frankpeggy27,

I understand the importance of getting the correct deduction amounts for the employee paychecks. I would also check the paycheck's details before processing the payroll in QuickBooks Desktop.

Aside from what you've entered in the paycheck, the payroll data and prior transactions will also affect your future payroll. I'm here to help you get back on track so you can provide accurate payroll to your employees.

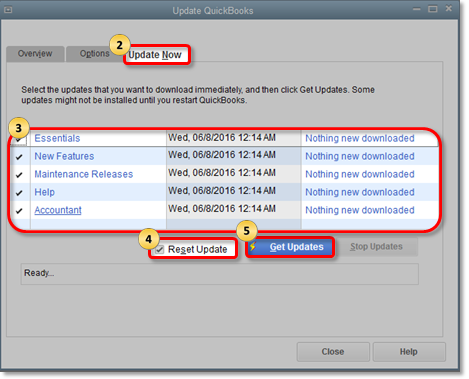

There are troubleshooting steps to determine the cause of the issue. Before you start, download the latest software release and Tax Table updates.

This way, we can ensure the problem isn't related to an outdated QuickBooks Desktop. Here's how to update QuickBooks:

Once done, you can start performing the necessary troubleshooting for the issue. I recommend you run payroll reports to review your employee(s)' payroll data and catch mistakes causing the Social security and Medicare to calculate incorrectly.

Here are the steps:

I've added a guide you can visit to fix the payroll tax calculations of your employee paychecks (scroll down to details): QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

Also, you can create a liability adjustment to correct an employee's YTD or QTD payroll info. In case you need to do this in the future, I've attached the article: Adjust payroll liabilities in QuickBooks Desktop Payroll.

Drop me a comment if you need more assistance fixing the payroll taxes in QuickBooks. Click the Reply button to add more details, and we'll be sure to get back to you. Have a great day.

How did you guys correct this?

Review the salary limit for the employee gross amount. There is a limit on the Social Security tax of $147,000 for 2022. This solved my problem. Hope it helps others.

That's a great help, TexasClerkGirl.

Thank you for sharing a solution so the Medicare and Social Security are taken out correctly on the employee's paycheck. Your information will surely help others who are experiencing this situation.

Feel free to share more solutions here in the Community forum. May your business flourish in the years to come. Have a wonderful day ahead!

I have the same issue I have 13 employees one employee out of 13 mysteriously has no Medicare and Social Security taxes withheld. They’re telling me it’s gonna be 30 to 60 days to get the problem resolved. In the meantime I have an employee who is waiting to file his taxes which he can’t do.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here