Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am trying to reconcile my 941 filings from 2022 with the W3.

I am trying to match:

1) form 941 line 2 (Wages, tips and other Compensation) to form W-3 line 1 (Wages, tips, other compensation)

2) form 941 line 5a column 1 (taxable social security wages) to form W-3 line 3 (social security wages)

3) form 941 line 5c column 1(Taxable Medicare wages & tips) to form W-3 line 5 (Medicare wages & tips)

1) matches but 2) and 3) do not match. The 941 is $5,000 higher for 1) and 2) compared to the W-3. This tells me that $5,000 is probably missing from the W-3 and W-2. What would cause this difference? How can I correct it?

Hi there,

Possible reasons for not having the same values are changes in the payroll records or a data issue. Let's check to find out.

Let's run the Verify and Rebuild data utilities to check if this scenario is caused by a data issue. Consider backing up your company file for doing anything.

If the utilities don't identify issues, you can run the 941 forms for quarters 1 to 3 and compare them with the submitted forms. If one quarter is not matching, you can check the records within that period for any possible adjustments, deleted checks, etc. using the Payroll Summary report.

I'm adding this article for your additional reference: How to reconcile payroll: A step-by-step process.

Let us know if you need help as you compare your forms. We'll continue to help.

I ran through the recommended steps (verify/rebuild) and the problem is still not corrected.

I found that the Q3 941 overstated Social Security and Medicare wages by $5,000. So I tried re-running the 941 from Q3 and ended up with the same incorrect Social Security and Medicare Wages. Are there any other steps that I can run to get a correct Q3 941 so I can file a 941X?

Let me guide you on how to correct your Social Security and Medical wages, IntDoesntCare.

In general, QuickBooks will automatically correct the calculation on the next pay period. You can correct the deduction items by adjusting payroll liabilities. To do so, you can follow the steps below:

To check on what payroll reports to run and if the liabilities are updated. you can go through this article for additional information: Adjust Payroll Liabilities In QuickBooks Desktop Payroll.

At the same time. paying your federal taxes and filing the necessary payroll forms on time is an essential task, learn from these articles for more details:

Fill me in and keep in touch if you have any questions about 941. Remember, the Community is always here to further assist you always.

This is not a simple adjustment to payroll liabilities. Lines 5a and 5c column 1 is incorrect in the report 941 that QuickBooks filed.

Is there a way to see the detail of what makes up lines 5a and 5b column 1 of the 941?

I'll gladly lend a hand and ensure your 941 forms are correct, IntDoesntCare.

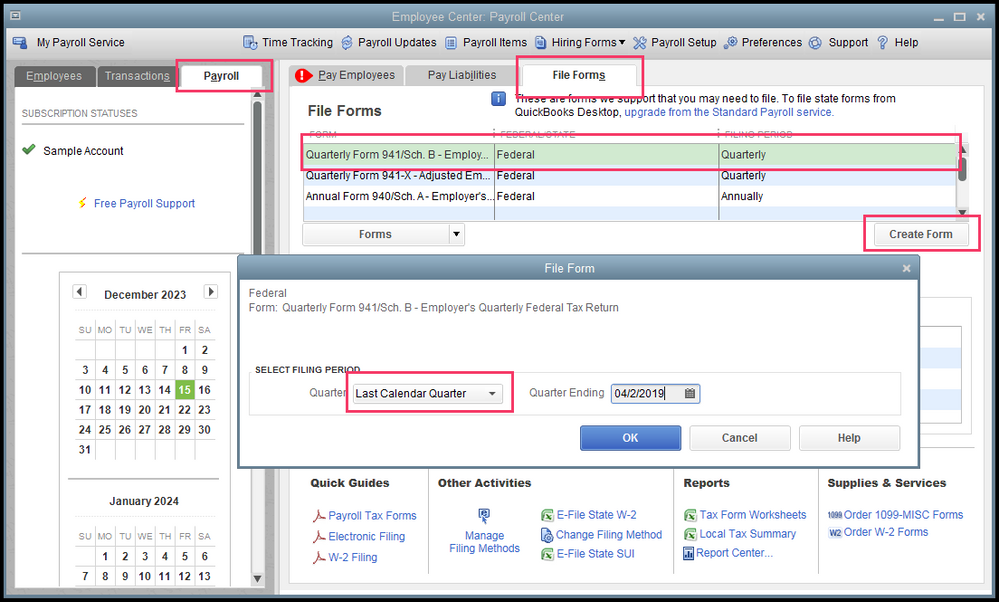

If you mean the details on lines 5a and 5c for Q3 941 form, you can run a tax form worksheet in QuickBooks Desktop. If you're using enhanced payroll, I can guide you through o how to e-file the form.

To learn more about e-filing in QuickBooks Desktop, check out this link: E-file 940, 941, and 944 tax forms.

However, if you're using assisted payroll, I suggest contacting our Customer Care Team. This way, they can guide you in filling out the 941 forms. Here's how to reach them:

To make sure you get prioritized on your concern. Please check out our support hours and contact us at a time convenient: Support hours and types.

Furthermore, browse this resource to learn more about e-filing your federal tax forms and e-pay federal taxes: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced

Please don’t hesitate to comment if you have more concerns about the 941 forms. The Community always has your back. Have a good one!

Q3 2022 941 is wrong no matter how many times I run it. I guess my next action is to call support. Close this discussion up without a solution unless I get some advice that will help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here