How payroll reconciliation works

Payroll reconciliation compares your payroll register with the amount of money you’re paying your employees to ensure they match. You're essentially double-checking your math to ensure you pay your employees correctly.

Payroll reconciliation should happen frequently, such as:

- Every pay period before you cut employee checks—ideally, at least two days before your payday.

- Quarterly when you submit Form 941 with your quarterly federal tax return.

- Annually before tax due dates when you confirm that your payroll data matches each employee’s Form W-2.

Payroll reconciliation is essential for several key reasons, such as avoiding fines and penalties. Making mistakes with payroll not only destroys morale but can also lead to penalties from the IRS. You also want to keep accurate payroll records to avoid major headaches and hassles come tax time—plus the potential for more penalties.

You’ll need a few things before you start your payroll reconciliation process. Make sure you have the following within reach:

- Your payroll register: To get all of the payroll data you need.

- Employee time cards or time sheets: To get hours worked for that specific payroll period.

- Your general ledger: To record wages and deductions and maintain accurate financial records.

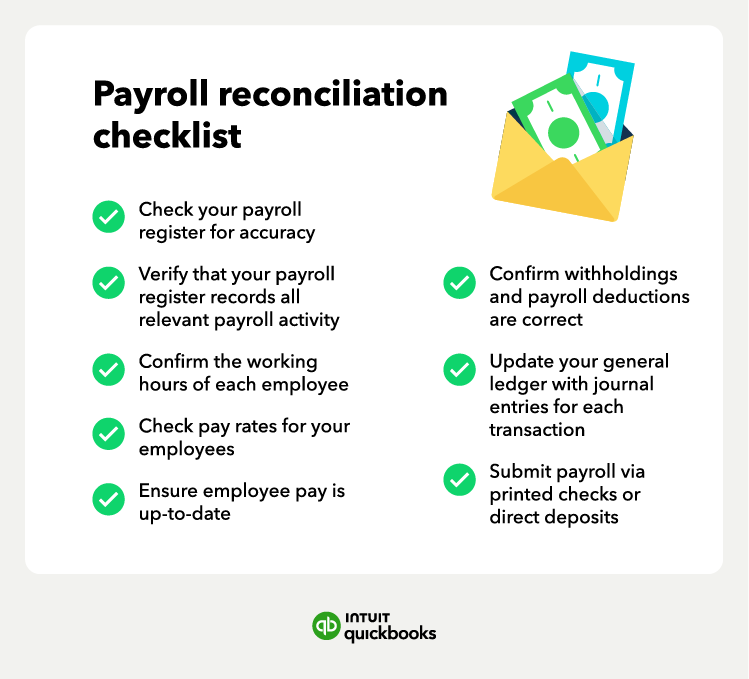

With these items, you can get into the specific payroll reconciliation steps:

You should also double-check your math by confirming that an employee’s gross pay on your payroll register equals their pay rate multiplied by the total number of hours worked.

You should also double-check your math by confirming that an employee’s gross pay on your payroll register equals their pay rate multiplied by the total number of hours worked.